Riverside County Ca Tax

When it comes to property taxes, Riverside County, California, is a region that often sparks curiosity and questions among residents and prospective homeowners. The tax system in this vibrant county is intricate, playing a pivotal role in the local economy and directly impacting property owners. Understanding the intricacies of Riverside County's tax system is essential for making informed financial decisions and navigating the local real estate market effectively.

The Riverside County Tax Landscape

Riverside County, with its diverse landscapes ranging from the urban hubs of Riverside and Moreno Valley to the picturesque wine regions of Temecula, boasts a unique tax structure that reflects its varied demographics and property types. The county’s tax system is governed by a set of regulations and assessments that determine the tax obligations of its residents, making it a critical aspect of homeownership in the region.

Property Assessment Process

The journey of property taxation in Riverside County begins with the assessor’s office, which is responsible for evaluating each property’s taxable value. This value is influenced by factors such as the property’s location, size, improvements, and the market value at the time of purchase. The assessor’s office conducts regular reviews, ensuring that property values remain up-to-date and in line with market trends.

For instance, a homeowner in the historic district of Riverside might see their property value influenced by the unique architectural features of their home, while a new development in Moreno Valley might be assessed based on the latest construction costs and market demand.

| Assessment Category | Description |

|---|---|

| Market Value | The current market price a property would likely sell for. |

| Improvement Value | Value added by any structural changes or upgrades. |

| Assessed Value | The value used for tax calculations, often a percentage of market value. |

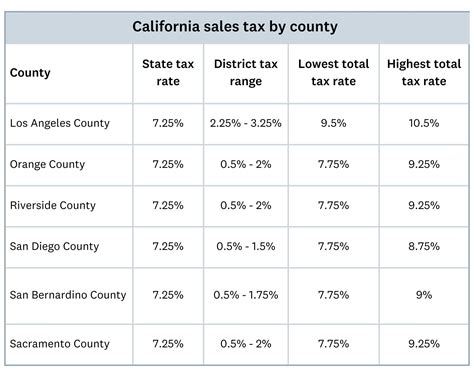

Tax Rates and Levies

Once a property’s assessed value is determined, it is subjected to the applicable tax rates, which are set by various taxing agencies within the county. These agencies, including the county government, school districts, and special districts, rely on property taxes to fund essential services and infrastructure.

The tax rate is expressed as a percentage of the assessed value, and it can vary significantly across the county. For example, a property in the heart of Temecula, known for its thriving tourism industry, might have a different tax rate compared to a rural property in Anza, reflecting the differing needs and services provided by these areas.

Navigating Riverside County Property Taxes

Understanding and managing property taxes in Riverside County is a crucial aspect of homeownership. Here’s a comprehensive guide to help you navigate the process:

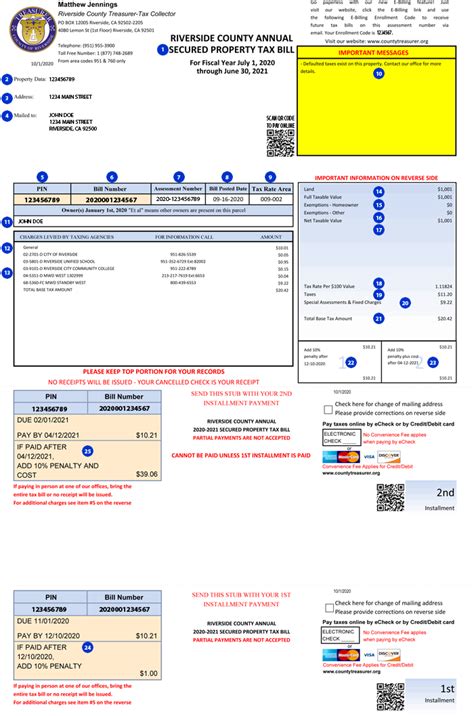

Tax Bill Breakdown

Your property tax bill, often referred to as a tax statement, is a detailed document that outlines the various components contributing to your tax liability. It typically includes the following:

- Assessed Value: The value of your property as determined by the assessor's office.

