How To Compute Property Tax

Computing property tax is a crucial aspect of homeownership and real estate investments. It is a significant financial obligation that homeowners and property owners must navigate. Property tax is a vital source of revenue for local governments and is used to fund essential services and infrastructure. Understanding how property tax is calculated and the factors that influence it is essential for property owners to plan their finances effectively and ensure compliance with local tax regulations.

Understanding Property Tax Assessments

Property tax is based on the assessed value of a property. The assessment process varies by jurisdiction, but it typically involves evaluating the property’s market value, location, and any improvements made. Assessors consider factors such as recent sales of similar properties, construction costs, and the property’s income-generating potential.

In many regions, property tax assessments are conducted periodically, often every few years. This allows for adjustments to be made to the tax rate based on changes in the property's value. Property owners may receive a notification of their assessed value and the corresponding tax liability. It is essential to review these assessments carefully, as errors can occur, and property owners have the right to appeal if they believe the assessment is inaccurate.

The Role of Tax Rates

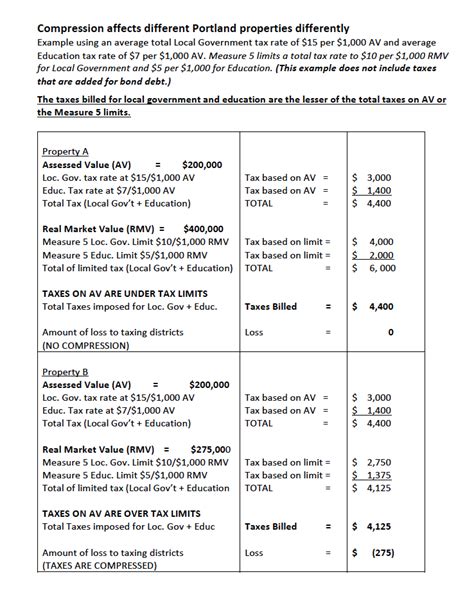

The property tax rate is determined by the local government or taxing authority. This rate is applied to the assessed value of the property to calculate the tax liability. Tax rates can vary significantly between different jurisdictions, and even within the same region, due to factors such as the cost of providing services and the financial needs of the local government.

Tax rates are often expressed as a millage rate, which represents the tax liability per $1,000 of assessed value. For example, a millage rate of 20 mills means that for every $1,000 of assessed value, the property owner owes $20 in property taxes. These rates can be adjusted annually or at specific intervals to account for changes in the local economy and budgetary requirements.

| Jurisdiction | Average Tax Rate (Mills) |

|---|---|

| City A | 15 |

| County B | 22 |

| Suburb C | 18 |

Factors Influencing Property Tax

Several factors contribute to the calculation of property tax. Understanding these factors can provide insight into how property tax is determined and the potential impact on your financial obligations.

Property Value and Assessment

The assessed value of a property is a critical determinant of property tax. Assessors use various methods to determine this value, including sales comparison, cost approach, and income capitalization. The sales comparison method involves analyzing recent sales of similar properties in the area. The cost approach considers the cost of replacing or reproducing the property, while the income capitalization method estimates the property’s potential income generation.

It is important to note that the assessed value may not always reflect the property's market value. In some cases, the assessed value may be lower or higher than the actual market value, depending on the assessment methods and market conditions.

Property Improvements and Upgrades

Any improvements or upgrades made to a property can impact its assessed value and, consequently, the property tax liability. Adding new structures, renovating existing spaces, or making significant upgrades can increase the property’s value, which may result in a higher tax assessment. It is essential to understand how local regulations treat property improvements and whether they trigger a reassessment.

For example, if you add a swimming pool or build an additional bedroom, these improvements may be factored into the next assessment, leading to a higher tax bill. However, some jurisdictions may offer exemptions or deferrals for certain improvements, such as energy-efficient upgrades or renovations for accessibility.

Tax Exemptions and Deductions

Property owners may be eligible for tax exemptions or deductions that can reduce their overall tax liability. These exemptions and deductions vary by jurisdiction and may be based on factors such as income level, age, disability, or property use. Common exemptions include homestead exemptions, which provide a reduction in tax for primary residences, and senior citizen exemptions, which offer relief to older homeowners.

Additionally, certain types of properties may be eligible for specialized tax treatments. For instance, agricultural or historic properties may have different assessment methods or tax rates. Understanding the available exemptions and deductions can help property owners optimize their tax obligations and take advantage of any applicable benefits.

Calculating Property Tax

The calculation of property tax involves multiplying the assessed value of the property by the applicable tax rate. This formula provides a straightforward method to determine the tax liability.

For example, if the assessed value of your property is $300,000 and the tax rate is 18 mills, the calculation would be as follows:

Property Tax = Assessed Value x Tax Rate

Property Tax = $300,000 x 0.018

Property Tax = $5,400

In this case, the property owner would owe $5,400 in property taxes for the year. It is important to note that this calculation assumes a static tax rate and assessed value. In reality, these values can change over time, and property owners should refer to their local tax authority for the most accurate and up-to-date information.

