Charleston Sc Property Tax

Welcome to our comprehensive guide on understanding and managing property taxes in Charleston, South Carolina. Property taxes are an essential aspect of homeownership, and as a resident or prospective buyer in Charleston, it's crucial to grasp the ins and outs of this financial obligation. In this expert-driven article, we will delve into the specifics of Charleston's property tax system, providing you with the knowledge and tools to navigate this crucial aspect of homeownership with confidence.

Unraveling the Complexities of Charleston’s Property Tax Landscape

Charleston’s property tax system, like many other municipalities, is a vital source of revenue for the local government, funding essential services and infrastructure development. However, the process of assessing and calculating property taxes can often be intricate and confusing for homeowners. In this section, we aim to demystify the intricacies of Charleston’s property tax system, ensuring you have a clear understanding of the key components.

Assessment Methodology: A Critical Component

At the heart of Charleston’s property tax system lies the assessment process. This critical step determines the value of your property, which in turn influences the amount of tax you will owe. The Charleston County Assessor’s Office is responsible for conducting these assessments, employing a systematic approach to ensure fairness and accuracy.

Assessors consider various factors when evaluating your property, including:

- Recent sales data of similar properties in your area.

- Physical characteristics of your property, such as size, age, and condition.

- Improvements or additions made to the property.

- Market trends and economic factors.

By analyzing these elements, assessors arrive at a fair market value for your property, which forms the basis for calculating your tax liability.

Tax Rates and Millage: Understanding the Numbers

Once your property’s value has been assessed, the next step involves determining the tax rate, also known as the millage rate. This rate is set by local government bodies, including the county, city, and school district, and represents the amount of tax owed per 1,000 of assessed property value.</p> <p>For instance, if your property is valued at 300,000 and the tax rate is set at 400 mills, your annual property tax would be calculated as follows:

Assessed Value x Tax Rate = Annual Property Tax

300,000 x 0.4 = 120,000

This means you would owe 120 in property taxes for every 1,000 of assessed value, resulting in a total annual tax bill of $48,000.

The Impact of Exemptions and Deductions

While property taxes can be a significant expense, Charleston offers a range of exemptions and deductions that can help reduce your tax liability. These incentives are designed to provide relief to eligible homeowners, making homeownership more affordable.

Some common exemptions and deductions in Charleston include:

- Homestead Exemption: This exemption is available to homeowners who use their property as their primary residence. It provides a reduction in the assessed value of the property, effectively lowering the tax burden.

- Senior Citizen Exemption: Elderly homeowners may be eligible for this exemption, which can provide significant savings on property taxes.

- Veteran’s Exemption: Charleston offers special exemptions for honorably discharged veterans, reducing their property tax obligations.

- Disabled Veteran’s Exemption: This exemption is tailored for veterans with service-related disabilities, offering further tax relief.

- Property Tax Deductions: Certain expenses related to your property, such as mortgage interest and property taxes, can be deducted from your federal income tax, providing additional financial benefits.

The Role of Property Tax Appeals

In some cases, homeowners may disagree with the assessed value of their property, leading to a situation where they believe their property taxes are unfairly high. In such instances, it’s essential to understand the process of filing a property tax appeal.

The first step in a property tax appeal is to gather evidence to support your case. This may include recent sales data of similar properties in your area, as well as any unique circumstances that may impact the value of your property.

Once you have gathered your evidence, you can file an appeal with the Charleston County Assessor’s Office. The appeal process typically involves a review by an independent board, who will consider your case and make a determination. If your appeal is successful, your property’s assessed value may be adjusted, resulting in a reduction in your tax liability.

Staying Informed: Property Tax Resources

As a Charleston homeowner, staying informed about property tax matters is essential. The Charleston County Assessor’s Office provides a wealth of resources to help you understand and manage your property taxes effectively.

Here are some valuable resources to keep in mind:

- Property Tax Guides: The Assessor’s Office offers comprehensive guides that explain the property tax process, assessment procedures, and available exemptions.

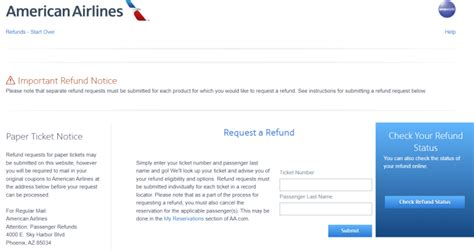

- Online Property Tax Lookup: This convenient tool allows you to access your property’s tax information, including assessed value and tax history, online.