- Tax Rate Area: The specific area within the county that your property falls into, with its associated tax rate.

- Tax Rate: The percentage applied to your assessed value to calculate your tax liability.

- Special Assessments: Any additional charges for specific services or improvements.

- Discounts and Exemptions : Any applicable reductions or waivers based on eligibility criteria.

Payment Options and Deadlines

Riverside County offers several payment options to cater to different financial situations. Homeowners can choose to pay their property taxes in two installments, typically due in November and April. However, early payment incentives and online payment portals provide flexibility and potential savings.

It's crucial to stay informed about payment deadlines to avoid late fees and penalties, which can significantly impact your financial planning.

Appealing Your Assessment

If you believe your property’s assessed value is inaccurate or unfair, you have the right to appeal. The assessment appeals process in Riverside County is designed to ensure fairness and transparency. Common grounds for an appeal include a recent decline in property value, errors in the assessor’s data, or a discrepancy between your property’s value and similar properties in the area.

To initiate an appeal, you'll need to gather evidence, such as recent sales data of comparable properties, and submit your request within a specified timeframe. The assessment appeals board will review your case and make a determination, providing an opportunity for you to voice your concerns and potentially reduce your tax burden.

The Impact of Property Taxes on Riverside County’s Economy

Property taxes in Riverside County are a critical component of the local economy, funding essential services and infrastructure projects that benefit residents and businesses alike. The revenue generated from property taxes supports vital areas such as education, public safety, transportation, and social services, contributing to the overall well-being and development of the county.

Education and Property Taxes

One of the most significant beneficiaries of property taxes in Riverside County is the education sector. School districts rely on property tax revenue to fund public schools, ensuring that students have access to quality education and resources. This funding supports teacher salaries, curriculum development, extracurricular activities, and the maintenance of school facilities, directly impacting the future of the county’s youth.

Infrastructure Development

Property taxes also play a crucial role in the development and maintenance of the county’s infrastructure. From road repairs and improvements to the construction of new parks and recreational facilities, these funds ensure that Riverside County remains a desirable place to live, work, and visit. Well-maintained infrastructure enhances the quality of life for residents and contributes to the county’s economic growth and sustainability.

Supporting Local Businesses

The revenue generated from property taxes extends its impact to local businesses as well. By funding essential services and maintaining a thriving community, property taxes create an environment that is conducive to business growth and development. Local businesses benefit from a skilled workforce, efficient transportation networks, and a strong local economy, all of which are supported by the tax revenue generated from properties within the county.

Future Outlook and Potential Changes

As Riverside County continues to evolve and adapt to changing economic and demographic trends, the property tax landscape is also subject to potential modifications. The county’s commitment to fiscal responsibility and its focus on community development may lead to adjustments in tax rates, assessment practices, and allocation of funds to better serve the needs of its residents and businesses.

Keeping abreast of these changes is essential for property owners and prospective buyers, as it allows for more accurate financial planning and informed decision-making. By staying informed and engaged with local government initiatives and tax policies, individuals can actively participate in shaping the future of their community and ensure that their tax contributions are utilized effectively.

How often are property values reassessed in Riverside County?

+

Property values are typically reassessed every year to ensure they reflect the current market conditions. However, certain events like significant improvements or damage to the property may trigger a reassessment outside of the annual cycle.

Are there any tax relief programs available for seniors or veterans in Riverside County?

+

Yes, Riverside County offers several tax relief programs, including the Senior Citizen’s Exemption and the Veterans Exemption. These programs provide eligible seniors and veterans with a reduction in their property taxes, helping to ease the financial burden of homeownership.

Can I pay my property taxes online in Riverside County?

+

Absolutely! Riverside County offers an online payment portal, providing a convenient and secure way to pay your property taxes. This option eliminates the need for a physical visit to the tax office and allows for timely payments, avoiding late fees and penalties.