Travis County Property Tax Search

Welcome to our comprehensive guide on the Travis County Property Tax Search, a vital tool for property owners and residents of this vibrant county in Texas. This article will delve into the intricacies of the property tax system in Travis County, offering a detailed overview, practical insights, and step-by-step instructions to help you navigate this essential process.

Property taxes are a significant responsibility for homeowners and businesses, and understanding how to effectively manage and search for this information is crucial. In Travis County, the process is streamlined and accessible, making it easier for taxpayers to stay informed and compliant. This guide will walk you through the entire journey, from the basics of property taxation to advanced search techniques and essential resources.

Understanding Travis County Property Taxes

Travis County, with its vibrant cities like Austin, Pflugerville, and Cedar Park, has a robust property tax system that contributes to the county’s growth and development. Property taxes are a primary source of revenue for local governments, funding essential services like schools, roads, emergency services, and public facilities.

In Travis County, the property tax process involves several key players. The Travis Central Appraisal District (TCAD) is responsible for appraising all taxable property each year. This ensures that property values are fair and accurate, forming the basis for tax assessments. The Travis County Appraisal Review Board (ARB) then reviews these appraisals, allowing taxpayers to appeal if they believe their property value is incorrect.

Once the appraisal process is complete and any disputes are resolved, the Travis County Tax Assessor-Collector office calculates the actual property tax bills based on the appraised values and the tax rates set by various taxing entities, such as the county, cities, school districts, and special districts. These tax rates are typically approved by the Travis County Commissioners Court and other local governing bodies.

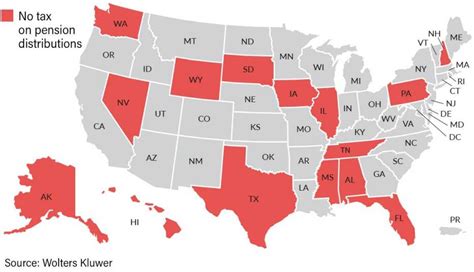

It's important to note that property taxes in Texas are ad valorem taxes, meaning they are based on the assessed value of the property. The higher the property value, the higher the tax liability. However, Travis County offers various exemptions and discounts to eligible taxpayers, such as the homestead exemption for primary residences, which can significantly reduce the taxable value of a property.

Exploring the Travis County Property Tax Search Tool

Travis County provides an intuitive and user-friendly online platform for property tax search and management. The Travis County Property Tax Search tool is a powerful resource that allows taxpayers to access a wealth of information about their properties and the associated taxes.

Here's a detailed breakdown of the features and functionalities of this essential tool:

Account Registration and Login

To access the advanced features of the Travis County Property Tax Search, users must first create an account. This process is straightforward and can be completed in a few simple steps:

- Visit the Official Website: Go to the Travis County Property Tax Search website.

- Click on "Register": Locate the registration link, usually found on the homepage or in the top navigation bar.

- Fill in the Registration Form: Provide the required details, including your name, email address, and a secure password. You may also need to enter your property address or account number for verification purposes.

- Verify Your Email: After submitting the registration form, check your inbox for a confirmation email. Click on the verification link provided to activate your account.

- Log In: Once your account is verified, you can log in using your credentials. This grants you access to your personalized property tax information and allows you to perform various actions.

Account registration offers several benefits, including personalized property tax data, the ability to set up tax payment reminders, and access to a dedicated support team for any queries.

Searching for Property Tax Information

The Travis County Property Tax Search tool offers multiple search methods to accommodate different user needs. Here are the primary search options:

- Account Number Search: This is the quickest way to access your property tax information. Simply enter your account number in the designated field, and the system will retrieve all relevant details.

- Address Search: If you don't have your account number handy, you can search by address. Enter the property's street address, city, and zip code to view the associated tax details.

- Property ID Search: For advanced users, the Property ID (or Parcel ID) search allows precise identification of a property. This unique identifier can be found on tax bills or through the TCAD website.

- Name Search: Searching by owner's name can be useful when managing multiple properties or researching a specific property owner. Enter the property owner's name to view a list of properties associated with that individual.

