Santa Clara Sales Tax

Santa Clara, a bustling city in the heart of Silicon Valley, is known for its vibrant tech industry and thriving business ecosystem. However, for residents and businesses alike, understanding the intricacies of sales tax is crucial. This comprehensive guide delves into the world of Santa Clara sales tax, offering a detailed analysis of its rates, exemptions, and impact on local commerce.

Understanding Santa Clara Sales Tax

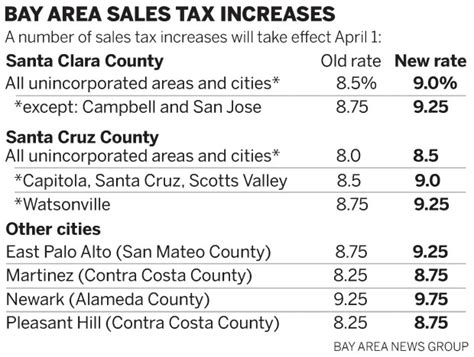

Santa Clara’s sales tax structure is a combination of state, county, and city taxes, with each level contributing to the overall rate. As of [date], the total sales tax rate in Santa Clara is [current rate]%, making it one of the higher sales tax rates in the Bay Area.

State Sales Tax

The state of California imposes a state sales tax of [state tax rate]%, which is a standard rate applied across the state. This tax is levied on most retail transactions, with a few notable exceptions.

County Sales Tax

Santa Clara County adds an additional county sales tax of [county tax rate]% to the state rate. This county tax helps fund various local services and infrastructure projects, ensuring the smooth functioning of the community.

City Sales Tax

The city of Santa Clara further adds its own sales tax of [city tax rate]%, bringing the total to the aforementioned [current rate]%. This city tax is essential for funding city-specific initiatives and maintaining the city’s unique character and amenities.

| Tax Jurisdiction | Sales Tax Rate |

|---|---|

| State of California | [state tax rate]% |

| Santa Clara County | [county tax rate]% |

| City of Santa Clara | [city tax rate]% |

| Total Sales Tax | [current rate]% |

Sales Tax Exemptions in Santa Clara

While sales tax is applicable to a wide range of goods and services, certain items are exempt from taxation. Understanding these exemptions is crucial for both consumers and businesses.

Groceries and Food

One of the most notable exemptions in Santa Clara is the sales tax exemption on groceries and unprepared food. This means that when you purchase essential items like milk, bread, and fresh produce, you won’t be charged the sales tax, making it a significant relief for households.

Prescription Drugs

Another important exemption is for prescription drugs. Whether you’re purchasing medications from a pharmacy or through a medical provider, you won’t be subject to sales tax, ensuring access to essential healthcare without the added financial burden.

Clothing and Shoes

Santa Clara also offers a sales tax exemption on clothing and footwear up to a certain value. This exemption is particularly beneficial for families and those looking to update their wardrobes without incurring additional costs.

Educational Materials

To promote education, educational materials such as books, school supplies, and certain software are exempt from sales tax. This encourages learning and makes essential educational resources more accessible.

Other Exemptions

Additionally, sales tax is not applied to newspaper and magazine subscriptions, as well as certain medical devices and wheelchair modifications. These exemptions aim to support the community’s access to information and essential healthcare needs.

| Exempt Item | Description |

|---|---|

| Groceries | Unprepared food items |

| Prescription Drugs | Medications and pharmacy items |

| Clothing and Shoes | Up to a certain value |

| Educational Materials | Books, school supplies, and software |

| Newspapers and Magazines | Subscriptions |

| Medical Devices | Certain specified devices |

| Wheelchair Modifications | For accessibility purposes |

Impact on Local Businesses

The sales tax structure in Santa Clara has a significant impact on local businesses, shaping their strategies and operations. Here’s how it affects various sectors:

Retail and E-commerce

For retail stores and e-commerce businesses, the sales tax rate directly influences their pricing strategies and competitive advantage. Businesses must carefully consider the tax rate when setting prices to remain attractive to consumers while maintaining profitability.

