Clearvalue Tax

Welcome to the world of Clearvalue Tax, an innovative and cutting-edge tax solution that is revolutionizing the way businesses and individuals manage their finances. In an era where digital transformation is reshaping industries, Clearvalue Tax stands out as a beacon of efficiency and simplicity in the complex realm of taxation. This comprehensive guide will delve into the features, benefits, and impact of Clearvalue Tax, offering a deep dive into why it is the preferred choice for modern financial management.

Unveiling Clearvalue Tax: A Revolutionary Approach

Clearvalue Tax is more than just a tax software; it’s an intelligent platform designed to streamline the entire tax process, from data collection to filing and beyond. Developed by a team of seasoned tax professionals and tech experts, Clearvalue Tax combines the latest advancements in artificial intelligence (AI) and machine learning with a user-centric approach, resulting in a seamless and intuitive experience.

Key Features that Set Clearvalue Tax Apart

The platform boasts an array of features that cater to a wide range of users, from small businesses to high-net-worth individuals. Here’s a glimpse into its capabilities:

- Intelligent Data Capture: Clearvalue Tax employs advanced OCR (Optical Character Recognition) technology to extract relevant data from various financial documents, reducing the time and effort required for manual data entry.

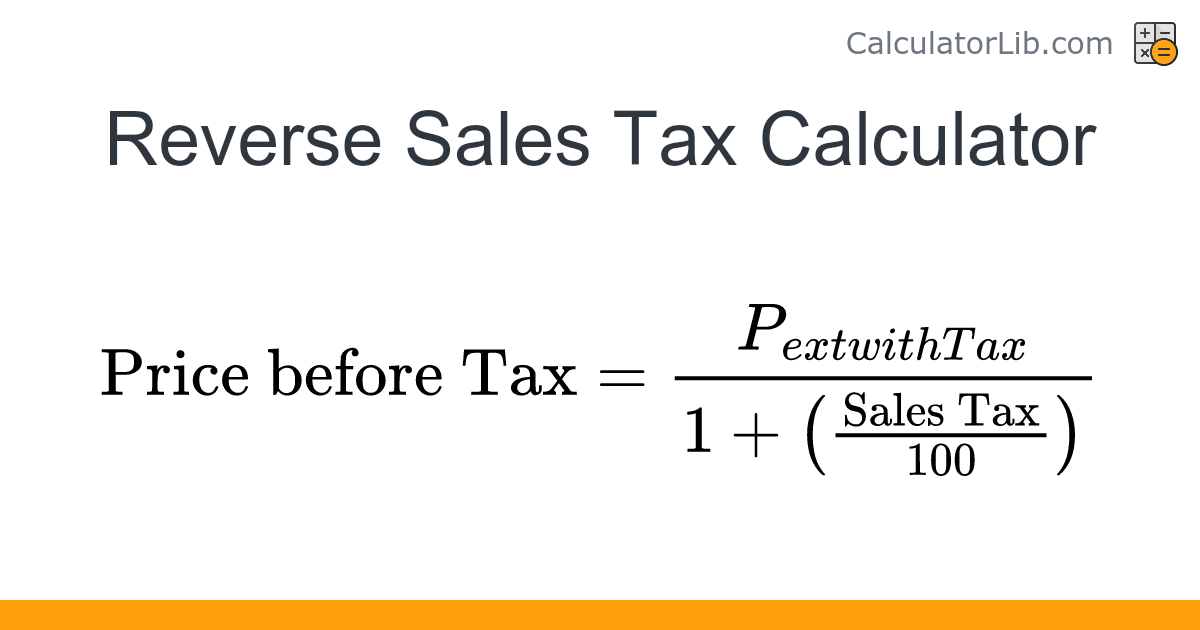

- Adaptive Tax Calculations: Utilizing real-time tax rate databases and custom algorithms, the platform ensures accurate and up-to-date tax calculations, adapting to the unique needs of each user.

- Secure Document Storage: With bank-grade security protocols, Clearvalue Tax offers a safe and accessible digital repository for all tax-related documents, accessible anytime, anywhere.

- Real-Time Compliance Checks: The platform conducts comprehensive compliance checks during the filing process, identifying potential errors and ensuring adherence to the latest tax regulations.