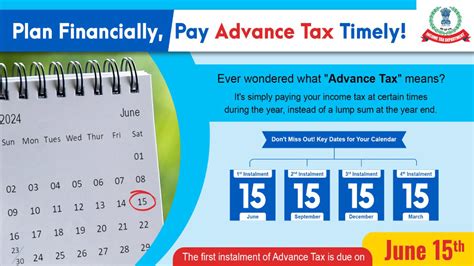

- Property Tax Calendar: Stay organized by referring to the tax calendar, which outlines important dates for payment deadlines, appeal periods, and other crucial deadlines.

- Assessor’s Office Contact: Don’t hesitate to reach out to the Assessor’s Office if you have specific questions or concerns. Their team is available to provide guidance and assistance.

Navigating the Property Tax Process: A Step-by-Step Guide

Now that we have explored the intricacies of Charleston’s property tax system, let’s walk through a step-by-step guide to help you navigate the process effectively.

Step 1: Understanding Your Property Assessment

The first step in managing your property taxes is to thoroughly understand your property assessment. This includes reviewing the assessment notice you receive from the Charleston County Assessor’s Office. Pay close attention to the assessed value of your property and ensure it aligns with your expectations.

If you have any questions or concerns about your assessment, don’t hesitate to reach out to the Assessor’s Office. Their team can provide clarification and guidance, ensuring you have a clear understanding of the assessment process.

Step 2: Exploring Exemptions and Deductions

As mentioned earlier, Charleston offers a range of exemptions and deductions that can significantly reduce your property tax burden. Take the time to research and understand the eligibility criteria for these incentives.

If you believe you qualify for any exemptions or deductions, be sure to apply for them. The process typically involves filling out an application and providing supporting documentation. Stay organized and keep track of important deadlines to ensure your application is processed in a timely manner.

Step 3: Budgeting for Property Taxes

Property taxes are an annual expense, and it’s essential to budget for them effectively. By understanding your tax liability, you can plan and allocate funds accordingly.

Consider setting aside a portion of your income specifically for property taxes. This will ensure you have the necessary funds available when tax payments are due, avoiding any financial strain.

Step 4: Payment Options and Deadlines

Charleston offers various payment options for property taxes, providing flexibility to homeowners. Familiarize yourself with the available methods and choose the one that best suits your needs.

Payment options may include online payment portals, direct debit, or traditional mail-in payments. Be sure to note the payment deadlines to avoid late fees and penalties.

Additionally, keep in mind that Charleston may offer payment plans or options for homeowners facing financial hardships. If you anticipate difficulty making a payment, reach out to the tax collector’s office to discuss your options.

Step 5: Staying Informed and Engaged

Property taxes are a dynamic aspect of homeownership, and staying informed about changes and updates is crucial. Regularly check the Charleston County Assessor’s website for any announcements or updates regarding tax rates, assessment procedures, or available exemptions.

Additionally, consider attending local government meetings or subscribing to newsletters to stay engaged with property tax matters. Being an informed and engaged homeowner can help you navigate any changes or challenges that may arise.

Future Outlook: Property Taxes in Charleston

As we look ahead, it’s essential to consider the future outlook for property taxes in Charleston. While it’s challenging to predict precise changes, certain trends and factors can provide valuable insights.

Economic Factors and Market Trends

The real estate market in Charleston, like any other, is influenced by a multitude of economic factors. These factors can impact property values, which in turn affect property tax assessments.

Factors such as supply and demand, interest rates, and overall economic conditions can cause fluctuations in property values. For instance, a robust housing market with high demand and limited supply may lead to increased property values, potentially resulting in higher tax assessments.

Government Budgetary Considerations

Local government bodies, including the county and city, rely on property taxes as a significant source of revenue. As such, their budgetary considerations can impact tax rates and assessment procedures.

If the local government faces budgetary constraints or seeks to fund specific initiatives, they may adjust tax rates or assessment methodologies. It’s essential to stay informed about local government finances and budget proposals to anticipate any potential changes in property tax obligations.

Community Development and Infrastructure

Property taxes play a crucial role in funding essential community development and infrastructure projects. As Charleston continues to grow and evolve, these projects may impact property tax assessments and rates.

For instance, the development of new infrastructure, such as roads, schools, or public amenities, may lead to increased property values in certain areas. This, in turn, can result in higher tax assessments for those properties. Staying informed about community development plans can help you understand how these projects may impact your property taxes.