Manufacturing and Distribution

In the manufacturing and distribution sectors, sales tax impacts the cost of doing business. Companies must factor in the tax rate when determining their product pricing, especially when competing with out-of-state or online retailers that may have lower tax rates.

Hospitality and Tourism

The hospitality industry, including hotels and restaurants, is heavily influenced by sales tax. The tax rate can affect the overall cost of travel and dining, impacting the decision-making process of tourists and locals alike. A higher tax rate may deter visitors, while a well-managed tax structure can enhance the city’s appeal.

Technology and Innovation

Santa Clara’s reputation as a tech hub is intertwined with its sales tax structure. Tech startups and innovative businesses often face unique challenges, and a well-designed tax system can encourage growth and investment. The city’s sales tax policies can either attract or deter tech companies, shaping the local economy.

Sales Tax Compliance and Filing

Understanding sales tax is one aspect, but compliance and accurate filing are crucial for businesses. Here’s a breakdown of the process:

Registering for Sales Tax

Businesses operating in Santa Clara must register for a seller’s permit with the California Department of Tax and Fee Administration (CDTFA). This permit allows them to collect and remit sales tax on behalf of the state, county, and city.

Sales Tax Calculation

Businesses must calculate the sales tax for each transaction based on the applicable tax rates. This involves understanding the tax rates for different jurisdictions and applying them accurately.

Sales Tax Collection

During the sales process, businesses are responsible for collecting the appropriate sales tax from customers. This tax is typically included in the final price displayed to the customer.

Sales Tax Remittance

On a regular basis, usually quarterly or monthly, businesses must remit the collected sales tax to the CDTFA. This involves filing tax returns and paying the total amount due, ensuring compliance with tax laws.

Sales Tax Audits

The CDTFA conducts periodic sales tax audits to ensure businesses are compliant with tax regulations. These audits involve reviewing sales records, tax returns, and other financial documents to verify the accuracy of tax filings.

Future Implications and Trends

As Santa Clara continues to evolve, the sales tax landscape is likely to see changes and adjustments. Here are some potential future implications and trends to watch:

Potential Rate Adjustments

The sales tax rate in Santa Clara is subject to change based on economic conditions and legislative decisions. While the current rate is stable, future adjustments could impact businesses and consumers alike.

Online Sales Tax Collection

With the rise of e-commerce, the collection of sales tax on online transactions is a growing concern. Santa Clara, along with other jurisdictions, may implement measures to ensure online retailers collect and remit sales tax, ensuring a level playing field for local businesses.

Tax Incentives for Businesses

To attract and retain businesses, Santa Clara may consider offering tax incentives, such as tax breaks or rebates, to promote economic growth and job creation. These incentives could make the city more attractive to startups and established companies.

Tax Automation and Technology

Advancements in technology are likely to streamline the sales tax process. Tax automation tools and software could make compliance easier for businesses, reducing the risk of errors and simplifying tax calculations and filings.

Community Engagement

Santa Clara’s sales tax structure can be a tool for community engagement and empowerment. The city could explore initiatives that allow residents to vote on how sales tax revenue is allocated, fostering a sense of ownership and investment in local projects.

What is the current sales tax rate in Santa Clara?

+

As of [date], the total sales tax rate in Santa Clara is [current rate]%, consisting of the state, county, and city taxes.

Are there any sales tax exemptions in Santa Clara?

+

Yes, Santa Clara offers sales tax exemptions on groceries, prescription drugs, clothing, educational materials, and certain other items.

How do sales tax rates impact local businesses?

+

Sales tax rates influence pricing strategies, competitiveness, and overall profitability for local businesses. They play a crucial role in shaping the business landscape.

What is the process for businesses to comply with sales tax regulations in Santa Clara?

+

Businesses must register for a seller’s permit, collect sales tax from customers, calculate the tax accurately, and remit it to the California Department of Tax and Fee Administration on a regular basis.

What are the potential future trends in Santa Clara’s sales tax landscape?

+

Future trends may include rate adjustments, online sales tax collection, tax incentives for businesses, tax automation, and community engagement initiatives related to sales tax revenue allocation.