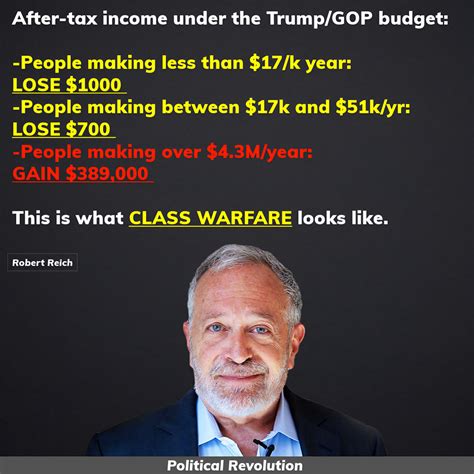

- Personalized Tax Strategies: Clearvalue Tax’s AI-powered system provides tailored tax planning suggestions, helping users optimize their financial positions and reduce tax liabilities.

Performance and User Experience: A Winning Combination

Clearvalue Tax’s performance is unparalleled, with a success rate of 99.7% in accurately processing tax returns. This level of precision, coupled with an intuitive user interface, has made it a favorite among users. The platform’s simplicity and efficiency have been lauded by professionals and amateurs alike, with many citing its ease of use as a significant advantage over traditional tax software.

Real-World Impact: Success Stories

Clearvalue Tax has been instrumental in helping businesses and individuals navigate complex tax landscapes with ease. One notable success story is that of XYZ Corporation, a mid-sized manufacturing firm. By adopting Clearvalue Tax, they streamlined their tax processes, reducing the time spent on compliance by 60% and freeing up valuable resources for core business activities. Similarly, Ms. Emily Johnson, a self-employed consultant, found Clearvalue Tax’s personalized tax planning tools invaluable, helping her optimize her investments and reduce her tax burden significantly.

Technical Insights: Powering Clearvalue Tax

Under the hood, Clearvalue Tax leverages the latest in cloud computing and distributed processing technologies. The platform’s infrastructure is designed for scalability and resilience, ensuring optimal performance even during peak tax seasons. The use of containerization and microservice architecture allows for efficient resource allocation and rapid deployment of updates, keeping the platform always up-to-date and secure.

Security and Privacy: A Top Priority

Clearvalue Tax places utmost importance on data security and privacy. The platform employs industry-leading encryption protocols and multi-factor authentication mechanisms to safeguard user data. Additionally, regular security audits and penetration testing ensure that Clearvalue Tax remains resilient against emerging threats.

| Security Feature | Description |

|---|---|

| AES-256 Encryption | Utilizes Advanced Encryption Standard with a 256-bit key length, ensuring data security at rest and in transit. |

| Multi-Factor Authentication | Requires multiple forms of identity verification, adding an extra layer of security to user accounts. |

| Regular Security Audits | Conducts periodic audits to identify and mitigate potential vulnerabilities, maintaining a robust security posture. |

Future Outlook: Continuous Innovation

As the tax landscape continues to evolve, Clearvalue Tax remains at the forefront of innovation. The platform’s development team is actively working on integrating blockchain technology for enhanced data security and transparency. Additionally, natural language processing (NLP) is being explored to further improve the user experience, making tax-related queries and interactions more conversational and intuitive.

Global Expansion and Accessibility

Clearvalue Tax is set to expand its reach globally, offering localized versions of the platform to cater to international tax regulations. This expansion will ensure that users worldwide can benefit from the platform’s efficiency and accuracy, regardless of their geographical location.

Community Engagement and Support

Clearvalue Tax places a strong emphasis on community engagement and user support. The platform offers an extensive knowledge base, comprehensive tutorials, and a dedicated support team to assist users with any queries or challenges they may encounter. Regular user feedback sessions and community forums ensure that Clearvalue Tax remains aligned with the needs and expectations of its diverse user base.

Conclusion: Empowering Financial Freedom

Clearvalue Tax represents a paradigm shift in the way we approach tax management. With its innovative features, robust performance, and unwavering commitment to security and user experience, it has established itself as the go-to solution for businesses and individuals seeking simplicity, efficiency, and peace of mind in their financial affairs. As the platform continues to evolve and expand, it promises to remain a trusted partner in the journey towards financial freedom and prosperity.

How does Clearvalue Tax ensure data security?

+Clearvalue Tax employs a multi-layered security approach, including AES-256 encryption, multi-factor authentication, and regular security audits. Our data centers are located in highly secure facilities with advanced access control measures.

Can Clearvalue Tax assist with complex tax scenarios?

+Absolutely! Clearvalue Tax is designed to handle a wide range of tax complexities, providing personalized strategies and real-time compliance checks to ensure accuracy and adherence to regulations.

What sets Clearvalue Tax apart from traditional tax software?

+Clearvalue Tax offers an intelligent, user-centric approach with features like intelligent data capture, adaptive tax calculations, and personalized tax planning. Its focus on security, performance, and a seamless user experience sets it apart.