What Is Ct Sales Tax

Understanding sales tax is crucial for businesses and consumers alike, as it directly impacts the final cost of goods and services. In the United States, sales tax is a state-level tax, meaning each state has its own set of rules and regulations regarding the imposition and collection of this tax. Connecticut, often referred to as "The Constitution State," has its own unique approach to sales tax. Let's delve into the intricacies of Connecticut Sales Tax and explore how it functions within the state's economic framework.

The Basics of Connecticut Sales Tax

Connecticut’s sales tax, also known as the General Sales and Use Tax, is a consumption tax levied on the sale of tangible personal property and certain services within the state. It is an essential revenue stream for the state government, funding various public services and infrastructure projects. The sales tax rate is a critical component of this system, and understanding how it works is key to navigating Connecticut’s economic landscape.

The current sales tax rate in Connecticut is 6.35%, which is applied to the purchase price of most goods and services. This rate is consistent across the state, meaning that regardless of where you make a purchase in Connecticut, the sales tax rate remains the same. However, it's important to note that this base rate can be subject to additional local taxes, known as municipal tax rates, which can vary depending on the specific location of the sale.

Sales Tax Exemption: What’s Not Taxed

While the majority of goods and services are subject to Connecticut’s sales tax, there are certain exemptions and exclusions that are worth noting. These exemptions can significantly impact the final cost of specific items and provide tax relief to certain sectors of the economy.

One notable exemption is for groceries, which are not subject to sales tax in Connecticut. This means that when you purchase essential food items at your local supermarket, you won't be charged the additional sales tax, making these staples more affordable for consumers. Additionally, prescription medications are also exempt from sales tax, providing a significant benefit to those who rely on medication for their health.

Another significant exemption is for real estate. The sale or transfer of real property, such as homes or commercial buildings, is not taxed under Connecticut's sales tax law. Instead, these transactions are subject to a separate conveyance tax, which is a one-time tax levied on the transfer of real estate ownership.

| Exempt Category | Description |

|---|---|

| Groceries | Food for home consumption is exempt from sales tax. |

| Prescription Medications | Drugs prescribed by a licensed physician are tax-free. |

| Real Estate | Transfers of real property are exempt from sales tax but subject to a conveyance tax. |

Sales Tax Registration and Compliance

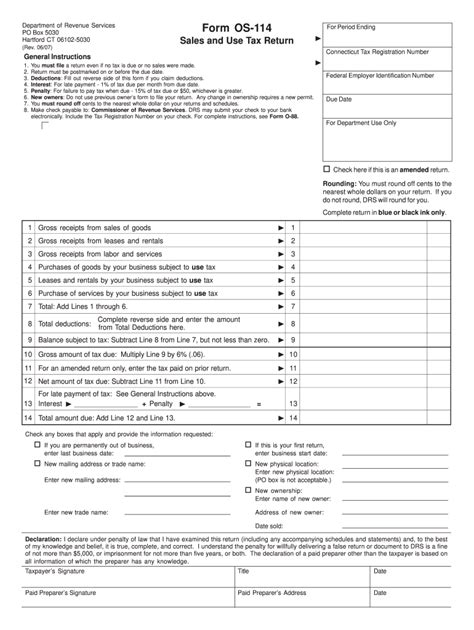

For businesses operating within Connecticut, understanding and complying with sales tax regulations is essential. This involves registering with the state’s taxing authority, the Connecticut Department of Revenue Services (DRS), and adhering to their guidelines for collecting and remitting sales tax.

Businesses are typically required to register for a Sales and Use Tax Permit if they meet certain criteria, such as having a physical presence in the state or making sales exceeding a specified threshold. This permit allows businesses to legally collect and remit sales tax on behalf of the state. Failure to register and comply with sales tax regulations can result in significant penalties and legal consequences.

To ensure compliance, businesses should maintain accurate records of sales transactions, including the amount of sales tax collected. These records are crucial for preparing sales tax returns, which are due periodically (usually quarterly) and must be filed with the DRS. The sales tax collected is then remitted to the state, ensuring the smooth functioning of Connecticut's fiscal system.

