Emplyer Tax Id Door Dash

For businesses and contractors alike, understanding the role of tax identification numbers (TINs) is crucial for navigating the complex world of taxation and compliance. In the context of DoorDash, a prominent player in the gig economy, this topic becomes even more relevant. This article aims to provide a comprehensive guide, shedding light on the significance of employer tax ID numbers for DoorDash contractors, and how they play a pivotal role in managing tax obligations effectively.

The Significance of Tax IDs for DoorDash Contractors

When you engage with DoorDash as an independent contractor, your tax obligations become a key aspect of your business operations. The employer tax ID, often referred to as an EIN (Employer Identification Number), is a unique identifier assigned by the Internal Revenue Service (IRS) to businesses and organizations. It serves as a critical tool for tax administration, enabling DoorDash contractors to fulfill their tax responsibilities efficiently.

An EIN is not just a random set of numbers; it is a vital component of your business identity. For DoorDash contractors, it acts as a digital footprint, linking you to your tax records and ensuring proper tax filing. This unique number is required for various tax-related tasks, such as opening business bank accounts, applying for loans, and, most importantly, filing taxes accurately.

Securing an EIN: The Process

Obtaining an EIN is a straightforward process, and the IRS provides a user-friendly online application system. Here’s a step-by-step guide to help you navigate the process:

- Access the Online Application: Visit the official IRS website, where you'll find a dedicated section for EIN applications. Ensure you have a stable internet connection and the necessary information at hand.

- Complete the Application Form: The application form will guide you through a series of questions. Be prepared to provide details about your business, including its legal structure, location, and ownership information. Accuracy is crucial here to avoid delays in processing.

- Submit and Receive Your EIN: Once you've completed the form, submit it electronically. The IRS will typically process your application within minutes, and you'll receive your EIN almost instantly. Make sure to keep this number secure and record it for future reference.

For contractors who prefer a more traditional approach, the IRS also offers the option to apply for an EIN via fax or mail. However, the online application is generally recommended for its convenience and speed.

| EIN Application Options | Method |

|---|---|

| Online | Quick and secure |

| Fax | Slower, requires physical forms |

| Least efficient, delays possible |

Using Your EIN Effectively

Once you have your EIN, it’s time to put it to work. Here are some key areas where your employer tax ID will come into play:

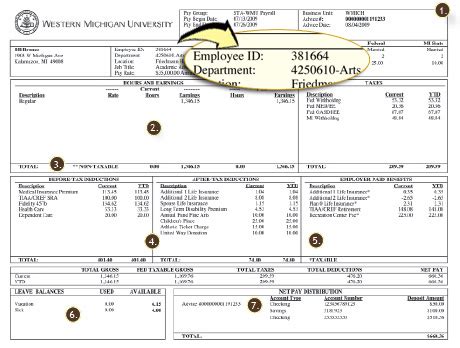

- Tax Filing: Your EIN is essential for filing federal tax returns. It's used to identify your business on tax forms, ensuring your tax payments are correctly attributed.

- Payroll and Employee Management: If you hire employees for your DoorDash business, your EIN will be crucial for managing payroll, withholding taxes, and reporting employee income and deductions.

- Banking and Financial Transactions: Many financial institutions require an EIN for business accounts. It adds an extra layer of security and helps in tracking business transactions.

- Business Licensing and Permits: In certain jurisdictions, an EIN may be required when applying for business licenses or permits. It demonstrates your legitimacy as a business entity.

