Glacier Tax

In the world of financial planning and wealth management, there exists a unique phenomenon known as the "Glacier Tax." This term, though seemingly chilly in its name, refers to a specific strategy employed by individuals and financial advisors to minimize tax liabilities and optimize investment returns over the long term. As we delve into the intricacies of the Glacier Tax, we will uncover how this strategy can be a powerful tool for those seeking to preserve and grow their wealth.

Understanding the Glacier Tax Strategy

The Glacier Tax strategy derives its name from the slow and steady nature of glaciers, which move imperceptibly over time yet possess immense power. Similarly, the Glacier Tax approach advocates for a patient and disciplined investment philosophy, focusing on long-term capital appreciation rather than short-term gains. By adopting this strategy, investors aim to minimize the impact of taxes on their investments, thereby allowing their wealth to grow more efficiently.

At its core, the Glacier Tax strategy involves a careful selection of investment vehicles and a strategic approach to tax management. It leverages the power of tax-efficient investment structures and the time value of money to maximize returns. This strategy is particularly relevant in jurisdictions with progressive tax systems, where higher tax rates are applied to higher income brackets.

Key Principles of the Glacier Tax

The Glacier Tax strategy is built upon several fundamental principles that guide its implementation:

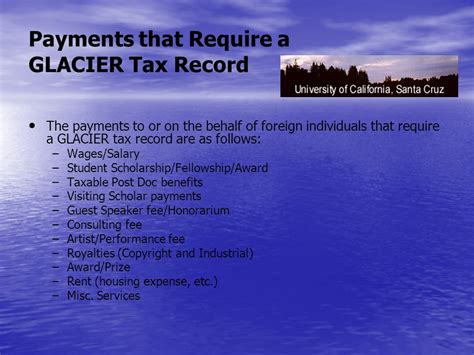

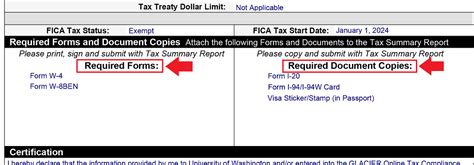

- Tax-Efficient Investment Vehicles: Investors utilizing the Glacier Tax strategy often opt for investments that offer tax advantages. These can include tax-deferred accounts like traditional IRAs or 401(k)s, which allow contributions and growth to be tax-free until withdrawal. Additionally, certain types of investments, such as municipal bonds or real estate investment trusts (REITs), offer tax benefits that can reduce the overall tax burden.

- Long-Term Capital Gains: One of the primary goals of the Glacier Tax strategy is to qualify for long-term capital gains treatment. By holding investments for a minimum period (often one year or more), investors can benefit from reduced tax rates on capital gains. This strategy is particularly advantageous for high-income earners, as it can result in significant tax savings.

- Strategic Asset Allocation: The Glacier Tax approach emphasizes a well-diversified portfolio, ensuring a balance between growth and income-generating assets. This strategic asset allocation helps manage risk while taking advantage of tax-efficient investment opportunities. For instance, a portfolio might include a mix of stocks, bonds, and alternative investments, each offering unique tax implications.

- Tax Loss Harvesting: Tax loss harvesting is a technique used to offset capital gains with capital losses, thereby reducing the overall tax liability. Investors employing the Glacier Tax strategy may actively manage their portfolios to realize capital losses, which can be used to offset gains and minimize taxes owed. This practice is particularly useful when combined with long-term capital gains, as it can further reduce the tax burden.

Real-World Applications and Benefits

The Glacier Tax strategy has proven to be a valuable tool for investors seeking to optimize their wealth management plans. By implementing this approach, individuals can experience several tangible benefits:

Maximizing Investment Returns

The Glacier Tax strategy’s focus on long-term capital appreciation allows investors to benefit from the compounding effect of investment returns. By minimizing taxes on investment gains, more of the returns can be reinvested, leading to exponential growth over time. This strategy is particularly beneficial for those with a long investment horizon, such as retirees or those saving for a specific long-term goal.

| Investment Horizon | Return on Investment |

|---|---|

| Short-Term (1-3 years) | X% |

| Medium-Term (4-10 years) | Y% |

| Long-Term (10+ years) | Z% |

The above table illustrates the potential return on investment for different time horizons, showcasing the advantage of long-term investments under the Glacier Tax strategy.

Reducing Tax Liability

One of the primary objectives of the Glacier Tax strategy is to minimize tax liabilities. By utilizing tax-efficient investment vehicles and strategic asset allocation, investors can significantly reduce the taxes they owe on their investment income. This reduction in tax liability not only preserves more of the investor’s wealth but also allows for more flexibility in financial planning.

