Ca Tax And Fee

Welcome to our comprehensive guide on the complex world of California's tax and fee system. As a business owner or an individual residing in the Golden State, understanding the intricacies of this system is crucial for financial planning and compliance. In this expert-led article, we will delve into the specifics of California's tax and fee structure, providing you with valuable insights and practical knowledge to navigate this essential aspect of doing business or living in California.

Unraveling the Complexity: An Overview of California’s Tax and Fee Landscape

California, known for its vibrant economy and diverse industries, has a unique tax and fee structure that can often be challenging to comprehend. From state income taxes to sales and use taxes, property taxes, and various other fees, the system is intricate and multifaceted. Our aim is to demystify this complexity and offer a clear roadmap for individuals and businesses alike.

State Income Tax: A Progressive Approach

California’s income tax system follows a progressive structure, meaning that higher income levels are taxed at increasingly higher rates. As of the 2023 tax year, the state has six income tax brackets, ranging from 1% to 12.3%, with each bracket applying to a specific portion of an individual’s taxable income. For instance, for single filers, the first bracket applies to income up to 9,999, with a tax rate of 1%. As income increases, so does the tax rate, with the highest bracket applying to income over 1,043,472.

| Income Tax Brackets for California Residents (2023) | Tax Rate |

|---|---|

| Income up to $9,999 | 1% |

| $10,000 - $25,099 | 2% |

| $25,100 - $36,749 | 4% |

| $36,750 - $52,749 | 6% |

| $52,750 - $286,359 | 8% |

| $286,360 and above | 12.3% |

It's important to note that these tax rates are subject to change annually, and the brackets may be adjusted to account for inflation. Additionally, California offers various tax credits and deductions that can reduce the overall tax liability for both individuals and businesses.

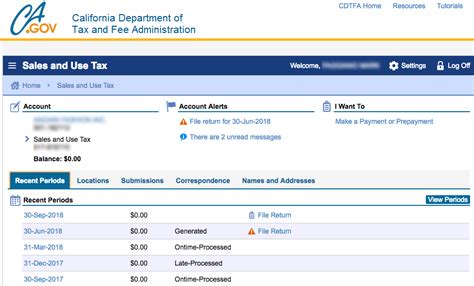

Sales and Use Tax: A Dual System

California employs a dual system for sales and use taxes, which means that both the state and local governments impose these taxes. The state sales and use tax rate is 7.25%, but when combined with local taxes, the total rate can vary significantly across different regions within the state. For instance, in the city of Los Angeles, the total sales tax rate is 9.5%, while in San Francisco, it’s 8.75%.

| City | Total Sales Tax Rate |

|---|---|

| Los Angeles | 9.5% |

| San Francisco | 8.75% |

| San Diego | 8.0% |

| Sacramento | 8.5% |

| Santa Monica | 10.25% |

Sales tax is applied to most retail transactions, while use tax is charged on goods purchased from out-of-state vendors and used within California. This ensures that all goods are taxed equally, regardless of where they are purchased.

Property Tax: A Long-Standing Tradition

California’s property tax system is deeply rooted in the state’s history, with Proposition 13 of 1978 serving as a cornerstone. This initiative limits property tax rates to 1% of the assessed value and caps annual increases at 2% or the inflation rate, whichever is lower. As a result, property taxes in California are generally lower than in many other states.

However, it's important to note that the assessed value can increase significantly when a property is sold or undergoes improvements. This "reassessment" can lead to higher property tax bills, even with the annual cap in place.

Other Fees and Taxes: A Varied Landscape

Beyond the major taxes, California imposes a myriad of smaller fees and taxes that contribute to the overall tax burden. These can include vehicle registration fees, business license fees, franchise taxes, and various other industry-specific taxes and fees.

For instance, the state imposes a $150 annual fee for electric vehicle registration, which helps fund environmental programs. Similarly, businesses engaged in specific industries, such as banking or insurance, may be subject to additional taxes and fees.

Compliance and Reporting: A Crucial Aspect of Tax Management

Navigating California’s tax landscape is only half the battle; the other half lies in ensuring compliance and accurate reporting. Failure to comply with tax laws can result in penalties, interest, and even legal consequences.

Filing Deadlines and Penalties

Understanding the filing deadlines for various taxes is crucial to avoid late filing penalties. For instance, the deadline for filing California state income tax returns is typically April 15th, coinciding with the federal deadline. However, if the due date falls on a weekend or holiday, the deadline is extended to the next business day.