DoorDash and Tax Compliance

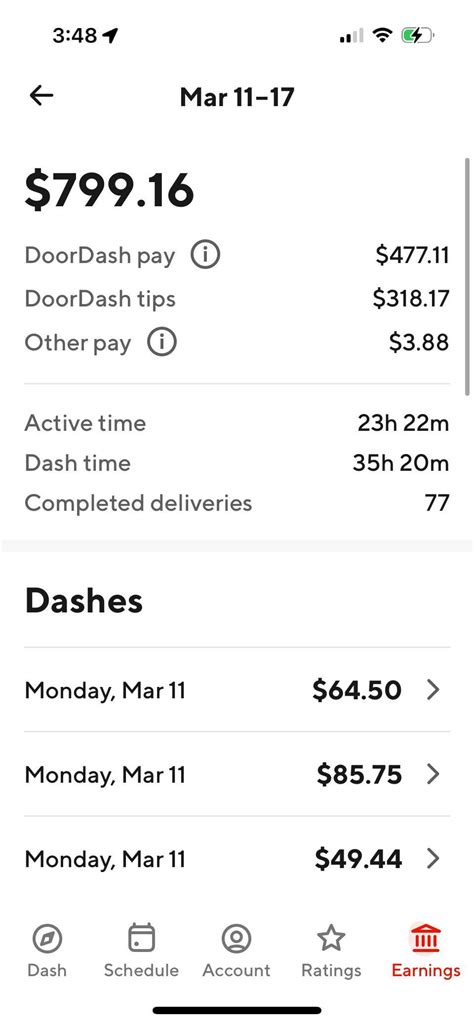

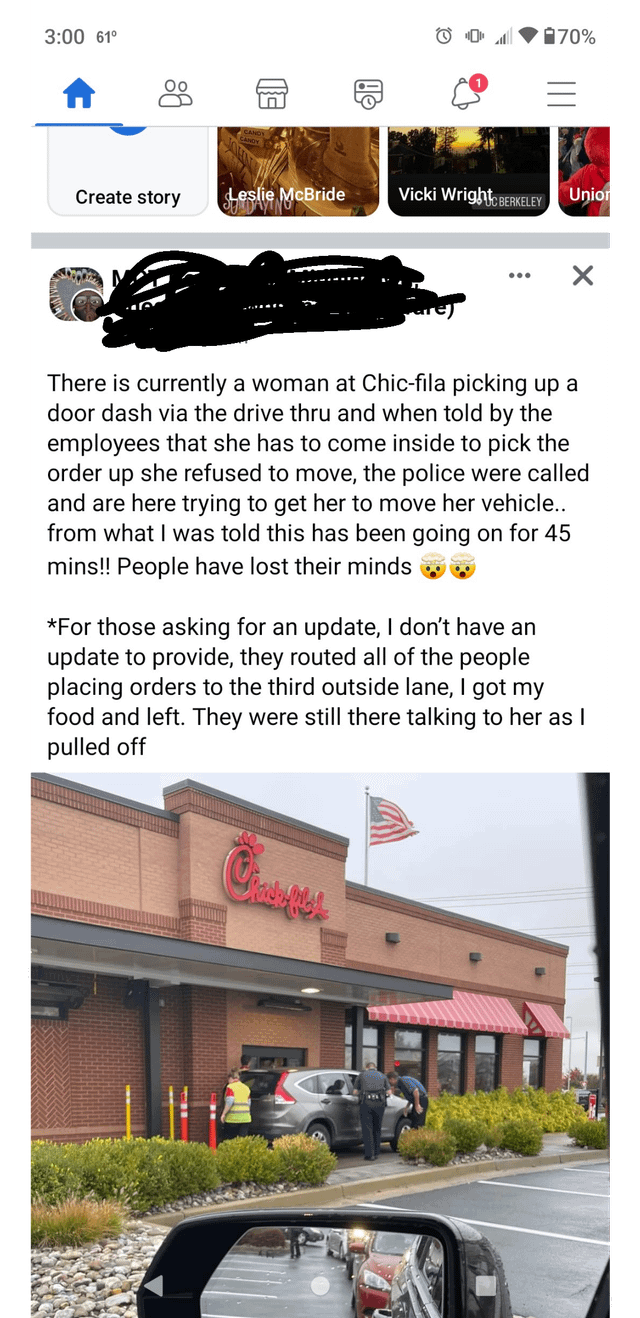

As a DoorDash contractor, understanding the platform’s role in tax compliance is essential. DoorDash provides a transparent platform for managing earnings and expenses, which is a significant step towards tax preparedness. The app offers features like tracking earnings, managing expenses, and providing tax estimates, making it easier for contractors to stay on top of their tax obligations.

However, it's important to note that DoorDash is not responsible for filing taxes on behalf of its contractors. The platform provides tools and resources to assist in tax management, but the ultimate responsibility lies with the contractor. This means that while DoorDash simplifies the process, contractors still need to be proactive in understanding their tax obligations and ensuring compliance.

