California Sales Tax Ventura County

California, known for its diverse landscapes, vibrant cities, and thriving industries, has a complex sales tax system that varies across its numerous counties. Understanding the sales tax structure is crucial for businesses and consumers alike, especially when operating in a bustling county like Ventura.

Ventura County, nestled along the stunning California coastline, boasts a unique blend of agriculture, technology, and tourism. With its thriving economy and diverse business landscape, it is essential to delve into the specifics of the sales tax system in this region. In this comprehensive guide, we will explore the intricacies of California sales tax as it applies to Ventura County, providing valuable insights for businesses and individuals seeking to navigate this complex tax landscape.

Unraveling the California Sales Tax Structure

California's sales tax system is a multi-layered structure, consisting of both state and local taxes. At the state level, a base sales tax rate is applied uniformly across the state. However, it is the local taxes, levied by counties and cities, that introduce variability and complexity to the system. These local taxes, often referred to as "add-on taxes," can significantly impact the overall sales tax burden for businesses and consumers.

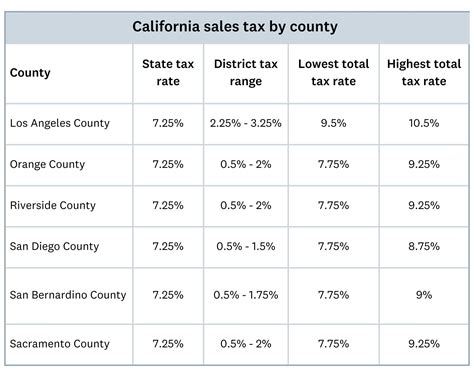

The state sales tax rate in California is currently set at 7.25%, which serves as the foundation for the sales tax calculation. However, when we consider the local taxes in Ventura County, the picture becomes more intricate. Ventura County, like many other counties in California, imposes an additional local sales tax on top of the state rate. This local add-on tax is used to fund various county services and infrastructure projects.

As of the most recent data, the Ventura County local sales tax rate stands at 1.25%, bringing the total combined sales tax rate in the county to 8.50%. This means that for every purchase made within Ventura County, consumers can expect to pay an additional 1.25% in local sales tax on top of the state rate.

It is important to note that the local sales tax rate in Ventura County is subject to change. County governments have the authority to adjust these rates periodically to meet revenue needs or address budgetary concerns. Therefore, it is crucial for businesses and individuals to stay updated on any potential changes to the sales tax rates in Ventura County.

Impact on Businesses and Consumers

The sales tax structure in Ventura County has a significant impact on both businesses and consumers. For businesses, understanding and complying with the sales tax requirements is essential to avoid legal complications and maintain a positive relationship with the California Board of Equalization (BOE), the agency responsible for tax administration in the state.

Businesses operating in Ventura County must collect and remit the appropriate sales tax on all taxable sales made within the county. This includes not only the state sales tax rate but also the local add-on tax. Failure to accurately collect and remit sales tax can result in penalties and interest charges, which can be costly for businesses.

For consumers, the higher sales tax rate in Ventura County means that they may pay a slightly higher price for goods and services compared to other counties with lower sales tax rates. However, it is important to recognize that these additional tax revenues are utilized to fund essential county services and infrastructure projects, which ultimately benefit the community as a whole.

Moreover, the sales tax structure in Ventura County can influence consumer behavior and purchasing decisions. Consumers may opt to make certain purchases in neighboring counties with lower sales tax rates, especially for high-value items. This phenomenon, known as "tax shopping," can impact the local economy and business revenues in Ventura County.

Navigating Sales Tax Compliance

Compliance with sales tax regulations is a critical aspect of doing business in Ventura County. Businesses must ensure that they are properly registered with the California BOE and obtain a valid seller's permit. This permit authorizes businesses to collect and remit sales tax on behalf of the state and county.

Businesses should maintain accurate records of all taxable sales, including the breakdown of state and local sales tax components. Regularly reviewing and reconciling sales tax records is essential to ensure compliance and identify any potential errors or discrepancies. Utilizing accounting software or engaging the services of tax professionals can greatly assist in maintaining accurate sales tax records.

In addition to collecting sales tax, businesses must also file periodic sales tax returns with the California BOE. These returns, typically filed quarterly or annually, declare the total sales tax collected during the reporting period. It is crucial to meet the filing deadlines and remit the appropriate sales tax payments to avoid late fees and penalties.

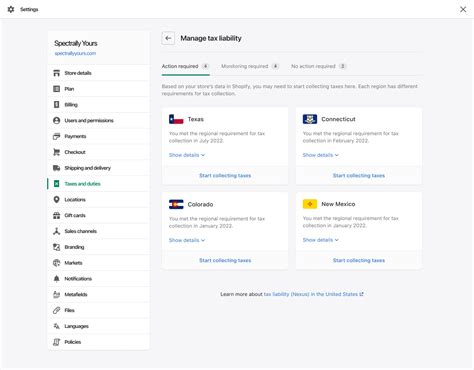

For businesses that operate in multiple counties or cities within California, the sales tax landscape can become even more complex. Each locality may have its own sales tax rate and regulations, requiring businesses to navigate a patchwork of tax jurisdictions. Staying informed about the sales tax rates and requirements in each location is essential for accurate compliance.

