Tax Id Same As Ein

In the realm of business and financial management, understanding the intricacies of identification numbers is crucial. One common query that arises is the relationship between a Tax ID and an EIN. This article aims to unravel this connection, providing a comprehensive guide for businesses and individuals seeking clarity on these essential identifiers.

Unraveling the Tax ID and EIN Enigma

The Tax Identification Number (TIN) and the Employer Identification Number (EIN) are both vital for businesses operating in the United States. While these terms are often used interchangeably, there are subtle differences and specific contexts where each is applicable.

Tax Identification Number (TIN)

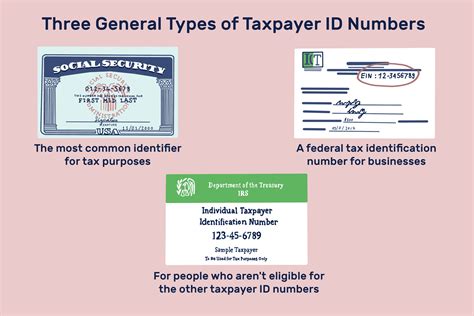

The Tax ID, officially known as the Taxpayer Identification Number, serves as a unique identifier for entities involved in financial transactions with the Internal Revenue Service (IRS). This number is a nine-digit code assigned to individuals, businesses, estates, trusts, and other entities for tax purposes.

Tax IDs are primarily used to report financial activities to the IRS. They are crucial for various tax-related tasks, such as filing tax returns, reporting income, and claiming deductions. Every individual who earns income or engages in business activities in the U.S. is required to have a Tax ID.

For individuals, the Social Security Number (SSN) often serves as the Tax ID. However, businesses and other entities are assigned a unique TIN, which is distinct from the SSN. This is where the concept of the Employer Identification Number (EIN) comes into play.

Employer Identification Number (EIN)

The Employer Identification Number, or EIN, is a unique nine-digit identifier assigned to businesses by the IRS. It is essentially a business’s version of a Social Security Number. The EIN is used to identify a business entity for tax purposes, much like the TIN is used for individuals.

An EIN is necessary for businesses that have employees, operate a sole proprietorship, partnership, corporation, or limited liability company (LLC), or are involved in certain types of activities, such as trusts, estates, and tax-exempt organizations. It is also required for businesses that engage in specific activities, like operating a farm, paying excise taxes, or filing pension plan returns.

The primary purpose of an EIN is to facilitate the reporting of financial activities to the IRS. It allows businesses to open bank accounts, apply for loans, and file various tax forms, including employment taxes, excise taxes, and annual tax returns.

The Relationship: Tax ID vs. EIN

So, are Tax IDs and EINs the same? In short, the answer is both yes and no. While they are similar in structure and purpose, they serve distinct roles in the eyes of the IRS.

For individuals, the Social Security Number is their primary Tax ID. However, for businesses, the EIN is their primary identifier. The EIN is specifically designed for business entities and is used for all tax-related activities associated with the business.

In some cases, a business's Tax ID and EIN may be the same. This often occurs with sole proprietorships where the owner's Social Security Number is used as the business's Tax ID. However, it's important to note that using a personal SSN for business purposes can have implications for privacy and security. Obtaining a dedicated EIN for a business is generally recommended.

| Identifier | Purpose | Primary User |

|---|---|---|

| Tax ID (TIN) | Identifies individuals and entities for tax purposes | Individuals, Businesses, Trusts, Estates, etc. |

| EIN | Identifies businesses for tax purposes | Businesses (Sole Proprietorships, Partnerships, Corporations, LLCs, etc.) |

When to Use Each

Understanding when to use a Tax ID or an EIN is crucial for compliance with tax regulations. Here’s a simplified breakdown:

- Individuals: Use your Social Security Number (SSN) as your Tax ID for personal tax filings and reporting.

- Sole Proprietorships: You can use your SSN as your Tax ID for business-related activities. However, obtaining an EIN is recommended for privacy and business management purposes.

- Partnerships, Corporations, LLCs, and Other Business Entities: An EIN is mandatory for tax filings and business operations. You should obtain an EIN from the IRS to avoid legal complications.

Obtaining a Tax ID or EIN

The process of obtaining a Tax ID or EIN is straightforward. For individuals, your SSN is your Tax ID, which is typically assigned at birth or upon legal immigration. For businesses, you can apply for an EIN through the IRS website. The application process is simple and can be completed online.

When applying for an EIN, you'll need to provide basic information about your business, such as the legal name, address, and type of business entity. The IRS will process your application and assign a unique EIN within a few days.

Conclusion: Navigating Tax Identifiers

In the complex world of business and tax management, understanding the difference between a Tax ID and an EIN is essential. While they may seem interchangeable, they serve distinct purposes and are integral to different aspects of financial reporting and compliance.

By grasping the nuances of these identifiers, businesses and individuals can ensure they are using the correct information for their tax obligations. This knowledge is a critical step in maintaining compliance with tax regulations and protecting one's financial interests.

Can I use my Social Security Number as my business’s Tax ID?

+Yes, you can use your Social Security Number as your business’s Tax ID if you operate as a sole proprietorship. However, it’s recommended to obtain a separate EIN for privacy and business management purposes.

Do I need an EIN if I have a small business with no employees?

+If you operate as a sole proprietorship with no employees, you may not need an EIN. However, an EIN is often beneficial for small businesses as it provides a dedicated identifier for tax and legal purposes.

How do I apply for an EIN if I’m a foreign entity doing business in the U.S.?

+Foreign entities can apply for an EIN through the IRS website. You’ll need to provide specific details about your business, such as the foreign country of incorporation and the U.S. business address.