Property Tax Frederick County Md

Welcome to an in-depth exploration of property taxes in Frederick County, Maryland, a topic of significant interest to homeowners, investors, and residents alike. Property taxes are an essential aspect of local government funding, impacting not only the financial obligations of property owners but also the provision of essential services and the overall economic health of the county.

This comprehensive guide will delve into the intricacies of property taxation in Frederick County, offering a detailed understanding of the assessment process, tax rates, exemptions, and payment options. We will also explore the factors that influence property values and the resulting tax obligations, providing valuable insights for those seeking to navigate the complexities of this vital aspect of homeownership.

Understanding Property Tax Assessments in Frederick County

The assessment process in Frederick County is a critical component of the property tax system. The county’s Department of Finance is responsible for assessing the value of all taxable real property within its jurisdiction. This process ensures that property owners pay taxes based on the current market value of their properties, maintaining fairness and equity among taxpayers.

Property assessments in Frederick County are conducted every three years, with the most recent assessment cycle taking place in 2023. During this cycle, the county's assessors visit each property to determine its value. They consider various factors, including the property's location, size, age, condition, and recent sales data of similar properties in the area.

After the assessment, property owners receive a Notice of Assessment, detailing the estimated value of their property. If a property owner disagrees with the assessed value, they have the right to appeal the decision through a formal process outlined by the county.

Factors Influencing Property Assessments

Several factors can impact the assessed value of a property in Frederick County. These include:

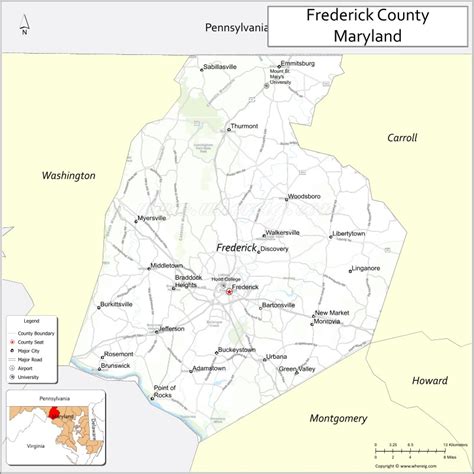

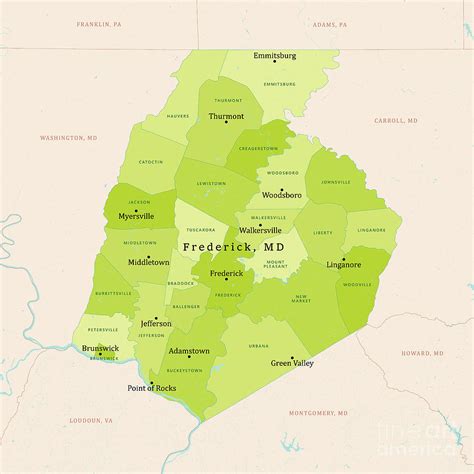

- Location: Properties in prime locations, such as those near amenities, schools, or transportation hubs, often command higher values.

- Size and Features: Larger properties or those with unique features, such as a pool or a finished basement, may have higher assessments.

- Age and Condition: Older properties may require more maintenance and could have lower assessments, depending on their condition and any recent improvements.

- Market Trends: The real estate market in Frederick County is influenced by various factors, including economic conditions, population growth, and development trends. These trends can affect property values and, consequently, tax assessments.

Property Tax Rates and Calculations

Once a property’s assessed value is determined, it is used to calculate the property taxes owed. Frederick County’s tax rate is set annually by the Board of County Commissioners and is based on the county’s budgetary needs and the revenue required to fund essential services.

The tax rate is expressed in dollars per hundred of assessed value ($/100). For the 2023 fiscal year, the county-wide tax rate is $0.9970 per hundred of assessed value. This rate may vary slightly for different jurisdictions within the county, as some municipalities may have additional tax levies.

