Philadelphia Real Estate Taxes

Philadelphia, the City of Brotherly Love, is renowned for its vibrant culture, rich history, and diverse neighborhoods. As one of the largest cities in the United States, Philadelphia offers a unique blend of urban living and historic charm. However, for property owners, one significant aspect of city life is understanding and navigating the Philadelphia real estate tax system. These taxes play a crucial role in funding public services and infrastructure, impacting both residents and businesses alike.

Unraveling the Complexities of Philadelphia Real Estate Taxes

Philadelphia’s real estate tax structure is a comprehensive system designed to generate revenue for the city’s operations and maintenance. The tax is calculated based on the assessed value of a property, which is determined by the Office of Property Assessment (OPA). This assessment process is a critical component, as it directly influences the tax liability for each property owner.

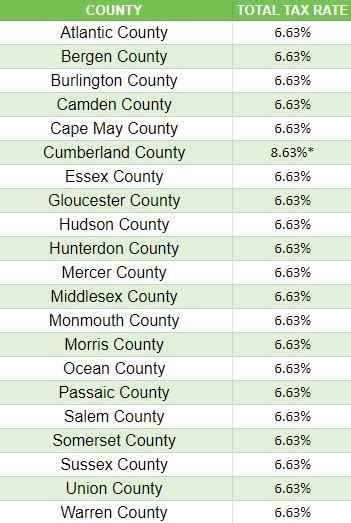

The tax rate in Philadelphia is expressed as a millage rate, where one mill is equal to $0.001. This rate is applied to the assessed value of the property to calculate the tax liability. For instance, if a property has an assessed value of $100,000 and the millage rate is 20 mills, the annual real estate tax would be $2,000. This rate can vary based on the property's location within the city and its classification, such as residential or commercial.

One notable aspect of Philadelphia's real estate tax system is the presence of tax abatements and incentives. These are designed to encourage development and support certain types of properties. For example, the city offers a 10-year tax abatement for new construction and substantial renovations, providing a significant relief for property owners during the initial years of ownership.

Understanding the Assessment Process

The assessment process in Philadelphia is a critical step in determining real estate tax liabilities. The OPA conducts regular assessments, typically every five years, to ensure that property values are accurately reflected. This involves evaluating factors such as property size, improvements, and market conditions. Property owners have the right to appeal their assessments if they believe the value is inaccurate, a process that is essential for ensuring fairness in the tax system.

During an assessment, the OPA may consider various factors, including recent sales of comparable properties, rental income, and the cost of construction or improvements. This comprehensive approach aims to provide an accurate valuation, which directly impacts the tax rate and overall tax burden for property owners.

| Assessment Year | Millage Rate (Residential) | Millage Rate (Commercial) |

|---|---|---|

| 2023 | 20.09 | 20.09 |

| 2022 | 20.15 | 20.15 |

| 2021 | 20.30 | 20.30 |

Tax Relief Programs: A Lifeline for Homeowners

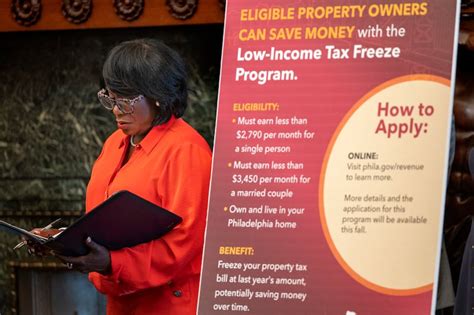

Philadelphia recognizes the impact of real estate taxes on its residents, especially those with limited means. To address this, the city offers a range of tax relief programs designed to ease the burden on eligible homeowners. These programs include the Homestead Exemption, which provides a reduction in assessed value for owner-occupied residential properties, and the Senior Citizen Real Estate Tax Freeze, which stabilizes real estate taxes for qualifying senior citizens.

The Homestead Exemption is a significant benefit, reducing the assessed value of a homeowner's primary residence by up to $30,000. This reduction directly impacts the real estate tax liability, making it a valuable incentive for homeowners to remain in the city. Similarly, the Senior Citizen Real Estate Tax Freeze ensures that eligible seniors do not face increasing tax burdens as property values rise, providing stability and peace of mind during their retirement years.

