Sales Tax On A Car In Nj

Navigating the sales tax landscape in New Jersey can be a complex affair, especially when it comes to purchasing a vehicle. The Garden State, like many others, imposes sales tax on various goods and services, including automobiles. This article aims to delve into the specifics of sales tax on cars in New Jersey, providing a comprehensive guide for prospective car buyers and those curious about the financial aspects of car ownership in the state.

Understanding Sales Tax in New Jersey

Sales tax in New Jersey is a state-mandated tax imposed on the sale of tangible personal property and certain services. The state’s sales tax rate is currently set at 6.625%, which is applied to the total purchase price of a vehicle. However, this is not the only tax levied on car sales in New Jersey.

Local Sales Tax

In addition to the state sales tax, New Jersey allows municipalities to impose their own local sales tax, adding another layer of complexity to the sales tax structure. These local sales taxes can range from 0% to 3.5%, depending on the jurisdiction where the vehicle is purchased. This means that the total sales tax rate can vary significantly across the state, impacting the overall cost of a car purchase.

Use Tax

New Jersey also enforces a use tax, which is applicable when a vehicle is purchased outside the state and brought into New Jersey. This use tax ensures that regardless of where a car is bought, the state still collects tax on it. The use tax rate is the same as the combined state and local sales tax rate in the buyer’s municipality.

| Tax Type | Rate |

|---|---|

| State Sales Tax | 6.625% |

| Local Sales Tax (Varies) | 0% - 3.5% |

| Use Tax | Varies (Based on local sales tax) |

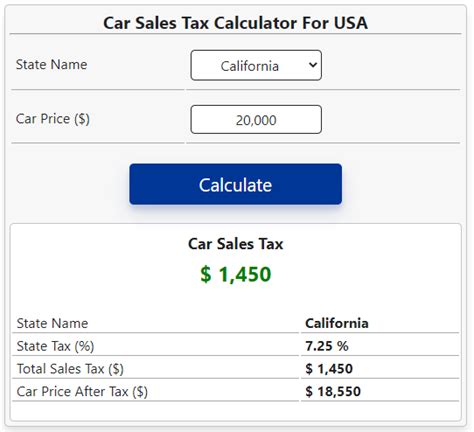

Calculating Sales Tax on a Car Purchase

To calculate the sales tax on a car purchase in New Jersey, you need to consider both the state sales tax and the local sales tax. Here’s a step-by-step guide:

Step 1: Determine the Purchase Price

Start by identifying the total purchase price of the vehicle, including any additional fees and charges. This is the amount on which the sales tax will be calculated.

Step 2: Calculate State Sales Tax

Apply the state sales tax rate of 6.625% to the purchase price. This will give you the amount of state sales tax you need to pay.

Step 3: Identify Local Sales Tax

Research the local sales tax rate for the municipality where the vehicle is being purchased. This information is typically available on the local government’s website or through a quick call to the tax office.

Step 4: Calculate Local Sales Tax

Multiply the purchase price by the local sales tax rate to determine the amount of local sales tax. Add this to the state sales tax calculated in Step 2 to get the total sales tax amount.

For example, if the purchase price is $25,000 and the local sales tax rate is 2.5%, the calculation would be as follows:

- State Sales Tax: $25,000 x 0.06625 = $1,656.25

- Local Sales Tax: $25,000 x 0.025 = $625

- Total Sales Tax: $1,656.25 + $625 = $2,281.25

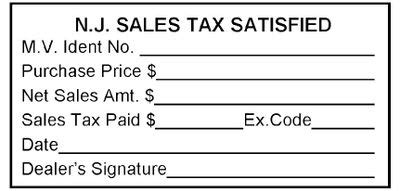

Sales Tax and Car Registration

In New Jersey, sales tax is typically paid at the time of vehicle registration. This means that when you register your newly purchased car with the Motor Vehicle Commission (MVC), you will be required to pay the calculated sales tax amount.

