Oklahoma State Tax Rate

Welcome to a comprehensive exploration of the Oklahoma State Tax Rate. Understanding the intricacies of taxation is crucial for both residents and businesses alike, as it directly impacts financial planning and decision-making. In this article, we delve into the specifics of Oklahoma's tax system, providing an in-depth analysis of its structure, rates, and implications.

Unraveling the Oklahoma State Tax Structure

Oklahoma’s tax system is a complex framework designed to generate revenue for the state’s operations and services. It consists of various components, each playing a vital role in contributing to the overall tax burden. Let’s break down these components to gain a clearer understanding.

Income Tax: A Significant Contributor

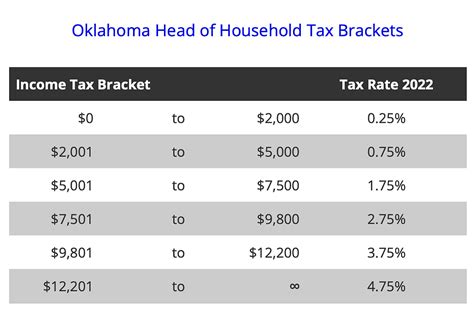

Oklahoma levies an income tax on individuals and businesses, with rates varying based on income brackets. The state’s income tax structure is progressive, meaning that higher incomes are taxed at higher rates. This ensures a fair distribution of tax responsibility among residents and businesses.

For the 2023 tax year, Oklahoma’s income tax rates range from 0.5% to 5.0%, with six different tax brackets. The income thresholds for these brackets are as follows:

| Tax Bracket | Income Threshold (Single Filers) | Income Threshold (Married Filing Jointly) |

|---|---|---|

| 0.5% | 0 - 1,750 | 0 - 3,500 |

| 1.25% | 1,751 - 4,250 | 3,501 - 8,500 |

| 2.25% | 4,251 - 7,500 | 8,501 - 15,000 |

| 3.25% | 7,501 - 25,000 | 15,001 - 50,000 |

| 4.00% | 25,001 - 62,500 | 50,001 - 125,000 |

| 5.00% | Over 62,500</td> <td>Over 125,000 |

Sales and Use Tax: Understanding Consumption

Oklahoma also imposes a sales and use tax on the sale or purchase of tangible goods and certain services. This tax is collected at the point of sale and is typically added to the retail price of goods. As of 2023, the state’s sales tax rate is 4.5%, while local governments can also impose additional sales taxes, resulting in varying total rates across the state.

For example, in the city of Oklahoma City, the total sales tax rate is 8.5%, consisting of the state’s 4.5% rate and a 4% local tax. On the other hand, in Tulsa, the total sales tax rate is 8.625%, with a breakdown of 4.5% state tax and a 4.125% local tax.

Property Tax: Assessing Real Estate

Property tax is another significant component of Oklahoma’s tax system. It is levied on real estate properties, including land, buildings, and certain improvements. The property tax rate varies across different counties and municipalities within the state.

Oklahoma utilizes a millage rate system for property taxation. A mill is equal to one-tenth of one cent or 0.001. Property taxes are calculated by multiplying the assessed value of the property by the applicable millage rate. For instance, if a property has an assessed value of 100,000 and the millage rate is 50 mills, the annual property tax would be $500.

The millage rates can differ greatly between counties. As an example, the millage rate in Oklahoma County is approximately 105 mills, while in Tulsa County, it stands at around 140 mills.

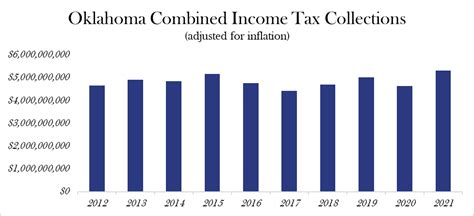

Impact and Analysis: How Oklahoma’s Tax Rates Affect Residents and Businesses

Oklahoma’s tax rates have a profound impact on both individuals and businesses operating within the state. Understanding these effects is crucial for financial planning and decision-making.

Income Tax Implications

The progressive nature of Oklahoma’s income tax system ensures that individuals and businesses with higher incomes contribute a larger share of their earnings to the state’s revenue. This approach aims to promote fairness and alleviate potential financial burdens on lower-income earners.

