Pinellas County Tax Collector'

Welcome to an in-depth exploration of the Pinellas County Tax Collector's Office, an essential institution that plays a crucial role in the financial and administrative life of Pinellas County, Florida. This office is responsible for a wide range of services, from vehicle registrations and title transfers to property tax collection and more. In this article, we'll delve into the functions, services, and impact of the Pinellas County Tax Collector's Office, offering a comprehensive guide for residents and businesses alike.

The Vital Role of the Pinellas County Tax Collector

The Pinellas County Tax Collector’s Office is a key player in the county’s governance, serving as a critical link between the government and the public. Its primary responsibility is to collect taxes and fees on behalf of various governmental entities, ensuring the smooth operation of local government services. Beyond tax collection, the office provides a diverse array of services, making it a one-stop shop for residents and businesses to handle their administrative and financial needs.

At the helm of this office is Judy Anne Payne, the Pinellas County Tax Collector. Elected to her position in 2020, Payne brings a wealth of experience and a commitment to innovation and efficiency. Under her leadership, the office has implemented several initiatives to enhance services and improve the taxpayer experience.

The office's operations are guided by a vision to provide efficient, effective, and friendly service to all taxpayers. This commitment is reflected in its mission statement: "To efficiently collect all revenue due, serve with integrity and treat each person with dignity and respect". This mission underscores the office's dedication to serving the community with professionalism and empathy.

A Suite of Services

The Pinellas County Tax Collector’s Office offers a comprehensive suite of services, designed to meet the diverse needs of the county’s residents and businesses. Here’s an overview of some of the key services provided:

Property Tax Collection

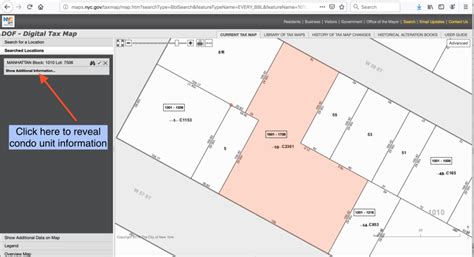

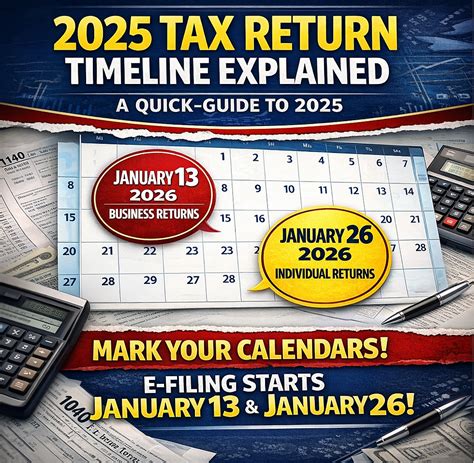

One of the primary responsibilities of the office is the collection of property taxes. Property owners in Pinellas County can pay their taxes through the office’s secure online platform, by mail, or in person at any of the office’s convenient locations. The office also provides resources to help taxpayers understand their property tax assessments and offers assistance with tax exemptions and appeals.

| Service | Description |

|---|---|

| Property Tax Lookup | An online tool to view property tax records and estimated taxes. |

| Tax Payment Options | Various payment methods including online, by phone, and in-person. |

| Tax Exemptions | Information and guidance on qualifying for tax exemptions. |

Vehicle Registrations and Title Transfers

The office is also the go-to place for all vehicle-related transactions. Whether you’re registering a new vehicle, renewing your registration, or transferring a title, the Tax Collector’s Office provides a seamless process. Online services are available for many vehicle transactions, making it convenient for residents to complete these tasks from the comfort of their homes.

| Vehicle Service | Description |

|---|---|

| Online Registration Renewal | Renew your vehicle registration without visiting a physical location. |

| Title Transfers | Process for transferring vehicle ownership, including steps and required documents. |

| Vehicle Tax Calculator | Tool to estimate vehicle taxes based on make, model, and year. |

Passport Services

In addition to tax-related services, the Pinellas County Tax Collector’s Office also provides passport services. Residents can apply for new passports, renew existing ones, or obtain passport cards for domestic travel. The office’s experienced staff can guide applicants through the process, ensuring a smooth and stress-free experience.

