Phantom Tax Urban Dictionary

The concept of a "Phantom Tax" has gained attention in various discussions, particularly in the context of economics and financial matters. In this article, we will delve into the meaning and implications of the term "Phantom Tax," exploring its definition, examples, and the impact it can have on individuals and societies. By understanding this phenomenon, we can gain insights into the intricate world of taxation and its potential consequences.

Unraveling the Mystery of Phantom Tax

Phantom Tax, a term coined to describe an indirect or hidden form of taxation, refers to the phenomenon where individuals or entities bear a financial burden without explicit knowledge or consent. It is a complex concept that operates beneath the surface, often unnoticed by those affected. This article aims to shed light on the nature of Phantom Tax, its mechanisms, and its potential repercussions.

Understanding the Nature of Phantom Tax

Phantom Tax encompasses a wide range of taxation practices that are not immediately apparent to the taxpayers. These taxes are often embedded within the prices of goods and services, making them difficult to identify and understand. Unlike traditional taxes, where the burden is directly visible and calculable, Phantom Taxes are subtle and can have a cumulative effect over time.

One of the key characteristics of Phantom Tax is its indirect nature. It is not levied directly on individuals' incomes or assets but is rather embedded in the cost of living. This can include taxes on specific goods, such as sin taxes on tobacco or alcohol, or taxes imposed on essential services like healthcare or education. These taxes are often disguised within the overall pricing structure, making it challenging for consumers to discern their impact.

| Tax Category | Description |

|---|---|

| Sin Taxes | Taxes on goods considered harmful or indulgent, e.g., tobacco, alcohol, sugar. |

| Excise Taxes | Taxes on specific goods or services, like gasoline or airline tickets. |

| Value-Added Taxes (VAT) | A consumption tax added to the price of goods and services at each production stage. |

Examples of Phantom Tax in Action

Phantom Tax can manifest in various forms, impacting different aspects of our daily lives. Let’s explore some real-world examples to understand its reach and implications.

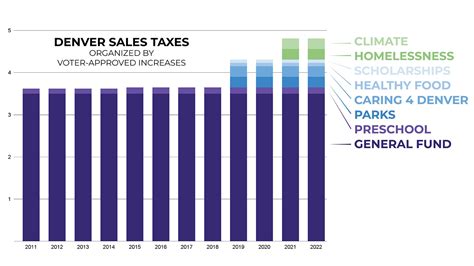

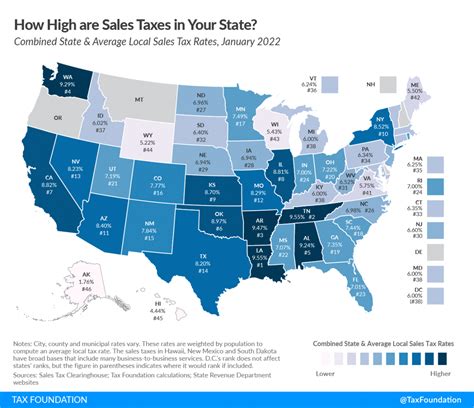

Sales Taxes

Sales taxes, a common form of Phantom Tax, are added to the retail price of goods and services. While these taxes are often explicitly stated on receipts, their impact can be subtle. For instance, a sales tax of 10% on a $100 item may not seem significant, but over time, the cumulative effect can be substantial. Consumers may not fully realize the tax burden until they analyze their spending patterns.

Taxes on Digital Services

With the rise of digital technologies, Phantom Tax has extended to the online realm. Many digital services, such as streaming platforms or online marketplaces, impose hidden fees and taxes. These charges are often buried within the terms of service or pricing structures, making it challenging for users to understand the true cost. For example, a streaming service may advertise a monthly fee, but additional taxes and surcharges can increase the actual cost.

Property Taxes

Property taxes are another example of Phantom Tax, especially when they are embedded within rental agreements or homeownership costs. Tenants may not realize the full extent of the tax burden, as it is often included in the rent. Similarly, homeowners may face unexpected tax increases, impacting their overall financial stability.