For instance, a single filer with an annual income of 50,000 would fall into the 4% tax bracket, paying approximately 2,000 in state income tax. In contrast, a high-income earner with an annual income of 200,000 would be taxed at the highest rate of 5%, resulting in a state income tax liability of 10,000.

Sales Tax and Consumption

Oklahoma’s sales tax rate, combined with local taxes, can significantly impact the purchasing power of residents and businesses. Higher sales tax rates can discourage spending and potentially drive consumers to make purchases in neighboring states with lower tax rates.

Consider the example of a business owner who frequently purchases office supplies. In a city with a total sales tax rate of 8.5%, the business owner might opt to buy these supplies online from out-of-state retailers to avoid the sales tax, thereby impacting local businesses and the state’s revenue.

Property Tax Considerations

Property taxes can have a substantial impact on individuals and businesses, especially those owning real estate properties. Higher property tax rates can affect cash flow and overall financial stability.

Let’s say a business owns a commercial property with an assessed value of 500,000. If the millage rate is 100 mills, the annual property tax would be 5,000. This expense can significantly impact the business’s operating costs and profit margins.

Comparative Analysis: Oklahoma’s Tax Rates in a National Context

To gain a broader perspective, let’s compare Oklahoma’s tax rates with those of other states.

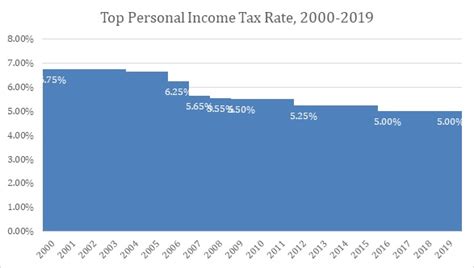

Income Tax Rates Across the U.S.

Oklahoma’s income tax rates are relatively competitive when compared to other states. For instance, neighboring states like Texas and Kansas have no state income tax, while Missouri and Arkansas have lower rates than Oklahoma. However, Oklahoma’s rates are still lower than many Northeastern and West Coast states, which often have higher income tax brackets.

Sales Tax: A Varied Landscape

Sales tax rates vary significantly across the United States. While some states, like Delaware and Oregon, have no sales tax, others like California and New York have rates above 8%. Oklahoma’s sales tax rate of 4.5% is on the lower end of the spectrum, providing a competitive advantage for businesses and consumers.

Property Tax: A State-by-State Comparison

Property tax rates can vary greatly from state to state. States like New Jersey and Illinois have some of the highest property tax rates in the nation, while states like Hawaii and Louisiana have lower rates. Oklahoma’s property tax rates fall within a moderate range, providing a balanced approach to real estate taxation.

Conclusion: Navigating Oklahoma’s Tax Landscape

Oklahoma’s tax system, with its progressive income tax, varied sales tax rates, and property tax structure, offers a unique financial landscape for residents and businesses. Understanding these tax rates and their implications is essential for effective financial planning and decision-making.

As Oklahoma continues to evolve and adapt its tax policies, staying informed about these changes will be crucial for individuals and businesses to optimize their financial strategies. By staying updated and analyzing the state’s tax system, residents and businesses can make informed choices that align with their financial goals and obligations.

How often are Oklahoma’s tax rates updated or revised?

+Oklahoma’s tax rates are subject to change annually, with updates typically taking effect for the upcoming tax year. The state legislature and relevant tax authorities review and adjust tax rates based on various factors, including economic conditions and budgetary needs.

Are there any tax incentives or deductions available in Oklahoma for individuals or businesses?

+Yes, Oklahoma offers a range of tax incentives and deductions to promote economic development and support certain industries. These can include tax credits for research and development, job creation, and investment in renewable energy. Additionally, individuals may be eligible for deductions related to charitable contributions, mortgage interest, and certain education expenses.

How does Oklahoma’s tax system compare to other states in terms of overall tax burden?

+Oklahoma’s tax system is generally considered moderate compared to other states. While it has competitive income tax rates and a relatively low sales tax, its property tax rates can vary significantly across the state. Overall, Oklahoma’s tax burden is often more favorable than many high-tax states, making it an attractive location for businesses and individuals.