Understanding Palo Alto Sales Tax: What You Need to Know

As commerce increasingly shifts toward digital platforms and cross-jurisdictional transactions, understanding the nuances of regional sales tax regulations becomes an essential competency for businesses operating or selling within California, especially in complex markets like Palo Alto. While often overlooked by entrepreneurs and even established corporations, sales tax compliance holds direct implications for profitability, legal standing, and customer satisfaction. This detailed exploration delves into the intricate landscape of Palo Alto sales tax, unpacking its mechanisms, legal structure, and practical implications, equipping stakeholders with the knowledge necessary to navigate this critical aspect of modern commerce effectively.

The Foundations of Sales Tax in California and Palo Alto

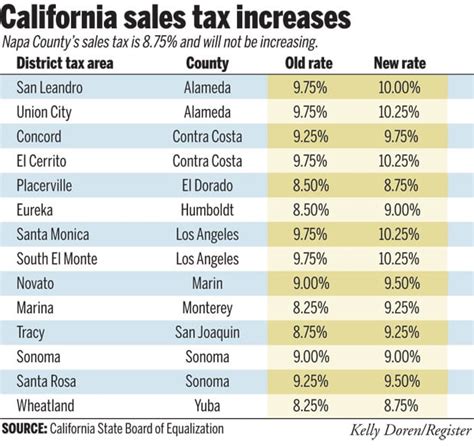

Sales tax in California is a multifaceted system governed by both state-wide legislation and local ordinances. At its core, California imposes a base state sales tax rate, which, as of 2024, stands at 7.25%. However, this rate is merely the starting point for understanding what retailers and consumers encounter at the register, particularly in jurisdictions like Palo Alto, a vibrant hub within Santa Clara County that contributes significantly to the regional economy.

The total sales tax rate in Palo Alto is a composite of the statewide base plus additional local taxes levied for various purposes such as transportation, public safety, and community development. As of 2024, Palo Alto’s combined sales tax rate approximates 9.125%, reflecting the aggregation of state, county, and city levies. This rate places Palo Alto among the higher-tax jurisdictions within California, underscoring the importance for business owners to comprehend where the tax dollars go and how to ensure compliance.

Understanding the legal foundation involves dissecting the California Revenue and Taxation Code, which grants local governments the authority to impose additional sales taxes through voter-approved measures. Consequently, the specific rate and taxability depend on current local ordinances, which are periodically updated to reflect community needs and political priorities. For businesses, the challenge lies in both accurately applying the correct rate and correctly categorizing taxable versus exempt transactions, including digital goods, services, and tangible personal property.

Mechanics of Applying Sales Tax in Palo Alto: How It Works in Practice

Applying Palo Alto sales tax requires a nuanced approach that accounts for jurisdictional boundaries, product classification, and transactional contexts. The first step in compliance is determining the origin of the sale—whether it occurs within a physical storefront or through remote, online channels. For brick-and-mortar stores, the process is straightforward: the tax rate corresponds to the location of the sale.

For remote or online transactions, the regulations have evolved significantly, especially post-2018 with the Supreme Court’s South Dakota v. Wayfair decision, which affirmed the authority of states to require out-of-state sellers to collect sales tax if they have a substantial economic nexus with the jurisdiction. In California, including Palo Alto, this means remote sellers with sales exceeding 500,000 annually in the state are now mandated to collect and remit sales tax. Consequently, e-commerce platforms and digital vendors need to integrate robust tax compliance systems that accurately calculate the correct rate based on delivery address.</p> <p>Furthermore, the taxability of specific items varies considerably. Essential tangible goods such as clothing, electronics, and furniture typically attract sales tax. However, exemptions exist for certain necessities or for specific categories like groceries and prescription medicines. Additionally, services, especially those classified as purely informational or consulting services, are generally tax-exempt, but some exceptions apply based on local ordinances or specific service categories such as digital downloads or software-as-a-service (SaaS).</p> <p>Business owners must also adhere to the correct calculation and reporting protocols, employing point-of-sale (POS) systems certified for local tax compliance and maintaining meticulous records of transactions, exemptions, and remittances. Sanctions for non-compliance include penalties, back taxes, and potential legal disputes, which complicate the fiscal landscape for unfamiliar vendors.</p> <table> <tr><th>Relevant Category</th><th>Substantive Data</th></tr> <tr><td>Standard Sales Tax Rate in Palo Alto</td><td>Approximately 9.125% as of 2024, composed of state, county, and local levies</td></tr> <tr><td>Economic Nexus Threshold</td><td>500,000 annual sales, triggering mandatory collection for remote sellers Taxable GoodsMost tangible personal property, some digital products; exemptions for necessities like certain foodstuffs and prescriptions

Legal and Regulatory Challenges Specific to Palo Alto

Palo Alto’s unique positioning at the heart of Silicon Valley tax complexities introduces challenges that extend beyond simple transactional calculations. Local voters often influence tax measures, leading to frequent changes in rate compositions and allowable exemptions. For example, recent voter-approved propositions have increased transit-related levies, impacting retail and service providers. Keeping pace with these modifications is essential for legal compliance.

