Sales Tax Denver Colorado

The topic of sales tax in Denver, Colorado, is an essential aspect of doing business in the Mile High City. Understanding the sales tax regulations and rates is crucial for businesses and consumers alike, as it directly impacts their financial operations and daily lives. Denver's sales tax system, like that of many other cities, is a complex interplay of state, county, and municipal taxes, each with its own rates and rules. This article aims to provide a comprehensive guide to the sales tax landscape in Denver, offering clarity and insight into this vital economic mechanism.

Unraveling the Sales Tax Structure in Denver

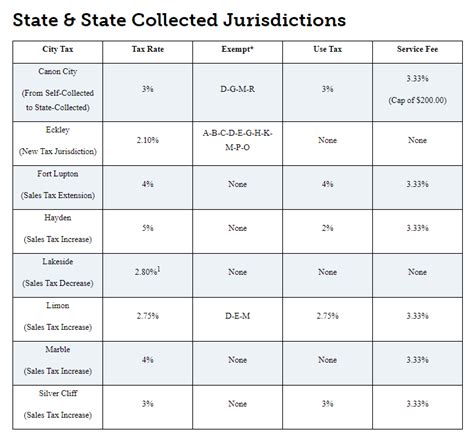

Denver’s sales tax system is a layered structure, comprising various tax rates and entities. At the core is the state sales tax rate, which is applied uniformly across Colorado. However, this is just the beginning, as Denver, being a home rule municipality, has the authority to impose its own city sales tax on top of the state rate.

Additionally, Denver County, where the city is located, adds its own county sales tax to the equation. This multi-layered approach to sales taxation means that the total sales tax rate in Denver can be quite significant, impacting the prices of goods and services for both residents and visitors.

State Sales Tax in Colorado

Colorado’s state sales tax is a fundamental component of the state’s revenue stream. As of my last update in January 2023, the statewide sales tax rate stood at 2.9%. This rate is applied to most retail transactions, including sales of tangible personal property and certain services.

However, it's important to note that certain goods and services are exempt from this tax. These exemptions can vary depending on the nature of the item or service, and they often include items like prescription medications, certain food products, and manufacturing machinery.

| Category | Sales Tax Rate |

|---|---|

| State Sales Tax | 2.9% |

| City Sales Tax (Denver) | 3.62% |

| County Sales Tax (Denver) | 0.1% |

| Total Sales Tax in Denver | 6.62% |

Colorado also allows for enterprise zones, which are specific geographic areas designated to encourage economic development. In these zones, businesses might enjoy tax incentives or reduced tax rates to promote investment and job creation.

City Sales Tax in Denver

Denver, as a major urban center, imposes its own city sales tax in addition to the state rate. As of my information cutoff, the Denver city sales tax rate is set at 3.62%, bringing the total sales tax rate in Denver to 6.52% (including the state rate). This city tax helps fund various municipal services and initiatives, contributing significantly to the city’s budget.

The city sales tax in Denver is not uniform across all goods and services. Certain items, such as prepared food, are subject to a higher city tax rate. Additionally, Denver has implemented a public improvement fee, which is essentially an additional sales tax dedicated to funding specific public projects. This fee is currently set at 0.1%, adding further complexity to the city's sales tax structure.

County Sales Tax in Denver County

Denver County, home to the city of Denver, also levies its own sales tax. The Denver County sales tax rate is currently set at 0.1%, a relatively small contribution to the overall sales tax rate. However, this tax plays a crucial role in funding county-wide initiatives and services.

It's important to note that while Denver County only encompasses the city of Denver, the sales tax rates are applicable to all transactions within the county's boundaries, regardless of whether the purchaser is a resident or a visitor.

Sales Tax Implications and Exemptions

The sales tax landscape in Denver is not a one-size-fits-all scenario. There are various exemptions and special considerations that can impact the total sales tax rate applicable to a transaction. These exemptions can be based on the nature of the business, the type of goods or services being sold, or even the purpose for which the item is being purchased.

Exemptions for Specific Industries

Certain industries in Denver enjoy sales tax exemptions or reduced rates. For instance, the manufacturing sector often benefits from sales tax exemptions on certain equipment and machinery purchases. This incentive is designed to encourage investment in the manufacturing industry and promote economic growth.

Similarly, the agriculture sector might be exempt from sales tax on certain farm equipment or supplies. These industry-specific exemptions can significantly impact a business's bottom line and its competitive positioning within the market.

Exemptions for Certain Goods and Services

Not all goods and services in Denver are subject to sales tax. For example, prescription medications, most medical devices, and certain food products are typically exempt from sales tax. These exemptions aim to alleviate financial burdens on essential goods and services, making them more accessible to consumers.

Additionally, certain services, such as professional services like legal or accounting advice, are often exempt from sales tax. This is because these services are considered intangible and are not subject to the same sales tax regulations as tangible goods.

Exemptions for Specific Purposes

Sales tax exemptions can also be granted based on the purpose for which an item is being purchased. For instance, certain purchases made for resale or for use in manufacturing might be exempt from sales tax. This exemption is designed to prevent double taxation and encourage economic activity.