DoorDash’s Role in Tax Support

DoorDash recognizes the importance of tax compliance for its contractors and has taken steps to provide support. The platform offers a range of resources, including educational materials, tax guides, and even partnerships with tax preparation services. These resources aim to empower contractors with the knowledge and tools needed to navigate the complex world of gig economy taxation.

Additionally, DoorDash has implemented features within its app to help contractors stay organized. For instance, the app provides a digital record of earnings and expenses, making it easier to track income and deductibles. This level of transparency and organization is invaluable when it comes to tax preparation.

Conclusion: Navigating Tax Obligations with Confidence

In the gig economy, where traditional employment structures are evolving, understanding tax obligations is more important than ever. For DoorDash contractors, securing an employer tax ID is a crucial step towards managing taxes effectively. The EIN acts as a cornerstone of your business identity, facilitating various tax-related tasks and ensuring compliance.

By leveraging the resources provided by DoorDash and staying informed about tax regulations, contractors can navigate the complex landscape of tax obligations with confidence. Remember, while the process may seem daunting at first, with the right tools and knowledge, managing taxes can become a streamlined and efficient part of your business operations.

FAQs

Can I use my Social Security Number instead of an EIN for tax purposes?

+Using your Social Security Number (SSN) for business-related tax purposes is generally not recommended. An EIN is specifically designed for business identification and offers several advantages. It helps maintain a clear separation between your personal and business tax obligations, reducing the risk of confusion or errors. Additionally, using an EIN can provide an extra layer of privacy and security, as it prevents your SSN from being publicly associated with your business activities.

How long does it take to receive an EIN after applying online?

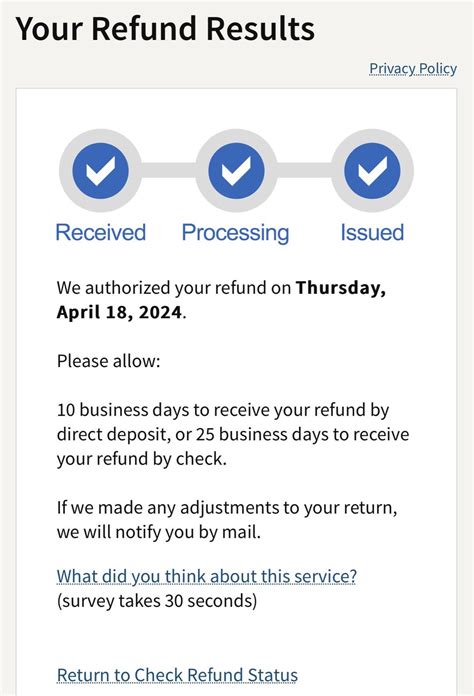

+When you apply for an EIN online through the IRS website, the process is typically very quick. You can expect to receive your EIN almost immediately after submitting your application. In most cases, the entire process, from filling out the application to receiving your EIN, takes less than 10 minutes. This makes the online application method a convenient and efficient choice for obtaining your EIN.

Are there any costs associated with obtaining an EIN for my DoorDash business?

+The good news is that obtaining an EIN from the IRS is a completely free service. You won’t be charged any fees when you apply online, by fax, or by mail. This makes it accessible for all businesses, regardless of their size or budget. However, it’s important to note that some third-party services may charge fees for assisting with the EIN application process. It’s always recommended to apply directly through the IRS to avoid unnecessary costs.

Can I change or update my EIN if my business structure changes?

+Yes, you can update or change your EIN if there are significant changes to your business structure. This might include a change in ownership, legal name, or business location. To make these changes, you’ll need to complete and submit Form 8822-B to the IRS. It’s important to keep your EIN information up-to-date to ensure accurate tax reporting and compliance with the law.

How can I keep track of my EIN and other important tax documents for my DoorDash business?

+Organizing and storing your EIN and other crucial tax documents is essential for efficient tax management. Consider using a dedicated digital folder or cloud storage system to keep all your tax-related files in one place. Additionally, make physical copies and store them securely. Regularly updating and backing up your records will ensure that you have easy access to these documents when needed, making tax preparation and filing a smoother process.