Broward County Property Taxes

Property taxes are an essential aspect of any county's financial landscape, and Broward County, located in the vibrant state of Florida, is no exception. With its diverse communities, vibrant culture, and dynamic real estate market, understanding the intricacies of property taxes in Broward County is crucial for residents, investors, and anyone interested in the local economy. This article delves into the specifics of Broward County property taxes, providing an in-depth analysis to guide individuals through the process and offer valuable insights.

The Broward County Property Tax System

Broward County’s property tax system is a cornerstone of its fiscal framework, playing a pivotal role in funding various public services and infrastructure development. The county, known for its thriving tourism industry and diverse population, relies on property taxes to maintain its economic vitality and provide essential services to its residents.

The property tax structure in Broward County is designed to ensure fairness and transparency. It is governed by state laws and regulations, with the Broward County Property Appraiser's Office overseeing the assessment process and the Broward County Tax Collector's Office responsible for collecting and distributing the taxes.

Property Assessment

The journey of property taxes begins with the assessment process. The Broward County Property Appraiser’s Office assesses the value of each property within the county annually. This valuation is based on factors such as the property’s location, size, improvements, and market conditions. The appraised value serves as the basis for calculating the property tax liability.

Homeowners and property owners can access their property's assessed value through the Property Appraiser's website, where detailed information about their property's characteristics and the valuation process is available. This transparency allows property owners to understand how their tax liability is determined.

| Property Type | Assessment Methodology |

|---|---|

| Residential Properties | Market value is considered, taking into account recent sales data and property improvements. |

| Commercial Properties | Appraisers analyze income potential, comparable rentals, and market trends to determine the assessment. |

| Agricultural Lands | Special valuation methods are applied, considering the land's agricultural use and productivity. |

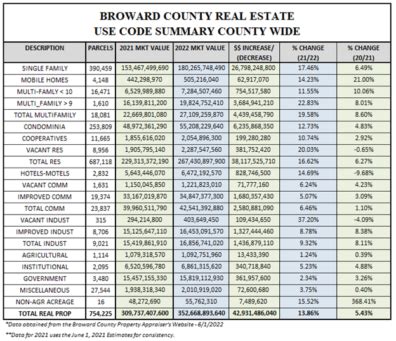

Tax Rates and Calculations

Once the assessed value is determined, the property tax rate is applied to calculate the tax liability. The tax rate is a combination of the countywide millage rate and any additional millage rates set by municipalities, special districts, and other taxing authorities within Broward County.

The millage rate is expressed in mills, with one mill representing $1 of tax for every $1,000 of the property's assessed value. For instance, a millage rate of 10 mills would mean that a property with an assessed value of $200,000 would have a tax liability of $2,000.

The specific millage rate for a property depends on its location within the county and the various taxing authorities it falls under. These rates can vary, leading to differences in tax liabilities for properties of similar value in different areas of Broward County.

| Taxing Authority | Millage Rate (2023) |

|---|---|

| Broward County | 6.1792 mills |

| City of Fort Lauderdale | 5.9360 mills |

| City of Hollywood | 5.5344 mills |

| City of Pompano Beach | 5.4960 mills |

Exemptions and Discounts

Broward County offers various exemptions and discounts to property owners, aimed at reducing their tax burden and promoting homeownership. These include homestead exemptions, which provide a reduction in the assessed value of a primary residence, and senior exemptions, which offer relief to homeowners aged 65 and older.

Additionally, the county provides tax discounts for early payment and offers programs to assist low-income homeowners with their property taxes. These initiatives ensure that Broward County's property tax system is not only fair but also supportive of its residents' financial well-being.

Impact of Property Taxes on the Community

Property taxes in Broward County have a significant impact on the local economy and community development. The revenue generated from these taxes funds essential services and infrastructure projects, shaping the county’s growth and prosperity.

Funding Public Services

A substantial portion of property tax revenue is allocated to fund public services, including education, public safety, healthcare, and social services. These funds ensure that Broward County’s residents have access to quality schools, efficient emergency response systems, and comprehensive healthcare facilities.

For instance, property taxes contribute to the funding of the Broward County Public School system, which serves over 270,000 students across the county. The revenue supports the maintenance and improvement of school facilities, the recruitment and retention of qualified teachers, and the implementation of innovative educational programs.

Infrastructure Development

Property taxes are also instrumental in financing infrastructure projects that enhance the county’s overall quality of life. These projects include road improvements, bridge repairs, public transportation enhancements, and the development of recreational facilities.

The Broward County Commission often utilizes property tax revenue to initiate and complete large-scale infrastructure projects, ensuring that the county's infrastructure remains modern and efficient. This not only improves the daily lives of residents but also attracts businesses and investors, further boosting the local economy.

| Infrastructure Project | Funding Source |

|---|---|

| I-595 Express Lanes | Property Tax Revenue & State Grants |

| Riverwalk Fort Lauderdale | Property Taxes & Tourism Development Funds |

| Beach Renourishment Projects | Property Taxes & State & Federal Grants |

Community Development and Social Programs

Beyond public services and infrastructure, property tax revenue also supports community development initiatives and social programs. These programs aim to enhance the well-being of Broward County’s residents, especially those from underserved communities.