Navigating the Real Estate Market: A Complex Equation

Philadelphia’s real estate market is a dynamic and complex landscape, influenced by a multitude of factors. From historic row homes in Center City to modern developments in University City, the city offers a diverse range of properties. Understanding the interplay between property values, tax assessments, and the overall market trends is crucial for both buyers and investors.

For buyers, the real estate tax structure is a critical consideration. While Philadelphia's tax rates are generally competitive compared to other major cities, the impact of assessments and potential increases over time can significantly affect a property's affordability. Additionally, the presence of tax abatements and incentives can make certain properties more attractive, especially for those looking to invest or develop.

Investors, on the other hand, must navigate the market with a keen eye for opportunities. The real estate tax system, along with other economic factors, can influence investment strategies. For instance, the availability of tax abatements may encourage investment in specific neighborhoods or property types. However, investors must also consider the long-term implications of tax liabilities and potential changes in the tax landscape.

Performance Analysis: A Snapshot of Philadelphia’s Real Estate Tax Landscape

A comprehensive analysis of Philadelphia’s real estate tax system reveals several key insights. Firstly, the city’s tax rates, while subject to fluctuations, are generally stable and competitive. This stability provides a degree of predictability for property owners and investors, allowing for effective financial planning. Secondly, the presence of tax abatements and incentives has been a strategic move by the city to stimulate development and support economic growth.

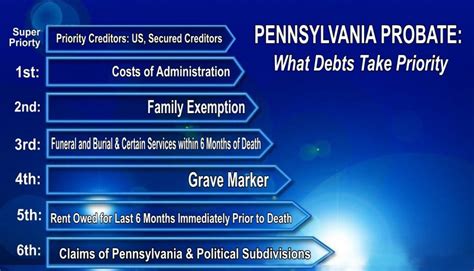

However, the real estate tax system also faces challenges. The assessment process, while thorough, can be complex and time-consuming. Property owners often navigate a bureaucratic maze when appealing assessments, which can lead to delays and uncertainties. Additionally, the city's reliance on real estate taxes as a primary revenue source may limit its flexibility in responding to economic downturns or unexpected challenges.

Future Implications: A Balancing Act for Philadelphia

Looking ahead, Philadelphia’s real estate tax system is likely to face evolving pressures and opportunities. As the city continues to grow and develop, the demand for public services and infrastructure will increase, putting pressure on the tax base. The city will need to carefully balance the need for revenue with the impact on its residents and businesses.

One potential strategy is to explore alternative revenue streams, such as increasing the tax base through targeted economic development initiatives. Additionally, the city may consider reevaluating its tax structure to ensure fairness and efficiency. This could involve revisiting tax rates, reassessing the impact of abatements and incentives, and exploring options for tax relief programs that provide broader support to residents.

How often are real estate taxes due in Philadelphia?

+Real estate taxes in Philadelphia are typically due in two installments: March 31st and October 31st of each year. Property owners receive a bill with the tax amount due, and late payments may incur penalties.

Are there any online resources to estimate my real estate taxes in Philadelphia?

+Yes, the Philadelphia Office of Property Assessment provides an online tax estimator tool. This tool allows property owners to input their address and receive an estimate of their real estate taxes based on the current millage rate and assessment value.

What happens if I disagree with my property assessment in Philadelphia?

+If you believe your property assessment is inaccurate, you have the right to appeal. The process involves submitting an appeal to the Board of Revision of Taxes (BRT) within a specified timeframe. The BRT will review your case and make a determination.

Are there any tax relief programs for low-income homeowners in Philadelphia?

+Yes, Philadelphia offers several tax relief programs for low-income homeowners. These include the Homestead Exemption, which reduces the assessed value of owner-occupied residential properties, and the Senior Citizen Real Estate Tax Freeze, which stabilizes taxes for qualifying seniors.

How do I pay my real estate taxes in Philadelphia?

+Philadelphia offers various payment methods for real estate taxes. You can pay online through the city’s official website, by mail with a check or money order, or in person at designated payment centers. Ensure you have your tax bill and follow the instructions provided.