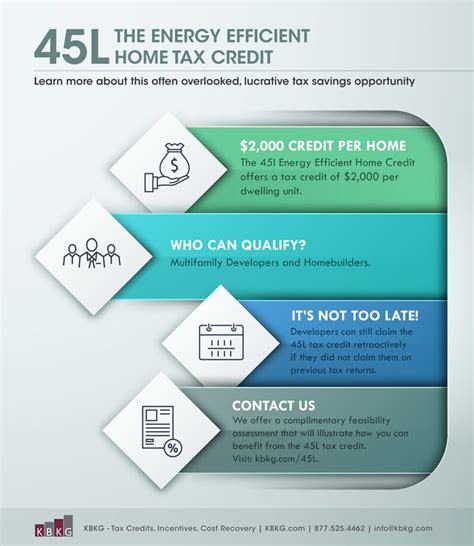

45L Tax Credit

The 45L Tax Credit, a powerful incentive in the United States' renewable energy sector, is an essential tool for promoting the development and adoption of energy-efficient homes. This tax credit, established by the Internal Revenue Service (IRS), provides a significant financial boost to those who invest in energy-efficient residential properties. With the growing global focus on sustainability and environmental responsibility, the 45L Tax Credit stands out as a critical mechanism for encouraging greener living and reducing carbon footprints.

Understanding the 45L Tax Credit

The 45L Tax Credit, a provision of the Internal Revenue Code, offers a $2,000 tax credit for each energy-efficient home constructed or rehabilitated. To qualify, homes must meet rigorous energy efficiency standards, which are designed to significantly reduce energy consumption and promote sustainable living practices. This credit is not only a financial incentive but also a driver for innovation in the construction industry, pushing builders and developers to adopt cutting-edge technologies and methods that minimize environmental impact.

Eligibility Criteria

Eligibility for the 45L Tax Credit is determined by the home’s energy efficiency. To qualify, a home must meet either of the following standards: the International Energy Conservation Code (IECC) for residential buildings, or the Energy Star qualification criteria. The IECC sets a benchmark for energy efficiency in residential construction, while Energy Star is a widely recognized symbol of energy efficiency for various products, including homes.

For homes to be eligible for the full $2,000 credit, they must achieve a 50% energy savings threshold relative to the IECC or Energy Star reference standards. This means the home must use at least 50% less energy than a comparable home built to code.

| Eligibility Criteria | Details |

|---|---|

| IECC Compliance | Meets or exceeds the IECC standards for energy efficiency |

| Energy Star Qualification | Qualified as Energy Star certified home |

The Impact and Benefits of the 45L Tax Credit

The 45L Tax Credit has had a significant impact on the construction and real estate industries, fostering a shift towards more sustainable practices. By incentivizing energy-efficient construction, this tax credit has encouraged builders to incorporate innovative energy-saving technologies and design strategies. This has not only reduced the carbon footprint of new homes but has also led to increased comfort and reduced utility costs for homeowners.

Financial Incentives and Cost Savings

The financial benefits of the 45L Tax Credit are substantial. For every eligible home constructed or rehabilitated, builders can claim a $2,000 tax credit. This credit can significantly offset construction costs, making energy-efficient homes more affordable and attractive to potential buyers. Moreover, energy-efficient homes often have lower operating costs due to reduced energy consumption, leading to long-term savings for homeowners.

| Financial Benefits | Description |

|---|---|

| $2,000 Tax Credit | Incentive for each eligible home constructed or rehabilitated |

| Lower Operating Costs | Energy-efficient homes have reduced energy consumption, leading to lower utility bills |

Environmental and Social Impact

Beyond the financial incentives, the 45L Tax Credit has a profound environmental and social impact. By encouraging the construction of energy-efficient homes, this tax credit contributes to the reduction of greenhouse gas emissions and the conservation of natural resources. Energy-efficient homes use less energy, which means less reliance on fossil fuels and a decrease in carbon emissions. This not only helps combat climate change but also promotes a more sustainable and environmentally friendly housing sector.