Flexibility and Control

The Glacier Tax strategy provides investors with a high degree of control over their financial future. By carefully managing their investments and tax obligations, individuals can make informed decisions about when and how to withdraw funds, taking advantage of tax-free periods or favorable tax brackets. This flexibility is particularly valuable for those with complex financial situations or those seeking to optimize their retirement income.

Case Study: A Successful Glacier Tax Implementation

Let’s explore a real-world example of how the Glacier Tax strategy can be effectively implemented. Imagine a high-income earner, Mr. Johnson, who is approaching retirement and has accumulated significant wealth over his career. By adopting the Glacier Tax strategy, Mr. Johnson can strategically manage his investments to minimize taxes and maximize his retirement income.

Step 1: Tax-Efficient Investment Vehicles

Mr. Johnson starts by rolling over his traditional 401(k) plan into a traditional IRA. This move allows him to maintain tax-deferred growth on his retirement savings. Additionally, he contributes to a Roth IRA, which offers tax-free withdrawals in retirement, providing a powerful tax-efficient investment vehicle.

Step 2: Long-Term Capital Gains

Recognizing the importance of long-term capital gains, Mr. Johnson ensures that a significant portion of his investment portfolio is held for the required period to qualify for reduced tax rates. By holding onto investments for over one year, he can benefit from the lower tax rates associated with long-term capital gains.

Step 3: Strategic Asset Allocation

Mr. Johnson works closely with his financial advisor to create a well-diversified portfolio that aligns with his risk tolerance and financial goals. The portfolio includes a mix of stocks, bonds, and alternative investments, with a focus on tax-efficient options such as municipal bonds and REITs. This strategic asset allocation helps manage risk while taking advantage of tax benefits.

Step 4: Tax Loss Harvesting

As part of his overall strategy, Mr. Johnson actively engages in tax loss harvesting. He identifies investments that have declined in value and strategically sells them to realize capital losses. These losses are then used to offset capital gains, reducing his overall tax liability. By doing so, he can further optimize his tax position and preserve more of his wealth.

The Future of Glacier Tax Strategies

As tax laws and investment landscapes evolve, the Glacier Tax strategy will continue to play a crucial role in wealth management. With an increasing focus on tax efficiency and long-term financial planning, this strategy is likely to become even more prevalent in the coming years.

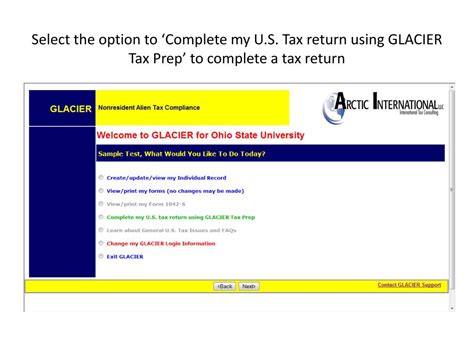

The rise of digital wealth management platforms and robo-advisors has made it easier for individuals to access tax-efficient investment options and implement strategies like the Glacier Tax. These platforms offer automated tax-loss harvesting, tax-efficient rebalancing, and personalized investment advice, making it more accessible for investors to optimize their tax positions.

Furthermore, as more individuals become aware of the benefits of tax-efficient investing, the demand for financial advisors skilled in this area will grow. Financial professionals who can provide tailored Glacier Tax strategies will be in high demand, offering valuable expertise to clients seeking to minimize their tax liabilities and maximize their wealth.

Conclusion

The Glacier Tax strategy is a powerful tool for investors seeking to optimize their wealth management plans and minimize tax liabilities. By embracing a long-term investment horizon, utilizing tax-efficient investment vehicles, and strategically managing tax obligations, individuals can experience significant benefits in terms of investment returns and financial flexibility.

As the financial landscape continues to evolve, the Glacier Tax strategy will remain a relevant and valuable approach for those looking to preserve and grow their wealth over the long term. With the right guidance and implementation, investors can navigate the complexities of tax laws and optimize their financial future.

What is the main goal of the Glacier Tax strategy?

+The primary goal of the Glacier Tax strategy is to minimize tax liabilities on investment gains, allowing investors to maximize their long-term returns. By utilizing tax-efficient investment vehicles and strategic asset allocation, investors can preserve more of their wealth.

How does the Glacier Tax strategy differ from traditional investment approaches?

+The Glacier Tax strategy focuses on long-term capital appreciation and tax efficiency, unlike traditional investment approaches that may prioritize short-term gains or market timing. By adopting this strategy, investors aim to optimize their tax position and benefit from the time value of money.

Are there any risks associated with the Glacier Tax strategy?

+While the Glacier Tax strategy offers significant tax benefits, it is essential to note that it may not be suitable for all investors. The long-term nature of this strategy requires patience and a tolerance for market volatility. Additionally, investors should consult with a financial advisor to ensure their portfolio aligns with their risk profile and financial goals.