Arkansas State Tax Refund Status

When it comes to tax refunds, staying informed about the status of your Arkansas state tax refund is essential. This comprehensive guide will walk you through the process, providing you with all the necessary information and insights to navigate the refund journey efficiently. By understanding the timelines, tracking options, and potential factors influencing your refund, you can ensure a smooth and stress-free experience.

Understanding the Arkansas State Tax Refund Process

The Arkansas Department of Finance and Administration (DFA) is responsible for processing state tax refunds. Each year, the DFA receives and processes a significant number of tax returns, with refunds issued promptly for those who are eligible. Understanding the basic timeline and procedures can help taxpayers anticipate when to expect their refunds.

Timeline for Arkansas State Tax Refunds

The processing timeline for Arkansas state tax refunds typically begins shortly after the filing deadline. Here’s a breakdown of the key stages:

- Filing Deadline: Arkansas tax returns are due by April 15th, aligning with the federal tax deadline. Filing promptly can help ensure timely processing.

- Processing Period: Once received, the DFA aims to process returns within 4-6 weeks. However, this timeframe may vary based on the complexity of the return and the volume of filings.

- Refund Issuance: After processing, refunds are typically issued within 2-3 weeks. The DFA uses direct deposit or check, depending on the taxpayer’s preference indicated on their return.

Tracking Your Arkansas State Tax Refund

Staying informed about the status of your refund is crucial. The DFA offers several methods for taxpayers to track their Arkansas state tax refund:

- Online Refund Tracker: The DFA provides an online tool, accessible through its website, that allows taxpayers to check the status of their refund. This tool is updated regularly, providing real-time information on the processing stage.

- Phone Inquiries: Taxpayers can also call the DFA’s refund hotline to speak with a representative and receive updates on their refund status. The hotline is available during business hours.

- Email Notifications: Upon filing their return, taxpayers can opt to receive email notifications from the DFA. These emails provide updates when the return is received, processed, and when the refund is issued.

Factors Influencing Arkansas State Tax Refund Timelines

While the DFA strives for timely processing, several factors can impact the refund timeline:

- Return Complexity: Returns with complex transactions, such as business income or rental property deductions, may require additional review, impacting the processing time.

- Errors or Omissions: Inaccurate or incomplete information on the tax return can lead to delays. The DFA may need to contact the taxpayer to clarify or correct the information.

- Fraud Prevention Measures: The DFA employs robust security measures to prevent tax refund fraud. These measures, while necessary, can occasionally cause processing delays as returns undergo additional scrutiny.

Accelerating Your Arkansas State Tax Refund

Taxpayers can take several steps to potentially speed up the refund process:

- File Electronically: Electronic filing is the fastest and most efficient way to submit your tax return. It reduces the chance of errors and ensures a quicker turnaround.

- Choose Direct Deposit: Opting for direct deposit, rather than a paper check, can significantly reduce the time it takes to receive your refund. Direct deposits are typically processed within 1-2 weeks after the refund is issued.

- Avoid Filing Errors: Review your tax return carefully before submission. Common errors, such as incorrect social security numbers or math mistakes, can delay processing.

Arkansas State Tax Refund: A Real-Life Example

To illustrate the process, let’s consider a hypothetical scenario:

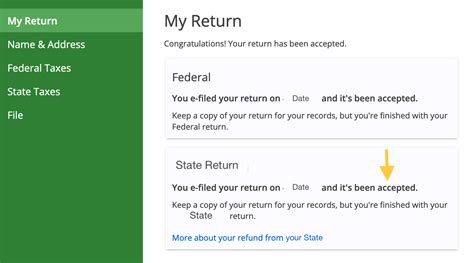

John, a resident of Little Rock, filed his Arkansas state tax return electronically on April 10th. He opted for direct deposit and accurately reported his income and deductions. The DFA received his return promptly, and within 3 weeks, John received an email notification that his return was being processed.

A week later, John checked the online refund tracker, which indicated that his refund had been approved and was scheduled for direct deposit within 3 business days. True to the timeline, John received his refund on the anticipated date, approximately 4-5 weeks after filing.

Arkansas State Tax Refund: Technical Specifications

Understanding the technical aspects of the refund process can provide further insights:

| Specification | Details |

|---|---|

| Filing Methods | Arkansas taxpayers can file their state tax returns electronically or via paper filing. Electronic filing is highly encouraged for its speed and accuracy. |

| Refund Methods | The DFA offers two refund options: direct deposit and paper check. Taxpayers can choose their preferred method when filing their return. |

| Online Refund Tracker | The DFA’s online refund tracker is accessible through its website. Taxpayers can use this tool to check the status of their refund by entering their social security number and expected refund amount. |

| Refund Hotline | The DFA’s refund hotline number is 501-682-7183. Taxpayers can call this number during business hours to speak with a representative and receive updates on their refund status. |

Arkansas State Tax Refund: Performance Analysis

Examining the DFA’s performance in processing tax refunds provides valuable insights:

- Timeliness: On average, the DFA processes tax refunds within the promised 4-6 week timeframe. However, during peak filing seasons, processing times may extend slightly.

- Accuracy: The DFA prioritizes accuracy in refund processing. While errors are rare, taxpayers should carefully review their returns to minimize the chance of delays.

- Security Measures: The DFA’s robust security protocols contribute to a low incidence of tax refund fraud. These measures ensure that refunds are issued to the rightful recipients.

Arkansas State Tax Refund: Future Implications

Looking ahead, the DFA is committed to continuous improvement in tax refund processing:

- Enhanced Online Services: The DFA plans to further develop its online services, making it easier for taxpayers to file returns, track refunds, and receive notifications.

- Fraud Prevention: While the DFA’s current security measures are effective, ongoing advancements in technology will allow for even stronger fraud prevention, ensuring taxpayers’ refunds are protected.

- Refunding Timelines: The DFA aims to reduce processing times, particularly during peak filing seasons, to provide taxpayers with quicker access to their refunds.

How can I check the status of my Arkansas state tax refund online?

+You can check the status of your Arkansas state tax refund online by visiting the DFA’s website and using the online refund tracker. You’ll need your social security number and expected refund amount to access your refund status.

What if my Arkansas state tax refund is delayed or I haven’t received it after the expected timeframe?

+If your Arkansas state tax refund is delayed or you haven’t received it after the expected timeframe, there are a few steps you can take. First, verify the status of your refund using the online refund tracker or by calling the DFA’s refund hotline. If your refund is still processing, be patient, as it may take a few more days. If the refund has been issued but you haven’t received it, contact the DFA to inquire about the status of the payment and provide them with any necessary information to facilitate its resolution.

Can I file an amended Arkansas state tax return if I made a mistake on my original return?

+Yes, if you discover a mistake on your Arkansas state tax return, you can file an amended return to correct the error. The process involves completing Form AR-100X and providing the necessary documentation to support the changes. It’s important to carefully review your amended return before submitting it to avoid further delays.