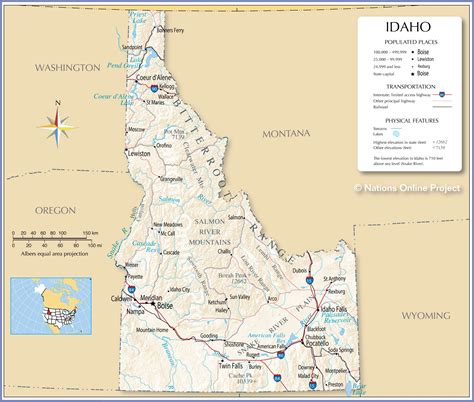

Idaho Income Tax Calculator

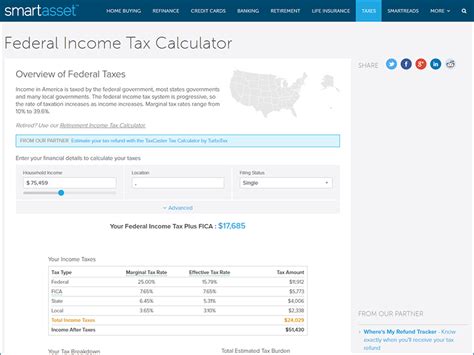

Welcome to our comprehensive guide on the Idaho Income Tax Calculator, an essential tool for residents and taxpayers in the state of Idaho. In this article, we will delve into the intricacies of calculating your Idaho income tax, providing you with a step-by-step process and valuable insights to ensure an accurate and efficient tax calculation. With a deep understanding of Idaho's tax laws and regulations, we aim to empower you with the knowledge and tools needed to navigate the tax landscape with confidence.

Understanding Idaho’s Income Tax Structure

Idaho employs a progressive income tax system, which means that your tax liability increases as your income rises. This system ensures fairness by requiring higher-income earners to contribute a larger portion of their income towards state revenue. The state has implemented a set of tax brackets and corresponding tax rates, which we will explore in detail, to determine your specific tax liability.

Idaho's income tax is calculated based on your taxable income, which is the amount remaining after deductions and exemptions are applied to your gross income. The state offers a range of deductions and credits to reduce your taxable income, allowing you to keep more of your hard-earned money. Let's explore the process of calculating your Idaho income tax step by step.

Step-by-Step Guide to Calculating Idaho Income Tax

Step 1: Determine Your Taxable Income

Start by calculating your gross income, which includes all sources of income such as wages, salaries, self-employment earnings, investment income, and any other taxable income. From there, subtract any applicable deductions and exemptions to arrive at your taxable income. Idaho offers a standard deduction, as well as the option to itemize deductions if it results in a larger reduction of your taxable income.

Step 2: Identify Your Tax Bracket

Idaho's income tax brackets are divided into various income ranges, each with a corresponding tax rate. By referring to the official tax tables provided by the Idaho State Tax Commission, you can identify the bracket that applies to your taxable income. It's important to note that Idaho has separate tax brackets for single filers, married couples filing jointly, and head of household filers, so be sure to select the appropriate bracket for your filing status.

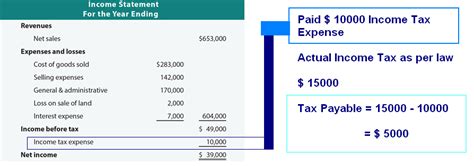

Step 3: Calculate Your Tax Liability

Once you have identified your tax bracket, apply the corresponding tax rate to your taxable income. This calculation will give you a preliminary tax liability. However, Idaho also offers various tax credits, such as the Earned Income Tax Credit (EITC) and Child Tax Credit, which can further reduce your tax burden. Ensure you claim any applicable credits to arrive at your final tax liability.

Step 4: Consider Additional Factors

Idaho's tax system takes into account various additional factors that can impact your tax liability. These include adjustments for income from specific sources, such as capital gains or rental income, as well as any applicable local taxes or surcharges. Be sure to account for these factors to ensure an accurate calculation.

Step 5: Estimate Your Tax Refund or Liability

After completing the calculations, you can estimate whether you are due for a tax refund or if you have a tax liability. If you have overpaid your taxes throughout the year, you are entitled to a refund. Conversely, if your tax liability exceeds the amount you have paid, you may need to make additional payments to the state.

