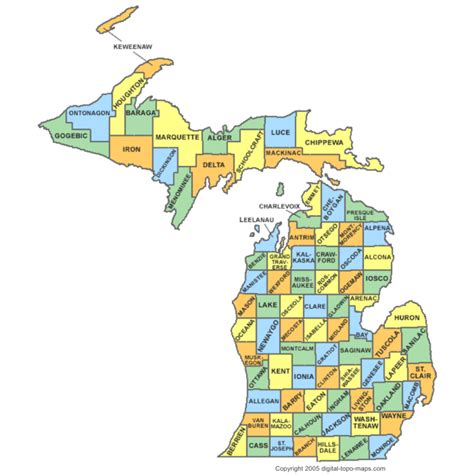

Tax Sale Michigan

Tax sales in Michigan are a complex yet intriguing aspect of the state's real estate landscape. These sales, often resulting from property owners' inability to pay their taxes, provide an opportunity for investors and individuals to acquire properties at potentially favorable rates. Understanding the intricacies of Michigan's tax sale process is crucial for anyone looking to navigate this unique market.

The Michigan Tax Sale Process: A Comprehensive Overview

Michigan’s tax sale process is governed by state laws and regulations, which outline the procedures for collecting delinquent taxes and the subsequent sale of properties. The process aims to recover unpaid taxes while offering a transparent and fair system for property acquisition.

Delinquent Tax Identification

The journey begins with the identification of properties with delinquent taxes. In Michigan, properties are subject to a 18-month redemption period after which, if taxes remain unpaid, the property may be subject to a tax sale. During this period, the county treasurer’s office works to notify the property owner of the delinquent taxes and the potential consequences.

| Redemption Period Timeline | Action |

|---|---|

| 6 Months | Initial Notice of Delinquency |

| 12 Months | Publication of Notice of Foreclosure |

| 18 Months | Tax Sale or Redemption |

Foreclosure and Tax Sale

If the property owner fails to redeem the property by paying the delinquent taxes within the 18-month period, the property is considered foreclosed. At this stage, the county treasurer prepares the property for a tax sale, which is an auction where the property is offered to the highest bidder.

Auction Process

The tax sale auction is an open process where bidders compete for properties. Bidders must register and provide a deposit before the auction. The auction typically follows a set schedule, with properties listed and sold sequentially. The winning bid determines the new owner of the property, who then assumes responsibility for any outstanding taxes and any improvements needed.

Post-Sale Procedures

After the auction, the new owner must complete the necessary legal procedures, including recording the deed and ensuring compliance with local regulations. It’s essential to understand that tax sales may come with certain risks, such as existing liens or environmental concerns, which the new owner must address.

Benefits and Considerations of Tax Sale Investments

Investing in Michigan’s tax sale properties can offer significant opportunities, but it’s essential to approach these investments with a strategic mindset.

Advantages of Tax Sale Properties

- Affordable Entry Point: Tax sale properties often have a lower entry price point compared to traditional real estate, making them accessible to a wider range of investors.

- Potential for High Returns: Successful bidders can potentially realize significant returns by acquiring properties at a discount and either reselling or developing them.

- Diversification: Tax sale properties can add diversity to an investment portfolio, offering a unique asset class with its own market dynamics.

Challenges and Considerations

- Research and Due Diligence: Investors must conduct thorough research to understand the property’s condition, potential liabilities, and the local real estate market. This due diligence is crucial to making informed decisions.

- Competition: Tax sales often attract experienced investors, leading to competitive bidding. New investors should be prepared for this environment and have a clear strategy.

- Legal and Regulatory Compliance: Staying compliant with local regulations and ensuring all legal procedures are followed is essential to avoid potential issues down the line.

Strategies for Success in Michigan’s Tax Sale Market

Navigating Michigan’s tax sale market requires a combination of knowledge, strategy, and a bit of luck. Here are some strategies to enhance your chances of success:

Pre-Sale Preparation

Before the auction, familiarize yourself with the properties on offer. Attend pre-sale inspections and research the properties’ histories, including any outstanding taxes or potential issues. This knowledge can give you an edge when bidding.

Set Clear Objectives

Define your investment goals. Are you looking for a long-term rental property, a quick flip, or a development opportunity? Clear objectives will guide your bidding strategy and help you make informed decisions.

Develop Bidding Strategies

Determine your maximum bid amount based on your research and objectives. Consider the property’s potential value, the local market, and any potential costs associated with ownership. A well-planned bidding strategy can help you secure properties without overspending.

Post-Sale Action Plan

Have a post-sale plan in place. Whether it’s renovating the property, listing it for sale, or preparing it for rental, a clear plan will help you maximize the property’s value and return on investment.

The Future of Tax Sales in Michigan: Trends and Opportunities

The tax sale market in Michigan is evolving, offering both challenges and opportunities for investors. Staying abreast of market trends and understanding potential future developments is crucial for long-term success.

Market Trends

Recent years have seen an increase in the number of tax sales in Michigan, driven by various factors including economic conditions and changing property ownership dynamics. This trend has created a more active market, attracting a diverse range of investors.

Opportunities and Challenges

The increased activity presents opportunities for investors to find a wider variety of properties. However, it also means increased competition, especially for desirable properties. Investors must be prepared to adapt their strategies to meet these changing market conditions.

Future Outlook

Looking ahead, the tax sale market in Michigan is expected to remain active. As the state continues to evolve economically and demographically, the market may see further shifts. Staying informed about local developments and adapting investment strategies accordingly will be key to success.

Conclusion: Navigating Michigan’s Tax Sale Market

Michigan’s tax sale market offers a unique investment opportunity, providing access to properties at potentially attractive prices. However, it requires a thorough understanding of the process, careful research, and a strategic approach. By combining knowledge, preparation, and a touch of flexibility, investors can successfully navigate this market and realize their real estate goals.

Frequently Asked Questions

What is the typical timeline for a tax sale in Michigan?

+

The process typically takes around 18 months. This includes a 6-month initial notice period, followed by a 12-month publication of the notice of foreclosure, leading up to the tax sale at the 18-month mark.

Are there any risks associated with tax sale properties?

+

Yes, potential risks include existing liens, environmental issues, or structural problems with the property. It’s crucial to conduct thorough due diligence before bidding.

How can I stay informed about upcoming tax sales in Michigan?

+

You can monitor local county treasurer websites, which often provide schedules and details about upcoming tax sales. Additionally, subscribing to real estate newsletters or joining local investor groups can keep you updated.

Can I bid online for tax sale properties in Michigan?

+

Some counties in Michigan offer online bidding for tax sales. However, it’s essential to check with the specific county’s treasurer office to confirm their bidding procedures and any online bidding options.

What happens if I win a bid but can’t afford the property after the auction?

+

If you win a bid but are unable to complete the purchase, you may face legal consequences, including potential lawsuits. It’s crucial to ensure you have the financial means to complete the transaction before bidding.