Vehicle Excise Tax: The Tollbooth of Road Ownership

Understanding the intricacies of vehicle excise tax reveals more than just a financial obligation; it unravels a complex web of policy, economics, societal values, and governmental accountability. Often referred to colloquially as a tollbooth of road ownership, this form of taxation stands as a linchpin in the governance of transportation infrastructure, shaping how citizens interact with mobility and how states allocate resources for maintaining and expanding road networks. A comprehensive systems thinking analysis of vehicle excise tax involves dissecting its multifaceted components—policy frameworks, economic implications, social justice considerations, and technological evolutions—each interconnected within the overarching ecosystem of public transportation finance.

Deciphering Vehicle Excise Tax: Foundations and Functional Interrelations

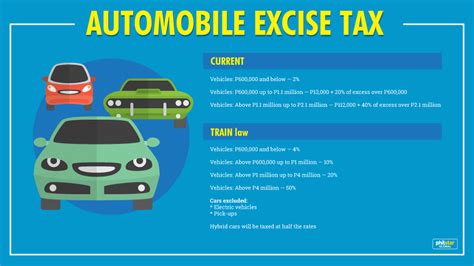

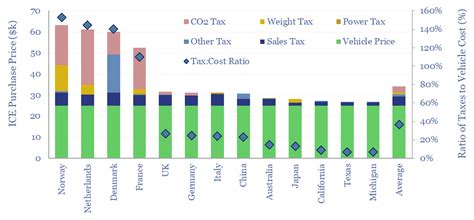

At its core, vehicle excise tax (VET)—sometimes called a road tax or car tax—is a fiscal policy mechanism employed by governments to generate revenue from vehicle owners based on the type, weight, emissions, or usage of their vehicles. Unlike traditional indirect taxes, VET functions as a direct user charge aligned with principles of road user pay, aiming to balance road maintenance costs with vehicle usage and environmental impact.

Embedded within broader transport economics, the VET system influences consumer behavior, vehicle innovation dynamics, and urban planning strategies. Its design reflects an intent not merely to fund infrastructure but to embed ecological and social considerations, such as incentivizing cleaner vehicles or reducing congestion through differentiated tax schemes. This interconnectedness between policy objectives, economic incentives, and societal impacts underscores the importance of a systems perspective—each change in tax rates, valuation methods, or exemptions triggers ripples across the transportation landscape.

Historical Evolution and Policy Drivers

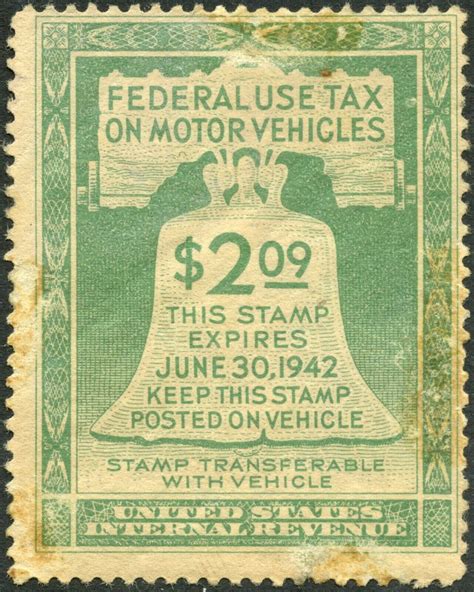

Historically, vehicle excise tax originated as a simple registration fee but has evolved into a nuanced instrument incorporating environmental and economic policies. In the UK, for example, the VET system dates back over a century, initially tied to vehicle weight, transitioning towards emissions-based taxation with the advent of environmental awareness in the late 20th century. Similarly, in the US, varying state-level taxes—ad valorem, flat fees, or hybrid models—mirror evolving priorities and technological changes.

The policy drivers behind VET encompass not only infrastructure funding but also congestion management, pollution mitigation, and revenue equity. For instance, the implementation of emissions-based taxes attempts to internalize environmental externalities, aligning individual vehicle behavior with broader climate objectives. These drivers often serve as nodes connecting economic efficiency, environmental sustainability, and social equity within a complex system that adapts over time through legislative reforms and technological innovations.

| Relevant Category | Substantive Data |

|---|---|

| Average Revenue per Vehicle | $250–$600 annually, depending on jurisdiction and vehicle class |

| Emission Reduction Impacts | Up to 15% decrease in CO2 emissions with implementation of eco-specific taxes |

| Revenue Allocation | ~70% allocated directly to road maintenance, remainder to public transit and environmental initiatives |

Interconnected Components of VET Systems and Their Influence on Road Ownership Dynamics

Analyzing vehicle excise tax as a ‘tollbooth’ of road ownership demands mapping out its interconnected components. This entails examining not just tax rates, but also vehicle classification criteria, enforcement mechanisms, technological alternatives, and the political-economic context shaping these policies.

