Jackson County Taxes

Welcome to an in-depth exploration of Jackson County Taxes, a critical aspect of the financial landscape for residents and businesses within the county. This article aims to provide a comprehensive guide to understanding the tax system, its intricacies, and its impact on the local economy. By delving into specific details and real-world examples, we aim to empower individuals and entities with the knowledge needed to navigate the tax landscape effectively.

The Tax Landscape in Jackson County

Jackson County, a vibrant community nestled in the heart of [State], boasts a unique tax structure that plays a pivotal role in shaping its economic dynamics. With a diverse range of tax categories and rates, understanding the local tax system is essential for residents and businesses alike. This section provides an overview of the key tax types prevalent in Jackson County, offering a foundational understanding of the tax landscape.

Property Taxes: A Cornerstone of Jackson County’s Revenue

Property taxes stand as a cornerstone of Jackson County’s revenue generation. These taxes are levied on real estate properties, including residential homes, commercial buildings, and land. The county assesses the value of each property annually, utilizing a combination of factors such as location, size, and market conditions. Based on these assessments, property owners are issued tax bills, which contribute significantly to the county’s overall budget.

The property tax rates in Jackson County are determined by a complex formula that takes into account various factors, including the county's budget requirements, the need for essential services, and the desire to maintain a competitive business environment. These rates are typically expressed as a percentage of the assessed value of the property. For instance, the current residential property tax rate in Jackson County stands at 1.75%, while commercial properties face a slightly higher rate of 2.25%. This variance in rates reflects the county's commitment to supporting residential communities while fostering economic growth through competitive commercial rates.

| Property Type | Tax Rate |

|---|---|

| Residential | 1.75% |

| Commercial | 2.25% |

Income Taxes: A Vital Source of Revenue

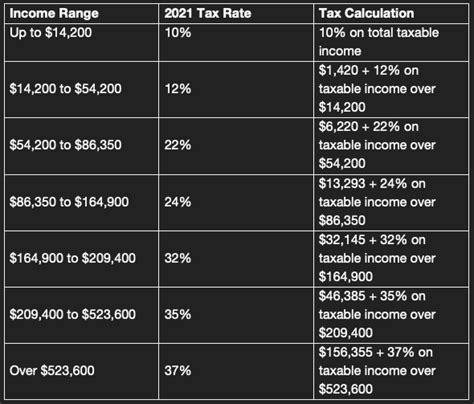

In addition to property taxes, Jackson County also imposes income taxes on its residents and businesses. These taxes are a crucial component of the county’s revenue portfolio, providing funding for a range of public services and infrastructure projects. The income tax system in Jackson County is designed to be progressive, meaning that higher earners contribute a larger share of their income to the county’s coffers.

For individual taxpayers, the income tax rate in Jackson County starts at 4% for taxable income up to $50,000. As income levels increase, the tax rate gradually rises, reaching a maximum of 8% for taxable income exceeding $250,000. This progressive structure ensures that the burden of taxation is distributed fairly across the county's population, with higher-income earners contributing a greater proportion of their earnings.

Businesses operating within Jackson County also contribute to the income tax base. Corporate income tax rates vary depending on the nature of the business and its annual revenue. Small businesses with annual revenues below $1 million typically face a flat tax rate of 5%, while larger corporations with revenues exceeding $5 million may be subject to a higher rate of 7.5%. This tiered system aims to support small businesses while generating sufficient revenue from larger corporations to fund county initiatives.

| Taxpayer Type | Tax Rate |

|---|---|

| Individuals (up to $50,000 income) | 4% |

| Individuals (over $250,000 income) | 8% |

| Small Businesses (revenue below $1 million) | 5% |

| Large Corporations (revenue over $5 million) | 7.5% |

Sales and Use Taxes: Supporting Local Businesses and Consumers

Sales and use taxes are another critical component of Jackson County’s tax landscape. These taxes are applied to the sale of goods and services within the county, as well as to the use of certain tangible personal property. The revenue generated from these taxes contributes significantly to the county’s budget, funding various public services and infrastructure improvements.

The sales tax rate in Jackson County stands at 6%, which is applied to most retail transactions. This rate is competitive with neighboring counties, ensuring that local businesses remain viable and attractive to consumers. Additionally, Jackson County has implemented a use tax to ensure fairness and compliance, especially for online purchases. The use tax is applied at the same rate as the sales tax, 6%, and is collected from consumers who purchase goods from out-of-state vendors that do not collect sales tax.

To support local businesses and encourage economic development, Jackson County offers a 1% sales tax rebate for qualifying business investments. This incentive program aims to attract new businesses and expand existing ones, fostering job creation and economic growth within the county. The rebate is available for a range of business investments, including real estate purchases, equipment acquisitions, and workforce training initiatives.

| Tax Type | Rate |

|---|---|

| Sales Tax | 6% |

| Use Tax | 6% |

Tax Benefits and Incentives in Jackson County

Jackson County recognizes the importance of fostering economic growth and community development. As such, the county has implemented a range of tax benefits and incentives designed to attract new businesses, support existing enterprises, and promote sustainable development. These initiatives not only benefit the local economy but also provide opportunities for individuals and businesses to thrive.