Furthermore, charitable organizations often enjoy sales tax exemptions on certain purchases. This supports the work of these organizations and ensures that their financial resources are not depleted by sales tax obligations.

Sales Tax Compliance and Reporting

Navigating the sales tax landscape in Denver requires meticulous compliance and reporting. Businesses operating in Denver must accurately calculate and collect sales tax on applicable transactions, ensuring they remit the correct amount to the appropriate tax authorities.

Sales Tax Registration and Remittance

Businesses in Denver must register with the Colorado Department of Revenue to obtain a sales tax license. This license allows them to collect and remit sales tax on behalf of the state, city, and county. The registration process involves providing detailed information about the business, its location, and the types of goods or services it offers.

Once registered, businesses must collect the appropriate sales tax rate on each taxable transaction. This tax must then be remitted to the respective tax authorities on a regular basis, typically on a monthly or quarterly basis. Failure to comply with these reporting requirements can result in penalties and interest charges.

Sales Tax Calculation and Collection

Calculating the correct sales tax rate for each transaction can be complex, given the layered structure of Denver’s sales tax system. Businesses must ensure they are applying the correct rates based on the location of the sale, the nature of the goods or services being sold, and any applicable exemptions.

To assist with this process, businesses can utilize sales tax software or consult with tax professionals. These tools and resources can help ensure accurate tax calculation and collection, reducing the risk of errors and non-compliance.

Sales Tax Audits and Penalties

The Colorado Department of Revenue conducts regular sales tax audits to ensure compliance with sales tax laws. These audits can be random or targeted, depending on various factors such as the size and nature of the business, the complexity of its sales tax operations, and previous audit history.

If a business is found to be non-compliant during an audit, it may face penalties and interest charges. These penalties can be significant, and in some cases, may result in the revocation of the business's sales tax license. Therefore, it is crucial for businesses to maintain accurate records and ensure timely and accurate sales tax reporting.

The Future of Sales Tax in Denver

The sales tax landscape in Denver, like that of many other cities, is subject to change and evolution. As economic conditions, legislative priorities, and societal needs shift, the sales tax rates and structures can be adjusted to meet these changing dynamics.

Potential Rate Changes

While the sales tax rates in Denver have been relatively stable over the past few years, there is always the possibility of rate changes. These changes could be driven by a variety of factors, including budgetary needs, economic growth or decline, or shifts in political leadership.

For instance, if Denver experiences a period of economic downturn, the city might consider increasing the sales tax rate to boost revenue and support essential services. Conversely, in times of economic prosperity, the city might consider reducing the sales tax rate to stimulate consumer spending and encourage economic growth.

Emerging Trends and Innovations

Denver, like many forward-thinking cities, is exploring innovative approaches to sales taxation. One emerging trend is the concept of a value-added tax (VAT), which is already common in many European countries. A VAT is a consumption tax placed on a product at each stage of its production, from raw materials to the point of sale.

Implementing a VAT system in Denver could provide a more streamlined and efficient approach to sales taxation, reducing administrative burdens on businesses and consumers alike. However, such a significant shift in the sales tax system would require careful planning and consideration of its potential impact on the local economy.

Impact of Technological Advancements

The rise of e-commerce and digital transactions has significantly impacted the sales tax landscape. Denver, like other cities, is navigating the challenges and opportunities presented by these technological advancements.

On one hand, e-commerce platforms provide a convenient and efficient way for businesses to reach a wider customer base. However, the remote nature of these transactions can make it challenging to determine the appropriate sales tax rate, especially when dealing with cross-border sales. As a result, Denver, along with other cities, is working to develop guidelines and regulations that ensure fair and accurate sales tax collection for these digital transactions.

What is the total sales tax rate in Denver, Colorado as of my last update in January 2023?

+The total sales tax rate in Denver, Colorado, as of January 2023, is 6.62%. This includes the state sales tax rate of 2.9%, the Denver city sales tax rate of 3.62%, and the Denver County sales tax rate of 0.1%.

Are there any industries or sectors in Denver that enjoy sales tax exemptions or reduced rates?

+Yes, certain industries in Denver, such as manufacturing and agriculture, often benefit from sales tax exemptions or reduced rates on certain equipment and supplies. These incentives are designed to encourage investment and economic growth in these sectors.

What is the process for registering a business for sales tax purposes in Denver?

+Businesses in Denver must register with the Colorado Department of Revenue to obtain a sales tax license. The registration process involves providing detailed information about the business, its location, and the types of goods or services it offers. Once registered, businesses must collect and remit sales tax on applicable transactions.

How often do businesses in Denver need to remit sales tax to the tax authorities?

+Businesses in Denver typically remit sales tax on a monthly or quarterly basis. The frequency of remittance depends on various factors, including the volume of sales and the business’s sales tax liability. However, businesses must ensure they are remitting sales tax in a timely manner to avoid penalties and interest charges.

What are some potential future developments in Denver’s sales tax landscape?

+Denver, like many cities, is exploring innovative approaches to sales taxation, such as the implementation of a value-added tax (VAT) system. Additionally, with the rise of e-commerce, Denver is working to develop guidelines for fair and accurate sales tax collection on digital transactions. These developments aim to streamline sales taxation and adapt to the changing economic landscape.