Illinois Gas Tax

The Illinois Gas Tax is a critical component of the state's revenue system, funding infrastructure projects and maintaining the quality of its transportation network. This excise tax, levied on gasoline and other motor fuels, plays a pivotal role in shaping the state's economic landscape and the daily lives of its residents.

The state's gas tax has been a subject of interest and debate, especially considering its impact on consumer spending and the overall economy. With the cost of living rising and economic pressures mounting, understanding the intricacies of the Illinois Gas Tax becomes increasingly important.

The History and Structure of Illinois Gas Tax

The history of the Illinois Gas Tax dates back to the early 20th century when the state first introduced the tax to generate revenue for road construction and maintenance. Since then, the tax has evolved to meet the changing needs of the state’s infrastructure and economic environment.

Illinois has a unique approach to its gas tax structure, employing a two-tiered system. The state imposes a base rate of $0.38 per gallon on gasoline and a variable rate on top of that, which is adjusted annually based on the Consumer Price Index (CPI) for Chicago. This variable rate ensures that the tax remains responsive to inflation and the changing costs of maintaining the state's roads and bridges.

The Illinois Gas Tax is not only a source of revenue for the state but also a tool for economic management. By adjusting the tax rate, the state can influence consumer behavior and, to some extent, control the pace of economic growth.

The Impact of Gas Tax on Illinois Residents

For Illinois residents, the gas tax is a significant expense. With the state’s vast network of highways and the reliance on personal vehicles for transportation, the cost of gas directly affects the daily lives and budgets of millions. The tax’s influence extends beyond the pump, impacting industries such as transportation, logistics, and tourism, which are integral to the state’s economy.

The tax has also been a subject of political discourse, with debates over its fairness and effectiveness. Some argue that it disproportionately affects lower-income households, while others highlight the need for a stable source of funding for infrastructure projects.

| Year | Base Rate ($/gallon) | Variable Rate ($/gallon) |

|---|---|---|

| 2021 | 0.38 | 0.08 |

| 2022 | 0.38 | 0.11 |

| 2023 | 0.38 | 0.14 |

Illinois Gas Tax and Infrastructure Development

The primary purpose of the Illinois Gas Tax is to fund infrastructure development and maintenance. The revenue generated is crucial for projects ranging from road repairs to the construction of new highways and bridges. These projects not only enhance the state’s transportation network but also create jobs and stimulate economic growth.

However, despite the tax's contribution, Illinois, like many other states, faces a significant infrastructure funding gap. This gap has led to delayed maintenance and construction projects, impacting the quality of roads and the overall efficiency of the transportation network.

Economic Implications and Consumer Behavior

The gas tax’s impact on the economy is multifaceted. While it generates revenue for the state, it also influences consumer spending and business operations. Higher gas prices can lead to reduced consumer spending in other areas, impacting the retail and service sectors. Businesses, especially those reliant on transportation, face increased operational costs, which can affect their profitability and growth prospects.

On the other hand, the tax also encourages the adoption of fuel-efficient vehicles and alternative transportation methods, promoting environmental sustainability and reducing the state's carbon footprint.

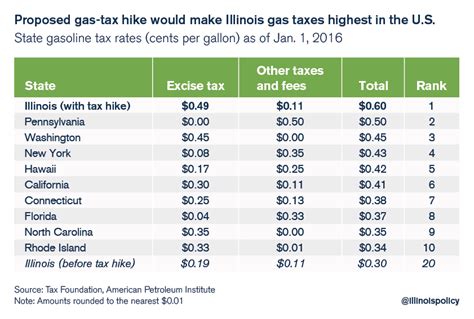

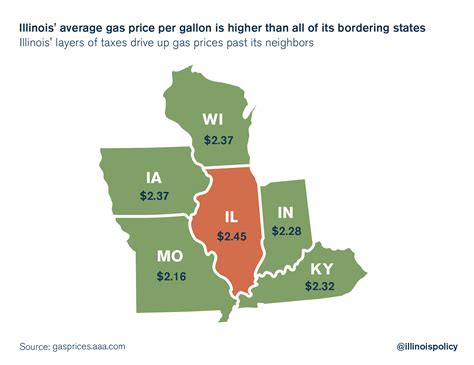

Comparative Analysis: Illinois Gas Tax vs. Other States

Illinois’ gas tax structure and rates are often compared to those of other states to assess its competitiveness and fairness. While the base rate is relatively standard across the country, the variable rate and its adjustment mechanism set Illinois apart.

Some states opt for a simpler structure with a fixed rate, while others, like Illinois, use a more dynamic approach. The CPI-linked variable rate ensures that the tax remains current and responsive to economic changes, a feature that is advantageous in a rapidly evolving economic landscape.

| State | Gas Tax Rate ($/gallon) | Adjustment Mechanism |

|---|---|---|

| California | 0.63 (including additional fees) | Fixed rate, adjusted periodically |

| Texas | 0.39 | Fixed rate |

| New York | 0.42 | Fixed rate, with additional regional fees |

| Illinois | 0.38 (base) + 0.14 (variable) | CPI-linked variable rate |

The Future of Illinois Gas Tax: Policy Considerations

Looking ahead, several policy considerations come into play when discussing the future of the Illinois Gas Tax. With the state’s infrastructure needs evolving and the economy changing, the tax structure may require adjustments to remain effective.

One potential consideration is the introduction of a road usage charge, a concept gaining traction in several states. This would involve charging motorists based on the miles they drive, rather than the amount of fuel they consume. Such a system could provide a more sustainable and equitable source of funding for infrastructure, especially as electric vehicles become more prevalent.

Additionally, there is a need to balance the tax's impact on different income groups and ensure that it remains fair and progressive. This may involve exploring tax credits or rebates for lower-income households, which could mitigate the tax's regressive nature.

Conclusion: Navigating the Complex Landscape of Gas Taxation

The Illinois Gas Tax is a complex and critical component of the state’s revenue and economic strategy. Its structure and rate adjustments have significant implications for residents, businesses, and the overall economy.

As the state continues to balance its infrastructure needs with economic realities, the gas tax will remain a focal point of policy discussions and a key factor in Illinois' economic development and sustainability.

How often is the Illinois Gas Tax rate adjusted?

+

The variable rate of the Illinois Gas Tax is adjusted annually based on the Consumer Price Index (CPI) for Chicago. This ensures that the tax rate keeps pace with inflation and the changing costs of infrastructure maintenance.

What is the primary purpose of the Illinois Gas Tax revenue?

+

The primary purpose of the Illinois Gas Tax revenue is to fund infrastructure development and maintenance, including road repairs, new highway construction, and bridge maintenance.

How does the Illinois Gas Tax compare to other states in terms of rate and structure?

+

Illinois’ gas tax structure, with its base rate and CPI-linked variable rate, sets it apart from many other states. While the base rate is relatively standard, the variable rate and its adjustment mechanism make Illinois’ tax more dynamic and responsive to economic changes.

What are the potential future directions for Illinois Gas Tax policy?

+

Potential future directions for Illinois Gas Tax policy include the exploration of a road usage charge, which would charge motorists based on miles driven rather than fuel consumed. Additionally, there may be considerations to make the tax more progressive through tax credits or rebates for lower-income households.