Does Pa Have A State Tax

Yes, Pennsylvania, often abbreviated as PA, does indeed have a state tax system in place. Understanding the intricacies of this tax structure is crucial for both residents and businesses operating within the state. This article aims to provide an in-depth exploration of Pennsylvania's state tax landscape, offering valuable insights into its mechanics, implications, and potential impacts on the state's economy.

Pennsylvania’s State Tax System: An Overview

The state of Pennsylvania imposes a variety of taxes to generate revenue for funding public services and infrastructure. These taxes are an essential component of the state’s fiscal framework, playing a significant role in shaping its economic policies and development.

One of the key components of Pennsylvania's tax system is the Personal Income Tax, which is levied on individuals, estates, and trusts based on their taxable income. This tax contributes significantly to the state's revenue and is a crucial aspect of its fiscal strategy.

In addition to the Personal Income Tax, Pennsylvania also implements a Corporate Net Income Tax, applicable to corporations and limited liability companies (LLCs) conducting business within the state. This tax further bolsters the state's financial resources and is a critical element in supporting its public initiatives.

Tax Rates and Brackets

Pennsylvania’s Personal Income Tax operates on a flat rate system, with a standard tax rate of 3.07% applicable to all taxpayers. However, it’s important to note that this rate is subject to change and may vary based on legislative decisions and economic considerations.

The Corporate Net Income Tax, on the other hand, operates on a graduated rate structure, with rates ranging from 4.99% to 9.99%, depending on the corporation's taxable income. This progressive tax system ensures that larger corporations contribute a higher proportion of their income towards the state's revenue.

| Taxable Income Range | Corporate Net Income Tax Rate |

|---|---|

| $0 - $100,000 | 4.99% |

| $100,001 - $250,000 | 7.07% |

| $250,001 - $500,000 | 8.12% |

| Above $500,000 | 9.99% |

Taxable Entities and Exemptions

Pennsylvania’s tax system applies to a wide range of entities, including individuals, businesses, estates, and trusts. However, certain entities and transactions are exempt from taxation under specific circumstances. For instance, certain types of income, such as interest from municipal bonds, are exempt from state income tax.

Additionally, Pennsylvania offers tax incentives and credits to encourage economic growth and development. These incentives can take various forms, such as tax credits for research and development activities, job creation, or investments in certain industries. Such initiatives are designed to attract businesses and stimulate the state's economy.

Impact on Pennsylvania’s Economy

Pennsylvania’s state tax system plays a pivotal role in shaping the state’s economic landscape. The revenue generated from these taxes funds essential public services, infrastructure development, and social programs, which in turn contribute to the overall well-being and prosperity of its residents.

The Personal Income Tax, being the primary source of revenue, allows the state to invest in education, healthcare, transportation, and other critical sectors. It also provides funding for initiatives aimed at reducing poverty, promoting economic equality, and supporting vulnerable populations.

Moreover, the Corporate Net Income Tax encourages businesses to contribute to the state's fiscal health, fostering a sense of corporate responsibility and accountability. This tax revenue can be utilized for various purposes, including attracting new businesses, improving the business environment, and creating job opportunities.

Comparison with Other States

When compared to other states, Pennsylvania’s tax system stands out for its simplicity and stability. The flat rate Personal Income Tax is straightforward and easy to understand, providing consistency for taxpayers. Additionally, the state’s tax rates are generally competitive, making it an attractive destination for businesses and individuals alike.

However, it's important to note that tax policies can vary significantly across states, and each state's tax system is influenced by its unique economic, social, and political factors. Therefore, a comprehensive analysis of Pennsylvania's tax system should consider these external factors and their potential impacts.

Conclusion: Navigating Pennsylvania’s Tax Landscape

Understanding Pennsylvania’s state tax system is essential for anyone living or doing business within the state. The system, with its flat rate Personal Income Tax and graduated Corporate Net Income Tax, provides a stable and predictable revenue stream for the state. This revenue is vital for funding public services, infrastructure, and social programs, ultimately contributing to the state’s overall economic health and well-being.

As with any tax system, there are complexities and nuances that require careful consideration. It is recommended that taxpayers seek professional guidance to ensure compliance with the state's tax laws and regulations. By understanding and effectively managing their tax obligations, individuals and businesses can contribute to the continued prosperity of Pennsylvania.

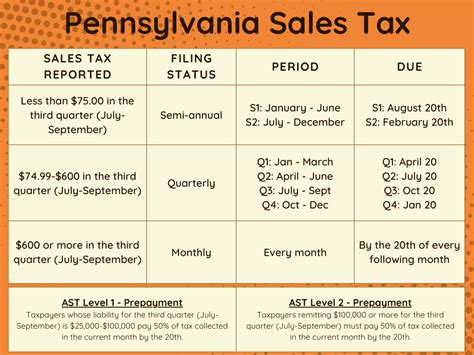

What are the tax filing deadlines in Pennsylvania?

+The standard tax filing deadline in Pennsylvania is April 15th, aligning with the federal tax deadline. However, it’s important to note that this date may change based on holidays or special circumstances. It’s recommended to check with the Pennsylvania Department of Revenue for the most up-to-date information.

Are there any tax incentives or credits available in Pennsylvania?

+Yes, Pennsylvania offers a range of tax incentives and credits to promote economic growth and development. These include tax credits for research and development, job creation, investments in renewable energy, and more. Businesses can benefit from these incentives by understanding and leveraging them effectively.

How does Pennsylvania’s tax system compare to its neighboring states?

+Pennsylvania’s tax system, particularly its flat rate Personal Income Tax, is relatively competitive when compared to neighboring states. However, it’s important to consider each state’s unique tax policies and how they align with individual or business needs. A comprehensive analysis should be conducted to make informed decisions.