Hawaii State Tax Refund Status

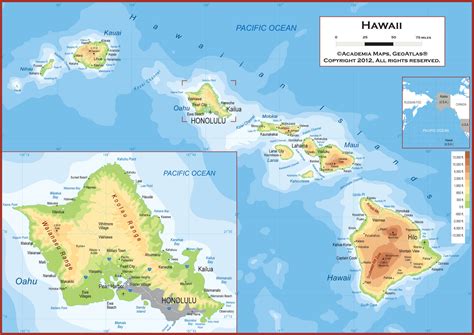

The Hawaii State Tax Refund Status is a crucial topic for many residents and taxpayers in the beautiful state of Hawaii. It involves understanding the process of claiming and receiving tax refunds, which can be a significant financial boost for individuals and families. In this comprehensive guide, we will delve into the intricacies of the Hawaii State Tax Refund process, offering an in-depth analysis and practical insights to help you navigate this important financial aspect of living in Hawaii.

Understanding the Hawaii State Tax System

Hawaii operates under a unique state tax system, which differs from many other states in the US. The state imposes an income tax on individuals and businesses, and understanding this system is key to comprehending the tax refund process. Hawaii's tax system is progressive, meaning that higher income levels are taxed at higher rates. This progressive structure aims to ensure fairness and provide essential revenue for the state's operations and services.

The Hawaii Department of Taxation oversees the state's tax collection and refund processes. They provide resources and guidance to help taxpayers navigate the system, including detailed instructions on how to file tax returns and claim refunds.

Taxable Income and Rates

Hawaii's tax system applies to various sources of income, including wages, salaries, business profits, and investment earnings. The state has multiple tax brackets, with tax rates ranging from 1.4% to 11%, depending on the taxable income level. It's important to note that Hawaii does not have a flat tax rate, so understanding your specific tax bracket is crucial for accurate tax planning and refund expectations.

| Tax Rate | Taxable Income Range |

|---|---|

| 1.4% | $0 - $2,999 |

| 3.2% | $3,000 - $7,999 |

| 5.6% | $8,000 - $12,999 |

| 7.25% | $13,000 - $29,999 |

| 8.25% | $30,000 - $249,999 |

| 10.25% | $250,000 - $399,999 |

| 11% | $400,000 and above |

These tax rates are applicable for the 2023 tax year and may be subject to change in future years. It's important to refer to the official Hawaii Department of Taxation website for the most up-to-date tax information.

Filing Deadlines and Methods

Hawaii typically follows a standard tax filing deadline of April 15th for individual tax returns. However, this deadline can be extended under certain circumstances, such as natural disasters or other unforeseen events. It's essential to stay updated on any changes to the filing deadlines to ensure compliance.

Taxpayers in Hawaii have several options for filing their tax returns. They can choose to file electronically, either through the Hawaii e-filing system or authorized tax preparation software. Electronic filing is generally the most efficient and secure method, offering faster processing times and reduced errors.

For those who prefer traditional methods, paper tax returns can be mailed to the Hawaii Department of Taxation. However, this option may take longer to process and may not be suitable for complex tax situations.

Claiming a Hawaii State Tax Refund

Claiming a tax refund in Hawaii involves a straightforward process, provided you have overpaid your taxes during the tax year. Here's a step-by-step guide to help you navigate the refund claim process:

Step 1: Determine Eligibility

Before claiming a refund, ensure you are eligible. This means you must have overpaid your taxes for the tax year. Common reasons for overpayment include withholding too much from your paychecks or having additional income sources that are not subject to withholding.

Review your tax return carefully to identify any overpayments. If you're unsure, consult a tax professional or use online tax refund calculators to estimate your potential refund.

Step 2: Gather Necessary Documents

To claim your refund, you'll need certain documents to support your claim. These typically include:

- A completed and accurate tax return for the relevant tax year.

- W-2 forms or other income statements showing your earnings and tax withholdings.

- Any relevant receipts or documentation supporting deductions or credits claimed.

- If you're claiming a refund for a deceased individual, you'll need a death certificate and proof of your relationship to the deceased.

Step 3: Choose Your Refund Method

Hawaii offers multiple options for receiving your tax refund. You can opt for direct deposit, which is the fastest and most secure method. With direct deposit, your refund is deposited directly into your bank account, typically within 7-10 business days of your return being processed.

Alternatively, you can choose to receive your refund via check. This method may take longer, with checks typically arriving within 3-4 weeks of processing. However, it's important to note that checks are mailed to the address on your tax return, so ensure your address is up-to-date.

