Mn Income Tax Refund

The Minnesota Income Tax Refund is a crucial aspect of the state's tax system, offering financial relief to eligible residents. This article delves into the intricacies of the Minnesota Income Tax Refund, providing an in-depth analysis of its benefits, eligibility criteria, and the process of claiming it. We will explore the various aspects of this tax refund, offering valuable insights for taxpayers in Minnesota.

Understanding the Minnesota Income Tax Refund

The Minnesota Income Tax Refund, often referred to as the “Minnesota Income Tax Rebate” or simply the “Income Tax Refund,” is a tax relief program designed to provide financial support to eligible Minnesota residents. It is an essential component of the state’s tax system, offering a means for taxpayers to reclaim a portion of the income taxes they have paid.

This refund is particularly beneficial for individuals and families who meet specific criteria, such as having a low to moderate income, being elderly, or having certain medical conditions. It serves as a way to offset the financial burden of state taxes and can provide a much-needed boost to households' financial stability.

The Historical Context

The concept of income tax refunds in Minnesota dates back to the early 20th century when the state began implementing progressive tax policies. Over the years, these refund programs have evolved, adapting to the changing needs of the state’s residents and the economic landscape.

In recent years, the Minnesota Income Tax Refund has gained significant attention due to its potential impact on the state's economy and its role in supporting low- and middle-income households. As of 2023, the state has allocated substantial funds towards these refunds, recognizing their importance in fostering economic stability and growth.

Benefits and Impact

The Minnesota Income Tax Refund offers a range of benefits to eligible taxpayers. Firstly, it provides a direct financial benefit, allowing individuals to reclaim a portion of their hard-earned income. This refund can significantly reduce the financial strain caused by state taxes, especially for those on fixed or limited incomes.

Moreover, the refund program stimulates the local economy. When taxpayers receive their refunds, they often reinvest this money into the community, supporting local businesses and contributing to economic growth. This multiplier effect can have a positive impact on employment rates and overall economic development.

Additionally, the refund serves as a safety net for vulnerable populations. For elderly individuals or those with medical conditions, the refund can provide essential financial support, helping them maintain their standard of living and access necessary healthcare services.

Eligibility and Criteria

Understanding the eligibility criteria for the Minnesota Income Tax Refund is crucial for taxpayers seeking to claim this benefit. While the exact criteria can vary based on legislative changes and annual budget allocations, there are some fundamental requirements that remain consistent.

Income Limits

The primary eligibility factor is the taxpayer’s income. The state sets specific income limits, and individuals or households whose income falls within these limits are eligible to apply for the refund. These income limits are adjusted annually to account for inflation and changes in the cost of living.

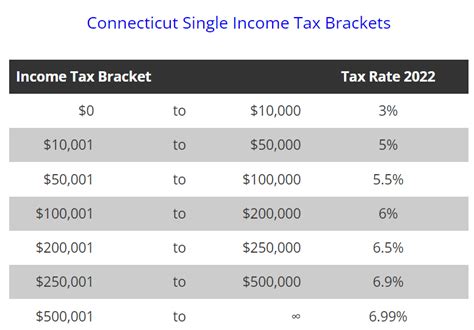

| Eligibility Category | Income Limit |

|---|---|

| Single Taxpayers | $36,000 |

| Married Couples | $48,000 |

| Head of Household | $42,000 |

It's important to note that these income limits are adjusted based on the number of dependents and other specific circumstances. For instance, individuals with dependents may have higher income limits, and certain medical conditions or disabilities can also impact eligibility.

Residency Requirements

To be eligible for the Minnesota Income Tax Refund, taxpayers must be residents of the state. This requirement ensures that the benefits are directed towards individuals who are contributing to and supporting the state’s economy.

The residency criteria typically involve meeting specific residency tests, such as maintaining a primary residence in Minnesota for a certain period and filing taxes as a resident. Temporary absences, such as for work or education, generally do not impact eligibility as long as the primary residence remains in the state.

