Where Is My Property Tax Refund

Property tax refunds, also known as property tax rebates or homeowner's refunds, are an important financial relief mechanism for property owners. These refunds aim to provide monetary benefits to eligible homeowners, tenants, and landlords, offering a partial reimbursement of the property taxes paid. However, the process of obtaining these refunds can sometimes be confusing, leading many property owners to wonder, "Where is my property tax refund?"

In this comprehensive guide, we will delve into the intricacies of property tax refunds, shedding light on the entire process, from understanding eligibility criteria to navigating the application procedure and ultimately receiving your well-deserved refund. Join us as we explore the world of property tax refunds and empower you with the knowledge to claim what is rightfully yours.

Understanding Property Tax Refunds

Property tax refunds are a financial initiative designed to assist property owners by providing a partial return on the taxes they have paid. These refunds are often issued by local or state governments and can significantly impact an individual's financial planning and budgeting. Understanding the nature of these refunds is crucial before delving into the specifics of eligibility and application processes.

Property taxes are a significant source of revenue for local governments, which use these funds to support various community services and infrastructure projects. However, the tax burden can be substantial, especially for homeowners with high-value properties. Property tax refunds act as a countermeasure, offering a reprieve to those who qualify, thus promoting financial stability and equity among property owners.

The specific mechanisms and criteria for property tax refunds vary depending on the jurisdiction. Some regions offer a standard refund based on a pre-determined formula, while others may provide additional benefits for specific circumstances, such as income level or veteran status. It is essential to familiarize yourself with the local regulations to determine your eligibility and understand the potential refund amount.

Eligibility Criteria for Property Tax Refunds

Determining your eligibility for a property tax refund is the first step in the process. While the exact criteria can differ based on location, there are some common factors that play a role in qualifying for a refund.

Firstly, property ownership is typically a fundamental requirement. Whether you own your home, a rental property, or a commercial space, you may be eligible for a refund based on the taxes paid on that property. However, it's important to note that the eligibility may extend beyond the property owner; in some cases, tenants and landlords can also benefit from these refunds.

Secondly, income level is often a critical factor. Many property tax refund programs are designed to assist low- to moderate-income individuals and families. The specific income thresholds can vary, and they may be based on individual or household income. Additionally, some programs consider factors like age, disability, or military service, offering additional benefits to eligible applicants.

Lastly, the amount of property tax paid during the relevant period is a key determinant. Refunds are typically calculated based on the taxes paid, and the refund amount may be a percentage of the total tax or a fixed sum, depending on the jurisdiction's guidelines. It is essential to review your property tax records to ensure accuracy and to have a clear understanding of the potential refund amount.

| Eligibility Factors | Description |

|---|---|

| Property Ownership | Owning a home, rental property, or commercial space. |

| Income Level | Meeting specific income thresholds based on individual or household income. |

| Property Tax Paid | Amount of property tax paid during the relevant period. |

Navigating the Application Process

Once you have confirmed your eligibility for a property tax refund, the next step is to navigate the application process. While the exact procedures can vary, there are some common steps and considerations to keep in mind to ensure a smooth and successful application.

Gathering Required Documentation

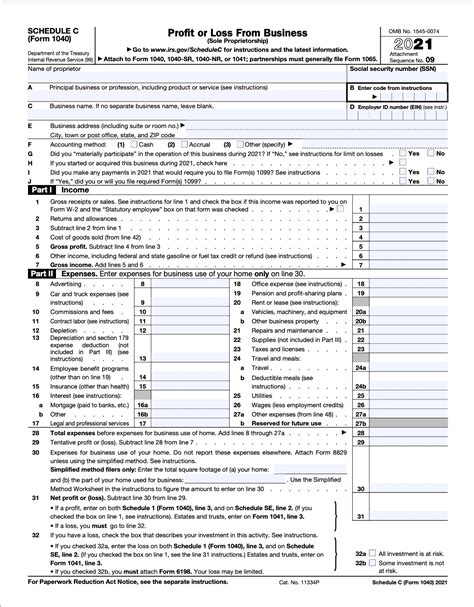

Before beginning the application, it is crucial to gather all the necessary documentation. This typically includes proof of property ownership, such as a deed or mortgage statement, and income verification documents like tax returns or pay stubs. Additionally, you may need to provide proof of residency, particularly if you are a tenant applying for a refund. Ensuring that all required documents are up-to-date and easily accessible will streamline the application process.

It is worth noting that some jurisdictions may require additional documentation, such as proof of eligibility for specific programs or forms of identification. It is essential to review the application guidelines thoroughly to avoid any delays or rejections due to missing information.

Completing the Application Form

The next step involves completing the application form accurately and completely. This form will typically require you to provide details about your property, such as its location, value, and the amount of tax paid. Additionally, you may need to disclose your income and other relevant personal information.

It is crucial to take your time when filling out the application, ensuring that all information is correct and up-to-date. Any errors or discrepancies can lead to delays or even rejection of your application. If you have any questions or concerns during this process, don't hesitate to reach out to the relevant government agency or tax authority for clarification.

