Tax Collector Highlands County

In the heart of Florida's Highlands County, the role of the Tax Collector is an integral part of the local government and community. This position holds significant responsibilities and plays a vital role in the financial operations of the county. From managing property taxes to offering a range of other essential services, the Tax Collector's office is a cornerstone of the region's administrative framework. In this article, we delve into the specifics of the Tax Collector's role in Highlands County, exploring the services they provide, their impact on the community, and the key considerations for residents and businesses alike.

The Role and Responsibilities of the Tax Collector in Highlands County

The Tax Collector in Highlands County is an elected official, chosen by the residents to oversee a range of financial and administrative duties. While the primary responsibility is the collection of property taxes, the scope of their work extends far beyond this crucial task. Here’s a detailed look at the key aspects of their role:

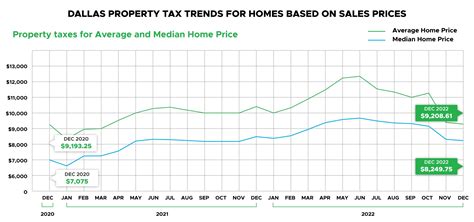

Property Tax Collection and Management

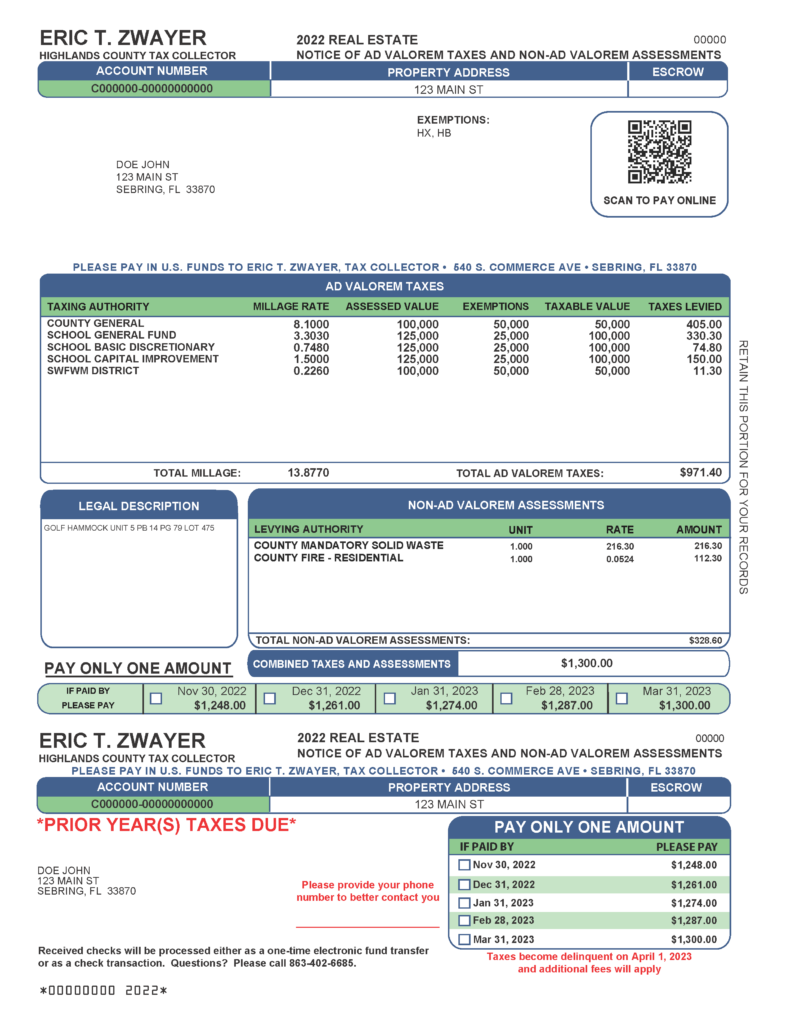

At the core of the Tax Collector’s responsibilities is the management and collection of property taxes. This process begins with the accurate assessment of property values, ensuring that residents and businesses pay their fair share based on the current market value of their properties. The Tax Collector’s office then handles the billing and collection process, providing clear and concise information to taxpayers. They also offer assistance and guidance to property owners, helping them understand the assessment process and their tax obligations.