Vehicle classification—based on weight, engine size, or emissions—serves as a primary determinant of taxable amount. This taxonomy influences manufacturers’ design strategies, consumer choices, and the progression toward electric and low-emission vehicles. Consequently, the system’s responsiveness to technological change becomes pivotal, creating feedback loops that can accelerate shift toward sustainable transport modes.

Enforcement mechanisms—ranging from traditional manual checks to advanced automatic number plate recognition (ANPR)—are interconnected with compliance rates and revenue stability. Innovations in digitization and data analytics can reduce evasion, enhance transparency, and enable policy refinements responsive to usage patterns.

Technological evolution, especially the rise of connected vehicles and mobility-as-a-service (MaaS), introduces new variables. Real-time data transmission could inform dynamic taxation models based on actual road usage rather than static valuation, fundamentally transforming the system into a form of fluid tollbooth—akin to a continuous, responsive tolling ecosystem.

The economic and political milieu—public acceptance, legislative inertia, and fiscal priorities—intertwine with these components, shaping the architecture and reform trajectories of VET systems. Misalignments or reforms in one area ripple through the entire system, affecting road ownership capacities and distribution of infrastructure responsibilities.

Environmental Externalities and Social Equity

Efforts to internalize externalities via vehicle excise tax mirror broader environmental policies. By increasing rates for high-emission vehicles, governments incentivize cleaner alternatives, reducing greenhouse gases and local pollutants. However, this approach intertwines with social equity issues: higher taxes on larger or luxury vehicles may disproportionally affect lower-income households that rely on older, less efficient vehicles, unless carefully structured.

Designing equitable VET systems involves balancing revenue needs with fairness, potentially through exemptions, rebates, or tiered rates that recognize societal disparities. These mechanisms influence vehicle ownership patterns and broader mobility options, underscoring the importance of a holistic, systems-oriented policy approach.

| Relevant Category | Substantive Data |

|---|---|

| Impact on Low-Income Households | Potential increase of up to 20% in annual costs without targeted exemptions |

| Emission Reduction Efficacy | Reduction of 10-15% in urban pollution with tiered, environmentally focused VET schemes |

| Public Acceptance | Varies widely; surveys indicate 65% support when revenues fund localized road improvements |

Impacts of Technological Innovation and Future Trends

The future of vehicle excise tax is increasingly intertwined with technological advancements. Electric vehicles (EVs), autonomous driving, and digital infrastructure portend a paradigm shift from traditional vehicle classification to usage-based and data-driven taxation.

Transitioning from static rates based on vehicle specifications to dynamic, real-time tolling systems hinges upon robust telematics and IoT connectivity. This evolution could facilitate a more direct and efficient internalization of external costs—such as congestion, wear and tear, and pollution—transforming the excise tax from a static annual burden into a flexible, real-time economic signal.

Furthermore, integrating blockchain technology offers transparency, security, and decentralization, promising enhancements in compliance and revenue collection. As autonomous vehicle fleets become mainstream, their usage patterns can be meticulously monitored, enabling highly tailored taxation aligned with vehicle miles traveled (VMT) or time of usage, echoing the function of a continuously adjustable tollbooth ecosystem.

Policy adaptation to these technological shifts must be vigilant about privacy concerns, infrastructural costs, and the risk of digital divide—factors that could influence overall system acceptance and effectiveness.

Systems Approach to Policy and Implementation

Pursuing an integrated systems approach involves developing adaptable frameworks that can evolve with technological, environmental, and societal changes. This encompasses iterative policy design, stakeholder engagement, technological integration, and ongoing data analysis to calibrate the system.

The combined effect of optimized vehicle classification, real-time dynamic taxation, and equitable revenue redistribution can enhance the legitimacy and efficiency of road ownership models, making them more responsive, fair, and sustainable over time.

Key Points

- Vehicle excise tax serves as a systemic vehicle for funding road infrastructure and influencing mobility patterns.

- Its interconnected components—classification, compliance, technology—form a dynamic system responsive to policy, environmental, and technological shifts.

- Designing equitable, adaptive VET systems requires balancing fiscal, ecological, and social priorities, facilitated by data and stakeholder feedback.

- Future trends point toward data-driven, usage-based models that could redefine road ownership tolls as real-time, intelligent ecosystems.

- Systems thinking enhances strategic policymaking, ensuring resilience amid rapid technological and societal change.

How does vehicle excise tax influence vehicle innovation?

+By varying tax rates based on vehicle emissions or efficiency, policymakers incentivize manufacturers to develop cleaner, more energy-efficient vehicles, accelerating technological advancement and market adoption of eco-friendly options.

Can real-time data change how vehicle excise tax is implemented?

+Yes. Utilizing telematics and IoT, authorities can adopt dynamic taxation models that adjust costs based on actual usage, reducing evasion and aligning charges more closely with individual behavior and societal costs.

What are the equity considerations in vehicle excise tax reforms?

+Reforms must ensure that low-income households are not disproportionately burdened, possibly through exemptions or sliding scales, to maintain fairness and social acceptance within the broader transportation system.