Understanding Tampa FL sales tax: The financial roadmap you need

Navigating the complex landscape of sales tax in Tampa, Florida, demands a precise understanding of local regulations, rate structures, and the broader fiscal environment. For entrepreneurs, consumers, and financial professionals alike, grasping the nuances of Tampa’s sales tax system isn't just about compliance—it's about optimizing fiscal health, making strategic decisions, and fostering sustainable business growth. This guide aims to serve as your comprehensive roadmap, unraveling the intricacies of Tampa FL sales tax with clarity, precision, and actionable insights backed by authoritative data and industry-standard practices.

Understanding Tampa FL Sales Tax: The Financial Roadmap You Need

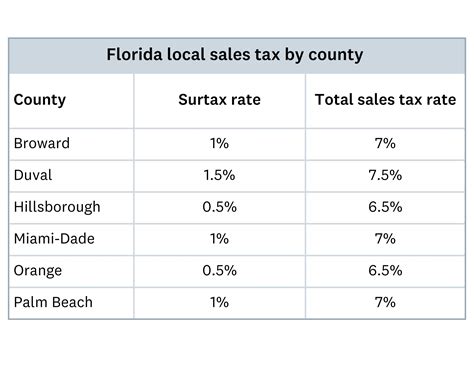

Sales tax in Tampa, FL, reflects a layered interplay of state, county, and municipal levies, each contributing to the comprehensive rate that consumers and businesses encounter at the point of sale. In 2023, Florida maintained a statewide base sales tax rate of 6.0%, but local jurisdictions like Hillsborough County—where Tampa is located—add their own supplementary taxes. For anyone operating within Tampa’s commercial sphere, understanding these components simplifies compliance and helps craft informed financial strategies. Critical to this understanding is the distinction between the taxable base and the total rate, which varies depending on the location, type of commodity or service, and specific legislative overrides.

The Components of Tampa FL Sales Tax

Breaking down Tampa’s sales tax involves analyzing the primary constituents that determine the final rate seen by the end consumer.

- State Sales Tax (6.0%): The foundational rate mandated by Florida’s Department of Revenue, applicable across all counties unless explicitly exempted.

- Local Discretionary Sales Surtaxes: Hillsborough County imposes additional surtaxes for specific purposes, such as transportation improvements, educational funding, or infrastructure development. These surtaxes can vary over time and are approved through referendum processes.

- Special District Taxes: Certain districts within Tampa may levy additional taxes for targeted projects, often related to redevelopment or infrastructure enhancements.

In sum, the total sales tax rate in Tampa as of late 2023 ranges between 7.5% and 8.5%, typically centered around 7.5%, with specific nuances depending on the precise locale and product category.

Steps to Calculate and Comply with Tampa FL Sales Tax

The process of accurately calculating Tampa’s sales tax is fundamental for compliance and financial planning. Below is a step-by-step guide to ensure precision and adherence to local regulations.

Step 1: Identify the Applicable Tax Rate

Consult the Florida Department of Revenue’s current tax rate database to determine the specific combined rate for the transaction location. Use tools like the Florida Sales Tax Rate Lookup to verify local surtaxes, which can change periodically based on legislation or local referenda.

Step 2: Determine the Taxable Goods or Services

Florida law defines taxable items broadly but also includes exemptions—for example, groceries and certain medical supplies. Understanding the classification of goods and services is critical for proper tax application. For instance, digital products, clothing, or restaurant services may have different exemptions or specific rules.

Step 3: Calculate the Total Tax

Multiply the pre-tax sale price by the current tax rate. For example, if a digital device priced at 500 is sold in Tampa with a 7.5% tax rate, the calculation would be:</p> <table> <tr><th>Sale Price</th><th>Tax Rate</th><th>Tax Collected</th></tr> <tr><td>5007.5%$37.50

This calculation should be integrated into point-of-sale systems to ensure real-time accuracy and compliance.

Step 4: Remit Collected Tax to Authorities

Register with the Florida Department of Revenue to obtain a sales tax certificate of registration. Schedule regular submissions—monthly, quarterly, or annually—depending on your gross sales volume. Maintain meticulous records, including sales receipts and exemption certificates, for audit preparedness.