To ensure timely payment, the Tax Collector's office provides various payment options, including online payments, mail-in payments, and in-person payments at their offices. They also maintain a transparent and accessible website, where taxpayers can find detailed information about their tax bills, payment due dates, and any applicable discounts or exemptions.

| Property Tax Collection Statistics | Highlands County |

|---|---|

| Total Property Value Assessed | $12.5 Billion (as of 2023) |

| Average Property Tax Rate | 1.11% (as of 2023) |

| Total Property Taxes Collected | $138.5 Million (2022 Fiscal Year) |

Vehicle Registration and Titling

In addition to property taxes, the Tax Collector’s office is responsible for vehicle registration and titling in Highlands County. This includes issuing new vehicle registrations, renewing existing registrations, and processing title transfers. They ensure that all vehicles operated within the county are properly registered and titled, in compliance with state laws.

The Tax Collector's office provides a streamlined process for vehicle registration, offering online renewal options and convenient drop-off locations for paperwork. They also assist residents with the necessary documentation and fees, making the process as smooth as possible. Furthermore, they maintain a database of registered vehicles, which is essential for law enforcement and road safety initiatives.

Other Services and Responsibilities

The Tax Collector’s office in Highlands County offers a range of additional services to residents and businesses. These include:

- Business Tax Receipts: Issuing and renewing business tax receipts, which are required for most businesses operating within the county.

- Hunting and Fishing Licenses: Processing and issuing licenses for hunting and fishing activities, ensuring compliance with state regulations.

- Voter Registration: Assisting with voter registration, providing forms, and answering queries related to the voting process.

- Motorcycle and Specialty License Plates: Handling the application and issuance of specialty license plates, including those for motorcycles, veterans, and organizations.

- Passport Services: Offering passport application and renewal services, providing a convenient location for residents to complete the process.

By offering these diverse services, the Tax Collector's office serves as a one-stop shop for many of the county's administrative needs, making it more efficient for residents to access essential government services.

The Impact of the Tax Collector on the Community

The role of the Tax Collector extends beyond the mere collection of taxes. Their work has a profound impact on the community, influencing various aspects of life in Highlands County. Here’s a closer look at how the Tax Collector’s office affects the region:

Financial Stability and Community Development

The property taxes collected by the Tax Collector’s office are a significant source of revenue for Highlands County. This revenue is vital for funding essential public services, such as schools, emergency services, infrastructure development, and social programs. By ensuring a steady stream of tax revenue, the Tax Collector contributes to the overall financial stability and growth of the community.

Moreover, the Tax Collector's office plays a crucial role in community development initiatives. They work closely with local government and community leaders to identify areas that require investment and improvement. Through their data-driven approach to property assessment and tax collection, they provide valuable insights that inform decision-making processes, ensuring that resources are allocated effectively to meet the needs of the community.

Enhancing Government Efficiency and Transparency

The Tax Collector’s office is committed to delivering efficient and transparent services to the residents of Highlands County. By leveraging technology and implementing innovative practices, they streamline processes, reduce wait times, and provide convenient access to essential services. Their online platforms and user-friendly interfaces make it easier for residents to manage their tax obligations and access information.

Additionally, the Tax Collector's office fosters transparency by providing detailed reports and data on tax collections, assessments, and expenditures. This transparency builds trust between the government and the community, ensuring that residents have confidence in the fair and equitable distribution of tax revenue.

Supporting Local Businesses and Economic Growth

The Tax Collector’s office plays a vital role in supporting local businesses and fostering economic growth in Highlands County. By providing a streamlined process for business tax receipts and ensuring compliance with regulations, they create an environment that encourages entrepreneurship and business development.