Sales Tax Collection and Administration

The process of collecting and administering sales tax in Connecticut is a complex but well-regulated system, designed to ensure fairness and efficiency. Let’s explore the key aspects of this process.

Who Collects Sales Tax in Connecticut

In Connecticut, the primary responsibility for collecting sales tax falls on the seller, or the business making the sale. This means that when you purchase an item from a store or online retailer, the sales tax is typically included in the final price, and it is the seller’s duty to remit this tax to the state.

However, there are instances where the buyer may be responsible for paying sales tax. This occurs when the seller does not have a physical presence in Connecticut but still makes sales to Connecticut residents. In such cases, the buyer is required to pay a use tax, which is essentially the same as sales tax but applied to purchases made from out-of-state sellers. The use tax ensures that all purchases, regardless of the seller's location, are taxed equally.

Sales Tax Rates and Local Variations

While Connecticut has a uniform statewide sales tax rate of 6.35%, there are additional local sales tax rates that can be applied depending on the jurisdiction of the sale. These local rates, known as municipal tax rates, are set by individual towns and cities and can vary significantly.

For example, a purchase made in the city of Hartford may be subject to an additional 1.5% local sales tax rate, bringing the total sales tax to 7.85%. On the other hand, a purchase in a different town, such as Fairfield, may have a lower local tax rate, resulting in a total sales tax of 7.25%. These variations are important to consider, especially for businesses operating in multiple locations or for consumers making significant purchases.

| Location | State Sales Tax | Local Sales Tax | Total Sales Tax |

|---|---|---|---|

| Hartford | 6.35% | 1.5% | 7.85% |

| Fairfield | 6.35% | 0.9% | 7.25% |

Sales Tax on Online Purchases

With the rise of e-commerce, the collection of sales tax on online purchases has become a critical issue. In Connecticut, online retailers are required to collect sales tax on transactions made with Connecticut residents, provided they meet certain criteria, such as having a physical presence in the state or making a certain volume of sales.

For online shoppers, this means that when you purchase items from an online retailer that is required to collect sales tax, the tax will be included in the final price. However, if the online retailer does not have a physical presence in Connecticut and does not meet the sales volume threshold, the buyer may be responsible for paying the use tax directly to the state.

The Impact of Sales Tax on Connecticut’s Economy

Sales tax is a significant revenue source for Connecticut, contributing billions of dollars to the state’s annual budget. This revenue is essential for funding a wide range of public services and infrastructure projects, from education and healthcare to transportation and public safety.

Sales Tax Revenue Distribution

The revenue generated from Connecticut’s sales tax is distributed across various state and local government entities. The majority of the revenue goes to the state general fund, which supports a wide array of state-level services and programs. Additionally, a portion of the sales tax revenue is allocated to the Municipal Aid Fund, which provides financial assistance to local governments for essential services.

The distribution of sales tax revenue is carefully balanced to ensure that both state and local governments have the resources they need to provide effective services to their constituents. This distribution system is a key component of Connecticut's fiscal policy and helps maintain a strong and resilient economy.

Sales Tax and Economic Growth

Sales tax plays a crucial role in driving economic growth in Connecticut. By providing a stable source of revenue, the sales tax system allows the state government to invest in infrastructure development, business incentives, and job creation programs. These initiatives attract new businesses and encourage existing businesses to expand, ultimately boosting the state’s economy.

Furthermore, the sales tax system promotes a fair and competitive business environment. By requiring all businesses to collect and remit sales tax, the playing field is leveled, ensuring that no business gains an unfair advantage by avoiding tax obligations. This fosters a healthy business climate, encouraging innovation and economic prosperity.

Sales Tax and Consumer Behavior

The sales tax rate can significantly influence consumer behavior and spending patterns. When sales tax rates are high, consumers may be more inclined to seek out tax-free alternatives or make purchases in states with lower tax rates. This can lead to a loss of revenue for Connecticut and potentially impact local businesses.

