Michigan Tax Refund Status

The Michigan Department of Treasury is responsible for processing tax refunds for residents and businesses in the state. Understanding the tax refund status and the various factors influencing its processing time is crucial for individuals and businesses alike. This article aims to provide an in-depth analysis of the Michigan tax refund status, including the timelines, factors affecting refunds, and strategies to optimize the refund process.

Michigan Tax Refund Status: A Comprehensive Overview

In the state of Michigan, tax refunds are a vital component of the financial landscape, offering a much-needed boost to residents and businesses alike. The Michigan Department of Treasury plays a pivotal role in managing and disbursing these refunds, ensuring a smooth and timely process for taxpayers.

Understanding the Tax Refund Process in Michigan

The tax refund process in Michigan is a meticulous journey, beginning with the accurate filing of tax returns. The Michigan Department of Treasury receives a deluge of tax returns each year, with the majority processed within a few weeks. However, it's important to note that various factors can influence the timeline, resulting in delays or early disbursements.

One of the key factors is the complexity of the tax return. Returns with straightforward deductions and credits are generally processed more swiftly than those with intricate transactions or adjustments. Additionally, the accuracy of the return plays a significant role; errors or discrepancies can lead to delays as the department seeks further clarification.

| Return Complexity | Processing Time |

|---|---|

| Simple Returns | 2-3 weeks |

| Complex Returns | 4-6 weeks |

Timelines for Michigan Tax Refunds

The timeline for receiving a Michigan tax refund varies depending on several factors, including the method of filing and the time of year. Here's a breakdown of the typical timelines:

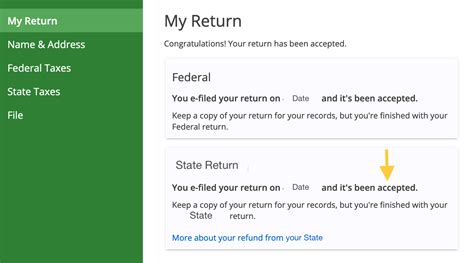

- E-Filing with Direct Deposit: Taxpayers who choose electronic filing and direct deposit can expect their refunds within 7-14 days of filing. This is the fastest way to receive a refund, and it's recommended for those seeking prompt financial relief.

- E-Filing with Check: For those opting for a paper check, the refund timeline extends to 3-4 weeks. While still relatively quick, it's important to note that the processing and mailing of checks can take additional time.

- Paper Filing: Traditional paper filing methods tend to result in longer wait times. Refunds for paper returns can take anywhere from 6-8 weeks, primarily due to the manual processing involved.

It's worth noting that these timelines are estimates and can be influenced by various factors. For instance, tax refunds during the peak filing season (typically January-April) may experience delays due to the high volume of returns being processed.

Factors Affecting Michigan Tax Refunds

Several factors can impact the processing time and status of Michigan tax refunds. Understanding these factors can help taxpayers anticipate delays or prepare for potential issues.

- Errors or Discrepancies: Inaccurate or incomplete information on tax returns can lead to delays. The Department of Treasury may need to request additional documentation or clarification, prolonging the refund process.

- Audit Considerations: In rare cases, tax returns may be selected for audit. This can significantly impact the refund timeline as the department scrutinizes the return for accuracy and compliance.

- Identity Verification: To prevent fraud, the Department of Treasury employs robust identity verification measures. If there are concerns about identity theft or fraudulent activity, refunds may be delayed while these issues are resolved.

- Payment Issues: Refunds may be delayed if there are issues with the taxpayer's banking information, such as a closed account or incorrect routing numbers. It's crucial to ensure banking details are accurate and up-to-date.

Optimizing Your Michigan Tax Refund

While the Michigan Department of Treasury works diligently to process tax refunds efficiently, there are strategies taxpayers can employ to optimize their refund journey.

- E-File and Direct Deposit: Opting for electronic filing and direct deposit is the fastest way to receive your refund. It's a secure and efficient process, reducing the risk of errors and delays.

- Double-Check Your Return: Take the time to thoroughly review your tax return before submission. Ensure all information is accurate and complete to avoid unnecessary delays due to errors or missing data.

- Stay Informed: The Michigan Department of Treasury provides regular updates and resources on tax refund status and processing times. Stay tuned to their official channels and websites for the latest information.

- Monitor Your Refund Status: Taxpayers can track the status of their refund using the Michigan Treasury's online tool. This allows you to stay informed about the progress of your refund and take action if needed.

Michigan Tax Refund Status: Future Implications

The Michigan tax refund landscape is evolving, and several factors are shaping its future. As technology advances, the Michigan Department of Treasury is exploring ways to enhance the refund process, making it more efficient and secure.

Technology and Automation

The Department of Treasury is investing in technology to streamline the tax refund process. Automation and digital tools are being leveraged to improve accuracy, reduce processing times, and enhance security measures. This includes the use of artificial intelligence and machine learning to identify potential errors or fraudulent activities, allowing for swift action and faster refund disbursements.

Taxpayer Education and Support

The Michigan Department of Treasury is committed to empowering taxpayers with the knowledge and tools they need to navigate the tax refund process smoothly. This includes providing educational resources, webinars, and workshops to help taxpayers understand their rights, responsibilities, and the steps involved in claiming refunds.

Continuous Improvement

The Department of Treasury recognizes that there is always room for improvement. They are dedicated to continuously refining their processes, policies, and systems to ensure a seamless and efficient tax refund journey for all Michigan residents and businesses. This includes soliciting feedback from taxpayers and incorporating their insights into future iterations of the refund process.

Conclusion: A Brighter Tax Refund Future for Michigan

In conclusion, the Michigan tax refund status is a dynamic and evolving landscape, influenced by a myriad of factors. From technological advancements to taxpayer education initiatives, the Department of Treasury is committed to making the refund process more efficient, secure, and accessible. As Michigan continues to adapt and innovate, taxpayers can look forward to a brighter and more streamlined tax refund future.

How can I check the status of my Michigan tax refund online?

+

You can check your Michigan tax refund status online by visiting the Michigan Department of Treasury’s official website. Navigate to the “Where’s My Refund?” section and enter your Social Security Number, Refund Type, and Expected Refund Amount. This tool provides real-time updates on the status of your refund.

What if my tax refund is delayed due to errors or discrepancies?

+

If your tax refund is delayed due to errors or discrepancies, the Michigan Department of Treasury will send you a notice explaining the issue. Respond promptly to the notice, providing any additional information or documentation requested. This will help expedite the refund process.

Can I receive my Michigan tax refund by check instead of direct deposit?

+

Yes, you can choose to receive your Michigan tax refund by check instead of direct deposit. When filing your tax return, indicate your preference for a paper check. Keep in mind that receiving a refund by check may result in slightly longer processing times compared to direct deposit.

What should I do if my Michigan tax refund is lost or stolen?

+

If your Michigan tax refund is lost or stolen, contact the Michigan Department of Treasury’s Refund Inquiry Unit immediately. They will guide you through the process of filing a claim and issuing a replacement refund. It’s crucial to act promptly to minimize any financial impact.

How can I stay updated on Michigan tax refund news and updates?

+

Stay updated on Michigan tax refund news and updates by subscribing to the Michigan Department of Treasury’s email notifications. Additionally, follow their official social media channels and regularly visit their website for the latest announcements, changes, and improvements related to tax refunds.