Sales Tax In Ny

Understanding the intricacies of sales tax regulations is crucial for businesses operating in New York State. Sales tax is a significant source of revenue for the state, and its proper implementation and compliance are essential for businesses to avoid legal issues and maintain a positive relationship with tax authorities.

This comprehensive guide aims to delve into the specifics of sales tax in New York, offering an in-depth analysis of the rates, exemptions, registration processes, and compliance requirements. By providing a detailed understanding of these aspects, businesses can navigate the complex world of sales tax with confidence and ensure they are meeting their obligations effectively.

Sales Tax Rates and Exemptions

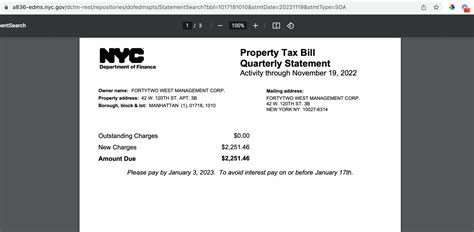

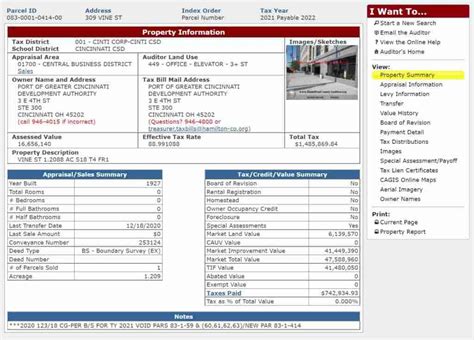

Sales tax rates in New York State vary based on the location of the sale and the nature of the product or service being sold. As of the latest update, the state-wide sales tax rate stands at 4%, which serves as the foundation for local and municipal additions. These additional rates can significantly increase the overall sales tax, making it essential for businesses to have a clear understanding of the specific rates applicable to their operations.

For instance, in New York City, the combined sales tax rate totals 8.875%, which includes the state rate and various local and municipal surcharges. This rate can further vary within the city, with different boroughs and neighborhoods having their own specific additions. It is crucial for businesses operating in multiple locations to stay updated on these variations to ensure accurate tax collection and compliance.

Additionally, New York State offers a range of exemptions and special provisions for certain products and services. These exemptions are designed to encourage specific economic activities, support particular industries, or provide relief to specific consumer groups. For example, sales tax is generally not applicable to the following:

- Prescription drugs

- Most clothing items under $110

- Certain food products

- Machinery and equipment used in research and development

- Sales to non-profit organizations

However, it is important to note that these exemptions are subject to specific criteria and limitations. For instance, the clothing exemption only applies to items sold for personal use, not for resale or industrial purposes. Understanding these nuances is vital for businesses to accurately determine their tax obligations and avoid potential penalties for non-compliance.

