Track Alabama Tax Refund

Staying informed about your tax refund status is an essential part of financial planning, especially when you're eagerly awaiting funds to arrive in your account. In this comprehensive guide, we'll explore the various methods and resources available to track your Alabama tax refund, ensuring you receive timely updates and peace of mind.

Understanding the Alabama Tax Refund Process

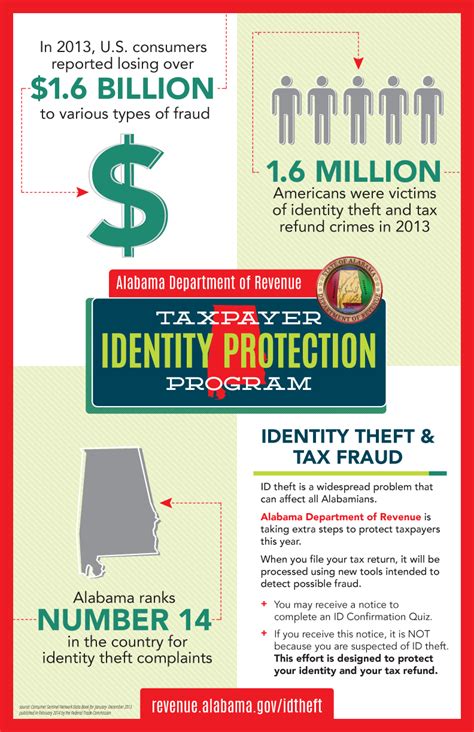

Before delving into the tracking methods, let’s establish a solid understanding of the Alabama tax refund process. Alabama, like many states, offers residents the opportunity to claim refunds on state income taxes they have overpaid. The Alabama Department of Revenue manages this process, and it’s crucial to stay informed about your refund’s progress.

The state of Alabama provides a dedicated online portal and telephone services for residents to check the status of their tax refunds. These resources are designed to offer real-time updates, ensuring that taxpayers can stay informed and take appropriate action if needed.

Online Tracking: A Digital Advantage

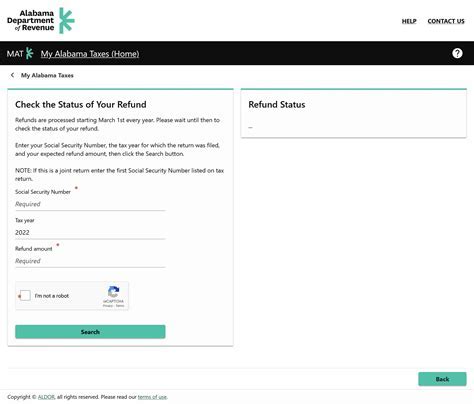

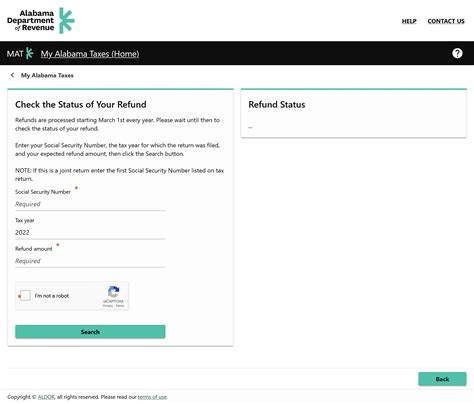

In today’s digital age, online tracking is a convenient and efficient way to stay informed about your Alabama tax refund. The Alabama Department of Revenue offers an online refund status checker, which is accessible 24⁄7. This tool provides a user-friendly interface, allowing taxpayers to input their personal information and receive an instant update on their refund status.

To utilize this service, you'll need the following information:

- Social Security Number: Your unique SSN is a crucial identifier when tracking your refund.

- Tax Year: Specify the year for which you're claiming the refund.

- Refund Amount: Enter the exact amount of your expected refund.

Once you've provided this information, the online portal will display your refund status, offering clarity on whether your refund has been processed, is in progress, or if there are any delays. This real-time update ensures you can plan your finances accordingly.

Telephone Services: A Personalized Approach

For those who prefer a more personalized experience, Alabama also offers a telephone refund inquiry service. This service is particularly beneficial for individuals who may not have easy access to the internet or prefer speaking to a representative directly.

To use the telephone service, you'll need to call the Alabama Department of Revenue's dedicated refund inquiry line at (800) 829-4070. The line is operational from Monday to Friday, 8 AM to 5 PM Central Time, providing a convenient window for callers.

When calling, be prepared to provide the same information as the online portal, including your Social Security Number, tax year, and expected refund amount. A representative will then guide you through the process, offering real-time updates and assistance if needed.

Expected Wait Times and Processing Speeds

Understanding the expected wait times and processing speeds is crucial when tracking your Alabama tax refund. The state aims to process refunds promptly, but various factors can influence the timeline.

