When Is California Property Tax Due

Understanding the California property tax system is essential for homeowners and investors alike. The state's unique assessment process and billing cycle can be quite different from other parts of the country, making it crucial to stay informed and organized. This article aims to provide a comprehensive guide to when California property taxes are due, along with insights into the assessment process, billing cycle, and potential consequences of missed payments.

The California Property Tax Assessment Process

California employs a unique property tax assessment system known as the “Proposition 13” system, which was enacted in 1978. This system is designed to protect homeowners from sudden and significant increases in property taxes. Here’s how it works:

- Assessed Value: When a property is purchased, its assessed value is set at the purchase price. This value serves as the basis for property tax calculations.

- Annual Increase Cap: Each year, the assessed value can only increase by a maximum of 2% or the rate of inflation, whichever is lower. This cap ensures that property taxes remain manageable for homeowners.

- Reassessments: Certain events trigger a reassessment of the property's value, such as significant improvements or changes in ownership. This reassessment can result in a new, higher assessed value.

- Base Year Value: The assessed value, whether it's the purchase price or the result of a reassessment, becomes the property's "base year value." This value is used to calculate property taxes until there's another qualifying event.

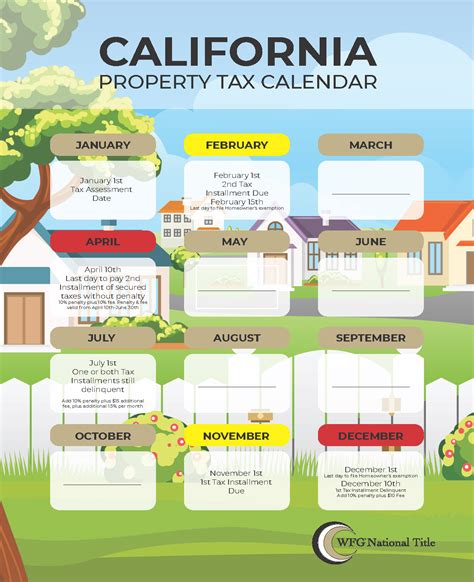

The California Property Tax Billing Cycle

The billing cycle for California property taxes operates on a fiscal year basis, running from July 1st to June 30th of the following year. Here’s an overview of the key dates and processes:

July 1st to September 30th

This period marks the start of the new fiscal year. During this time, the Assessor’s Office reviews property records and makes any necessary updates to assessed values. They also send out preliminary property tax bills, which are based on the previous year’s tax rates and assessed values.

October 1st to November 30th

The Tax Collector’s Office takes over and begins the formal billing process. They send out the final property tax bills, which include the exact amount due and the due dates. These bills are typically mailed by the end of November.

First Installment Due Date: November 1st to December 10th

California property taxes are divided into two installments. The first installment is due between November 1st and December 10th. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Failure to pay the first installment by December 10th results in a 10% penalty.

Second Installment Due Date: February 1st to April 10th

The second installment of property taxes is due between February 1st and April 10th. Again, if the due date lands on a weekend or holiday, the deadline is extended to the next business day. Non-payment of the second installment by April 10th incurs a 10% penalty and may lead to additional fees and potential legal action.

Consequences of Missed Payments

Failure to pay California property taxes on time can have serious consequences. Here’s what you need to know:

- Penalties and Fees: As mentioned, missing the installment deadlines results in a 10% penalty. Additionally, there may be late payment fees and interest charges.

- Tax Default: If the second installment remains unpaid after the grace period, the property becomes tax-defaulted. This status can lead to further penalties and legal action.

- Tax Sale: In extreme cases, the county may place the property up for a tax sale to recover the unpaid taxes. This process can result in the loss of ownership.

Strategies for Staying Current on Property Taxes

To avoid the potential pitfalls of missed property tax payments, consider these strategies:

- Set Reminders: Mark your calendar with the due dates for both installments. You can also set up reminders on your phone or digital assistant.

- Payment Plans: If you anticipate difficulty paying your property taxes, consider contacting the Tax Collector's Office to discuss payment plan options.

- Monitor Your Assessment: Stay informed about your property's assessed value and any potential reassessments. This knowledge can help you budget for future tax payments.

- Understand the Appeal Process: If you believe your property's assessed value is incorrect, you have the right to appeal. Understanding the appeal process can help you challenge an unfair assessment.

Conclusion

California’s property tax system, while unique, can be navigated successfully with the right knowledge and planning. Understanding the assessment process, staying informed about billing cycles, and staying organized with payment deadlines can help ensure that you meet your property tax obligations without penalty. By staying proactive and informed, you can avoid the potential pitfalls of missed payments and maintain a positive relationship with your local tax authorities.

What happens if I miss the first installment deadline but pay the second on time?

+

If you miss the first installment deadline but pay the second installment on time, you’ll still incur a 10% penalty on the first installment. However, there won’t be any additional penalties for the second installment as long as it’s paid by the due date.

Can I appeal my property’s assessed value if I believe it’s incorrect?

+

Yes, you have the right to appeal your property’s assessed value if you believe it’s inaccurate or unfair. The process typically involves submitting an appeal to the Assessor’s Office and providing evidence to support your claim. It’s important to act promptly, as there are deadlines for appealing assessments.

How often does the assessed value of my property change?

+

The assessed value of your property can change whenever there’s a qualifying event, such as a change in ownership or significant improvements to the property. Additionally, the assessed value can increase by a maximum of 2% or the rate of inflation annually, whichever is lower.