It's important to note that the MVC may also require additional documentation to prove that the sales tax has been paid, especially if the vehicle was purchased out-of-state. This could include a bill of sale, a sales tax receipt, or other proof of payment.

Registration Fees and Other Charges

In addition to sales tax, New Jersey also imposes various registration fees and charges when registering a vehicle. These fees can vary based on the type of vehicle, its weight, and other factors. Some common registration fees include:

- Registration Fee: Typically a flat rate, but can vary based on vehicle type.

- Title Fee: A fee for issuing a new vehicle title.

- Surcharges: Additional charges based on the vehicle's weight or other factors.

Exemptions and Special Cases

While most car purchases in New Jersey are subject to sales tax, there are certain exemptions and special cases to be aware of. These include:

Trade-Ins

If you trade in your old vehicle as part of the purchase of a new one, the trade-in value is typically subtracted from the purchase price before calculating sales tax. This can result in a lower sales tax amount.

Leased Vehicles

Vehicles leased from out-of-state dealers may be subject to different tax rules. In some cases, the sales tax may be paid to the leasing company, who then remits it to the appropriate tax authority.

Disabled Persons and Veterans

Certain disabled persons and veterans may be eligible for sales tax exemptions or reductions on vehicle purchases. These exemptions are granted under specific conditions and require documentation.

Sales Tax Holidays

New Jersey occasionally holds sales tax holidays, during which certain types of purchases are exempt from sales tax. While these holidays are rare, they can provide significant savings on car purchases. It’s worth checking the state’s official website for any upcoming sales tax holidays.

Impact on Car Buying Experience

The sales tax on car purchases in New Jersey can significantly impact the overall cost of a vehicle. For example, on a 30,000 car, the total sales tax (state and local) could range from approximately 2,000 to $3,500, depending on the local sales tax rate. This additional cost is a critical factor for car buyers to consider when budgeting for a new vehicle.

Furthermore, the varying local sales tax rates across the state can create a scenario where two individuals purchasing the same vehicle could pay significantly different amounts in sales tax, depending on their location. This variability highlights the importance of understanding the tax landscape in New Jersey before making a car purchase.

Tips for Car Buyers

- Research local sales tax rates in advance to get an accurate estimate of the total sales tax.

- Consider the impact of sales tax on your overall budget and negotiate accordingly.

- Be prepared to provide documentation to prove sales tax payment when registering the vehicle.

- Explore trade-ins and leasing options to potentially reduce sales tax liability.

Future Implications and Changes

While the current sales tax structure in New Jersey is well-established, there are always possibilities for future changes and reforms. The state government may consider adjusting tax rates, introducing new exemptions, or implementing other changes to the tax system. Staying informed about any potential changes is crucial for car buyers and sellers alike.

Additionally, the increasing popularity of electric vehicles (EVs) and the state's push towards sustainable transportation may lead to new tax incentives or programs to encourage EV adoption. These initiatives could impact the sales tax landscape for EVs in the future.

Conclusion

Understanding the sales tax landscape in New Jersey is an essential part of the car buying process. By comprehending the state and local sales tax rates, as well as any potential exemptions or special cases, car buyers can make more informed decisions and budget effectively for their vehicle purchases. As the state continues to evolve its tax policies, staying informed will be key to navigating the financial aspects of car ownership in New Jersey.

FAQ

How often do sales tax rates change in New Jersey?

+Sales tax rates in New Jersey are subject to change based on legislative decisions. While they don’t change frequently, it’s important to stay updated with any new laws or proposals that could impact tax rates.

Can I negotiate the sales tax on my car purchase?

+Sales tax is a mandatory charge set by the state and local governments, so it cannot be negotiated. However, you can negotiate the purchase price of the vehicle, which can indirectly impact the sales tax amount.

What happens if I fail to pay sales tax on my car purchase?

+Failing to pay sales tax on a car purchase can result in penalties and interest charges. It’s important to pay the sales tax in full and on time to avoid these additional costs.