Illinois Capital Gains Tax

Understanding the intricacies of state tax systems is crucial, especially when it comes to capital gains and the potential impact on investors and businesses. This article delves into the specific tax landscape of Illinois, exploring its capital gains tax and how it affects individuals and enterprises within the state.

Unraveling Illinois’ Capital Gains Tax: A Comprehensive Overview

Illinois, the Prairie State, presents a unique tax environment with its own set of regulations and rates. This section provides an in-depth analysis of Illinois’ capital gains tax structure, shedding light on the key aspects that every taxpayer should be aware of.

The Illinois Tax Landscape

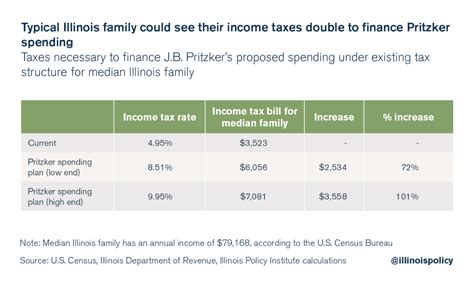

Illinois operates a graduated income tax system, meaning that tax rates vary depending on the income bracket an individual or entity falls into. This approach ensures a fair distribution of tax burden across different income levels. As of 2023, the state has established four income tax brackets, with rates ranging from 4.75% to 7.75%.

However, it's important to note that Illinois' tax structure is more nuanced when it comes to capital gains. The state has a distinct set of rules and regulations governing the taxation of capital gains, which we will explore in detail.

Capital Gains Taxation in Illinois

Illinois treats capital gains as a specific type of income, distinct from regular earned income. This classification has significant implications for taxpayers, as it affects the tax rates applied and the overall tax liability.

For long-term capital gains, which result from the sale of assets held for more than a year, Illinois imposes a flat tax rate of 4.95%. This rate is applicable to all long-term capital gains, regardless of the taxpayer's income bracket.

| Capital Gains Type | Tax Rate |

|---|---|

| Long-Term Capital Gains | 4.95% |

| Short-Term Capital Gains | Variable (Based on Income Bracket) |

On the other hand, short-term capital gains, arising from the sale of assets held for a year or less, are taxed at the same rate as regular income. This means that the tax rate for short-term capital gains depends on the taxpayer's income bracket, ranging from 4.75% to 7.75%.

Real-World Examples and Impact

To illustrate the impact of Illinois’ capital gains tax structure, let’s consider a few scenarios. Imagine an individual investor, Emily, who has a total income of 80,000 and realizes a long-term capital gain of 10,000 from the sale of stocks. In this case, Emily’s long-term capital gain would be taxed at the flat rate of 4.95%, resulting in a tax liability of $495 for her capital gains.

Now, let's consider a small business owner, David, who falls into the highest income tax bracket with a total income of $500,000. David sells a piece of equipment he purchased a year ago for a short-term capital gain of $50,000. In this scenario, David's short-term capital gain would be taxed at the highest income tax rate of 7.75%, leading to a tax liability of $3,875 for his capital gains.

Comparative Analysis: Illinois vs. Other States

When compared to other states, Illinois’ capital gains tax structure stands out due to its simplicity and flat rate for long-term capital gains. While some states, like California, impose a progressive tax on capital gains, Illinois maintains a consistent rate, providing a degree of predictability for taxpayers.

However, it's worth noting that Illinois' flat tax rate of 4.95% for long-term capital gains is relatively higher than the rates in neighboring states. For instance, neighboring Indiana has a flat rate of 3.23% for capital gains, while Iowa and Kentucky do not tax capital gains at all. This could potentially influence investment decisions and business operations for taxpayers.

Implications for Taxpayers and Businesses

Illinois’ capital gains tax structure has implications for both individual taxpayers and businesses operating within the state. For individuals, understanding the distinction between long-term and short-term capital gains and the applicable tax rates is crucial for effective tax planning. Holding investments for longer periods to qualify for the lower long-term capital gains tax rate can be a strategic move.

Businesses, especially those involved in asset-intensive industries, need to carefully consider the impact of capital gains taxes on their operations. The decision to sell assets, whether for short-term or long-term gains, can have significant tax implications. Proper tax planning and consulting with financial advisors can help businesses optimize their tax strategies.

Looking Ahead: Future Tax Policy and Considerations

As tax policies are subject to change, it’s essential to stay informed about potential future developments in Illinois’ tax landscape. While the current capital gains tax structure provides a stable environment for taxpayers, there is always the possibility of future amendments or reforms.

Taxpayers and businesses should stay engaged with industry news and consult with tax professionals to anticipate any changes in the tax system. Being proactive in tax planning can help mitigate potential risks and take advantage of any favorable tax developments that may arise.

How does Illinois' capital gains tax rate compare to other states?

+Illinois' capital gains tax rate of 4.95% for long-term gains is relatively higher than some neighboring states. For instance, Indiana has a flat rate of 3.23%, while Iowa and Kentucky do not tax capital gains. This can influence investment decisions and business operations.

Are there any strategies to minimize capital gains tax in Illinois?

+Yes, taxpayers can employ strategies such as holding investments for longer periods to qualify for the lower long-term capital gains tax rate. Proper tax planning and consulting with financial advisors can also help optimize tax strategies.

What is the difference between long-term and short-term capital gains in Illinois?

+Long-term capital gains result from the sale of assets held for more than a year and are taxed at a flat rate of 4.95% in Illinois. Short-term capital gains, arising from assets held for a year or less, are taxed at the same rate as regular income, which varies based on the taxpayer's income bracket.

How often are Illinois' tax rates updated or changed?

+Illinois' tax rates are subject to change through legislative amendments. It's essential to stay informed about any potential updates or reforms to ensure compliance and take advantage of any favorable tax developments.

In conclusion, understanding Illinois’ capital gains tax structure is vital for taxpayers and businesses operating within the state. With its distinct rules and rates, Illinois offers a unique tax environment. By staying informed and engaging in proactive tax planning, individuals and businesses can navigate the state’s tax landscape effectively.