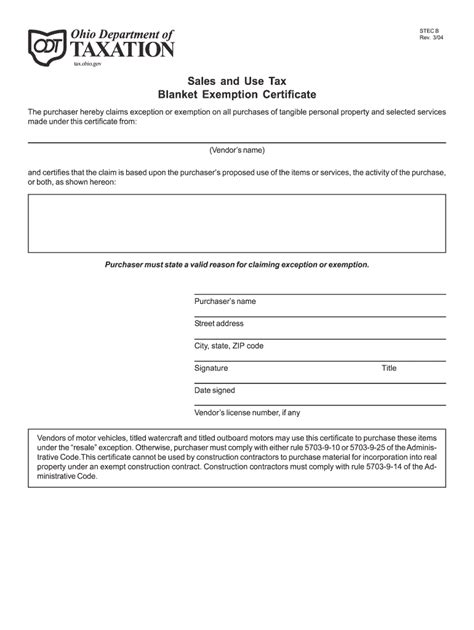

Ohio Tax Exempt Form

The Ohio Tax Exempt Form is an essential document for businesses, organizations, and individuals operating within the state of Ohio. This form, officially known as the "Ohio Certificate of Exemption," is used to claim exemption from certain state taxes, including sales and use taxes. Understanding the intricacies of the Ohio Tax Exempt Form is crucial for businesses looking to navigate the state's tax landscape effectively.

Understanding the Ohio Tax Exempt Form

The Ohio Tax Exempt Form is a vital tool for entities that qualify for tax-exempt status under Ohio law. It allows eligible parties to avoid paying sales and use taxes on purchases made within the state. This exemption can provide significant savings and is particularly beneficial for nonprofit organizations, government entities, and businesses engaged in specific activities or industries.

The form itself is relatively straightforward, but the eligibility criteria and the process of obtaining the exemption can be more complex. It is important to understand the various types of tax exemptions available, the documentation required, and the procedures for registering and maintaining tax-exempt status.

Types of Tax Exemptions in Ohio

Ohio offers several types of tax exemptions, each with its own set of qualifications and requirements. The most common types include:

- Sales Tax Exemption for Resale: Businesses that purchase goods for resale can claim this exemption. This applies to retailers, wholesalers, and manufacturers who sell products to the end consumer.

- Sales Tax Exemption for Manufacturing: Manufacturing businesses in Ohio can claim an exemption on purchases of certain materials, supplies, and equipment used directly in manufacturing processes.

- Use Tax Exemption for Government Entities: Governmental bodies, including state and local governments, can claim an exemption from use tax on purchases of tangible personal property.

- Sales Tax Exemption for Nonprofit Organizations: Nonprofit organizations, such as charities, educational institutions, and religious groups, may be eligible for sales tax exemption on purchases made for their nonprofit activities.

It is important to note that while these are the most common exemptions, there are additional specific exemptions available for certain industries, such as agriculture, construction, and research.

The Process of Obtaining Tax-Exempt Status

Obtaining tax-exempt status in Ohio typically involves the following steps:

- Determine Eligibility: Review the criteria for the specific exemption you are seeking. Ensure that your organization or business meets the requirements.

- Complete the Ohio Tax Exempt Form: Fill out the form accurately, providing all the necessary information. This includes details about your organization, the type of exemption sought, and supporting documentation.

- Submit the Form: Submit the completed form to the Ohio Department of Taxation. This can be done online or by mail, depending on the specific exemption.

- Wait for Approval: The processing time can vary, but once your application is approved, you will receive a Certificate of Exemption.

- Maintain Your Status: Tax-exempt status is not permanent and may require periodic renewals or updates. Keep track of renewal deadlines and ensure you have the latest Certificate of Exemption.

Benefits and Considerations of Tax-Exempt Status

Claiming tax-exempt status in Ohio can provide significant benefits to eligible entities. These benefits include:

- Cost Savings: By avoiding sales and use taxes, organizations can reduce their operating costs, allowing for more efficient use of resources.

