Indiana Tax Exempt Form

In the state of Indiana, tax exemptions play a crucial role in managing the financial landscape for businesses and organizations. These exemptions are governed by specific regulations and forms, one of which is the Indiana Tax Exempt Form. Understanding the purpose, process, and implications of this form is essential for any entity seeking tax-exempt status in the state.

The Indiana Tax Exempt Form: Unlocking Tax Benefits

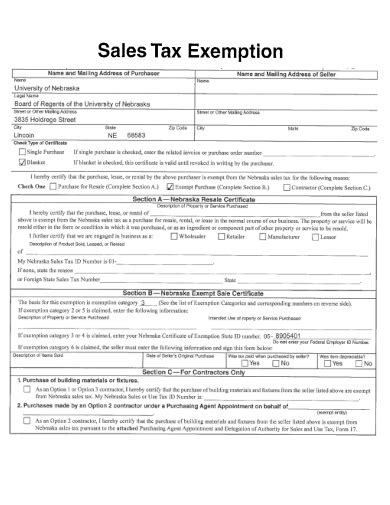

The Indiana Tax Exempt Form is a vital document that serves as the gateway to tax-exempt status for qualifying entities within the state. This form, officially known as the ST-115, is a comprehensive tool used by the Indiana Department of Revenue to evaluate and grant tax exemptions to eligible organizations. By completing and submitting this form accurately, businesses and non-profit organizations can secure significant tax benefits, reducing their overall tax liabilities and improving their financial outlook.

Tax exemptions in Indiana are not a one-size-fits-all proposition. The state offers a range of exemptions tailored to different types of organizations and activities. These exemptions can be broadly categorized into sales and use tax exemptions and income tax exemptions. The Indiana Tax Exempt Form is the key to unlocking these benefits, providing a structured way for entities to demonstrate their eligibility and ensure compliance with the state's tax laws.

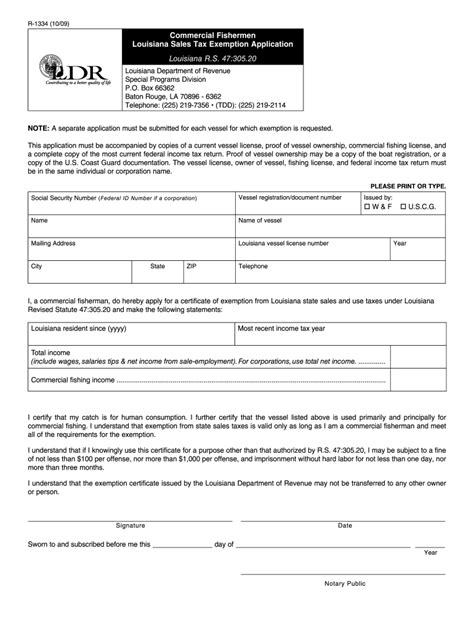

Sales and Use Tax Exemptions

Sales and use tax exemptions are particularly relevant for businesses operating within Indiana. These exemptions can significantly reduce the tax burden on purchases made by eligible entities, leading to substantial savings over time. The Indiana Tax Exempt Form is the primary mechanism through which businesses can claim these exemptions, providing a detailed record of their eligibility and the specific exemptions they are entitled to.

For instance, consider a scenario where a non-profit educational institution in Indiana purchases office supplies. By completing the Indiana Tax Exempt Form and obtaining a certificate of exemption, the institution can avoid paying sales tax on these purchases. This exemption not only reduces the institution's immediate costs but also contributes to its long-term financial health by lowering its overall tax obligations.

| Sales Tax Exemption Category | Description |

|---|---|

| Manufacturing Exemption | Exempts qualified manufacturing businesses from sales tax on certain purchases. |

| Resale Exemption | Allows businesses to purchase goods for resale without incurring sales tax. |

| Agricultural Exemption | Provides tax relief for agricultural producers and related industries. |

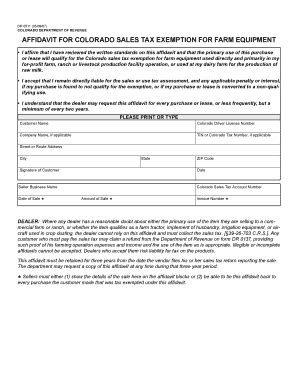

Income Tax Exemptions

Income tax exemptions, on the other hand, are more commonly associated with non-profit organizations and charitable entities. These exemptions recognize the unique nature of these organizations' missions and activities, granting them tax-exempt status for their income and, in some cases, for specific transactions. The Indiana Tax Exempt Form is instrumental in navigating this complex landscape, guiding organizations through the process of securing income tax exemptions.

Take the example of a local charity in Indiana that raises funds through various activities, such as fundraising events and donations. By obtaining an income tax exemption through the Indiana Tax Exempt Form, this charity can ensure that its income is not subject to state income tax. This exemption not only boosts the charity's ability to support its causes but also simplifies its tax reporting and compliance obligations.

| Income Tax Exemption Category | Description |

|---|---|

| 501(c)(3) Organizations | Non-profit organizations with this status are exempt from income tax. |

| Religious Organizations | Religious institutions and affiliated entities are often eligible for income tax exemptions. |

| Educational Institutions | Schools, colleges, and universities may qualify for income tax exemptions. |

The Process of Obtaining Tax Exempt Status

The journey to tax-exempt status begins with a thorough understanding of the eligibility criteria and requirements outlined by the Indiana Department of Revenue. This involves reviewing the specific guidelines for each type of tax exemption and ensuring that the organization meets the necessary conditions.

