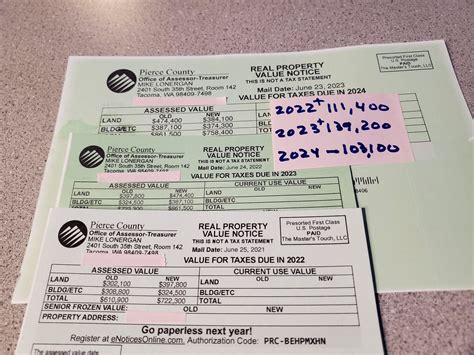

Pierce County Property Taxes

Understanding property taxes is crucial for homeowners, especially in Pierce County, Washington. Property taxes are an essential component of local government funding, impacting various services and infrastructure. This comprehensive guide will delve into the specifics of Pierce County property taxes, providing insights into how they are calculated, what they fund, and strategies for managing them effectively.

The Mechanics of Pierce County Property Taxes

Property taxes in Pierce County are determined by a complex process that considers various factors. Here’s a breakdown of the key elements:

Assessment Process

The Pierce County Assessor’s Office is responsible for evaluating all taxable properties within the county. This evaluation, conducted every two years, considers the property’s market value, location, and any improvements made. The assessed value forms the basis for calculating property taxes.

| Assessment Year | Average Assessed Value |

|---|---|

| 2022 | $350,000 |

| 2020 | $320,000 |

Properties with higher assessed values generally contribute more to the county's tax revenue.

Tax Rates and Levies

Pierce County operates with a tax rate structure that varies based on the type of property and its usage. Residential, commercial, and industrial properties have different tax rates. Additionally, special levies, such as those for schools or transportation, may be applied to specific properties or areas.

| Property Type | Tax Rate (per $1,000 assessed value) |

|---|---|

| Residential | $12.50 |

| Commercial | $18.75 |

| Industrial | $20.00 |

These rates are subject to change annually, influenced by local government budgets and voter-approved initiatives.

Tax Exemptions and Deductions

Pierce County offers various exemptions and deductions to reduce the tax burden for certain property owners. Common exemptions include those for senior citizens, veterans, and homeowners with disabilities. Additionally, certain improvements, such as energy-efficient upgrades, may qualify for deductions.

The Impact of Pierce County Property Taxes

Property taxes are a significant source of revenue for Pierce County, funding a wide array of services and infrastructure projects. Here’s an overview of where your property taxes go:

Education

A substantial portion of property taxes is allocated to local schools. This funding supports student programs, teacher salaries, and the maintenance of school facilities. In Pierce County, property taxes contribute to the budget of the Tacoma Public Schools district, ensuring quality education for students.

Public Safety

Property taxes also play a vital role in funding public safety initiatives. This includes supporting the Pierce County Sheriff’s Department, fire departments, and emergency services. The tax revenue helps maintain a safe and secure community for residents.

Infrastructure and Transportation

Another significant area where property taxes are utilized is infrastructure development and maintenance. This encompasses road repairs, bridge maintenance, and public transit systems. For instance, property taxes contribute to the upkeep of the Pierce County Ferry System, providing essential transportation services to residents.

Social Services

Property taxes fund various social services, including healthcare, welfare programs, and community development initiatives. These services aim to improve the overall well-being of Pierce County residents, ensuring a healthy and thriving community.

Strategies for Managing Property Taxes

While property taxes are an essential aspect of community funding, managing them effectively can provide some relief to homeowners. Here are some strategies to consider:

Understanding Your Assessment

Regularly reviewing your property’s assessment is crucial. If you believe your property’s value has been overestimated, you can appeal the assessment. The Pierce County Assessor’s Office provides resources and guidelines for property owners to challenge their assessments.

Exploring Tax Relief Programs

Pierce County offers various tax relief programs aimed at assisting specific groups of homeowners. These programs often provide exemptions or reduced tax rates for senior citizens, disabled individuals, and veterans. Researching and applying for these programs can lead to significant savings.

Making Property Improvements

Certain property improvements can qualify for tax deductions. For instance, installing energy-efficient appliances or making eco-friendly upgrades may reduce your property’s tax liability. Consulting with a tax professional can help identify opportunities for tax savings through improvements.

Considering Payment Options

Pierce County provides flexible payment options for property taxes. Homeowners can choose to pay their taxes in installments or explore options like escrow accounts, where the tax amount is included in their monthly mortgage payments. These options can make property tax payments more manageable.

Conclusion

Property taxes in Pierce County are a complex but vital aspect of community funding. Understanding how they are calculated, what they fund, and the strategies for managing them empowers homeowners to navigate the process effectively. By staying informed and taking advantage of available resources, Pierce County residents can ensure their property taxes are fair and support the services and infrastructure that enhance their quality of life.

How often are property taxes assessed in Pierce County?

+Property taxes are assessed every two years in Pierce County. The assessment considers the property’s value and any improvements made during this period.

Can I appeal my property’s assessed value?

+Yes, if you believe your property’s assessed value is inaccurate, you can appeal the assessment. The Pierce County Assessor’s Office provides guidelines and resources for property owners to challenge their assessments.

What happens if I don’t pay my property taxes on time?

+Late payment of property taxes may result in penalties and interest. In severe cases, the county may initiate a tax foreclosure process, which could lead to the loss of your property. It’s essential to stay current with your property tax payments to avoid these consequences.

Are there any tax relief programs for senior citizens in Pierce County?

+Yes, Pierce County offers the Senior Citizen Tax Exemption Program. This program provides a tax exemption for qualifying senior citizens, reducing their property tax burden. To learn more and apply, visit the Pierce County Treasurer’s Office website.