Property Tax Exemption For Veterans

For veterans who have dedicated their lives to serving the nation, the idea of financial relief and support is not only a welcome benefit but also a token of gratitude from a grateful nation. One such relief comes in the form of property tax exemptions, which can provide significant savings and peace of mind. In this comprehensive guide, we delve into the world of property tax exemptions for veterans, exploring the eligibility criteria, application processes, and the impact these exemptions can have on veterans' financial well-being.

Understanding Property Tax Exemptions for Veterans

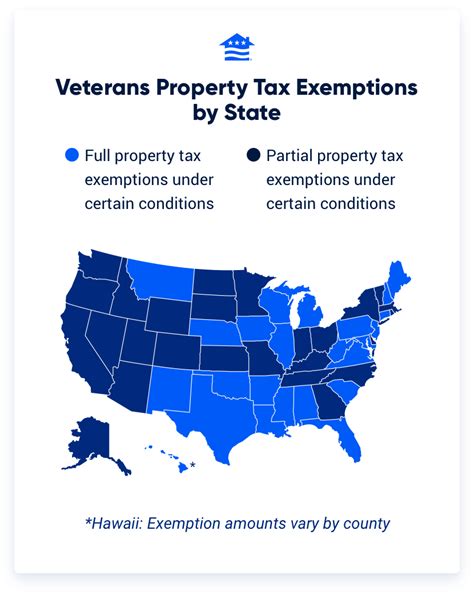

Property tax, a levy imposed on homeowners by local governments, can be a substantial financial burden, especially for veterans on a fixed income. However, many states and counties across the United States recognize the sacrifices made by veterans and offer exemptions or reductions in property taxes as a way to show their appreciation and support.

These exemptions can significantly reduce the financial burden on veterans, allowing them to save a substantial amount each year. The specifics of these exemptions vary widely, depending on factors such as the veteran's disability status, the length of their military service, and the state or county they reside in.

Eligibility Criteria

Service Requirements

The primary eligibility criterion for property tax exemptions is usually tied to the veteran’s military service. Most programs require a minimum period of active duty service, often ranging from 90 days to several years, depending on the jurisdiction. For instance, in State X, veterans who have served for at least 180 days during a period of war or national emergency may be eligible for an exemption.

Disability Status

Many property tax exemption programs give special consideration to veterans with service-connected disabilities. These veterans often face unique challenges and financial burdens, making them prime candidates for tax relief. For example, State Y offers a higher exemption percentage for veterans with a VA disability rating of 100%.

Age and Income

Some jurisdictions also take into account the veteran’s age and income when determining eligibility. Older veterans or those with lower incomes may be given priority or offered more generous exemptions. County Z, for instance, provides an additional exemption for veterans aged 65 and above, helping to ease the financial strain of retirement.

Application Process

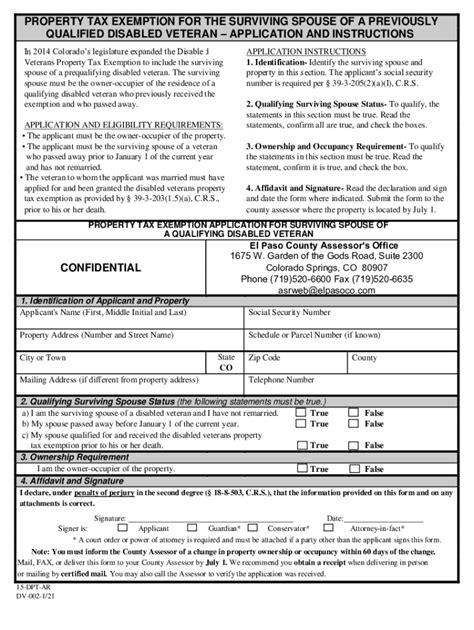

Navigating the application process for property tax exemptions can be a complex task, but with the right guidance and preparation, it can be a straightforward journey. Here's a step-by-step breakdown of what veterans can expect:

- Research State and Local Laws: Begin by understanding the specific laws and regulations regarding property tax exemptions in your state and county. Each jurisdiction may have its own set of rules and criteria, so it's crucial to get the details right.

