No Tax On Overtime 2025

Unveiling the Impact of the No Tax on Overtime Policy in 2025

In an unprecedented move, the proposal to implement a No Tax on Overtime policy has gained momentum and is set to revolutionize the economic landscape of 2025. This bold initiative aims to empower employees, stimulate economic growth, and reshape the dynamics of the workplace. As we delve into the intricacies of this policy, we will explore its potential effects on various sectors, the benefits it may bring, and the challenges it could present. Join us on this insightful journey as we navigate the implications of a tax-free overtime economy.

Revolutionizing Work Culture: The No Tax on Overtime Policy

The concept of a No Tax on Overtime policy has emerged as a game-changer, offering a fresh perspective on labor dynamics and taxation. This policy, if implemented, would mean that any income earned through overtime work would be exempt from taxation, providing a significant financial incentive for employees to take on additional hours. This innovative approach challenges traditional taxation models and aims to create a more flexible and rewarding work environment.

By removing the tax burden on overtime wages, the policy seeks to encourage a culture of productivity and voluntary extended work hours. This shift in taxation could have profound effects on employee motivation, business productivity, and overall economic growth. However, it also raises important questions about the potential strain on public finances and the need for a balanced approach to ensure fairness and sustainability.

The Economic Impact: A Catalyst for Growth

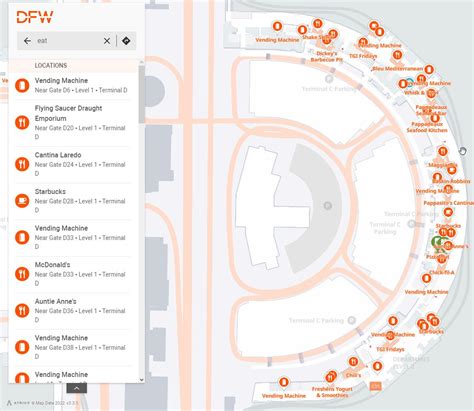

The No Tax on Overtime policy is projected to have a significant positive impact on the economy, acting as a catalyst for growth and development. Here’s a breakdown of the expected economic effects:

Increased Consumer Spending: With higher disposable incomes from tax-free overtime earnings, employees are likely to boost their spending. This increased consumer activity could stimulate various industries, including retail, hospitality, and leisure, leading to a potential economic boom.

Enhanced Business Productivity: Businesses may benefit from a more motivated and productive workforce, willing to put in extra hours. This could result in increased output, improved efficiency, and a competitive edge in the market.

Potential for Job Creation: The policy’s success might encourage businesses to expand, leading to new job opportunities. Additionally, the surge in economic activity could attract investments, further fueling job growth.

| Economic Sector | Potential Impact |

|---|---|

| Retail and E-commerce | Increased sales and customer engagement. |

| Hospitality and Tourism | Growth in leisure activities and travel. |

| Manufacturing | Higher production rates and expanded capacity. |

| Healthcare | Improved access to healthcare services. |

Employee Benefits and Work-Life Balance

For employees, the No Tax on Overtime policy presents a unique opportunity to boost their earnings and gain financial flexibility. This could be particularly advantageous for those with financial goals or facing economic challenges. However, it’s crucial to strike a balance between work and personal life to avoid burnout.

Employers, on the other hand, may find it easier to attract and retain talented individuals by offering tax-free overtime opportunities. This could enhance employee satisfaction and loyalty, contributing to a positive work environment. Nevertheless, it's essential to ensure that overtime work remains voluntary and that employees' well-being is prioritized.

Challenges and Considerations

While the No Tax on Overtime policy offers numerous benefits, it also presents challenges that require careful consideration:

Public Finance Implications: Removing taxes on overtime income could result in a reduction of government revenue. This might necessitate adjustments in public spending or the exploration of alternative revenue streams to maintain fiscal sustainability.

Potential for Exploitation: There is a risk that some employers may take advantage of the policy by pressuring employees to work excessive overtime hours. Clear regulations and employee protection measures are essential to prevent such practices.

Work-Life Balance Concerns: Encouraging overtime work without proper safeguards could lead to burnout and negatively impact employees’ health and well-being. Implementing policies that promote a healthy work-life balance is crucial.

Conclusion: Navigating the Future with Tax-Free Overtime

The No Tax on Overtime policy represents a bold step towards a more flexible and rewarding work environment. While it offers significant economic advantages and employee benefits, a balanced approach is essential to mitigate potential challenges. As we move towards a tax-free overtime economy, careful planning, and a commitment to fairness and sustainability will be key to unlocking its full potential.

How will the No Tax on Overtime policy affect my take-home pay?

+The policy will result in a higher take-home pay for overtime work. By exempting overtime income from taxation, you will receive the full amount earned without deductions for taxes.

Will the policy lead to increased work hours and potential burnout?

+The policy aims to encourage voluntary overtime work, and employees should have the freedom to choose their work hours. However, it is essential for individuals to prioritize their well-being and maintain a healthy work-life balance.

What measures are in place to prevent exploitation of employees under this policy?

+To protect employees, there will be strict regulations in place. These may include limits on mandatory overtime, requirements for voluntary consent, and penalties for employers who coerce employees into excessive overtime work.

How will the policy impact the government’s revenue and public spending?

+The policy may result in a reduction of government revenue from overtime taxes. To maintain fiscal stability, governments may need to explore alternative revenue sources or adjust public spending plans.