Once an organization has determined its eligibility, the next step is to complete the Indiana Tax Exempt Form accurately and comprehensively. This form requires detailed information about the organization's structure, activities, and financial details. It is crucial to provide accurate and honest information to avoid potential penalties and complications down the line.

After submitting the form, the Indiana Department of Revenue reviews the application and may request additional documentation or information. This review process ensures that only legitimate organizations are granted tax-exempt status, maintaining the integrity of the system. Once approved, the organization receives a certificate of exemption, which serves as proof of its tax-exempt status and can be used to claim exemptions on applicable taxes.

Key Considerations for Tax Exempt Organizations

Securing tax-exempt status is just the beginning for organizations. Maintaining this status requires ongoing compliance with state regulations and guidelines. Tax-exempt organizations must adhere to specific reporting requirements, such as filing annual reports and ensuring transparency in their financial operations.

Furthermore, tax-exempt organizations must be cautious about certain activities that could jeopardize their status. Engaging in excessive lobbying, political activities, or unrelated business activities can lead to the revocation of tax-exempt status. It is crucial for these organizations to maintain a clear understanding of the boundaries and limitations associated with their tax-exempt privileges.

The Impact of Tax Exemptions on Indiana's Economy

Tax exemptions play a significant role in shaping Indiana's economic landscape. By providing tax relief to specific organizations and activities, the state encourages economic growth, supports community initiatives, and fosters innovation. The impact of these exemptions can be seen across various sectors, from manufacturing and agriculture to education and charitable endeavors.

For instance, the manufacturing exemption attracts businesses to Indiana, as it reduces their tax burden and improves their competitive edge. This, in turn, leads to job creation, increased economic activity, and a boost in the state's overall prosperity. Similarly, income tax exemptions for non-profit organizations allow these entities to allocate more resources towards their missions, enhancing their impact on society.

A Case Study: Impact on Local Communities

To illustrate the real-world impact of tax exemptions, consider the example of a small town in Indiana. This town has a vibrant non-profit sector, with several organizations dedicated to community development, education, and social services. By obtaining tax-exempt status through the Indiana Tax Exempt Form, these organizations can redirect their resources towards their core missions.

For instance, a local community center that provides after-school programs and support services for at-risk youth can use its tax-exempt status to secure grants and donations more easily. This, in turn, allows the center to expand its programs, hire additional staff, and provide a safer and more enriching environment for the town's youth. The positive impact of this tax exemption extends beyond the organization, benefiting the entire community.

Looking Ahead: Future Implications and Considerations

As Indiana's economy evolves and tax laws adapt to changing circumstances, the role of tax exemptions will continue to be a critical factor in shaping the state's financial landscape. While tax exemptions offer undeniable benefits, they also present challenges and considerations that policymakers and organizations must address.

One key consideration is the balance between providing tax relief and maintaining a robust tax base. As tax exemptions reduce the state's revenue, policymakers must carefully evaluate the impact of these exemptions on the overall economy and ensure that they do not unduly burden other taxpayers. Striking this balance requires ongoing analysis and adjustments to the tax code, ensuring that Indiana remains competitive while also supporting its communities.

Furthermore, the evolving nature of certain industries and sectors may require a reevaluation of existing tax exemptions. For instance, as technology advances and new business models emerge, the manufacturing exemption may need to be adapted to accommodate these changes. Similarly, as the non-profit sector evolves, income tax exemptions may need to be refined to reflect the diverse activities and missions of these organizations.

A Holistic Approach to Tax Exemptions

In navigating the complex landscape of tax exemptions, it is essential to adopt a holistic approach that considers the broader implications of these policies. This involves not only understanding the immediate benefits and challenges of tax exemptions but also anticipating their long-term effects on the state's economy, society, and communities.

A well-designed tax exemption system should be flexible enough to adapt to changing circumstances while also maintaining fairness and transparency. It should encourage economic growth, support vital community initiatives, and foster an environment that attracts and retains businesses and organizations. By striking this balance, Indiana can continue to thrive and remain a competitive and attractive destination for investment and innovation.

Frequently Asked Questions

How often do tax-exempt organizations need to renew their status in Indiana?

+Tax-exempt organizations in Indiana typically do not need to renew their status annually. Once granted, tax-exempt status remains in effect unless there is a significant change in the organization’s structure, activities, or financial operations. However, it is essential for these organizations to stay compliant with reporting requirements and notify the Indiana Department of Revenue of any significant changes.

Are there any penalties for claiming exemptions incorrectly?

+Yes, claiming exemptions incorrectly can result in penalties and interest charges. It is crucial for organizations to carefully review their eligibility and accurately complete the Indiana Tax Exempt Form. If an organization is found to have claimed exemptions fraudulently or in error, it may face financial penalties and potential legal consequences.

Can a business be exempt from both sales and use tax and income tax in Indiana?

+Yes, a business can qualify for both sales and use tax exemptions and income tax exemptions in Indiana. However, the eligibility criteria for each type of exemption are different, and businesses must meet the specific requirements for each category to qualify. It is essential to review the guidelines for each exemption carefully and consult with tax professionals if needed.

How long does it typically take to receive a response after submitting the Indiana Tax Exempt Form?

+The processing time for the Indiana Tax Exempt Form can vary depending on several factors, including the volume of applications received and the complexity of the organization’s structure and activities. Generally, it takes several weeks to several months for the Indiana Department of Revenue to review and respond to an application. Organizations should plan accordingly and allow sufficient time for the process.