Submitting the Application

Once you have gathered all the required documentation and completed the application form, it's time to submit your application. Most jurisdictions offer multiple submission methods, including online portals, mail, or in-person delivery. Choose the method that is most convenient and efficient for you, ensuring that your application is received within the specified deadline.

When submitting your application, pay close attention to the instructions provided. Some agencies may require specific packaging or formatting for the documents, and failing to adhere to these guidelines can result in processing delays. It is also a good idea to keep a copy of your completed application and supporting documents for your records, in case you need to reference them in the future.

| Application Process Steps | Description |

|---|---|

| Gather Documentation | Collect necessary proof of ownership, income, and residency. |

| Complete Application Form | Provide accurate details about your property and personal information. |

| Submit Application | Choose a submission method (online, mail, in-person) and ensure timely delivery. |

Receiving Your Property Tax Refund

After submitting your application, the wait for your property tax refund begins. The timeframe for receiving your refund can vary depending on several factors, including the volume of applications, the efficiency of the processing system, and the method of refund distribution.

Processing Timeframes

It is essential to be aware of the expected processing time for property tax refund applications in your area. While some jurisdictions may process applications within a few weeks, others may take several months, especially during peak periods such as the tax season. Understanding the typical processing timeframe can help you manage your expectations and plan your finances accordingly.

If you have any concerns about the status of your application or the processing timeframe, don't hesitate to reach out to the relevant government agency or tax authority. They can provide you with an update on your application and offer guidance if there are any delays or issues.

Methods of Refund Distribution

Property tax refunds can be distributed through various methods, and it is crucial to be aware of the options available in your jurisdiction. Common methods of refund distribution include:

- Check or Money Order: Many jurisdictions issue refunds in the form of a paper check or money order, which can be deposited or cashed at your convenience.

- Direct Deposit: Some agencies offer the option of direct deposit, where the refund amount is electronically transferred to your designated bank account.

- Prepaid Debit Card: In certain cases, refunds may be issued on a prepaid debit card, providing a convenient and secure way to access your funds.

- Credit to Future Tax Payments: In some instances, the refund amount may be credited to your future property tax payments, reducing the amount due in subsequent years.

Understanding the available refund distribution methods can help you plan your finances effectively. For example, if you opt for direct deposit, you can ensure that your bank account is ready to receive the funds, while if you prefer a check, you can plan for the arrival of the physical refund.

Using Your Property Tax Refund

Property tax refunds can provide a significant financial boost, and it's essential to consider how you will utilize this money. Here are some ideas on how to make the most of your refund:

- Home Improvements: Consider using your refund to invest in your property. This could include renovations, repairs, or upgrades that not only enhance your living space but also potentially increase your property value.

- Financial Planning: Property tax refunds can be a valuable addition to your savings or investment accounts. Consider setting aside a portion of your refund for future financial goals, such as retirement, education, or emergency funds.

- Debt Repayment: If you have outstanding debts, such as credit card balances or personal loans, using your refund to reduce or eliminate these debts can help improve your financial health and reduce interest charges.

- Community Contributions: Property tax refunds can also be an opportunity to give back to your community. Consider donating a portion of your refund to local charities, schools, or community projects that align with your values.

Frequently Asked Questions

How often can I apply for a property tax refund?

+The frequency of property tax refund applications can vary depending on the jurisdiction. Some areas offer annual refund programs, while others may have specific periods or deadlines for applications. It is essential to review the guidelines provided by your local government or tax authority to understand the application frequency and deadlines.

Can I apply for a refund if I am a tenant?

+Yes, in many cases, tenants can also apply for property tax refunds. However, the eligibility criteria and application process may differ for tenants. It is recommended to review the specific guidelines for tenants in your jurisdiction to understand the requirements and potential benefits.

What if I miss the application deadline for a refund?

+Missing the application deadline can result in forfeiture of your eligibility for that specific refund period. However, it is worth contacting the relevant government agency or tax authority to inquire about late application options or potential extensions. They may provide guidance or alternatives based on your circumstances.

Are there any penalties for claiming a property tax refund if I am not eligible?

+Yes, claiming a property tax refund when you are not eligible can lead to penalties, including fines, interest charges, or even legal consequences. It is crucial to thoroughly review the eligibility criteria and only apply for a refund if you meet the specified requirements. Honesty and accuracy are essential when applying for property tax refunds.

Can I appeal a denied property tax refund application?

+Yes, if your property tax refund application is denied, you typically have the right to appeal the decision. The appeal process may involve providing additional documentation or information to support your case. It is essential to review the appeal guidelines provided by the relevant government agency to understand the procedure and required steps.

Property tax refunds can provide significant financial relief for eligible property owners, tenants, and landlords. By understanding the eligibility criteria, navigating the application process, and receiving your refund, you can effectively manage your finances and plan for the future. Remember to stay informed about the specific regulations in your area and utilize your refund wisely to maximize its benefits.