- Gather Required Documentation: Prepare all the necessary documents, including your DD-214, proof of disability (if applicable), and income verification. Having these ready will streamline the application process.

- Contact the Local Tax Assessor's Office: Reach out to your local tax assessor's office to inquire about the specific application process. They will guide you on the required forms and any additional steps you need to take.

- Complete and Submit the Application: Carefully fill out the application, ensuring all details are accurate and complete. Double-check your work before submitting to avoid any delays.

- Follow-up and Appeal (if needed): If your application is approved, you'll receive confirmation and information on how the exemption will be applied to your property taxes. If denied, you have the right to appeal the decision, so be sure to understand the appeal process and your rights.

Real-World Impact and Testimonials

The impact of property tax exemptions on veterans' lives can be profound. Not only do these exemptions provide much-needed financial relief, but they also offer a sense of validation and appreciation for their service. Here are a few testimonials from veterans who have benefited from these exemptions:

"The property tax exemption has been a game-changer for me. As a veteran with a disability, every dollar counts. This exemption has allowed me to breathe easier financially and focus on my recovery."

"I had no idea I was eligible for such a generous exemption. It's been a blessing, especially as I navigate retirement. I'm grateful for the support and recognition it represents."

"As a veteran, I'm proud to have served my country, but it's an honor to be recognized in this way. The exemption has made a real difference in my quality of life."

Maximizing Your Benefits

To make the most of your property tax exemption, it's essential to stay informed and proactive. Here are some tips to help you navigate this process:

- Stay Updated on Changes: Tax laws and regulations can evolve, so keep yourself informed about any updates or changes that may affect your exemption.

- Understand the Fine Print: Read the details of your exemption carefully. Some jurisdictions may require re-application or have specific criteria for maintaining the exemption over time.

- Seek Professional Advice: If you're unsure about any aspect of the exemption or your eligibility, consider seeking advice from a tax professional or veteran service organization.

- Explore Additional Benefits: Property tax exemptions are just one of the many benefits available to veterans. Explore other financial assistance programs, such as VA home loans or educational benefits, to maximize your support.

A Gratitude-Filled Journey

Property tax exemptions for veterans are not just about financial savings; they are a symbol of gratitude and appreciation for the sacrifices made by our nation's heroes. As veterans navigate this process, it's essential to remember that they are part of a larger community of support, with resources and benefits designed to ease their transition to civilian life.

By understanding the eligibility criteria, navigating the application process, and maximizing the benefits, veterans can ensure they receive the financial relief they deserve. It's a journey filled with gratitude, recognition, and the opportunity to thrive in a supportive community.

| Jurisdiction | Minimum Service Requirement | Disability Consideration |

|---|---|---|

| State X | 180 days during a period of war or national emergency | Higher exemption for 100% VA disability rating |

| State Y | 365 days of active duty service | Exemption based on VA disability percentage |

| County Z | No minimum service requirement | Additional exemption for veterans aged 65 and above |

How often do I need to reapply for the property tax exemption?

+

Reapplication requirements vary by jurisdiction. Some may require annual reapplication, while others may grant the exemption for a set period or indefinitely. Check with your local tax assessor’s office for specific details.

Can I receive the exemption if I own multiple properties?

+

This depends on the jurisdiction’s rules. Some may limit the exemption to one primary residence, while others may allow for multiple properties. It’s essential to review the specific criteria for your area.

Are there any income restrictions for the property tax exemption?

+

Income restrictions vary by state and county. Some jurisdictions may have income limits, while others base the exemption solely on service and disability status. Check the specific criteria for your area to understand any income-related requirements.

What if I don’t qualify for the full exemption?

+

Even if you don’t meet the criteria for a full exemption, you may still be eligible for a partial reduction. Reach out to your local tax assessor’s office to understand your options and the potential savings.

Can I transfer the exemption to a surviving spouse?

+

In many cases, surviving spouses of veterans can continue to receive the property tax exemption. However, the specific rules and requirements vary by jurisdiction. Contact your local tax assessor’s office to understand the process and eligibility for surviving spouses.