- Administrative Efficiency: Tax-exempt status simplifies the accounting and bookkeeping processes, as there is no need to track and remit sales and use taxes on exempt purchases.

- Enhanced Financial Stability: The savings from tax-exempt purchases can be redirected towards core organizational goals, improving financial stability and allowing for growth and development.

However, it is important to consider the responsibilities that come with tax-exempt status. Entities must maintain accurate records, ensure proper use of the exemption, and stay compliant with all tax laws and regulations. Misuse of tax-exempt status can result in penalties and loss of the exemption.

Real-World Example: A Nonprofit's Journey to Tax-Exempt Status

Consider the case of the Green Community Foundation, a nonprofit organization dedicated to promoting environmental sustainability in Ohio. When the foundation was established, its board of directors recognized the potential benefits of tax-exempt status.

They began by researching the specific criteria for nonprofit tax exemption in Ohio. After confirming their eligibility, they downloaded the Ohio Tax Exempt Form from the Department of Taxation's website. The form required detailed information about the foundation's mission, activities, and financial structure.

The board members worked together to gather the necessary documentation, including articles of incorporation, bylaws, and financial reports. They also obtained letters of support from community leaders and other organizations to strengthen their application.

Once the form was completed and the supporting documents were ready, they submitted the application online. The process was relatively smooth, and within a few weeks, they received their Certificate of Exemption. This allowed the foundation to purchase office supplies, equipment, and even vehicles tax-free, significantly reducing their operational costs.

The Green Community Foundation's story illustrates how tax-exempt status can be a powerful tool for nonprofit organizations, helping them stretch their resources further and focus on their mission.

Staying Informed and Up-to-Date

Ohio's tax laws and regulations are subject to change, so it is crucial for businesses and organizations to stay informed. The Ohio Department of Taxation provides resources and updates on its website, including guidance on tax exemptions and changes to tax laws.

Additionally, consulting with tax professionals or legal advisors can provide valuable insights and ensure compliance with the latest regulations. Keeping abreast of these changes is essential to maintaining tax-exempt status and avoiding potential penalties.

| Exemption Type | Form Number |

|---|---|

| Sales Tax Exemption for Resale | Form ST-7 |

| Sales Tax Exemption for Manufacturing | Form ST-5 |

| Use Tax Exemption for Government Entities | Form ST-7A |

| Sales Tax Exemption for Nonprofit Organizations | Form ST-7C |

Conclusion

The Ohio Tax Exempt Form is a powerful tool for businesses and organizations to navigate the state's tax landscape. By understanding the different types of tax exemptions, the application process, and the benefits and responsibilities of tax-exempt status, entities can make informed decisions to optimize their financial strategies. Staying informed and compliant with Ohio's tax laws is key to reaping the benefits of tax-exempt status while avoiding potential pitfalls.

Frequently Asked Questions

What is the Ohio Tax Exempt Form used for?

+The Ohio Tax Exempt Form, also known as the Certificate of Exemption, is used to claim exemption from sales and use taxes in Ohio. It allows eligible entities to avoid paying these taxes on purchases made within the state.

<div class="faq-item">

<div class="faq-question">

<h3>Who is eligible for tax-exempt status in Ohio?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Eligibility for tax-exempt status varies depending on the type of exemption. Common eligible entities include nonprofit organizations, government bodies, and businesses engaged in specific activities like manufacturing or resale.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How do I obtain tax-exempt status in Ohio?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>To obtain tax-exempt status, you must determine your eligibility, complete the appropriate Ohio Tax Exempt Form, and submit it to the Ohio Department of Taxation. The process may vary depending on the type of exemption you are seeking.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What are the benefits of tax-exempt status in Ohio?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Tax-exempt status provides cost savings by allowing entities to avoid sales and use taxes. It simplifies accounting processes and can enhance financial stability by redirecting saved funds towards core organizational goals.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any responsibilities associated with tax-exempt status in Ohio?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, entities with tax-exempt status must maintain accurate records, ensure proper use of the exemption, and stay compliant with all tax laws and regulations. Misuse of tax-exempt status can result in penalties and loss of the exemption.</p>

</div>

</div>