Step 4: File Your Tax Return

Once you've gathered your documents and chosen your refund method, it's time to file your tax return. You can file electronically or by mail, depending on your preference and the complexity of your tax situation.

If filing electronically, ensure you have the necessary software or access to the Hawaii e-filing system. Follow the instructions carefully and double-check your return for accuracy before submission.

For paper returns, ensure you use the correct forms and provide all required information. Mail your return to the address specified by the Hawaii Department of Taxation, ensuring it arrives before the filing deadline.

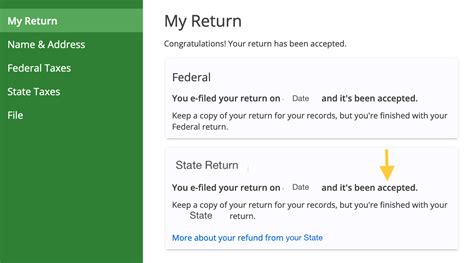

Step 5: Track Your Refund Status

After filing your tax return, you'll likely want to keep track of your refund status. Hawaii provides an online tool called "Where's My Refund?" which allows taxpayers to check the status of their refunds. This tool is typically available within 24 hours of filing electronically and provides real-time updates on the processing of your refund.

To use the "Where's My Refund?" tool, you'll need your Social Security Number, filing status, and the exact amount of your expected refund. This information can be found on your tax return.

Factors Affecting Hawaii State Tax Refunds

Several factors can impact the amount of your Hawaii state tax refund. Understanding these factors can help you optimize your tax planning and ensure you receive the maximum refund possible.

Withholding and Estimated Tax Payments

The amount you withhold from your paychecks or make in estimated tax payments plays a significant role in determining your refund. If you withhold too much, you'll likely receive a refund. On the other hand, if you underwithhold, you may owe taxes when filing your return.

To optimize your withholding, review your W-4 form regularly and adjust your allowances or additional withholding amounts as needed. This ensures you're not overpaying or underpaying throughout the year.

Deductions and Credits

Deductions and credits can significantly reduce your taxable income and increase your refund. Hawaii offers various deductions and credits, including those for education expenses, child care costs, and certain medical expenses. Ensure you claim all applicable deductions and credits to maximize your refund.

Keep in mind that some deductions and credits have income limitations or specific eligibility criteria. Research these carefully and consult a tax professional if needed to ensure you're claiming the right deductions and credits for your situation.

Taxable Income Changes

Changes in your taxable income during the year can also impact your refund. For example, if you receive a bonus or additional income, it may push you into a higher tax bracket, resulting in a lower refund or even a tax liability.

On the other hand, if your income decreases due to job loss or reduced hours, you may be eligible for additional credits or deductions, increasing your refund. It's important to stay updated on any changes in your financial situation and adjust your tax planning accordingly.

Common Questions and Considerations

Can I check my Hawaii state tax refund status online?

+Yes, you can check your Hawaii state tax refund status online using the "Where's My Refund?" tool provided by the Hawaii Department of Taxation. You'll need your Social Security Number, filing status, and the exact amount of your expected refund to access this tool.

How long does it take to receive my Hawaii state tax refund?

+The processing time for Hawaii state tax refunds can vary. If you file electronically and choose direct deposit, you can expect to receive your refund within 7-10 business days of your return being processed. For paper returns or checks, it may take up to 3-4 weeks.

What if I don't receive my Hawaii state tax refund on time?

+If you don't receive your Hawaii state tax refund within the expected timeframe, you can contact the Hawaii Department of Taxation to inquire about the status of your refund. They can provide specific updates and assist you in resolving any delays.

Can I amend my Hawaii state tax return if I made a mistake?

+Yes, you can amend your Hawaii state tax return if you discover a mistake or need to make changes. You'll need to file an amended return, typically using Form N-10A. It's important to review your return carefully before filing to minimize the need for amendments.

Are there any special considerations for Hawaii state tax refunds for military personnel or retirees?

+Hawaii has specific provisions for military personnel and retirees regarding state tax refunds. Military personnel may be eligible for certain deductions and credits, such as the Military Spouse Deduction or the Hawaii Military Exclusion Zone Credit. It's important to consult the Hawaii Department of Taxation's resources or a tax professional to ensure you're claiming all applicable benefits.

The Hawaii State Tax Refund process can be complex, but with the right knowledge and tools, it becomes more manageable. By understanding the state’s tax system, claiming your refund efficiently, and staying informed about factors affecting your refund, you can ensure a smooth and rewarding tax experience. Remember to consult the Hawaii Department of Taxation’s resources and seek professional advice when needed.