Business Tax Receipts

For businesses operating in Pinellas County, the Tax Collector’s Office is responsible for issuing and renewing business tax receipts. This process is streamlined, with online applications and renewals available. The office also provides resources to help businesses understand their tax obligations and offers assistance with any questions or concerns.

Other Services

Beyond the services mentioned above, the Pinellas County Tax Collector’s Office also offers a range of other services, including:

- Motorcycle registrations and titles.

- Voter registration.

- Hunting and fishing licenses.

- Notary public services.

- Boat registrations and titles.

Innovative Initiatives and Community Engagement

Under the leadership of Judy Anne Payne, the Pinellas County Tax Collector’s Office has embraced innovation and community engagement. One notable initiative is the implementation of a mobile app, allowing taxpayers to access services and information on the go. The app provides real-time updates, tax due dates, and a convenient payment platform.

The office also actively engages with the community through educational outreach programs. These programs aim to inform residents about tax obligations, provide financial literacy resources, and offer guidance on various services. By fostering a culture of transparency and accessibility, the office strengthens its relationship with the community it serves.

A Commitment to Excellence

The Pinellas County Tax Collector’s Office operates with a deep commitment to excellence in service delivery. This commitment is evident in its efficient processes, friendly staff, and innovative approaches to serving the community. The office’s focus on customer satisfaction and continuous improvement ensures that taxpayers receive the best possible service.

The office also prioritizes transparency and accountability. Financial reports, budget information, and performance metrics are publicly available, allowing taxpayers to understand how their tax dollars are being utilized. This commitment to transparency strengthens trust between the office and the community.

Looking Ahead

As Pinellas County continues to grow and evolve, the Tax Collector’s Office is poised to adapt and meet the changing needs of its residents. With a focus on innovation and community engagement, the office is well-positioned to provide efficient, effective, and friendly services in the years to come. By leveraging technology and maintaining a customer-centric approach, the office will continue to serve as a trusted partner for taxpayers in Pinellas County.

Conclusion

The Pinellas County Tax Collector’s Office is a vital component of the county’s governance and community. Through its diverse range of services, innovative approaches, and commitment to excellence, the office plays a pivotal role in the lives of residents and businesses. As we’ve explored in this article, the office’s impact extends far beyond tax collection, contributing to the overall well-being and prosperity of Pinellas County.

What are the office hours for the Pinellas County Tax Collector’s Office?

+The Pinellas County Tax Collector’s Office is open Monday to Friday, from 8:30 AM to 4:30 PM. However, it’s always best to check the official website for any holiday closures or temporary adjustments to these hours.

How can I pay my property taxes in Pinellas County?

+There are several convenient ways to pay your property taxes. You can pay online through the Tax Collector’s secure website, by phone using a credit or debit card, or in person at any of the office’s locations. You can also mail your payment, but ensure you allow enough time for delivery and processing.

What documents do I need for a vehicle title transfer in Pinellas County?

+To transfer a vehicle title in Pinellas County, you’ll need the following documents: a completed title application, the original title signed by the seller, proof of insurance, and a valid form of identification. If the vehicle is being gifted, you’ll also need a gift tax form. It’s always best to check the official website for any updates or additional requirements.

How can I obtain a passport through the Pinellas County Tax Collector’s Office?

+To apply for a passport through the Pinellas County Tax Collector’s Office, you’ll need to provide specific documentation, including proof of citizenship, a valid form of identification, and two passport photos. You can find a detailed list of requirements and instructions on the office’s website. Appointments are required for passport services, so be sure to schedule one in advance.

What is the process for renewing my business tax receipt in Pinellas County?

+Renewing your business tax receipt in Pinellas County is a straightforward process. You can renew online, by mail, or in person. The renewal process typically opens in the fall, and it’s important to renew by the deadline to avoid late fees. The Tax Collector’s Office will send out renewal notices, but it’s always a good idea to check the official website for specific dates and instructions.