Madison County Il Real Estate Taxes

Madison County, located in the southern region of Illinois, is a vibrant community known for its rich history, diverse landscapes, and thriving real estate market. Real estate taxes are an integral part of property ownership, and understanding the intricacies of these taxes is essential for both homeowners and investors alike. In this comprehensive guide, we will delve into the world of Madison County real estate taxes, exploring the factors that influence tax assessments, the payment process, and the potential benefits and challenges associated with these taxes.

The Landscape of Madison County Real Estate

Madison County boasts a diverse range of residential and commercial properties, from historic homes in charming neighborhoods to modern developments in thriving business districts. The county’s real estate market reflects a unique blend of urban and rural living, attracting a wide range of buyers and investors. With its proximity to major cities like St. Louis and its own vibrant culture, Madison County offers a desirable location for property ownership.

Understanding Real Estate Taxes in Madison County

Real estate taxes in Madison County are assessed annually based on the value of properties. These taxes are a crucial source of revenue for the county, funding essential services such as education, infrastructure, and public safety. The tax assessment process involves evaluating the property’s market value, taking into account factors such as location, size, improvements, and recent sales data.

Assessment Process

The Madison County Assessor’s Office is responsible for conducting property assessments. Assessors visit properties periodically to evaluate their current condition and market value. They consider various factors, including:

- Property Type: Residential, commercial, or agricultural properties have different assessment criteria.

- Location: The neighborhood, proximity to amenities, and local market trends influence property values.

- Size and Features: The square footage, number of bedrooms/bathrooms, and unique features like pools or garages impact assessments.

- Recent Sales: Assessed values are often based on recent comparable sales in the area.

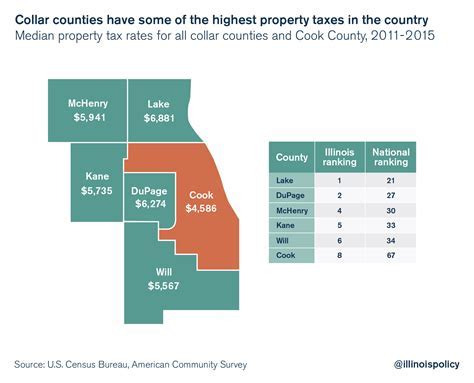

Tax Rates and Calculations

Once the assessed value of a property is determined, the applicable tax rate is applied. Tax rates in Madison County are set by various taxing bodies, including the county government, school districts, and special purpose districts. These rates are expressed as a percentage of the assessed value.

The formula for calculating real estate taxes is straightforward: Assessed Value x Tax Rate = Annual Real Estate Tax.

| Property Type | Average Assessed Value | Tax Rate |

|---|---|---|

| Residential | $150,000 | 3.5% |

| Commercial | $250,000 | 4.2% |

| Agricultural | $100,000 | 2.8% |

The Impact of Real Estate Taxes on Property Owners

Real estate taxes in Madison County can have both positive and negative implications for property owners. On one hand, these taxes contribute to the overall development and maintenance of the community, ensuring access to essential services. On the other hand, high tax assessments can impact homeowners’ financial planning and investment strategies.

Benefits of Real Estate Taxes

- Community Development: Real estate taxes fund vital infrastructure projects, such as road improvements, parks, and public transportation, enhancing the overall quality of life in Madison County.

- Education: A significant portion of real estate tax revenue is allocated to local schools, ensuring quality education for the county’s youth.

- Public Safety: Tax revenue supports police and fire departments, ensuring the safety and security of residents and businesses.

Challenges and Strategies

High real estate taxes can present challenges for homeowners, especially those on a fixed income or first-time buyers. However, there are strategies to mitigate the impact of these taxes:

- Appealing Assessments: Property owners have the right to appeal their assessed values if they believe the assessment is inaccurate or unfair. The appeal process involves submitting evidence to support a lower valuation.

- Tax Deductions: Homeowners can often deduct a portion of their real estate taxes from their federal and state income taxes, providing some relief.

- Strategic Planning: When purchasing a property, consider the long-term tax implications. Research tax rates and historical assessments to make informed decisions.

Payment Process and Due Dates

Madison County real estate taxes are typically due in two installments. The payment schedule varies depending on the taxing district, but most districts follow a similar timeline.

| Installment | Due Date |

|---|---|

| First Installment | Early June |

| Second Installment | Late September |

Tax bills are mailed to property owners several weeks before the due dates. Late payments may incur penalties and interest.

Online Payment Options

Madison County offers convenient online payment options for real estate taxes. Property owners can access their tax information and make payments through the county’s official website. This digital platform provides a secure and efficient way to manage tax obligations.

The Future of Real Estate Taxes in Madison County

As Madison County continues to grow and develop, the real estate tax landscape is likely to evolve. Here are some potential future implications and considerations:

- Economic Growth: A thriving economy and increased development may lead to higher property values, impacting tax assessments.

- Infrastructure Projects: Large-scale infrastructure initiatives could result in temporary tax increases to fund construction.

- Tax Reform: Changes in tax policies at the state or federal level may influence local tax rates and assessment processes.

- Community Engagement: Transparent communication between taxing bodies and residents is essential to ensure fair and equitable tax assessments.

Conclusion

Understanding the intricacies of Madison County real estate taxes is crucial for property owners and investors. While these taxes contribute to the vitality of the community, they also present challenges that require strategic planning. By staying informed about assessment processes, tax rates, and payment options, individuals can navigate the real estate tax landscape effectively. As Madison County continues to flourish, proactive engagement with local tax authorities and a comprehensive understanding of the tax system will empower residents to make informed decisions about their properties.

How often are properties reassessed for tax purposes in Madison County?

+Properties in Madison County are typically reassessed every four years. However, certain changes or improvements to a property may trigger an assessment update before the scheduled four-year cycle.

Can I receive a tax bill electronically instead of by mail?

+Yes, Madison County offers an e-billing service. You can sign up to receive your tax bills electronically, which provides a more environmentally friendly and convenient option.

What happens if I miss the tax payment deadline?

+Late payments may result in additional fees and penalties. It’s important to stay informed about the payment schedule and set reminders to ensure timely payments.

Are there any tax relief programs available for seniors or low-income homeowners in Madison County?

+Yes, Madison County offers various tax relief programs, including the Senior Citizens Real Estate Tax Deferral Program and the Property Tax Deferral Program for Low-Income Persons with Disabilities. These programs aim to provide financial assistance to eligible homeowners.

Can I pay my real estate taxes in installments, and if so, what are the payment options?

+Yes, Madison County allows property owners to pay their taxes in installments. The standard payment plan divides the annual tax into two installments due in June and September. However, some taxing districts may offer alternative payment plans with more frequent or customized schedules.