The Impact of Phantom Tax

The effects of Phantom Tax can be far-reaching, influencing economic behavior and societal dynamics. Here are some key implications to consider:

- Consumer Behavior: Phantom Tax can alter consumer choices and spending patterns. When taxes are hidden, consumers may make purchasing decisions without fully understanding the financial implications. This can lead to unintended consequences, such as reduced savings or increased debt.

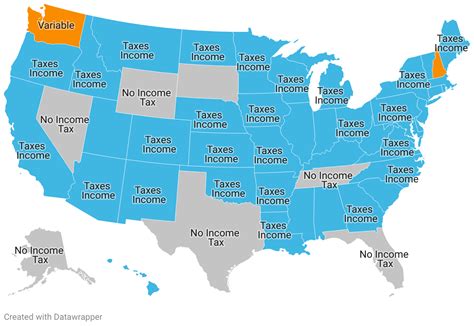

- Income Inequality: Phantom Taxes can disproportionately affect low-income individuals, as they often spend a higher proportion of their income on taxed goods and services. This can exacerbate income inequality, as the tax burden is felt more acutely by those with limited financial resources.

- Market Distortions: By influencing consumer behavior, Phantom Tax can distort market dynamics. For instance, sin taxes on tobacco may reduce consumption but can also lead to the emergence of black markets or illegal trade.

- Transparency and Trust: The lack of transparency associated with Phantom Tax can erode public trust in government institutions. When taxes are hidden, individuals may feel deceived or misled, leading to a breakdown in trust and cooperation.

Navigating the Phantom Tax Landscape

Given the complexities of Phantom Tax, individuals and policymakers face unique challenges. Here are some strategies to navigate this landscape:

- Education and Awareness: Promoting financial literacy and awareness of taxation practices can empower individuals to make informed choices. Understanding the tax implications of various goods and services can help consumers budget effectively and advocate for transparency.

- Policy Reform: Policymakers can play a crucial role in addressing Phantom Tax by implementing reforms that enhance transparency. This may include simplifying tax structures, providing clear breakdowns of tax components, and ensuring that taxes are visible and understandable to consumers.

- Alternative Revenue Sources: Exploring alternative revenue sources, such as wealth taxes or progressive income taxes, can reduce the reliance on Phantom Taxes. By shifting the tax burden to those with greater financial means, policymakers can promote fairness and equity.

The Future of Phantom Tax

As societies evolve and technological advancements continue, the nature of taxation is likely to change. The rise of digital economies and the gig economy may present new challenges and opportunities for Phantom Tax. Here are some potential future implications:

- Digital Taxation: With the increasing prevalence of digital platforms and services, governments may explore innovative ways to tax digital transactions. This could include taxes on digital advertising, online sales, or even data usage.

- Automated Taxation: As artificial intelligence and automation advance, the taxation process may become more automated. This could lead to more efficient tax collection but also raise concerns about privacy and data security.

- Global Taxation: In an interconnected world, the issue of global taxation becomes increasingly relevant. Phantom Taxes may take on new forms as countries grapple with the challenges of taxing multinational corporations and digital giants.

Frequently Asked Questions

What are some common examples of Phantom Tax in everyday life?

+Phantom Tax can be found in various forms, such as sales taxes on goods, hidden fees for digital services, and property taxes embedded in rental agreements. These taxes are often not explicitly stated, making them difficult to identify.

How does Phantom Tax impact low-income individuals and communities?

+Phantom Taxes can disproportionately affect low-income individuals, as they often have limited financial resources and spend a higher proportion of their income on taxed goods and services. This can exacerbate income inequality and financial strain.

What steps can policymakers take to address Phantom Tax concerns?

+Policymakers can enhance tax transparency by simplifying tax structures, providing clear breakdowns of tax components, and exploring alternative revenue sources. By promoting fairness and equity, they can mitigate the impact of Phantom Taxes.