To calculate the property taxes for a given property, the assessed value is multiplied by the applicable tax rate. For example, a property with an assessed value of $250,000 would have a tax liability of $2,492.50 ($250,000 x $0.9970) for the county portion of the tax bill.

Tax Rate Variations

It’s important to note that the tax rate may differ depending on the property’s location within Frederick County. Some areas may have higher or lower tax rates due to variations in the cost of providing services or additional taxes levied by municipalities or special districts.

| Jurisdiction | Tax Rate ($/100) |

|---|---|

| Frederick County | $0.9970 |

| City of Frederick | $1.2260 |

| Brunswick | $0.9760 |

| Montgomery County (for certain properties) | $1.0670 |

Property Tax Exemptions and Credits

Frederick County offers several tax exemptions and credits to eligible property owners, which can significantly reduce their tax liability. These incentives are designed to support specific groups of taxpayers and promote economic development within the county.

Homestead Tax Credit

The Homestead Tax Credit is a valuable benefit for homeowners in Frederick County. This credit provides a reduction in the taxable value of a property’s assessed value, up to a maximum of $2,500. To qualify, the property must be the owner’s primary residence, and the owner must apply for the credit annually.

Other Exemptions and Credits

Frederick County also offers various other exemptions and credits, including:

- Senior Citizen Exemption: Eligible senior citizens may qualify for a reduction in their property taxes based on their age and income. This exemption can provide significant savings for older homeowners.

- Veteran's Exemption: Certain veterans may be eligible for a property tax exemption, based on their service and disability status. This exemption can help reduce the tax burden for those who have served our country.

- Agricultural Land Preservation Program: Property owners with land enrolled in the Agricultural Land Preservation Program can benefit from a reduced tax assessment, encouraging the preservation of farmland in the county.

Property Tax Payment Options and Due Dates

Property taxes in Frederick County are due semi-annually, with payments typically due in June and December. Tax bills are mailed to property owners several weeks before the due date, providing ample time for payment.

Property owners have several options for paying their taxes, including:

- Online Payment: The county's website offers a secure online payment portal, allowing taxpayers to pay their bills using a credit card, debit card, or electronic check.

- Mail-in Payment: Taxpayers can mail their payments to the Department of Finance, ensuring the payment is received before the due date to avoid late fees.

- In-Person Payment: Property owners can visit the Department of Finance's office to make payments in person. This option is ideal for those who prefer face-to-face interactions or need assistance with their tax bills.

It's crucial for property owners to stay informed about the due dates and payment options to avoid late fees and penalties. The county provides detailed information on its website, and taxpayers can also subscribe to email notifications to receive reminders about upcoming tax deadlines.

Conclusion: Navigating Property Taxes in Frederick County

Understanding the intricacies of property taxes in Frederick County is an essential aspect of homeownership and investment in the area. From the assessment process to tax rates, exemptions, and payment options, this guide has provided a comprehensive overview of the property tax system in the county.

By staying informed about the assessment process, keeping track of tax rates, and exploring the various exemptions and credits available, property owners can effectively manage their tax obligations. Additionally, understanding the factors that influence property values and tax assessments can help homeowners make informed decisions about their properties and their financial planning.

As Frederick County continues to thrive and develop, the property tax system plays a vital role in funding essential services and maintaining the economic health of the community. By navigating this system effectively, property owners can contribute to the county's growth while managing their financial responsibilities.

How often are property assessments conducted in Frederick County?

+Property assessments in Frederick County are conducted every three years. The most recent assessment cycle was in 2023, and the next cycle will occur in 2026.

Can I appeal my property’s assessed value?

+Yes, if you disagree with your property’s assessed value, you have the right to appeal. The appeal process is outlined by the Department of Finance and typically involves submitting documentation to support your case.

Are there any online tools to estimate my property taxes in Frederick County?

+Yes, the Frederick County website offers an online property tax estimator. This tool allows property owners to estimate their tax liability based on their property’s assessed value and the current tax rate.