Business Tax Incentives: Encouraging Growth and Investment

Jackson County offers a suite of tax incentives tailored to support businesses at various stages of development. These incentives aim to encourage investment, job creation, and economic diversification within the county. One notable incentive is the Enterprise Zone Program, which provides tax breaks and credits to businesses that locate or expand within designated enterprise zones. These zones are typically areas that have been identified as economically distressed or in need of revitalization.

Businesses that qualify for the Enterprise Zone Program can benefit from a range of incentives, including:

- Property Tax Abatements: Qualifying businesses may receive a partial or full abatement of their property taxes for a specified period, typically ranging from 5 to 10 years. This incentive helps reduce the financial burden on businesses, especially during their early stages of operation.

- Income Tax Credits: The county offers income tax credits to businesses that create new jobs or invest in capital improvements within the enterprise zone. These credits can offset a portion of the business's income tax liability, providing a financial boost to support expansion and growth.

- Sales Tax Exemptions: Certain purchases made by businesses within the enterprise zone may be exempt from sales tax. This incentive encourages businesses to invest in equipment, machinery, and other assets needed to support their operations.

Additionally, Jackson County has established a Small Business Development Fund to provide financial support and resources to emerging businesses. This fund offers low-interest loans, grant opportunities, and technical assistance to help small businesses navigate the challenges of startup and growth. By supporting small businesses, the county aims to foster a vibrant and diverse local economy.

Residential Tax Benefits: Supporting Homeownership and Community Stability

Jackson County also recognizes the importance of supporting homeownership and community stability. To this end, the county has implemented a range of tax benefits aimed at making homeownership more affordable and accessible.

One notable initiative is the First-Time Homebuyer Tax Credit, which provides a credit of up to $2,000 to individuals or couples purchasing their first home within Jackson County. This credit helps offset some of the costs associated with homeownership, making it more feasible for first-time buyers to enter the housing market. To qualify, buyers must meet certain income and purchase price criteria, ensuring that the credit benefits those who need it most.

Additionally, Jackson County offers a Homestead Exemption for primary residence property owners. This exemption reduces the taxable value of a homeowner's property, resulting in lower property taxes. The exemption is particularly beneficial for seniors and long-term residents, providing stability and financial relief as they age in place. To qualify, homeowners must meet residency and income requirements, and the exemption is renewable annually.

Tax Collection and Compliance in Jackson County

Effective tax collection and compliance are essential to ensuring that Jackson County’s tax system functions smoothly and efficiently. The county employs a range of strategies and resources to collect taxes fairly and accurately, while also providing support and guidance to taxpayers.

Tax Collection Processes: Ensuring Efficient Revenue Generation

Jackson County utilizes a comprehensive tax collection system that encompasses various tax types, including property taxes, income taxes, and sales taxes. The county employs a team of dedicated tax professionals who work diligently to ensure that taxes are assessed accurately and collected in a timely manner.

For property taxes, the county conducts annual assessments to determine the value of each property. These assessments are based on a combination of factors, such as market conditions, location, and improvements made to the property. Once the assessments are complete, tax bills are issued to property owners, outlining the amount due and the payment due date. The county offers a variety of payment options, including online payments, mail-in payments, and in-person payments at designated locations.

Income tax collection in Jackson County is facilitated through a combination of voluntary compliance and enforcement measures. The county encourages taxpayers to file their income tax returns accurately and on time, providing clear guidelines and resources to assist with the filing process. For individuals and businesses that fail to comply with their tax obligations, the county has a range of enforcement tools at its disposal, including audits, penalties, and legal action.

Sales tax collection is a critical component of the county's revenue generation. Jackson County works closely with businesses to ensure that sales taxes are accurately collected and remitted to the county. The county provides businesses with the necessary tools and resources to comply with sales tax regulations, including registration processes, tax rate updates, and reporting requirements. Regular audits and inspections are conducted to ensure compliance, and penalties are imposed for non-compliance to maintain the integrity of the sales tax system.

Taxpayer Support and Education: Empowering Compliance

Jackson County understands that tax compliance can be complex and often daunting for individuals and businesses. To address this, the county provides a range of support and educational resources to empower taxpayers with the knowledge and tools needed to meet their tax obligations.

The county's website serves as a comprehensive hub for tax information, offering clear and concise explanations of tax laws, regulations, and processes. Taxpayers can access a wealth of resources, including tax forms, instructional guides, and frequently asked questions (FAQs) to assist with their tax-related inquiries. Additionally, the county hosts regular tax workshops and seminars, providing taxpayers with the opportunity to learn from tax professionals and ask questions in a supportive environment.

For businesses, Jackson County offers a dedicated Business Tax Assistance Program. This program provides personalized support and guidance to businesses navigating the complexities of tax compliance. Tax professionals work closely with business owners to ensure they understand their tax obligations, assist with tax planning and strategy, and provide resources to streamline the tax filing process. The program aims to foster a culture of compliance while reducing the administrative burden on businesses.

