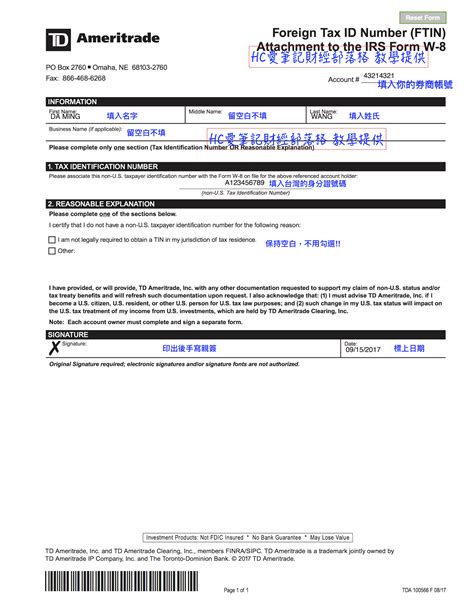

7 Essential Tips to Simplify Davidson County Tax Payments

Navigating the intricacies of Davidson County tax payments often resembles trying to decipher a complex puzzle—each piece interconnected, yet seemingly overwhelming at first glance. How can residents and business owners streamline this process, ensuring timely and accurate payments without the redundancy of redundant steps or lingering confusion? To answer this, we must explore the foundational principles of local tax systems, the common pitfalls faced by taxpayers, and pragmatic strategies rooted in both tax law and technology integration. In essence, simplifying Davidson County tax payments isn't merely about ease; it’s about empowering individuals with knowledge and tools that foster transparency, efficiency, and compliance.

Understanding Davidson County’s Taxation Landscape

Before diving into tips and actionable strategies, what fundamental questions should one ask to grasp the scope and structure of Davidson County’s tax obligations? Is there a clear delineation between property taxes, income taxes, and sales taxes in the county? How do changes in legislation or policy affect payment procedures, and what are the historical trends that influence current practices? Analyzing the evolution of Davidson County’s tax system reveals that a well-structured process combines legal clarity, technological support, and proactive engagement from taxpayers.

What are the core categories of taxes applicable to Davidson County residents and businesses?

Primarily, property taxes constitute a significant revenue source, with assessments based on property valuation models rooted in real estate market trends. Meanwhile, sales and use taxes contribute notably to county funding, complemented by income tax considerations aligned with Tennessee state law. Each category operates under distinct assessment timelines, payment schedules, and reporting mechanisms, prompting a layered approach to compliance. Recognizing these differences is fundamental to understanding how to streamline interactions with the system.

| Relevant Category | Substantive Data |

|---|---|

| Property Tax | Assessment based on real estate valuation; due biannually; average property tax rate around 0.75% of appraised value |

| Sales Tax | Current combined rate approximately 9.25%; collected at point of sale; remitted monthly or quarterly |

| Income Tax | State-level; local implications minimal; annual filings align with federal tax deadlines |

Seven Tips to Simplify Davidson County Tax Payments

1. Embrace Electronic Payment Platforms

Is your current method of payment adding unnecessary complexity? Transitioning to online portals like the Davidson County Trustee’s website facilitates seamless transactions, reduces paperwork, and offers instant confirmation. Not only does digital payment reduce mailing delays, but it also enables automated reminders aligned with your tax deadlines. For example, setting up recurring payments for property taxes ensures punctuality and minimizes manual oversight.

2. Maintain Accurate and Up-to-Date Records

Could outdated information be the silent cause of missed payments or penalties? Regularly reviewing property valuations, exemption statuses, and business registration details ensures that your tax calculations are precise. This practice guards against surprises during audit periods or reassessments, simplifying your financial recordkeeping and reducing stress.

3. Use Tax Preparation and Management Software

How can technology shift your tax years from chaos to clarity? Modern software solutions tailored for tax management can aggregate income data, generate reminders, and even pre-fill forms based on historical inputs. Such tools connect directly with county reporting systems, aligning your entries with official records—cutting down time spent on manual data entry and reducing human error.

4. Leverage Professional Tax Assistance Strategically

Does engaging with tax professionals add a layer of safety and efficiency? Seasoned tax advisors familiar with Davidson County’s regulations can identify eligible exemptions or deductions you might overlook. At the same time, their expertise streamlines audit preparation and ensures compliance with evolving legal requirements, ultimately saving both time and money in the long run.

5. Monitor and Investigate Your Tax Assessments

What if you regularly scrutinized your assessment notices? Understanding how property values or taxable thresholds shift over time helps proactively challenge inaccuracies. Questioning questionable values through formal appeals can reduce overpayment burdens, simplifying your financial commitments and aligning your payments with actual valuation.

6. Plan Ahead with Budgeting and Forecasting

Are you setting aside adequate funds ahead of tax due dates? Anticipatory budgeting based on historical data prevents cash flow shortfalls during payment periods. Incorporating monthly or quarterly allocations into your financial routine transforms tax payments from a last-minute scramble into a routine component of your fiscal discipline.

7. Stay Informed on Policy Changes and Deadlines

Could missed announcements be the hidden pitfalls in your tax management? Subscribing to official county updates or newsletters ensures you’re aware of upcoming deadlines, rate adjustments, or procedural amendments. Staying informed turns a reactive process into a proactive strategy, significantly reducing unintentional late payments.

Key Points

- Adopting electronic payment methods streamlines fiscal transactions and minimizes delays.

- Maintaining meticulously updated records prevents errors and eases audits.

- Using dedicated software tools enhances accuracy and reduces manual effort.

- Expert consultation can uncover savings opportunities and ensure compliance.

- Proactive assessment reviews and appeals foster fair taxation.

- Forecasting aligns financial planning with tax obligations, ensuring readiness.

- Staying informed invalidates surprises, reinforcing a confident tax strategy.

Overcoming Common Challenges in Davidson County Tax Compliance

Where do most taxpayers stumble, and what questions could help address these issues? Is the primary obstacle the technical complexity, or perhaps the voluminous regulatory updates? For instance, why do some avoid digital platforms despite their proven efficiency? Perhaps learning from both successful case studies and pitfalls could illuminate pathways to further simplification.

How can you systematically address and prevent payment errors?

Methodologies such as routine reconciliation of account statements, establishing alerts for due dates, and engaging with local authorities during open forums can preempt mistakes. Moreover, a mindset attuned to continuous learning about local policies cultivates resilience during periods of regulatory shifts.

What are the main benefits of online tax payments in Davidson County?

+Online payments offer speed, convenience, immediate confirmation, and less risk of postal delays, making compliance both easier and more reliable.

How often should I review my property valuation assessments?

+Annually, particularly after major market shifts or reassessment notices, to ensure valuations reflect current market conditions.

Are there programs available to assist small businesses in tax compliance?

+Yes, Davidson County offers workshops, digital guides, and one-on-one consultations to help small business owners navigate complex tax obligations effectively.