However, Connecticut's sales tax rate of 6.35% is relatively moderate compared to some other states. This rate balance aims to strike a compromise between generating sufficient revenue and maintaining consumer affordability. By keeping the sales tax rate competitive, Connecticut can encourage consumer spending and support local businesses without placing an undue burden on shoppers.

The Future of Sales Tax in Connecticut

As Connecticut’s economy continues to evolve, the state’s sales tax system is likely to undergo changes and adaptations to meet the needs of a dynamic business landscape. Here are some potential future developments and their potential implications.

Sales Tax Reform and Simplification

There have been ongoing discussions about reforming and simplifying Connecticut’s sales tax system to make it more efficient and business-friendly. This could involve streamlining the registration and filing processes, reducing administrative burdens, and providing clearer guidelines for businesses. Such reforms would make it easier for businesses to comply with sales tax regulations and could potentially lead to increased tax compliance and revenue.

Expansion of Sales Tax Base

One potential strategy to boost sales tax revenue is to expand the tax base by including more goods and services under the sales tax umbrella. This could involve eliminating certain exemptions or introducing new taxes on previously untaxed items. While this would increase revenue, it could also impact consumer spending and business costs, requiring careful consideration and public consultation.

Integration with Other States’ Sales Tax Systems

With the rise of e-commerce, there is growing pressure to create a more unified sales tax system across states. Connecticut could potentially collaborate with other states to establish reciprocal sales tax agreements, simplifying the collection and remittance process for businesses operating across state lines. This integration would not only streamline tax administration but could also promote fairness and consistency in interstate commerce.

Sales Tax and Technology

Advancements in technology are likely to play a significant role in the future of sales tax administration. The use of digital platforms and automation could streamline the collection and remittance process, reducing errors and administrative costs. Additionally, technology can enhance compliance by making it easier for businesses to track and report sales tax data accurately.

Conclusion: Navigating Connecticut’s Sales Tax Landscape

Connecticut’s sales tax system is a complex but essential component of the state’s fiscal framework. Understanding the intricacies of this system is crucial for businesses and consumers alike, as it directly impacts their economic decisions and obligations.

By navigating the sales tax landscape with awareness and compliance, Connecticut's businesses and residents can contribute to a strong and resilient economy. As the state continues to evolve, the sales tax system will likely adapt to meet new challenges and opportunities, ensuring a fair and sustainable fiscal environment for all.

What is the current sales tax rate in Connecticut, and when was the last time it changed?

+The current sales tax rate in Connecticut is 6.35%. The last change to the sales tax rate occurred in 2018, when the rate was increased from 6.35% to 6.35%.

Are there any upcoming changes to Connecticut’s sales tax rate or regulations?

+As of my last update in January 2023, there were no immediate plans for changes to Connecticut’s sales tax rate. However, sales tax regulations are subject to periodic review and may be updated to reflect changes in the economy or legislative priorities. It’s always a good idea to stay informed and consult official sources for the most current information.

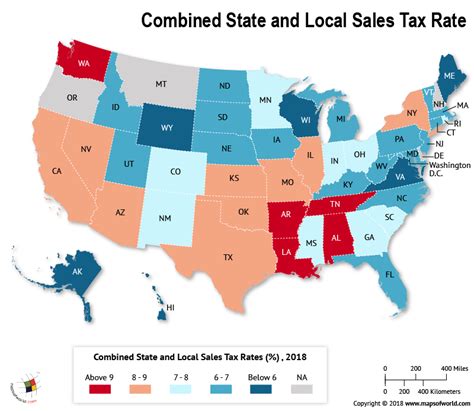

How does Connecticut’s sales tax rate compare to other states in the region?

+Connecticut’s sales tax rate of 6.35% is relatively moderate compared to some neighboring states. For example, Massachusetts has a higher sales tax rate of 6.25%, while New York’s rate is 4%. However, it’s important to consider that sales tax rates can vary significantly across states, and local tax rates can further impact the total tax burden.