Furthermore, the county recognizes the importance of early intervention and outreach. Tax professionals actively engage with taxpayers who may be facing challenges with compliance, offering support and guidance to help them get back on track. This proactive approach not only ensures a higher level of compliance but also fosters a positive relationship between the county and its taxpayers.

Impact of Jackson County Taxes on the Local Economy

The tax system in Jackson County plays a pivotal role in shaping the local economy, influencing investment, business growth, and community development. Understanding the impact of taxes is essential for stakeholders, including residents, businesses, and policymakers, to make informed decisions and contribute to the county’s long-term prosperity.

Tax Revenue Allocation: Funding Essential Services and Infrastructure

The revenue generated from Jackson County’s diverse tax system is a critical source of funding for a wide range of essential services and infrastructure projects. Tax dollars are carefully allocated to support various sectors, ensuring the county’s continued growth and development.

A significant portion of tax revenue is dedicated to funding public education. Jackson County invests in its schools, providing resources for quality education and ensuring that students have access to the tools and opportunities they need to succeed. This investment not only benefits current students but also contributes to the development of a skilled workforce for the future.

Tax dollars also support public safety initiatives, including law enforcement, fire protection, and emergency response services. These essential services are vital to maintaining a safe and secure community, attracting businesses and residents, and fostering economic growth. The county's investment in public safety helps create an environment where individuals and businesses can thrive.

Additionally, tax revenue is directed towards infrastructure development and maintenance. This includes funding for road repairs and improvements, bridge maintenance, and the expansion of transportation networks. A well-maintained infrastructure network not only enhances the quality of life for residents but also supports the efficient movement of goods and services, benefiting local businesses and the overall economy.

Economic Development and Business Attraction: The Role of Tax Incentives

Jackson County’s tax incentives and benefits play a crucial role in attracting new businesses and supporting existing enterprises. These initiatives not only stimulate economic growth but also create a competitive business environment, attracting investments and job opportunities.

The county's Enterprise Zone Program, for instance, has been instrumental in revitalizing economically distressed areas. By offering tax abatements, credits, and exemptions, the program encourages businesses to locate or expand within these zones, bringing new jobs and economic activity. The resulting growth not only benefits the enterprise zones but also contributes to the overall economic health of the county.

Furthermore, the Small Business Development Fund provides critical support to emerging businesses, helping them navigate the challenges of startup and growth. By offering low-interest loans and grant opportunities, the fund empowers small businesses to thrive and contribute to the local economy. This support is particularly beneficial in nurturing innovation and entrepreneurship, which are key drivers of long-term economic prosperity.

Community Impact: Tax Benefits for Homeownership and Social Programs

Jackson County’s tax benefits and incentives also have a significant impact on the community, particularly in terms of homeownership and social programs. These initiatives aim to create a more equitable and stable environment, fostering a sense of community and belonging.

The First-Time Homebuyer Tax Credit, for example, makes homeownership more attainable for individuals and couples who may otherwise struggle to enter the housing market. By providing a financial boost, the credit helps reduce the initial costs associated with purchasing a home, empowering more residents to achieve the dream of homeownership. This, in turn, contributes to community stability and a sense of rootedness.

Additionally, the Homestead Exemption supports long-term residents, particularly seniors, by reducing their property tax burden. This exemption allows homeowners to maintain their homes without the financial strain of increasing property taxes. By providing this relief, the county demonstrates its commitment to supporting its residents, especially those who have contributed to the community for many years.

Furthermore, tax revenue is directed towards social programs that address the needs of vulnerable populations. This includes funding for healthcare initiatives, social services, and community development projects. By investing in these programs, Jackson County aims to create a more equitable and inclusive community, ensuring that all residents have access to the resources and opportunities they need to thrive.

Looking Ahead: Future Implications and Opportunities

As Jackson County continues to evolve and adapt to changing economic landscapes, the tax system will play a crucial role in shaping its future. By analyzing current trends and exploring potential opportunities, stakeholders can make informed decisions to ensure the county’s continued prosperity and sustainability.

Economic Trends and Tax Policy Adjustments

Jackson County’s economic landscape is dynamic, influenced by a range of factors including technological advancements, industry shifts, and demographic changes. As these factors evolve, the county’s tax policies must adapt to remain effective and equitable.

One emerging trend is the growth of the gig economy and remote work. As more individuals engage in freelance work and remote employment, the county may need to reconsider its tax policies to ensure fair taxation and compliance. This may involve exploring new methods of tax collection and enforcement, such as digital platforms and automated systems, to effectively capture income from these non-traditional work arrangements.

Additionally, the county may need to address the increasing complexity of tax laws and regulations. As tax codes become more intricate, providing clear guidance and support to taxpayers becomes essential. The county can invest in tax education initiatives, simplify tax forms and processes, and enhance taxpayer assistance programs to ensure compliance and reduce the administrative burden on individuals and businesses.