Other Eligibility Factors

Beyond income and residency, there are additional factors that can influence eligibility. For example, individuals who receive certain government benefits, such as Social Security or veterans’ benefits, may be eligible for the refund. Similarly, those who are enrolled in specific healthcare programs or have certain medical expenses may also meet the criteria.

It's crucial for taxpayers to review the specific guidelines provided by the Minnesota Department of Revenue to ensure they meet all the necessary eligibility requirements.

The Application Process

Claiming the Minnesota Income Tax Refund involves a straightforward application process, which is designed to be accessible to all eligible taxpayers. The key steps in this process include:

Step 1: Gather Necessary Documentation

Before initiating the application, taxpayers should gather all relevant documentation. This typically includes:

- Proof of residency, such as a driver’s license or utility bills.

- Income statements, including pay stubs, tax returns, and other income verification documents.

- Information on dependents, such as birth certificates or adoption papers.

- Documentation of any applicable government benefits or medical expenses.

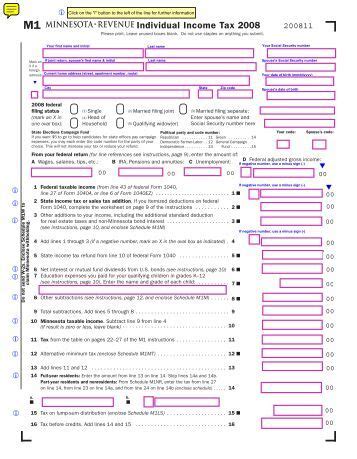

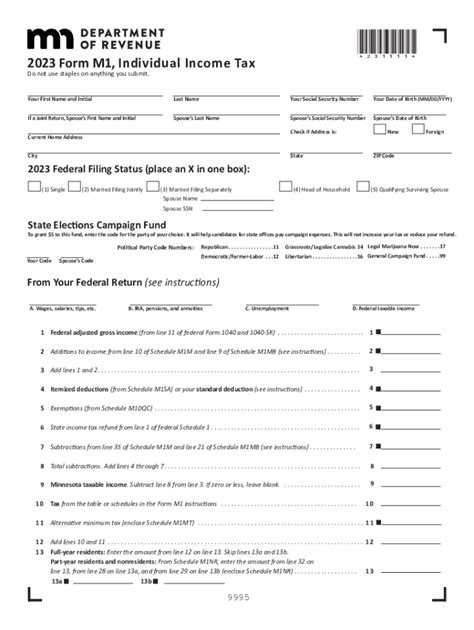

Step 2: Complete the Application Form

The application form for the Minnesota Income Tax Refund is available on the Minnesota Department of Revenue’s website. This form requires detailed information about the taxpayer’s income, residency, and any other relevant factors. It’s crucial to complete this form accurately and provide all the required details.

For individuals who face challenges with online applications, the state also provides assistance through local community centers and tax preparation services.

Step 3: Submit the Application

Once the application form is completed, taxpayers can submit it electronically or by mail. The preferred method of submission is often specified on the application form, and taxpayers should ensure they adhere to the provided guidelines.

For electronic submissions, taxpayers can typically track the status of their application online. In the case of mailed applications, it's advisable to use a trackable delivery service to ensure the application reaches the department.

Step 4: Await Processing and Approval

After submitting the application, taxpayers should allow sufficient time for processing. The timeframe for processing and approval can vary based on the volume of applications and the complexity of the case. The Minnesota Department of Revenue aims to process applications as quickly as possible, but taxpayers should be prepared for some wait time.

During the processing period, taxpayers can check the status of their application online or by contacting the department's customer service. Once the application is approved, the refund will be issued, typically through direct deposit or a mailed check.

Maximizing Your Refund

To ensure you receive the maximum benefit from the Minnesota Income Tax Refund, there are several strategies you can employ. These strategies can help optimize your refund and make the most of this financial support.