For example, property taxes contribute to affordable housing programs, providing financial assistance to low- and moderate-income households. They also fund community centers, parks, and recreational facilities, ensuring that all residents have access to safe and enjoyable public spaces.

Navigating the Property Tax Process

Understanding and navigating the property tax process in Broward County can be a complex task, but it is crucial for homeowners and property owners to stay informed and proactive.

Assessment Appeals

If a property owner believes their property has been over-assessed, they have the right to appeal the assessed value. The Broward County Property Appraiser’s Office provides a detailed process for filing an appeal, which typically involves submitting evidence and supporting documentation to challenge the assessment.

Appeals are often successful when property owners can demonstrate that the assessed value is significantly higher than the property's fair market value. This might involve providing recent sales data of similar properties or evidence of property damage or deficiencies that were not considered in the initial assessment.

Payment Options and Deadlines

Property taxes in Broward County are typically due twice a year, with specific deadlines set by the Broward County Tax Collector’s Office. Late payments may incur penalties and interest, so it is essential for property owners to stay informed about these deadlines.

The Tax Collector's Office offers various payment options, including online payments, mail-in payments, and in-person payments at designated locations. Property owners can also explore options for early payment discounts and payment plans to manage their tax liabilities effectively.

Staying Informed and Engaged

Staying informed about property tax changes, new regulations, and exemptions is crucial for property owners. The Broward County Property Appraiser’s Office and Tax Collector’s Office regularly communicate updates and provide resources to help property owners understand their rights and responsibilities.

Attending public meetings and staying engaged with local government bodies can also provide valuable insights into the property tax landscape. This engagement ensures that property owners have a voice in the decision-making process and can advocate for their interests effectively.

Future Outlook and Trends

As Broward County continues to grow and evolve, the property tax landscape is likely to experience changes and shifts. Understanding these potential trends is essential for property owners, investors, and policymakers to make informed decisions.

Population Growth and Development

Broward County’s population is projected to continue its steady growth, with an increasing demand for housing and commercial spaces. This growth will likely lead to an increase in property values, impacting the assessed values and, consequently, the property tax revenue.

As the county develops, there may be a need for additional infrastructure and public services to accommodate the growing population. This could result in a shift in tax rates or the implementation of new tax initiatives to fund these necessary developments.

Tax Policy Changes

Changes in tax policies at the state and local levels can have a significant impact on property taxes. Broward County, like many other counties in Florida, has a history of tax reform initiatives aimed at making the system more equitable and efficient.

Potential changes could include adjustments to the millage rate, the introduction of new exemptions or discounts, or reforms to the assessment process. Staying informed about these potential changes is crucial for property owners to understand how they might be affected.

Impact of Economic Fluctuations

Economic fluctuations, whether at a local, state, or national level, can influence property values and, consequently, property taxes. During economic downturns, property values may decrease, leading to a reduction in tax revenue. Conversely, economic booms can drive property values up, increasing tax revenue.

Broward County's vibrant economy and diverse industries make it relatively resilient to economic fluctuations. However, property owners should be aware of the potential impact of economic shifts on their property taxes and plan accordingly.

Conclusion

Broward County’s property tax system is a vital component of the local economy, funding essential services, infrastructure, and community development initiatives. Understanding the intricacies of this system is crucial for property owners and residents alike.

From the assessment process to the allocation of tax revenue, Broward County's property taxes play a significant role in shaping the county's future. By staying informed, engaging with local government, and taking advantage of available resources, property owners can navigate the property tax landscape with confidence and contribute to the continued prosperity of Broward County.

How often are property values assessed in Broward County?

+Property values in Broward County are assessed annually by the Broward County Property Appraiser’s Office. This annual assessment ensures that property values remain up-to-date and reflect market conditions.

Are there any exemptions or discounts available for property owners in Broward County?

+Yes, Broward County offers various exemptions and discounts to property owners. These include homestead exemptions, senior exemptions, and tax discounts for early payment. Additionally, the county provides programs to assist low-income homeowners with their property taxes.

How can I appeal my property’s assessed value if I believe it is inaccurate?

+If you believe your property’s assessed value is inaccurate, you have the right to appeal. The Broward County Property Appraiser’s Office provides a detailed process for filing an appeal, which typically involves submitting evidence and supporting documentation to challenge the assessment.

What happens if I miss the deadline to pay my property taxes in Broward County?

+If you miss the deadline to pay your property taxes in Broward County, you may be subject to penalties and interest. It is important to stay informed about the payment deadlines and explore options for early payment discounts or payment plans to avoid late fees.

Where can I find more information about Broward County’s property tax system and my tax liability?

+The Broward County Property Appraiser’s Office and Tax Collector’s Office provide a wealth of resources and information about the property tax system. Their websites offer detailed explanations, FAQs, and contact information for further assistance. It is recommended to explore these resources to gain a comprehensive understanding of your tax liability.