Example Calculation: Idaho Income Tax Scenario

Let’s illustrate the calculation process with a practical example. Consider a single filer with a taxable income of 50,000 for the tax year. By referring to the Idaho tax brackets, we find that this income falls within the 5.9% tax bracket for single filers. Applying this rate to the taxable income, we calculate a preliminary tax liability of 2,950.

However, our filer also qualifies for the Earned Income Tax Credit, which provides a credit of $1,500. By subtracting this credit from the preliminary tax liability, we arrive at a final tax liability of $1,450. This means our filer is due for a tax refund of $50 (assuming they have paid $1,500 in estimated taxes throughout the year).

| Tax Bracket | Tax Rate | Taxable Income Range |

|---|---|---|

| 1% | 1.0% | $0 - $2,000 |

| 2% | 2.0% | $2,001 - $4,000 |

| 3% | 3.0% | $4,001 - $6,000 |

| 4% | 4.0% | $6,001 - $8,000 |

Maximizing Your Tax Benefits: Strategies and Tips

To make the most of your tax situation, here are some strategies and tips to consider:

- Take Advantage of Deductions and Credits: Explore all eligible deductions and credits to reduce your taxable income and overall tax liability. From standard deductions to education credits, there are various opportunities to lower your tax burden.

- Optimize Your Filing Status: Idaho offers different tax brackets for various filing statuses. Review your options and choose the status that provides the most favorable tax treatment for your situation.

- Plan for Capital Gains: If you have realized capital gains from the sale of assets, understand the tax implications and consider strategies to minimize the impact. Holding assets for longer periods or utilizing tax-efficient investment vehicles can help reduce your tax liability.

- Explore Retirement Account Contributions: Contributing to retirement accounts, such as IRAs or 401(k)s, can provide tax advantages. These contributions reduce your taxable income and offer long-term growth potential.

- Utilize Tax Software or Professional Services: Consider using tax software or engaging the services of a tax professional to ensure an accurate and efficient tax calculation. These tools can help you navigate the complexities of Idaho's tax system and maximize your deductions and credits.

Staying Informed: Idaho Tax Resources and Updates

To stay up-to-date with Idaho’s tax laws and regulations, it’s essential to regularly consult reliable sources. The Idaho State Tax Commission provides official guidance, tax forms, and resources on their website. Additionally, tax publications and updates from reputable accounting firms and financial institutions can offer valuable insights into the latest tax developments.

Furthermore, staying informed about federal tax laws is crucial, as they can impact your state tax obligations. Changes at the federal level, such as tax reform or new deductions, may have implications for Idaho's tax system. Monitoring federal tax news and updates can help you anticipate and plan for any potential changes.

Conclusion: Empowering Idaho Taxpayers

Calculating your Idaho income tax can be a complex process, but with the right tools and knowledge, it becomes a manageable task. By understanding Idaho’s tax structure, utilizing the Idaho Income Tax Calculator, and implementing strategic tax planning, you can ensure an accurate and optimized tax calculation. Remember to stay informed about tax laws, explore deductions and credits, and consider seeking professional guidance when needed.

As you navigate the world of Idaho taxes, remember that your tax obligations are a crucial aspect of your financial well-being and contribute to the state's overall prosperity. By taking a proactive approach to tax planning, you can maximize your tax benefits and make the most of your hard-earned income.

What is the Idaho Income Tax Calculator, and how does it work?

+The Idaho Income Tax Calculator is a specialized tool designed to assist taxpayers in calculating their Idaho state income tax liability. It takes into account various factors such as taxable income, deductions, credits, and tax brackets to determine the amount of tax owed or the potential refund. The calculator simplifies the tax calculation process by applying the appropriate tax rates and considering any applicable tax laws and regulations.

Are there any deductions or credits available for Idaho taxpayers?

+Yes, Idaho offers a range of deductions and credits to reduce taxpayers’ taxable income and overall tax liability. These include the standard deduction, itemized deductions for specific expenses, and credits such as the Earned Income Tax Credit (EITC), Child Tax Credit, and various education credits. It’s important to review the eligibility criteria and requirements for each deduction and credit to maximize your tax benefits.

How often are Idaho’s tax laws and regulations updated?

+Idaho’s tax laws and regulations can be subject to changes and updates on an annual basis. The Idaho State Tax Commission is responsible for implementing any modifications to the tax code, which may include adjustments to tax rates, brackets, deductions, or credits. It’s crucial to stay informed about these changes to ensure compliance and take advantage of any new tax benefits.