Indiana Sales Tax On Cars

When it comes to purchasing a car, understanding the associated sales taxes is crucial to ensure a seamless and informed transaction. In the state of Indiana, sales tax on cars is a key consideration for both residents and car enthusiasts alike. This comprehensive guide will delve into the intricacies of Indiana's sales tax regulations for vehicles, providing valuable insights and expert advice.

Understanding Indiana’s Sales Tax Structure

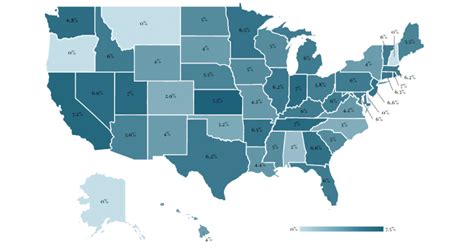

Indiana imposes a state sales tax on various goods and services, including the purchase of vehicles. This tax is applied uniformly across the state, making it essential for car buyers to be aware of the rates and potential exemptions.

The state sales tax rate in Indiana is currently set at 7%, which applies to most retail sales, including automobiles. However, it's important to note that this is not the only tax that may be applicable to car purchases.

In addition to the state sales tax, Indiana allows for the collection of local option sales taxes, which can vary depending on the county or city where the purchase is made. These local taxes are often implemented to fund specific initiatives or infrastructure projects, adding an additional layer of complexity to the sales tax landscape.

The combined state and local sales tax rates can significantly impact the final cost of a vehicle, so it's crucial for buyers to research and understand the specific tax rates applicable to their location.

Exemptions and Special Considerations

While the standard sales tax rate applies to most car purchases, Indiana does offer certain exemptions and special considerations that can reduce the overall tax burden.

- Trade-Ins: When trading in an old vehicle, the sales tax is typically calculated based on the difference between the trade-in value and the purchase price of the new car. This can result in a lower tax amount, especially if the trade-in value is substantial.

- Military Personnel: Active-duty military members stationed in Indiana may be eligible for tax exemptions or reduced tax rates. These benefits are in recognition of their service and vary based on individual circumstances.

- Certain Disabilities: Indiana provides sales tax exemptions for individuals with specific disabilities. This includes the purchase of vehicles modified for disabled use, such as wheelchair-accessible vans. It's essential to consult the official guidelines to understand the eligibility criteria.

These exemptions and special considerations can provide significant savings for eligible individuals, so it's advisable to explore these options thoroughly before finalizing a car purchase.

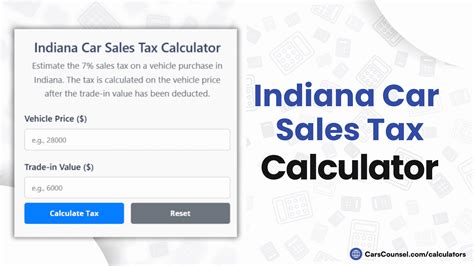

Calculating Sales Tax on Car Purchases

Calculating the sales tax on a car purchase in Indiana involves a straightforward process, but it’s crucial to consider all applicable taxes to arrive at an accurate figure.

Step-by-Step Guide

- Determine the Purchase Price: Start by identifying the agreed-upon price for the vehicle, excluding any additional fees or add-ons.

- Apply the State Sales Tax: Multiply the purchase price by the 7% state sales tax rate to calculate the state tax amount.

- Factor in Local Taxes: Research the specific local option sales tax rate for your county or city. Add this tax amount to the state tax calculated in the previous step.

- Consider Trade-Ins and Discounts: If applicable, subtract the trade-in value or any other discounts from the total purchase price before calculating the taxes. This ensures an accurate representation of the taxable amount.

- Final Tax Amount: The sum of the state and local taxes, adjusted for any trade-ins or discounts, represents the total sales tax due on the car purchase.

| Tax Component | Tax Rate |

|---|---|

| State Sales Tax | 7% |

| Local Option Sales Tax (Variable) | Varies by Location |

It's advisable to consult with the dealership or a tax professional to ensure an accurate calculation and to understand any potential adjustments based on individual circumstances.

Example Calculation

Let’s consider an example to illustrate the sales tax calculation process.

Given a vehicle with a purchase price of $25,000, located in a county with a 2% local option sales tax rate, the sales tax calculation would proceed as follows:

- State Sales Tax: $25,000 x 7% = $1,750

- Local Option Sales Tax: $25,000 x 2% = $500

- Total Sales Tax: $1,750 + $500 = $2,250

In this example, the total sales tax due on the car purchase would be $2,250, which is added to the purchase price to arrive at the final cost.

Tips for Navigating Indiana’s Sales Tax on Cars

Understanding the sales tax landscape is just the first step in navigating the complexities of car purchases in Indiana. Here are some expert tips to ensure a smooth and informed transaction:

- Research Local Tax Rates: Before finalizing a purchase, research the specific local option sales tax rate applicable to your location. This information is often available on official government websites or through local tax authorities.

- Negotiate Trade-Ins: If trading in a vehicle, negotiate the trade-in value to maximize the potential savings on sales tax. A higher trade-in value can reduce the taxable amount, resulting in a lower overall tax burden.

- Explore Financing Options: Consider different financing options, such as loans or leases, to manage the upfront costs associated with sales tax. Some financing options may provide flexibility in managing the tax payments.

- Seek Professional Advice: Consult with tax professionals or financial advisors who specialize in automotive transactions. They can provide tailored advice based on your specific circumstances and help you navigate any potential tax complexities.

Conclusion

Indiana’s sales tax regulations for car purchases offer a blend of uniformity and localized considerations. While the state sales tax rate is a consistent 7%, the inclusion of local option sales taxes adds a layer of complexity that buyers must navigate. By understanding the applicable tax rates, exploring exemptions, and employing strategic negotiation tactics, individuals can make informed decisions and potentially reduce their overall tax burden.

As with any financial transaction, staying informed and seeking professional guidance can greatly enhance the car-buying experience. Indiana's sales tax structure may present challenges, but with the right knowledge and approach, buyers can successfully navigate these complexities and drive away with their dream vehicle.

FAQ

What is the state sales tax rate in Indiana for car purchases?

+The state sales tax rate in Indiana is currently set at 7% for car purchases.

Are there any local sales taxes in addition to the state tax?

+Yes, Indiana allows for the collection of local option sales taxes, which can vary depending on the county or city. These taxes are in addition to the state sales tax.

Are there any exemptions or special considerations for sales tax on cars in Indiana?

+Yes, Indiana offers exemptions for certain circumstances, such as trade-ins, military personnel, and individuals with specific disabilities. It’s essential to consult official guidelines to understand eligibility.