Property Tax Due Dates and Payment Options

Property tax payments are typically due annually, but the specific due dates and payment options can vary by jurisdiction. Some areas may offer semi-annual or quarterly payment plans, while others may have specific deadlines for paying property taxes without incurring penalties.

Property owners should familiarize themselves with the payment options and deadlines to avoid late fees and potential penalties. It is advisable to set reminders or automate payments to ensure timely payment. Many jurisdictions offer online payment portals, making it convenient to manage property tax obligations remotely.

Appealing Property Tax Assessments

If a property owner believes that their assessed value is inaccurate or unfair, they have the right to appeal the assessment. The appeals process varies by jurisdiction, but it generally involves submitting documentation and evidence to support the claim of an incorrect assessment.

Common reasons for appealing a property tax assessment include:

- Recent sales of similar properties indicate a lower market value.

- Overvaluation due to unique circumstances or market conditions.

- Errors in the assessment, such as incorrect square footage or property characteristics.

- Significant changes in the property's condition or use.

To initiate an appeal, property owners should gather relevant evidence, such as recent sales data, appraisals, and photographs. It is beneficial to consult with a tax professional or attorney who specializes in property tax appeals to ensure a strong case is presented.

Property Tax Implications for Real Estate Investments

For real estate investors, property tax considerations play a crucial role in financial planning and investment strategies. Property taxes can impact the overall profitability of an investment and must be factored into cash flow projections.

Cash Flow Analysis

When evaluating potential real estate investments, property tax obligations should be included in the cash flow analysis. Investors must consider the impact of property taxes on their net operating income (NOI) and potential returns. Higher property taxes can reduce the cash flow available for distribution to investors or impact the property’s overall value.

Property Tax Strategies

Real estate investors can employ various strategies to optimize their property tax obligations. These strategies may include:

- Structuring ownership entities to take advantage of tax benefits or deductions.

- Exploring investment opportunities in areas with lower tax rates or more favorable tax policies.

- Engaging in cost-effective property maintenance and upgrades to control assessment increases.

- Monitoring tax laws and regulations for potential changes that may impact investment properties.

Property Tax Deferrals and Abatements

Some jurisdictions offer property tax deferral programs or abatements to support specific types of investments or development projects. These programs may provide temporary relief from property tax obligations, allowing investors to redirect funds toward other aspects of the investment.

For example, certain regions may offer tax abatements for mixed-use developments or renewable energy projects. Investors should research and understand the availability of such programs to determine if they align with their investment goals.

Conclusion: Navigating Property Tax Obligations

Computing property tax is a complex process that involves understanding assessment methods, tax rates, and various factors influencing tax liability. Property owners and real estate investors must stay informed about local regulations and assess their properties’ value to plan their finances effectively.

By comprehending the factors that impact property tax, property owners can make informed decisions, appeal assessments when necessary, and optimize their tax obligations. Real estate investors, in particular, must integrate property tax considerations into their investment strategies to ensure long-term financial success.

Staying engaged with local tax authorities, seeking professional advice when needed, and keeping up with tax law changes are essential aspects of navigating property tax obligations. With a comprehensive understanding of property tax computations, property owners can ensure compliance, plan their finances, and make informed decisions regarding their real estate assets.

How often are property tax assessments conducted?

+

Property tax assessments are typically conducted every few years, but the frequency can vary by jurisdiction. Some areas may assess properties annually, while others may do so every 2-5 years. It is essential to check with your local tax authority for the specific assessment schedule in your region.

Can I appeal my property tax assessment if I disagree with it?

+

Yes, if you believe your property tax assessment is incorrect or unfair, you have the right to appeal. The appeals process varies by jurisdiction, but it generally involves submitting evidence and documentation to support your claim. It is advisable to consult with a tax professional or attorney to guide you through the appeals process.

What happens if I don’t pay my property taxes on time?

+

Late payment of property taxes can result in penalties and interest charges. Additionally, in some cases, non-payment can lead to a lien being placed on your property, which could eventually result in foreclosure. It is crucial to stay informed about due dates and payment options to avoid these consequences.

Are there any tax exemptions or deductions available for property owners?

+

Yes, many jurisdictions offer tax exemptions or deductions to eligible property owners. These can include homestead exemptions, senior citizen exemptions, agricultural property exemptions, and more. It is beneficial to research and understand the specific exemptions and deductions available in your area to potentially reduce your tax liability.

How can I estimate my property tax liability before it is officially assessed?

+

You can estimate your property tax liability by multiplying the assessed value of your property (or its estimated value) by the applicable tax rate. This simple calculation provides a rough estimate, but it is important to consult with a tax professional or use online tools that consider specific factors unique to your property and jurisdiction.