From a social perspective, energy-efficient homes offer improved comfort and health benefits to residents. These homes are designed to maintain consistent temperatures, reducing the need for excessive heating or cooling. They also often feature better insulation and ventilation systems, which can lead to improved indoor air quality and a healthier living environment.

Implementing the 45L Tax Credit: A Step-by-Step Guide

To ensure that builders and developers can effectively utilize the 45L Tax Credit, a clear understanding of the process and requirements is essential. Here’s a comprehensive guide to implementing this tax credit.

Step 1: Understanding the Eligibility Requirements

As mentioned earlier, homes must meet either the IECC or Energy Star standards to be eligible for the 45L Tax Credit. It’s crucial to understand these standards and ensure that the construction or rehabilitation project aligns with them. This may involve working with energy efficiency experts or consultants to ensure compliance.

Step 2: Documenting Energy Efficiency

To claim the 45L Tax Credit, builders must document the energy efficiency of the home. This involves collecting and organizing various documents, including energy efficiency test results, certifications, and other relevant paperwork. These documents will be crucial when it comes to claiming the credit.

Step 3: Claiming the Tax Credit

When it’s time to file taxes, builders can claim the 45L Tax Credit on IRS Form 8904. This form requires detailed information about the energy-efficient home, including its location, square footage, and the methods used to achieve energy efficiency. It’s important to consult with a tax professional or accountant to ensure that the credit is claimed correctly and in compliance with IRS regulations.

Future Prospects and Potential Changes

The 45L Tax Credit has been a successful incentive for promoting energy-efficient homes, but like many tax policies, it is subject to potential changes and updates. As the focus on sustainability and energy efficiency continues to grow, the parameters and incentives offered by this tax credit may evolve.

Potential Policy Updates

One potential change could involve increasing the tax credit amount to further incentivize energy-efficient construction. This could make the credit even more attractive to builders and developers, potentially leading to a wider adoption of sustainable building practices. Additionally, the eligibility criteria might be adjusted to encourage the use of even more advanced energy-saving technologies and strategies.

The Role of Renewable Energy Sources

As the world moves towards a more sustainable energy future, the integration of renewable energy sources in residential construction could become a significant focus. This could include the increased use of solar panels, wind turbines, and other renewable energy technologies in homes. The 45L Tax Credit could play a crucial role in encouraging the adoption of these technologies by offering additional incentives for their integration.

Conclusion: A Sustainable Future with the 45L Tax Credit

The 45L Tax Credit is a powerful tool in the drive towards a more sustainable and energy-efficient housing sector. By incentivizing builders and developers to construct energy-efficient homes, this tax credit is helping to reduce our environmental impact and promote greener living. With its financial benefits, environmental advantages, and potential for future growth, the 45L Tax Credit is a key component in the transition to a more sustainable future.

What is the 45L Tax Credit and how does it work?

+

The 45L Tax Credit is a $2,000 tax credit offered to builders or developers for each energy-efficient home constructed or rehabilitated. To qualify, homes must meet either the International Energy Conservation Code (IECC) or Energy Star standards, achieving at least 50% energy savings relative to these benchmarks.

Who is eligible for the 45L Tax Credit?

+

Builders and developers of energy-efficient homes are eligible for the 45L Tax Credit. Homes must meet the energy efficiency standards set by the IECC or Energy Star to qualify.

How can I claim the 45L Tax Credit?

+

To claim the 45L Tax Credit, you’ll need to complete IRS Form 8904. This form requires detailed information about the energy-efficient home, including its location, square footage, and methods used to achieve energy efficiency. It’s recommended to consult with a tax professional for guidance.

Are there any potential changes to the 45L Tax Credit in the future?

+

While the specifics are unknown, there is a possibility of changes to the 45L Tax Credit in the future. This could include an increase in the tax credit amount, adjustments to the eligibility criteria, or additional incentives for integrating renewable energy sources in residential construction.