Once you've found the property you're interested in, the search results will display essential information such as the property address, account number, appraised value, tax rate, and estimated tax amount. This data is updated regularly to ensure accuracy and transparency.

Viewing and Downloading Tax Records

The Travis County Property Tax Search tool provides users with the ability to view and download detailed tax records. This feature is particularly useful for taxpayers who want to keep comprehensive records or for professionals who require this information for various purposes.

To access tax records:

- Log in to Your Account: Ensure you are logged in to your registered account on the Travis County Property Tax Search platform.

- Select the Property: Choose the specific property for which you want to view or download tax records. You can do this by entering the account number or searching by address.

- Click on "View Tax Records": Locate the "View Tax Records" button or link on the property's detail page. This will open a new window or tab with the tax record details.

- Review the Records: The tax record page will display a comprehensive breakdown of the property's tax information, including the appraisal history, tax rate details, and any applicable exemptions or discounts.

- Download the Records: If you wish to save a copy of the tax records for future reference, look for the "Download" button or link. This will typically provide you with a PDF or CSV file that you can save to your device.

Having access to these detailed tax records empowers taxpayers to stay informed, make informed financial decisions, and ensure compliance with local tax regulations.

Online Tax Payment and Reminders

Travis County offers a convenient online tax payment system, allowing taxpayers to pay their property taxes securely from the comfort of their homes or offices. This service not only saves time but also provides a transparent and efficient payment process.

To make an online tax payment:

- Log in to Your Account: Ensure you are logged in to your registered account on the Travis County Property Tax Search platform.

- Select the Property: Choose the specific property for which you want to make a tax payment. You can do this by entering the account number or searching by address.

- Click on "Make a Payment": Locate the "Make a Payment" button or link on the property's detail page. This will direct you to the secure payment portal.

- Choose Your Payment Method: The payment portal will offer various payment options, such as credit card, debit card, or electronic check. Select the method that suits your preference.

- Enter Payment Details: Provide the required payment information, including the amount you wish to pay and any additional security codes or verification details.

- Review and Confirm: Carefully review the payment summary, ensuring all details are correct. Once satisfied, click on the "Confirm Payment" or similar button to finalize the transaction.

To further enhance convenience, Travis County provides tax payment reminders. Users can set up email or text reminders for upcoming tax deadlines, ensuring they never miss a payment and avoid late fees.

Advanced Property Tax Search Techniques

For users who require more advanced search capabilities, Travis County offers several powerful features to enhance the property tax search experience. These techniques are particularly useful for real estate professionals, investors, and individuals researching multiple properties.

Batch Searches and Reports

The Travis County Property Tax Search tool supports batch searches, allowing users to retrieve information for multiple properties simultaneously. This feature is ideal for conducting comparative analyses, researching investment opportunities, or managing a portfolio of properties.

To perform a batch search:

- Log in to Your Account: Ensure you are logged in to your registered account on the Travis County Property Tax Search platform.

- Select the Batch Search Option: Look for the "Batch Search" or "Bulk Search" button or link on the homepage or in the navigation menu. This will open a new window or tab with the batch search interface.

- Enter Property Details: The batch search interface will provide fields for entering multiple properties. You can input account numbers, addresses, or other unique identifiers for each property you wish to include in the search.

- Choose Search Criteria: Specify the type of information you want to retrieve for each property. This could include appraisal values, tax rates, tax amounts, or other relevant data.

- Run the Search: Once you have entered all the necessary details and selected the search criteria, click on the "Run Search" or similar button to initiate the batch search. The system will process your request and generate a comprehensive report.

- Review the Results: The batch search results will be presented in a tabular format, with each property's details displayed in a row. You can scroll through the table to review the information for each property and make comparisons as needed.

Additionally, the batch search feature often includes the option to download the search results as a CSV or Excel file, making it easier to analyze and manipulate the data using spreadsheet software.

Advanced Property Search Filters

The Travis County Property Tax Search tool offers advanced search filters to refine your property search results. These filters enable users to narrow down their searches based on specific criteria, making it easier to find properties that match their requirements.