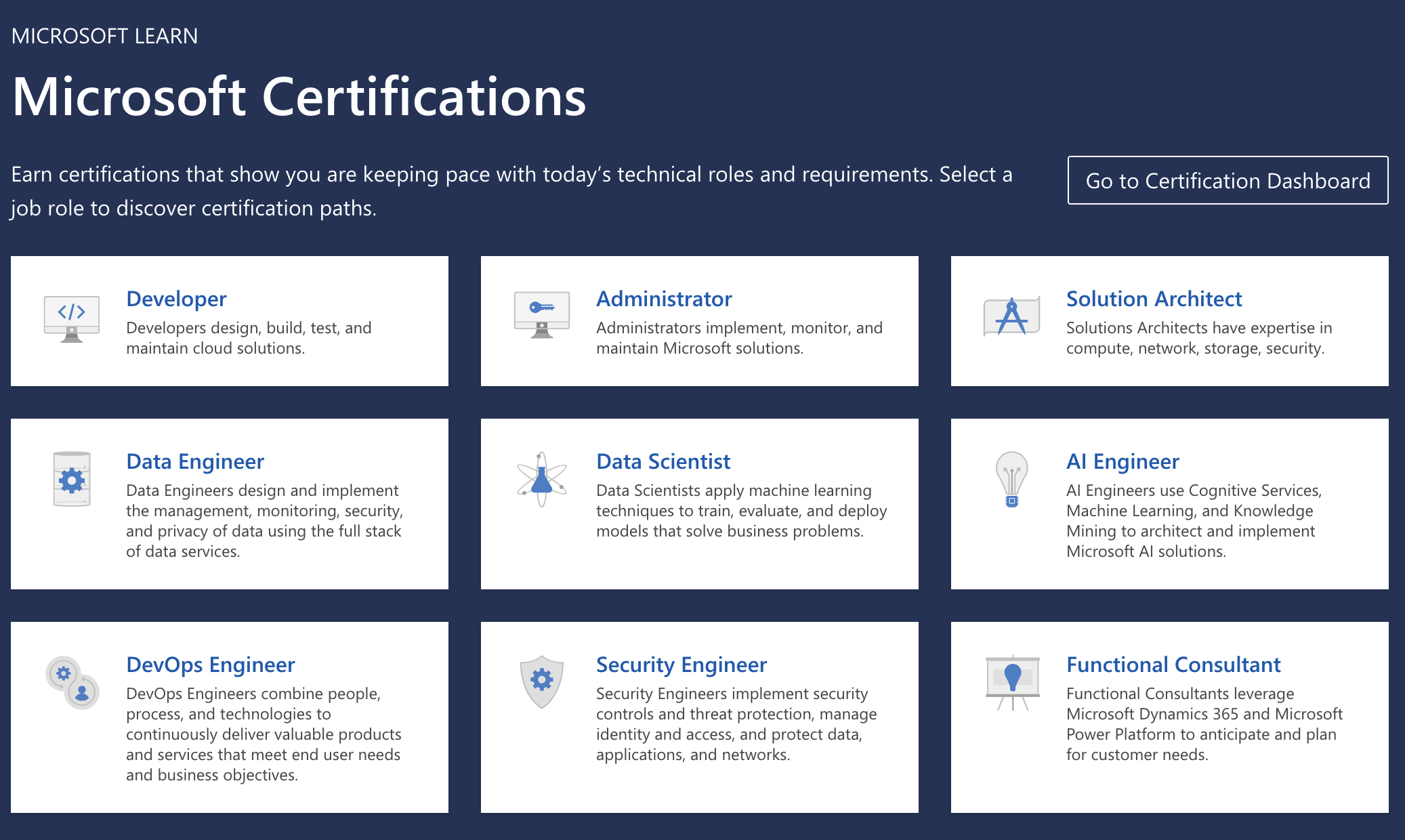

Registration and Compliance

Registering for sales tax in New York is a straightforward process, but it requires attention to detail to ensure accurate and timely compliance. The registration process can be completed online through the New York State Department of Taxation and Finance’s website, offering a convenient and efficient way for businesses to meet their initial compliance requirements.

During the registration process, businesses will need to provide specific information, including their legal name, business address, contact details, and the nature of their operations. This information is crucial for the tax authorities to correctly identify and categorize the business, ensuring that the appropriate tax rates and exemptions are applied.

Once registered, businesses must comply with a range of ongoing obligations to maintain their sales tax license. These obligations include the accurate collection of sales tax on taxable sales, the timely filing of sales tax returns, and the remittance of collected taxes to the state. Non-compliance with these obligations can result in penalties, interest charges, and even the revocation of the business's sales tax license.

To assist businesses in their compliance efforts, the New York State Department of Taxation and Finance provides a range of resources and tools. These include online filing and payment systems, educational materials, and dedicated helplines for businesses seeking assistance with their sales tax obligations. By leveraging these resources, businesses can streamline their compliance processes and ensure they are meeting their tax obligations efficiently and accurately.

Sales Tax Filing and Payment

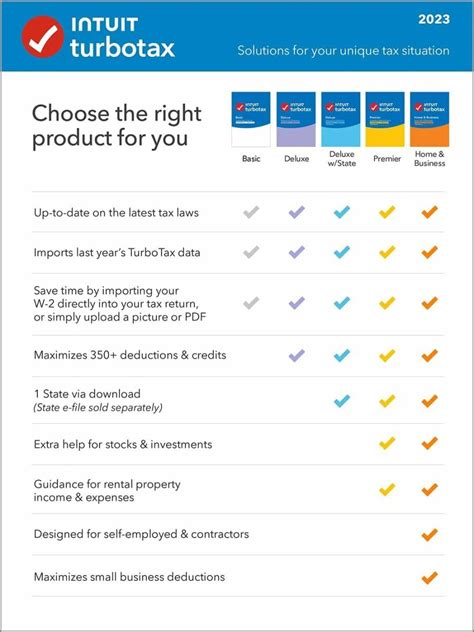

Filing sales tax returns in New York is a critical aspect of compliance, as it ensures that businesses accurately report their taxable sales and remit the corresponding taxes to the state. The frequency of filing can vary depending on the business’s sales volume and the type of sales tax license it holds.