Tax Policy Changes and Exemptions

Property tax policies and exemptions are subject to change, and keeping abreast of any proposed or enacted changes is essential. Local government bodies may introduce new exemptions or modify existing ones to support specific initiatives or provide relief to homeowners.

Stay engaged with local politics and community discussions to stay informed about any potential tax policy changes. This will ensure you can take advantage of any new exemptions or deductions that may become available.

Expert Insights: Maximizing Your Property Tax Strategy

As an expert in the field, I’ve gathered some valuable insights and strategies to help you maximize your property tax savings. These tips can help you navigate the complexities of Charleston’s property tax system and ensure you’re taking advantage of all available opportunities.

1. Stay Informed and Proactive

The key to effectively managing your property taxes is staying informed and proactive. Regularly review your property tax assessments, understand the available exemptions, and stay updated on any changes or updates from the Charleston County Assessor’s Office.

By being proactive, you can identify potential issues or discrepancies early on and take the necessary steps to address them. This may include filing appeals, applying for exemptions, or exploring alternative payment options.

2. Optimize Your Property Value

While property values are primarily determined by market conditions and assessments, there are strategies you can employ to optimize your property’s value and potentially reduce your tax liability.

Consider making improvements or upgrades to your property that align with market trends and buyer preferences. This could include updating your kitchen or bathroom, adding energy-efficient features, or enhancing your property’s curb appeal. These improvements can increase your property’s value and potentially result in a higher assessment, leading to increased tax savings.

3. Explore Alternative Payment Methods

Charleston offers a range of payment options for property taxes, and exploring these alternatives can provide flexibility and potential savings.

For instance, if you have the means, consider paying your property taxes in full upfront. Many municipalities offer discounts or incentives for early or lump-sum payments, reducing your overall tax burden.

Alternatively, if you prefer a more structured approach, consider enrolling in a payment plan. These plans allow you to spread out your tax payments over time, making them more manageable and potentially reducing the impact on your cash flow.

4. Seek Professional Advice

Navigating the complexities of property taxes can be challenging, and seeking professional advice can provide valuable insights and guidance.

Consider consulting with a tax professional or financial advisor who specializes in property tax matters. They can help you understand the intricacies of Charleston’s property tax system, identify potential savings opportunities, and ensure you’re maximizing your tax benefits.

5. Stay Engaged with Your Community

As a Charleston homeowner, your involvement in the community can have a direct impact on your property taxes. Stay engaged with local government initiatives, attend community meetings, and participate in discussions about property tax matters.

By staying informed and engaged, you can influence policy decisions and advocate for changes that benefit homeowners. Your involvement can help shape the future of property taxes in Charleston, ensuring a fair and sustainable system for all residents.

Conclusion: Empowering Homeowners with Knowledge

Understanding and managing property taxes in Charleston is an essential aspect of homeownership. By unraveling the complexities of the property tax system, exploring available exemptions, and staying informed about future trends, you can navigate this financial obligation with confidence.

Remember, knowledge is power, and by arming yourself with the expertise and strategies outlined in this guide, you can maximize your property tax savings and ensure a more financially secure future. As a Charleston homeowner, you have the tools and resources to make informed decisions and take control of your property tax obligations.

How often are property assessments conducted in Charleston?

+Property assessments in Charleston are conducted on a regular basis, typically every 5 years. However, certain circumstances, such as a significant improvement or addition to a property, may trigger an assessment update before the scheduled reassessment.

Can I appeal my property tax assessment if I disagree with the value?

+Yes, if you believe your property tax assessment is incorrect or unfair, you have the right to file an appeal. The process typically involves submitting an appeal form and providing supporting evidence to the Charleston County Assessor’s Office. An independent review board will then consider your case and make a determination.

What happens if I miss the property tax payment deadline?

+Missing the property tax payment deadline can result in late fees and penalties. It’s important to stay organized and plan your payments accordingly. If you anticipate difficulty making a payment, contact the tax collector’s office to discuss available options, such as payment plans or extensions.

Are there any online resources to help me estimate my property taxes in Charleston?

+Yes, the Charleston County Assessor’s Office provides an online property tax estimator tool. This tool allows you to input your property details and estimate your annual tax liability. It’s a convenient way to get a rough estimate of your property taxes before receiving your official assessment notice.