According to official sources, most refunds are processed within 4-6 weeks of filing. However, this timeline can vary based on factors like the complexity of your tax return, errors or discrepancies in the filing, and the overall volume of tax returns being processed by the state.

It's worth noting that refunds for electronic returns (e-filed) are often processed faster than those submitted via paper. Additionally, refunds involving direct deposit are typically received sooner than those sent via check.

Common Issues and Troubleshooting

While the Alabama tax refund process is generally efficient, there may be instances where refunds are delayed or issues arise. Being aware of common problems and their potential solutions is essential for a smooth experience.

Delayed Refunds: What to Do

If your refund is taking longer than expected, there are a few steps you can take to investigate the delay:

- Check the Status Online or by Phone: As mentioned earlier, utilize the online status checker or call the refund inquiry line to get an update on your refund’s progress. This is the quickest way to identify if there are any processing issues.

- Review Your Tax Return: Sometimes, refunds are delayed due to errors or discrepancies in the tax return. Review your return to ensure all information is accurate and complete. If you identify an error, amend your return as soon as possible.

- Contact the Alabama Department of Revenue: If you’ve exhausted the above steps and your refund is still delayed, it’s advisable to contact the department directly. Their contact information is readily available on their official website, and their team can provide personalized assistance.

Error Messages and Resolution

When using the online status checker, you may encounter error messages. These messages often provide valuable insights into the status of your refund and potential issues. Here are some common error messages and their interpretations:

- Invalid Information: This message typically indicates that the information you entered (SSN, tax year, or refund amount) doesn’t match the records. Double-check your details and ensure accuracy.

- Refund Not Found: If you receive this message, it means the system hasn’t processed your refund yet. Check back later, as the status may update as the refund progresses through the system.

- Processing Error: This message suggests an issue with the refund processing. Contact the Alabama Department of Revenue for further assistance and guidance.

Stay Informed: Additional Resources

To ensure you stay informed about Alabama tax refund processes and updates, it’s beneficial to leverage additional resources. Here are some valuable sources of information:

- Alabama Department of Revenue Website: The official website (https://www.tax.alabama.gov) is a comprehensive resource, offering up-to-date information on tax refund processes, forms, and important dates.

- Tax Preparation Software: If you used tax preparation software to file your return, many providers offer refund tracking tools within their platforms. These tools can provide real-time updates on your refund’s status.

- Social Media and News Outlets: Follow the Alabama Department of Revenue’s official social media accounts and local news outlets. They often share important updates and announcements regarding tax refund processes and potential delays.

Staying Proactive: Filing Timely Returns

One of the best ways to ensure a smooth tax refund process is to file your tax return promptly and accurately. Alabama has specific deadlines for tax filing, and adhering to these deadlines is crucial to avoid delays and penalties.

Additionally, consider e-filing your tax return, as this method is often processed faster than paper returns. When filing, ensure all your personal and financial information is accurate and up-to-date to minimize the chances of errors and delays.

Future Implications: A Digital Evolution

As technology continues to advance, the Alabama Department of Revenue is likely to enhance its digital services, making tax refund tracking even more efficient and accessible. The state’s commitment to digital transformation ensures that taxpayers can expect improved online portals, mobile apps, and potentially even real-time notifications in the future.

Furthermore, as more taxpayers embrace digital filing and tracking, the overall efficiency of the tax refund process is expected to improve. This digital evolution will not only benefit taxpayers but also reduce administrative burdens for the state, leading to a more streamlined and timely refund process.

| Online Portal | Telephone Inquiry |

|---|---|

| Real-time status updates | Personalized assistance |

| Accessible 24/7 | Operational during business hours |

| Requires internet access | Ideal for those without internet |

Frequently Asked Questions

Can I track my Alabama tax refund without my Social Security Number?

+No, your Social Security Number is a critical identifier when tracking your refund. It ensures the system can accurately locate your refund status. Without it, you won’t be able to access your refund information.

What if I don’t remember the exact refund amount I’m expecting?

+If you don’t recall the exact refund amount, you can still track your refund by providing an estimate. However, for the most accurate results, it’s best to enter the exact amount if possible.

Can I check the status of multiple tax years simultaneously?

+Yes, both the online portal and telephone inquiry service allow you to check the status of multiple tax years. Simply input the relevant information for each year, and you’ll receive updates for all your pending refunds.

How often should I check my refund status?

+It’s recommended to check your refund status once every week or two. This frequency ensures you stay updated without overwhelming the system with excessive inquiries.

What should I do if my refund is significantly delayed?

+If your refund is significantly delayed, it’s advisable to contact the Alabama Department of Revenue directly. They can investigate the delay and provide you with a more detailed update on your refund’s status.