Step 5: Stay Informed on Rate Changes and Legislative Updates

Tax rates and regulations evolve. Regularly review official sources, subscribe to industry newsletters, and consider consulting a tax professional specializing in Florida sales tax law to remain compliant and optimize your tax handling.

Impact of Tampa FL Sales Tax on Local Economy and Business Practices

Sales tax rates directly influence consumer behavior and business competition within Tampa. Lower rates tend to promote retail activity, while higher taxes can fund infrastructure projects that enhance the city’s appeal and productivity. The balance between generating revenue and maintaining a competitive business environment hinges on transparent, responsible management of these taxes.

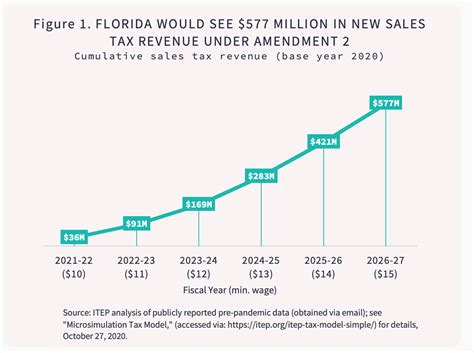

Case Study: Infrastructure Funding and Sales Tax Revenues

Over the past decade, Hillsborough County used surtaxes levied on sales to finance public transit initiatives, road improvements, and public school constructions. These initiatives contributed significantly to Tampa’s growing suburban sprawl, improved transit accessibility, and increased property values. According to county financial reports, surtax revenue accounts for approximately 20% of the county’s annual budget, emphasizing the importance of accurate calculation and timely remittance for local fiscal health.

Legal and Compliance Considerations in Tampa FL Sales Tax

While compliance necessitates adherence to rate calculations and remittance schedules, legal nuances can arise from misunderstandings or oversight. Key areas of concern include:

- Correct classification of taxable vs. exempt items

- Proper documentation for tax exemptions, especially for wholesale vs. retail sales

- Timely filing of returns and accurate record-keeping for audits

- Changes in tax laws following legislative amendments or ballot initiatives

The Florida Department of Revenue provides detailed guidance and resources to navigate these issues, but engaging with compliance specialists ensures robust risk mitigation.

Leveraging Technology for Accurate Sales Tax Management in Tampa

The automation of sales tax calculation and remittance is vital for modern businesses. Tools such as integrated POS systems, tax calculation APIs, and cloud-based accounting platforms reduce errors and improve audit readiness. When selecting software, verify:

- Real-time rate updates aligned with Tampa’s jurisdictional nuances

- Audit trail capabilities for all transactions

- Compliance with state and local filing requirements

Implementation of these tools not only streamlines operations but also safeguards against costly errors, enabling firms to focus on growth and customer engagement.

Future Trends and Policy Discussions in Tampa Sales Tax

The fiscal outlook of Tampa and Hillsborough County suggests ongoing debates around tax rates, exemptions, and revenue allocation. Digital innovation, e-commerce growth, and shifting consumer preferences will influence legislative priorities.

Emerging trends include:

- Expanding tax bases to include digital services and online marketplaces

- Implementing destination-based taxation to address mobile and transient sales

- Exploring tax incentives tied to sustainable development and public transit

Stakeholders must stay engaged with policy discussions to anticipate changes that could impact cash flows, pricing strategies, and overall competitiveness.

How often does Tampa adjust its sales tax rates?

+Rate adjustments typically follow legislative or referendum processes and can occur annually or less frequently, based on local fiscal needs and political decisions. Regular monitoring of official sources is recommended.

Are online sales in Tampa subject to the same local sales tax?

+Yes. As of the 2018 Supreme Court decision in South Dakota v. Wayfair, online sales delivered into Tampa are subject to the same local taxes if the seller exceeds certain thresholds of sales volume or transaction count, aligning remote commerce with brick-and-mortar taxation.

What penalties exist for failure to remit Tampa sales tax on time?

+Penalties can include fines, interest on overdue amounts, and potential audits. Florida law emphasizes prompt compliance, with an emphasis on maintaining accurate records and timely filings to avoid these consequences.