Here are some of the advanced search filters available:

- Property Type: Filter properties by their type, such as residential, commercial, industrial, or agricultural.

- Appraisal Value Range: Specify a range of appraised values to find properties within a certain price range.

- Tax Rate: Search for properties with specific tax rates, which can be useful for comparative analyses.

- Exemptions: Filter properties based on the types of exemptions they have, such as homestead exemptions or veterans' exemptions.

- Tax Status: Locate properties with specific tax statuses, such as delinquent or current.

- School District: Target properties that fall within a particular school district, which is especially relevant for families considering school options.

By utilizing these advanced search filters, users can quickly identify properties that meet their unique criteria, making the search process more efficient and targeted.

Essential Resources for Property Tax Management

Travis County provides a range of resources to support taxpayers in managing their property taxes effectively. These resources offer valuable information, guidance, and tools to ensure a smooth and compliant tax experience.

Travis Central Appraisal District (TCAD) Website

The TCAD website is a comprehensive resource for property owners in Travis County. It provides detailed information on the appraisal process, property tax laws, and exemptions. Taxpayers can access valuable resources such as:

- Property Appraisal Records: Obtain detailed appraisal reports and track the appraisal history of your property.

- Protest and Appeal Guidelines: Learn about the protest process and understand your rights if you disagree with your property's appraised value.

- Exemption Applications: Download and submit exemption forms, such as the homestead exemption or disability exemption, to reduce your taxable value.

- Online Account Management: Register and manage your TCAD account online, allowing you to view and update your property information.

Travis County Tax Assessor-Collector Office

The Travis County Tax Assessor-Collector Office is responsible for assessing and collecting property taxes. Their website offers essential resources, including:

- Tax Payment Options: Explore the various methods for paying your property taxes, such as online payments, in-person payments, or by mail.

- Tax Due Dates and Deadlines: Stay informed about important tax deadlines to avoid penalties and late fees.

- Tax Rate Information: Find the tax rates applicable to your property, including the rates for the county, cities, and special districts.

- Property Tax Exemptions: Understand the different types of exemptions available and the criteria for eligibility.

Tax Assessment and Payment Calendar

Travis County provides a detailed Tax Assessment and Payment Calendar to help taxpayers plan their finances effectively. This calendar outlines important dates, including appraisal deadlines, protest periods, tax bill mailing dates, and payment due dates. By referring to this calendar, taxpayers can stay organized and ensure timely payments.

| Event | Date |

|---|---|

| Appraisal Notices Mailed | April |

| Protest Deadline | May |

| Tax Bills Mailed | October |

| First Installment Due | January |

| Second Installment Due | July |

Staying informed about these key dates is crucial for effective property tax management.

Future Implications and Trends

As technology continues to advance, the Travis County Property Tax Search tool is expected to evolve and incorporate new features. Here are some potential future developments:

- Enhanced Data Visualization: Future updates may include interactive maps and charts to visualize property tax data, making it easier to compare and analyze property values across the county.

- Mobile App Integration: Developing a dedicated mobile app could provide users with convenient access to property tax information on the go, enabling quick searches and payments.

- AI-Powered Search: Artificial intelligence could be utilized to enhance search capabilities, allowing users to find properties based on natural language queries or advanced search algorithms.

- Integration with Real Estate Portals: Integrating the property tax search tool with popular real estate platforms could provide homebuyers and investors with comprehensive property information in one place.

- Tax Planning Tools: Advanced tax planning tools could be introduced to help taxpayers estimate their annual tax liabilities, offering budgeting insights and potential savings opportunities.

By embracing these technological advancements, Travis County can further improve the property tax search experience, making it even more accessible and user-friendly for taxpayers.

What are the tax rates in Travis County for the current year?

+The tax rates in Travis County vary depending on the taxing entity and the type of property. For the current year, the effective tax rate for a typical residential property is approximately 2.14%. However, it’s important to note that tax rates can change annually, so it’s advisable to refer to the official Travis County Tax Assessor-Collector website for the most up-to-date information.

How often are property values appraised in Travis County?

+Property values in Travis County are typically appraised every year. The Travis Central Appraisal District (TCAD) conducts