For businesses with high sales volumes, the sales tax returns are typically due monthly. This ensures that the state receives the collected taxes promptly, minimizing the potential for interest and penalty charges. On the other hand, businesses with lower sales volumes may be eligible for quarterly or annual filing, providing a more flexible compliance schedule.

The sales tax return process involves a detailed reporting of taxable sales, including the calculation of the applicable sales tax rate for each sale. Businesses must carefully track and categorize their sales to ensure accurate reporting. This process can be simplified by utilizing accounting software or dedicated sales tax management tools, which can automate the calculation and reporting process.

Once the sales tax return is completed, businesses have the option to file and pay their taxes online through the Department of Taxation and Finance's secure portal. This portal provides a convenient and efficient way to manage sales tax obligations, offering real-time updates on filing and payment statuses. Additionally, businesses can receive electronic notifications and reminders, ensuring they stay on top of their compliance requirements.

Challenges and Considerations

While New York’s sales tax regulations provide a comprehensive framework for businesses to follow, there are several challenges and considerations that businesses should be aware of. These challenges can arise from the complex nature of the tax system, the frequent updates and amendments to regulations, and the potential for errors in compliance.

One of the key challenges is keeping up with the frequent changes to sales tax rates and exemptions. These changes can occur at the state, county, and municipal levels, making it essential for businesses to stay informed and updated. Failure to do so can result in inaccurate tax collection and potential non-compliance issues.

Additionally, the complexity of sales tax regulations can lead to errors in compliance. This is particularly true for businesses with diverse product offerings or those operating in multiple jurisdictions. Misclassifying products, incorrectly applying exemptions, or failing to collect the appropriate tax rates can result in significant penalties and interest charges.

To mitigate these challenges, businesses should consider implementing robust sales tax management systems. These systems can automate tax calculation, reporting, and filing processes, reducing the risk of errors and ensuring compliance. Additionally, businesses should stay informed about any regulatory changes by subscribing to official notifications and seeking professional advice when needed.

Future Implications and Industry Insights

The landscape of sales tax in New York is continuously evolving, with potential changes on the horizon that could significantly impact businesses. One key area of focus is the ongoing debate surrounding the state’s online sales tax collection. Currently, New York does not collect sales tax on remote sales, which has led to concerns about lost revenue and potential competitive disadvantages for brick-and-mortar businesses.

However, there are proposals to implement a "marketplace facilitator" model, similar to those in other states. Under this model, online marketplaces and third-party sellers would be responsible for collecting and remitting sales tax on behalf of their sellers. This would simplify the sales tax collection process for online businesses and ensure a more level playing field for traditional retailers.

Additionally, there are discussions about expanding the range of exempt products and services to promote economic growth and support specific industries. For example, there have been proposals to exempt certain renewable energy technologies, construction materials, and educational resources from sales tax. These exemptions could encourage investment and innovation in these sectors, while also providing cost savings for consumers.

Staying informed about these potential changes is crucial for businesses to proactively adapt their sales tax strategies and ensure ongoing compliance. By monitoring industry news and engaging with professional advisors, businesses can stay ahead of the curve and make informed decisions about their sales tax obligations.

What are the penalties for non-compliance with sales tax regulations in New York?

+Non-compliance with sales tax regulations in New York can result in significant penalties and interest charges. These penalties can range from 5% to 50% of the unpaid tax, depending on the severity of the violation and the cooperation of the business. Additionally, the state may impose criminal charges for repeated or intentional non-compliance.

How often do sales tax rates change in New York?

+Sales tax rates in New York can change periodically, typically as a result of legislative decisions or local initiatives. While the state-wide rate has remained stable in recent years, local and municipal rates can fluctuate more frequently. It is essential for businesses to stay updated on these changes to ensure accurate tax collection.

Are there any specific industries or products that have unique sales tax considerations in New York?

+Yes, New York has specific sales tax considerations for various industries and products. For example, the state offers tax incentives for renewable energy equipment, certain agricultural products, and machinery used in manufacturing. Additionally, there are unique rules for the sale of digital products and services, which businesses should be aware of.