Late filing penalties can be significant, ranging from 5% to 25% of the unpaid tax liability, depending on the severity of the delay. Additionally, interest accrues on the unpaid tax amount at a rate of 4% per year.

Tax Registration and Permits

Before engaging in any taxable activity, it’s essential to register with the appropriate tax agencies. This includes registering for a Seller’s Permit if you’re selling taxable goods or services, or obtaining a Business License for certain professions or industries.

Failure to register can result in fines and penalties, and in some cases, businesses may be required to pay taxes and fees retroactively, along with interest and penalties.

Tax Return Preparation and Submission

Preparing and filing tax returns accurately is crucial to ensure compliance. This process can be complex, especially for businesses with multiple tax obligations. It’s advisable to seek professional assistance from tax preparers or accountants who specialize in California tax laws.

Electronic filing is encouraged by the state, as it's faster, more secure, and reduces the risk of errors. Most tax returns can be filed electronically through the California Franchise Tax Board's website.

Tax Planning and Strategies: Maximizing Benefits and Minimizing Burden

Effective tax planning is a strategic approach to managing tax obligations, maximizing benefits, and minimizing the overall tax burden. Here, we explore some key strategies that individuals and businesses can employ to achieve these goals.

Tax Credits and Deductions

California offers a wide range of tax credits and deductions that can significantly reduce tax liabilities. These include credits for research and development, film and television production, hiring veterans, and various other incentives aimed at promoting economic growth and sustainability.

For instance, the Research and Development Tax Credit provides a credit of up to 15% of qualified research expenses, encouraging innovation and technological advancement. Similarly, the Film and Television Production Tax Credit offers a 25% credit for qualified expenditures, supporting the state's thriving entertainment industry.

Tax-Efficient Business Structures

The choice of business structure can have a significant impact on tax obligations. In California, sole proprietorships and partnerships are taxed at the individual level, while corporations and limited liability companies (LLCs) are taxed at the entity level. Each structure has its own advantages and disadvantages in terms of tax liability and reporting requirements.

For instance, corporations are subject to double taxation, with profits taxed at the corporate level and then again at the individual level when distributed as dividends. In contrast, LLCs offer pass-through taxation, where profits and losses are reported on the owners' personal tax returns.

Strategic Investment and Asset Management

Investing in certain assets or industries can lead to tax advantages. For instance, California offers tax incentives for investing in renewable energy projects, such as solar or wind power. These incentives can take the form of tax credits, accelerated depreciation, or other benefits.

Additionally, strategic asset management can help reduce tax liabilities. For instance, selling assets at a loss can offset capital gains, reducing the overall tax burden. Similarly, charitable contributions of appreciated assets can provide a tax deduction while avoiding capital gains taxes.

Conclusion: Navigating California’s Tax and Fee System with Confidence

California’s tax and fee system is a complex web of regulations, rates, and obligations. However, with the right knowledge and strategic planning, individuals and businesses can navigate this landscape with confidence. Understanding the intricacies of this system is the first step towards effective tax management, compliance, and financial planning.

We hope this guide has provided valuable insights and practical advice for those living and doing business in California. Remember, staying informed, seeking professional guidance, and staying proactive are key to success in managing California's tax and fee obligations.

How often are tax rates and brackets updated in California?

+Tax rates and brackets are typically updated annually to account for inflation and other economic factors. The California Franchise Tax Board announces any changes before the start of the new tax year.

Are there any tax breaks or incentives for small businesses in California?

+Yes, California offers various tax incentives for small businesses, including tax credits for hiring veterans, investing in renewable energy, and conducting research and development. These incentives aim to support small businesses and promote economic growth.

What is the penalty for late filing of tax returns in California?

+Late filing penalties in California can range from 5% to 25% of the unpaid tax liability, depending on the severity of the delay. Additionally, interest accrues on the unpaid tax amount at a rate of 4% per year. It’s crucial to file tax returns on time to avoid these penalties.

How does California’s property tax system work, and can I contest my property tax assessment?

+California’s property tax system is governed by Proposition 13, which limits property tax rates to 1% of the assessed value and caps annual increases at 2% or the inflation rate. If you believe your property tax assessment is incorrect, you can appeal to the county assessor’s office within a specified timeframe.

Are there any tax advantages for investing in certain industries in California?

+Yes, California offers tax incentives for investing in various industries, such as renewable energy, film and television production, and research and development. These incentives can take the form of tax credits, accelerated depreciation, or other benefits, encouraging investment and job creation.