Compounding this complexity is the advent of digital commerce, which complicates jurisdictional determination, especially when transactions cross multiple borders temporarily—the classic example being a California-based online retailer shipping a product that moves through multiple jurisdictions en route to the customer. The California Department of Tax and Fee Administration (CDTFA) has issued guidance to clarify these situations, yet the onus remains on vendors to apply precise location-based sales tax calculations.

Legal disputes over whether certain products or services are taxable persist, particularly in emerging sectors such as online streaming, cloud-based SaaS, and intangible digital assets. Courts have sometimes sided with consumers or digital providers arguing for broader exemptions or different tax treatment, but the overarching principle remains: accurate, transparent, and well-documented compliance is non-negotiable for future-proofing operations.

Implications for Business Strategy and Consumer Confidence

Understanding and managing sales tax in Palo Alto is not solely a matter of legal compliance—it directly impacts strategic planning, pricing, and consumer trust. For retailers contemplating pricing models, the inclusion of tax considerations can influence competitive positioning. A comprehensive view may involve adjusting net prices to remain attractive while ensuring margins are preserved after tax remittance.

Moreover, consumers are increasingly aware of the tax implications of their purchases. Transparency about sales tax components fosters trust and reduces cart abandonment in online markets. Digital platforms that clearly communicate tax inclusion or addition at checkout tend to outperform those that obscure the tax calculation process.

From a broader perspective, local tax revenues sustain Palo Alto’s infrastructure, public services, and community development initiatives. Businesses should view tax collection not merely as a compliance task but as an integral part of corporate social responsibility that contributes to the community’s vitality. Responsible tax practices enhance brand reputation and build goodwill among civic stakeholders and consumers alike.

Best Practices for Managing Sales Tax in Palo Alto

Successful navigation of Palo Alto’s sales tax landscape involves a multi-pronged strategy:

- Regularly updated compliance systems: Partnering with reputable tax software providers and maintaining ongoing education about local regulations.

- Robust record-keeping: Ensuring detailed documentation for all transactions, exemptions, and filings for audit preparedness.

- Staff training: Equipping sales and finance teams with current information and operational procedures for tax collection and remittance.

- Monitoring legislative changes: Subscribing to updates from California tax authorities and local government notices to adapt swiftly.

- Customer communication: Transparently conveying tax details during the purchasing process to cultivate consumer confidence and loyalty.

Key Points

- Understanding the layered structure of California sales tax is key to compliance in Palo Alto’s jurisdiction.

- Applying accurate, location-specific tax rates enhances legal adherence and customer satisfaction.

- Emerging digital commerce challenges necessitate adaptive, technology-driven solutions.

- Proactive legal and financial planning mitigates risks associated with evolving regulations and court rulings.

- Effective sales tax management supports broader strategic goals including brand reputation and community engagement.

What are the current sales tax rates in Palo Alto, and how are they determined?

+The total sales tax rate in Palo Alto as of 2024 is approximately 9.125%, combining state, county, and city levies. This rate is determined based on legislative measures, voter-approved measures, and local ordinances, which are subject to change with policy updates and fiscal needs.

How does digital commerce impact tax collection in Palo Alto?

+Digital commerce introduces complexity by enabling remote sales across jurisdictions; California’s economic nexus threshold requires remote sellers with over $500,000 in sales to collect and remit sales tax. Proper integration of tax technology is essential to remain compliant across physical and digital channels.

Are digital goods and services taxable in Palo Alto?

+Many digital goods, such as downloadable software or e-books, are taxable if classified as tangible personal property under California law. However, certain services like streaming or online subscriptions may qualify for exemption, depending on specific local and state regulations.

What strategies can businesses use to manage sales tax effectively in Palo Alto?

+Implementing integrated, real-time tax calculation tools, maintaining meticulous records, staying informed about legislative changes, and transparent customer communication are all best practices to ensure compliance while supporting business growth in Palo Alto’s competitive environment.