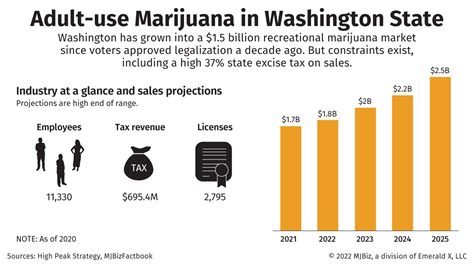

Washington State Sales Tax 2025

As we embark on the journey towards 2025, it's crucial to understand the evolving landscape of sales tax regulations in Washington State. With an ever-changing tax environment, businesses and individuals alike must stay informed to ensure compliance and make strategic financial decisions. This article delves into the intricacies of Washington State's sales tax projections for 2025, offering a comprehensive guide to help navigate the tax landscape effectively.

Understanding Washington State’s Sales Tax Structure

Washington State boasts a unique sales tax system, characterized by a combination of state and local sales taxes. The state sales tax rate is currently set at 6.5%, with the authority to levy additional taxes resting with local jurisdictions. These local taxes, often referred to as local option taxes, can significantly impact the overall sales tax burden, creating a diverse tax landscape across the state.

The Role of Local Option Taxes

Local option taxes are a critical component of Washington’s sales tax structure. These taxes are imposed by counties, cities, or other local governing bodies, and their rates can vary significantly. For instance, in King County, the local option tax rate is 0.5%, whereas in Pierce County, it stands at 2%. This variation results in a complex web of tax rates, with the overall sales tax burden ranging from 7% to 9% across the state.

To illustrate, consider the city of Seattle, which levies a local option tax of 2.25%, resulting in a combined sales tax rate of 8.75%. In contrast, the city of Spokane, with a local option tax of 0.75%, has a total sales tax rate of 7.25%. These disparities underscore the importance of understanding local tax rates when conducting business or making purchases in Washington State.

| Location | State Tax Rate | Local Option Tax Rate | Total Sales Tax Rate |

|---|---|---|---|

| Seattle | 6.5% | 2.25% | 8.75% |

| Spokane | 6.5% | 0.75% | 7.25% |

| Tacoma | 6.5% | 1.5% | 8% |

| Vancouver | 6.5% | 1% | 7.5% |

Projected Sales Tax Rates for 2025

Predicting sales tax rates for 2025 requires an analysis of historical trends, economic forecasts, and legislative intentions. While the state sales tax rate of 6.5% is unlikely to change, the local option tax rates may undergo modifications based on local economic conditions and political decisions.

Potential Scenarios for Local Option Taxes

Scenarios for local option tax rates in 2025 can be broadly categorized into two possibilities:

- Stability: If economic conditions remain relatively stable, with no significant shifts in local revenue needs or political agendas, we can expect local option tax rates to remain consistent with current levels. This scenario would result in a continued diverse tax landscape across Washington State.

- Change: However, should economic conditions fluctuate significantly, or if there are notable shifts in local government priorities, we may see adjustments to local option tax rates. These adjustments could take the form of increases or decreases, depending on the specific circumstances of each locality.

For instance, if a county experiences a surge in infrastructure development projects, it might consider increasing its local option tax rate to fund these initiatives. Conversely, if a city's economic growth exceeds expectations, it might opt to reduce its local option tax rate to encourage further investment and consumer spending.

Preparing for the Future: Strategies for Businesses

As we anticipate the sales tax landscape of 2025, businesses operating in Washington State can benefit from implementing strategic measures to navigate potential changes:

- Stay Informed: Keep abreast of local tax rate changes and their potential impact on your business operations. Subscribe to relevant newsletters, follow local government updates, and engage with industry associations for timely information.

- Adapt Pricing Strategies: Develop flexible pricing strategies that can accommodate varying tax rates. Consider offering dynamic pricing options that can be adjusted based on location-specific tax rates, ensuring a competitive edge and maintaining profitability.

- Optimize Tax Management: Invest in robust tax management systems that can automatically calculate and apply the correct tax rates based on the customer's location. This not only ensures compliance but also streamlines operations and reduces administrative burdens.

- Engage with Tax Professionals: Consult with tax advisors or accountants who specialize in Washington State's sales tax regulations. Their expertise can provide valuable insights and guidance on navigating the complexities of the tax system, helping you make informed financial decisions.

Conclusion: A Strategic Approach to Sales Tax Management

Washington State’s sales tax structure, with its blend of state and local taxes, presents a dynamic and complex landscape. As we look towards 2025, businesses and individuals must adopt a strategic mindset to navigate potential changes in tax rates. By staying informed, adapting pricing strategies, optimizing tax management systems, and seeking expert guidance, stakeholders can ensure compliance, maintain profitability, and make informed financial decisions in an ever-evolving tax environment.

Frequently Asked Questions

What is the current state sales tax rate in Washington State?

+

The current state sales tax rate in Washington State is 6.5%.

How do local option taxes impact the overall sales tax rate in Washington State?

+

Local option taxes, levied by counties, cities, or other local governing bodies, can significantly impact the overall sales tax burden. These taxes can vary greatly, resulting in a diverse tax landscape across the state.

Are there any projected changes to the state sales tax rate for 2025?

+

The state sales tax rate of 6.5% is unlikely to change for 2025. However, local option tax rates may undergo modifications based on local economic conditions and political decisions.

How can businesses prepare for potential changes in sales tax rates for 2025?

+

Businesses can prepare by staying informed about local tax rate changes, adapting pricing strategies, optimizing tax management systems, and seeking guidance from tax professionals.

What is the impact of varying local option tax rates on businesses operating in multiple locations within Washington State?

+

Varying local option tax rates can affect businesses by influencing operational costs and profitability. A strategic approach to pricing and tax management is essential for businesses operating across multiple locations.