1. Understand the Tax Code

Staying informed about the state’s tax code and any changes that impact the Income Tax Refund is crucial. The tax code can be complex, and understanding it can help you identify any potential benefits or deductions you may be eligible for.

The Minnesota Department of Revenue provides extensive resources, including guides and publications, to help taxpayers navigate the tax code. These resources can be invaluable in maximizing your refund.

2. Take Advantage of Deductions and Credits

The Minnesota tax system offers various deductions and credits that can reduce your taxable income and increase your refund. Some common deductions and credits include:

- The Minnesota Working Family Credit, which provides a refundable credit for low- to moderate-income working families.

- The Property Tax Refund, which can help offset the cost of property taxes for homeowners and renters.

- Deductions for medical expenses, charitable contributions, and certain business expenses.

Consulting with a tax professional or utilizing tax preparation software can help you identify and claim all eligible deductions and credits.

3. Plan Your Filing Strategy

Strategizing your tax filing can significantly impact your refund. For instance, if you have multiple sources of income, considering the timing of your filings can affect your refund amount. Filing your federal and state returns simultaneously may result in a more efficient refund process.

Additionally, if you are eligible for the Minnesota Income Tax Refund, ensure you file your state return even if you do not owe any taxes at the federal level. This is crucial for claiming your refund.

4. Stay Updated on Legislative Changes

Tax laws and refund programs can undergo changes from year to year. Staying updated on these changes can ensure you don’t miss out on any new benefits or provisions. The Minnesota Department of Revenue regularly publishes updates and news on its website, keeping taxpayers informed.

Conclusion

The Minnesota Income Tax Refund is a valuable program that provides financial relief to eligible residents. By understanding the eligibility criteria, following the application process, and employing strategies to maximize your refund, you can make the most of this beneficial program.

As you navigate the world of tax refunds and benefits, remember to stay informed, seek professional guidance when needed, and take advantage of the resources available to ensure you receive the support you're entitled to.

Frequently Asked Questions

How do I know if I’m eligible for the Minnesota Income Tax Refund?

+

Eligibility for the Minnesota Income Tax Refund is primarily based on your income and residency status. The state sets income limits, and if your income falls within these limits, you may be eligible. Additionally, you must be a resident of Minnesota, which typically involves maintaining a primary residence in the state and filing taxes as a resident.

What is the maximum amount I can receive as a refund?

+

The maximum refund amount varies based on your income, family size, and other factors. Generally, the refund amount is a percentage of your total income tax liability, with specific thresholds and limits set by the state. For the most up-to-date information on maximum refund amounts, it’s best to refer to the Minnesota Department of Revenue’s website or consult a tax professional.

Can I apply for the refund if I’m a student or a part-time worker?

+

Yes, students and part-time workers can be eligible for the Minnesota Income Tax Refund if their income falls within the specified limits and they meet the residency requirements. The refund is not limited to full-time employees or a specific type of income. As long as you meet the income and residency criteria, you may be eligible regardless of your employment status.

What happens if I miss the application deadline?

+

Missing the application deadline can result in a loss of eligibility for the current tax year. However, it’s important to note that the deadline for applying for the Minnesota Income Tax Refund is often flexible, and the state may allow extensions in certain circumstances. If you miss the initial deadline, it’s recommended to contact the Minnesota Department of Revenue to inquire about late filing options and potential extensions.

Can I apply for the refund if I’m not a U.S. citizen?

+

Eligibility for the Minnesota Income Tax Refund is not solely based on citizenship status. Non-citizens who are lawful permanent residents (green card holders) and meet the income and residency criteria can be eligible for the refund. However, certain types of non-resident aliens may not qualify. It’s advisable to consult the specific guidelines provided by the Minnesota Department of Revenue or seek professional tax advice to determine your eligibility as a non-citizen.