Furthermore, the Tax Collector's office often partners with local chambers of commerce and business associations to offer resources and support to businesses. They provide educational workshops, assist with tax-related queries, and promote local business initiatives. By facilitating a supportive business environment, the Tax Collector contributes to the overall economic vitality of the county.

Key Considerations for Residents and Businesses

Understanding the role and responsibilities of the Tax Collector is crucial for both residents and businesses in Highlands County. Here are some key considerations to keep in mind:

Property Tax Assessments and Appeals

Property tax assessments are a critical aspect of the Tax Collector’s work. It’s important for residents to understand the assessment process and their rights. If you believe your property has been incorrectly assessed, you have the right to appeal. The Tax Collector’s office provides guidance on the appeals process, ensuring that residents have a fair opportunity to challenge their assessments.

Additionally, residents should stay informed about any changes in tax rates or exemptions that may impact their property tax obligations. The Tax Collector's office often communicates these changes through their website and local media, ensuring that taxpayers are aware of any adjustments.

Timely Payment and Payment Options

Timely payment of property taxes is essential to avoid penalties and interest. The Tax Collector’s office offers a range of payment options to accommodate different preferences and circumstances. Residents can choose to pay online, by mail, or in person. It’s crucial to take advantage of these options and ensure that payments are made on time to avoid any additional fees.

Businesses, in particular, should be mindful of their tax obligations and ensure that they are up-to-date with their business tax receipts and other related taxes. The Tax Collector's office can provide guidance on payment plans and options to assist businesses in managing their tax liabilities.

Stay Informed and Engaged

Staying informed about the work of the Tax Collector’s office is essential for residents and businesses. The Tax Collector’s website is a valuable resource, providing updates on tax-related matters, important deadlines, and news about new services and initiatives. By staying engaged, residents can ensure that they are aware of any changes that may impact them.

Additionally, attending community meetings and events hosted by the Tax Collector's office can provide an opportunity to ask questions, voice concerns, and offer feedback. This engagement fosters a collaborative relationship between the Tax Collector and the community, leading to better services and a more efficient tax system.

How can I contact the Tax Collector's office in Highlands County?

+You can contact the Tax Collector's office by phone at (863) 402-6565 or by visiting their website at https://www.highlandstax.com. They also have physical offices located in Sebring and Avon Park, where you can seek assistance in person.

What are the deadlines for property tax payments in Highlands County?

+Property tax payments are due by March 31st of each year. However, to avoid interest and penalties, it is advisable to make your payment by the extended deadline of April 15th. You can find more detailed information about tax deadlines on the Tax Collector's website.

Are there any tax exemptions available for homeowners in Highlands County?

+Yes, there are several tax exemptions available for homeowners in Highlands County. These include the Homestead Exemption, which provides a reduction in taxable value for primary residences, and the Save Our Homes Cap, which limits the increase in assessed value for qualifying properties. You can find more information about these exemptions and how to apply on the Tax Collector's website.

How can I appeal my property tax assessment in Highlands County?

+If you believe your property has been incorrectly assessed, you have the right to appeal. The first step is to contact the Property Appraiser's office to discuss your concerns. If you remain dissatisfied, you can file a formal appeal with the Value Adjustment Board (VAB). The Tax Collector's office can provide guidance and resources to assist you through the appeals process.

What other services does the Tax Collector's office offer in Highlands County?

+In addition to property tax collection, the Tax Collector's office offers a wide range of services, including vehicle registration and titling, business tax receipts, hunting and fishing licenses, voter registration assistance, and passport services. They are a one-stop shop for many of the county's administrative needs, making it more convenient for residents to access essential government services.

The Tax Collector’s office in Highlands County is more than just a tax collection agency; it is a vital part of the community’s administrative framework. By understanding their role and staying engaged, residents and businesses can navigate the tax system more effectively, ensuring a stable and prosperous future for the county.