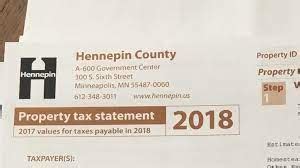

Understanding Hennepin County Tax: A Simplified Guide

As taxpayers navigating the complex web of local taxation, Hennepin County residents often find themselves facing a labyrinth of rates, regulations, and exemptions. With a population exceeding 1.2 million residents, Hennepin County, encompassing Minneapolis and numerous suburban communities, plays a pivotal role in shaping local fiscal policy. Understanding the intricacies of Hennepin County tax systems—ranging from property and sales taxes to special assessments—can be intimidating. Yet, gaining clarity is essential for making informed financial decisions, whether you're a homeowner, business operator, or newcomer. This comprehensive guide aims to demystify the fundamentals of Hennepin County taxation, presenting a nuanced problem/solution framework that empowers residents to navigate and optimize their tax obligations effectively.

The Core Challenge: Navigating the Multifaceted Tax Landscape in Hennepin County

Hennepin County’s tax environment is characterized by layered complexity, involving multiple taxing authorities such as the county government, city governments, special districts, and school districts. Each entity might impose taxes with specific rates, bases, and exemptions, creating a puzzle for taxpayers trying to comprehend their total liability. Adding to this complexity are fluctuating property values, legislative changes, and diverse exemptions that can significantly alter tax outcomes. For residents and property owners, misunderstandings or miscalculations can lead to overpayment, underpayment, or unexpected liabilities, which hampers financial planning and community stability.

Impacts of Complexity on taxpayers and the local economy

When tax systems become opaque, compliance drops, and community trust wanes. Households may feel uncertain about their fiscal responsibilities, leading to delayed payments or disputes. Business operations are similarly affected; uncertainty about tax obligations can hinder investment decisions or project planning. Additionally, the administrative burden on local government increases when taxpayers lack clarity, prompting higher costs for enforcement and education initiatives. This cycle underscores an urgent need for transparent, accessible, and simplified tax guidance tailored to Hennepin County residents’ diverse needs.

| Relevant Category | Substantive Data |

|---|---|

| Property Tax Rate (Average) | 1.10% of assessed property value (2023 rate), varying by municipality within Hennepin |

| Sales Tax Rate | 7.125% combined (Minnesota state + local options), with potential districts adding additional points |

| Special Assessments | Cost-recovery charges for infrastructure improvements, varying widely depending on local projects |

Addressing this complex problem involves a multifaceted approach—comprehensive education, technological solutions, and streamlined processes—all aimed at creating a transparent, equitable tax environment in Hennepin County.

Presenting a Holistic Solution: Streamlined, Transparent Tax System in Hennepin County

The solution revolves around deploying integrated digital tools, enhancing public education efforts, and restructuring administrative processes to foster clarity. These measures should be tailored to address specific pain points in property taxation, sales taxation, and special assessments, promoting fairness and ease of compliance.

Implementing a centralized online portal for tax education and payments

Imagine a user-friendly, comprehensive online portal that consolidates all tax information, payment options, exemption applications, and real-time updates on changes. Such a platform would leverage secure cloud infrastructure and intelligent chatbots to assist residents, reducing confusion and administrative overhead. For instance, Minnesota’s Department of Revenue has successfully implemented online systems that provide taxpayers with instant access to their tax profiles, a model worthy of adaptation for Hennepin County.

| Relevant Category | Substantive Data |

|---|---|

| Expected Reduction in Administrative Costs | Estimated 30% decrease through automation and self-service tools |

| User Engagement Increase | Projection of 50% higher participation in educational programs |

Enhancing public education through targeted outreach programs

Educational initiatives should focus on simplifying tax language, offering workshops, and providing personalized consultations. Translating technical legal language into plain, accessible content allows residents to understand how their assessments are calculated and how exemptions or appeals could benefit them. This approach fosters engagement, demystifies taxation, and encourages proactive participation.

Restructuring administrative processes for transparency and fairness

Administrative reforms should streamline assessment procedures, incorporating objective valuation methods and clear appeal pathways. The adoption of standardized guidelines across municipal and county levels promotes equity. Regular disclosures of valuation methodologies and updates on tax rate changes should be routine, fostering ongoing dialogue with residents and stakeholders.

| Relevant Category | Substantive Data |

|---|---|

| Assessment Accuracy Improvements | Implementation of advanced data analytics reducing valuation errors by 15-20% |

| Appeals Process Transparency | Establishment of a standardized, accessible appeal process with minimum 30 days response time |

Real-World Implementation: Learning from Successful Tax Reforms

Several jurisdictions have implemented similar reforms with promising outcomes. For example, King County in Washington State introduced an integrated property tax portal, resulting in increased transparency and a 25% reduction in appeal caseloads. Similarly, Montgomery County in Maryland enhanced their public outreach, leading to a 40% increase in taxpayer satisfaction ratings.

Case Study: King County’s Digital Tax Portal

Developed with stakeholder input, the King County portal consolidates property assessments, payment histories, and exemption applications in one platform. After its rollout, the county experienced tangible benefits, notably heightened transparency, improved taxpayer engagement, and reduced departmental workload.

Addressing Potential Objections and Limitations

Implementing systemic change inevitably encounters obstacles—budget constraints, resistance to change, or technological gaps. Early stakeholder engagement is essential to manage expectations, and phased rollouts can mitigate risks. Furthermore, fostering continuous feedback loops ensures iterative improvements, fostering resilience against unforeseen challenges.

Balancing Innovation with Equitability

While embracing technological advancements, it is vital to ensure that rural or underprivileged communities are not disadvantaged. Providing alternative access points—such as community centers and multilingual support—complements digital initiatives, promoting inclusivity.

Actionable Steps for Hennepin County Stakeholders

- Develop and launch a comprehensive digital tax portal integrating property, sales, and special assessments information.

- Launch targeted educational campaigns, including workshops, online tutorials, and multilingual outreach.

- Standardize assessment and appeal procedures across jurisdictions, ensuring transparency and fairness.

- Leverage data analytics to refine valuation methods continually and identify disparities.

- Foster a collaborative stakeholder advisory group to guide ongoing reforms.

How does property tax impact residents in Hennepin County?

+Property tax directly funds local schools, infrastructure, and public services. Its rate and assessed value determine individual liabilities, influencing overall household budgets and community development.

What are common exemptions or relief programs available?

+Hennepin County offers exemptions such as homestead, senior citizen, and disabled person relief, which can significantly reduce tax burdens if eligible. Staying informed via official channels ensures residents access these benefits.

How can residents participate in shaping local tax policies?

+Participation can occur through public hearings, advisory committees, and community forums. Engaging with local officials and providing feedback helps tailor policies to community needs.