Sales Tax Exemptions and Special Considerations

While the sales tax structure in Ventura County applies to most goods and services, there are certain exemptions and special considerations that businesses and consumers should be aware of. These exemptions can vary depending on the nature of the transaction and the specific goods or services involved.

One common exemption is for sales tax on groceries. In California, certain food items, such as unprocessed foods and non-prepared groceries, are exempt from sales tax. This exemption is aimed at reducing the tax burden on essential food items and promoting food security for low-income households.

Additionally, there are specific exemptions for certain industries, such as manufacturing, agriculture, and certain services. These exemptions are designed to support specific sectors of the economy and promote growth in those areas. Businesses operating in these sectors should consult with tax professionals or refer to the official guidelines provided by the California BOE to understand their eligibility for these exemptions.

Another important consideration is the treatment of online sales and remote sellers. With the rise of e-commerce, the sales tax landscape has become increasingly complex for online businesses. California has implemented various measures to ensure that online sellers collect and remit sales tax on transactions with California consumers. Businesses engaged in online sales should familiarize themselves with the applicable regulations and ensure compliance.

Sales Tax and Economic Development

The sales tax revenue generated in Ventura County plays a significant role in the county's economic development and infrastructure. The additional local sales tax collected is often allocated to fund essential services such as public safety, education, transportation, and social services. These investments contribute to the overall well-being and prosperity of the county's residents and businesses.

Moreover, the sales tax structure can influence business growth and investment decisions. A competitive sales tax rate, combined with other economic incentives and a favorable business environment, can attract new businesses and encourage existing businesses to expand. This, in turn, leads to job creation, increased economic activity, and a thriving local economy.

Ventura County has recognized the importance of a balanced and competitive sales tax rate in attracting and retaining businesses. The county has worked to create a business-friendly environment, offering various incentives and support programs to encourage economic growth. This approach has proven successful, as Ventura County continues to attract a diverse range of industries and businesses.

Looking Ahead: Future Implications and Considerations

As we look to the future, it is essential to consider the potential implications and evolving trends in the sales tax landscape. California, like many other states, is exploring various tax reform initiatives and policy changes to address budgetary needs and changing economic dynamics.

One potential area of focus is the implementation of a simplified sales tax system. While California's current system provides flexibility for local governments to set their own tax rates, it also introduces complexity for businesses and consumers. A simplified system, with a uniform sales tax rate across the state, could streamline compliance and reduce administrative burdens for businesses.

Additionally, with the continued growth of e-commerce and remote work, the sales tax landscape may need to adapt to accommodate these changing consumer behaviors. California, along with other states, is exploring ways to ensure fair taxation of online sales and remote sellers. This may involve implementing new tax collection mechanisms or updating existing regulations to keep pace with the evolving digital economy.

Furthermore, as California continues to prioritize economic development and infrastructure projects, the sales tax revenue generated in Ventura County will remain a critical source of funding. The county's ability to balance its sales tax rate with economic incentives will be key to attracting and retaining businesses, while also supporting essential public services.

In conclusion, understanding the sales tax structure in Ventura County is crucial for businesses and consumers alike. The combined state and local sales tax rate of 8.50% in Ventura County impacts pricing, consumer behavior, and business operations. By navigating the complexities of sales tax compliance and staying informed about exemptions and special considerations, businesses can ensure they meet their tax obligations while contributing to the economic vitality of Ventura County.

What is the current sales tax rate in Ventura County, California?

+The current sales tax rate in Ventura County, California is 8.50%. This includes the state sales tax rate of 7.25% and an additional local sales tax rate of 1.25%.

How does the sales tax rate in Ventura County impact businesses?

+The higher sales tax rate in Ventura County can impact businesses by increasing their costs and potentially affecting consumer purchasing decisions. Businesses must collect and remit the appropriate sales tax, ensuring compliance with the state and local regulations.

Are there any sales tax exemptions in Ventura County?

+Yes, there are certain sales tax exemptions in Ventura County. For example, certain food items, such as unprocessed groceries, are exempt from sales tax. Additionally, specific industries and services may be eligible for exemptions based on their nature.

How can businesses stay updated on sales tax rates and regulations in Ventura County?

+Businesses can stay updated on sales tax rates and regulations by regularly checking the official website of the California Board of Equalization (BOE) and subscribing to their notifications. They can also consult tax professionals or utilize tax software that provides real-time updates.

What are the consequences of non-compliance with sales tax regulations in Ventura County?

+Non-compliance with sales tax regulations in Ventura County can result in penalties, interest charges, and legal consequences. Businesses may face audits, fines, and potential revocation of their seller’s permit. It is crucial for businesses to ensure accurate sales tax collection and timely filing of returns.