Sales Tax Chicago

Sales tax is an essential aspect of doing business and is a crucial revenue source for local and state governments. In Chicago, sales tax is a complex system with multiple layers, impacting various industries and consumers alike. This comprehensive guide will delve into the intricacies of sales tax in Chicago, providing valuable insights for businesses and individuals navigating this intricate landscape.

Understanding Chicago’s Sales Tax Structure

The sales tax in Chicago comprises a combination of state, county, and municipal taxes, each with its own rate and applicable rules. This multi-tiered structure can be complex, especially for businesses operating across different jurisdictions. Let’s break down the components to understand the complete picture.

State Sales Tax

The state of Illinois imposes a base sales tax rate of 6.25% on most tangible personal property and certain services. This tax is collected by businesses and remitted to the Illinois Department of Revenue (IDOR) on a monthly or quarterly basis, depending on the business’s tax liability.

County Sales Tax

Cook County, where Chicago is located, levies an additional sales tax of 1.25% on top of the state rate. This county tax is applied to most retail sales, including food and beverages, and is collected and reported alongside the state tax.

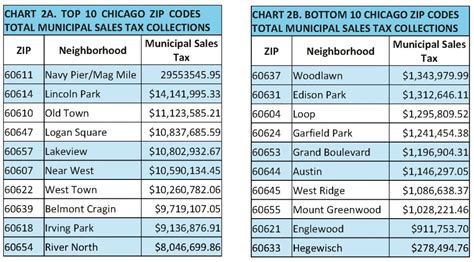

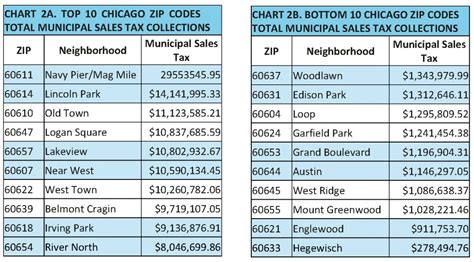

Municipal Sales Tax

Chicago, as a municipality, imposes its own sales tax of 1.25%, bringing the total sales tax rate within the city limits to 8.75%. This municipal tax is applicable to a wide range of goods and services and is an essential revenue stream for the city’s infrastructure and public services.

| Sales Tax Component | Rate |

|---|---|

| State Sales Tax | 6.25% |

| Cook County Sales Tax | 1.25% |

| Chicago Municipal Sales Tax | 1.25% |

| Total Sales Tax in Chicago | 8.75% |

Exemptions and Special Considerations

While the general sales tax rate in Chicago is 8.75%, there are certain exemptions and special considerations that businesses and consumers should be aware of. These exemptions can significantly impact the final sales tax liability and are essential to understand for accurate tax calculation and compliance.

Food and Grocery Exemptions

One notable exemption in Chicago’s sales tax structure is for unprepared food items and groceries. The sale of most food items, including fresh produce, meat, dairy, and bakery products, is exempt from the municipal sales tax, reducing the total tax rate to 7.75% for these essential household staples.

Medicine and Prescription Drugs

Medicine and prescription drugs are also exempt from sales tax in Chicago. This exemption applies to both over-the-counter medications and prescription drugs, making healthcare more affordable for residents and visitors alike.

Services and Digital Products

Certain services and digital products may be subject to a different tax rate or be exempt altogether. For instance, repairs and maintenance services are often taxed at a lower rate, while digital products like software and e-books may be subject to a use tax rather than sales tax.

| Category | Tax Rate |

|---|---|

| Food and Groceries | 7.75% |

| Medicine and Drugs | 0% |

| Services (Repairs, Maintenance) | Varies |

| Digital Products | Use Tax |

Sales Tax Compliance and Registration

Navigating Chicago’s sales tax landscape requires careful compliance and registration with the relevant tax authorities. Here’s an overview of the key steps and considerations for businesses and individuals.

Registering for Sales Tax

Businesses operating in Chicago must register with the IDOR to obtain a Sales and Use Tax Registration Certificate. This certificate is essential for legally collecting and remitting sales tax to the state and local authorities. The registration process involves providing detailed information about the business, its location, and the goods and services it offers.

Sales Tax Collection and Remittance

Once registered, businesses are responsible for collecting the appropriate sales tax from customers at the point of sale. This tax is then remitted to the IDOR on a regular basis, typically monthly or quarterly, depending on the business’s tax liability and registration category.

Record Keeping and Reporting

Maintaining accurate records of sales transactions, including the breakdown of taxable and exempt sales, is crucial for sales tax compliance. Businesses must report these sales and the corresponding tax collected to the IDOR through specific tax forms. These records are subject to audit by the tax authorities to ensure compliance.

Sales Tax for Online Businesses

With the rise of e-commerce, understanding sales tax for online businesses is crucial, especially for those operating in Chicago. Here’s a closer look at how sales tax applies to online transactions and the unique considerations for this rapidly growing sector.

Economic Nexus and Sales Tax

The concept of economic nexus has become increasingly important for online businesses. This term refers to the connection or presence a business has in a state, which can trigger sales tax collection obligations. In Chicago, online businesses that exceed a certain sales threshold or have a certain level of activity in the state may be required to register for sales tax and collect tax from customers.

Marketplace Facilitator Laws

Chicago, like many other jurisdictions, has implemented marketplace facilitator laws, which hold online marketplaces and platforms responsible for collecting and remitting sales tax on behalf of their third-party sellers. This law simplifies tax compliance for small online businesses but adds an additional layer of complexity for the marketplaces themselves.

Sales Tax for Drop-Shipping and Fulfillment

For businesses utilizing drop-shipping or fulfillment services, sales tax can become more complex. The location of the fulfillment center or drop-shipper can impact the sales tax rate and compliance obligations. It’s crucial for these businesses to understand the tax implications of their supply chain to ensure accurate tax collection and reporting.

Sales Tax for Tourism and Visitors

Chicago is a popular tourist destination, and understanding the sales tax implications for visitors is essential for both businesses and tourists alike. Here’s a closer look at how sales tax applies to tourism-related transactions.

Sales Tax on Hotel Accommodations

Hotel stays in Chicago are subject to a Transient Room Tax, which is an additional tax on the cost of accommodations. This tax varies depending on the location and type of accommodation but typically ranges from 17% to 21%, including the city’s sales tax rate. This tax is collected by the hotel and remitted to the city and state authorities.

Sales Tax for Entertainment and Attractions

Entertainment venues, such as theaters, concert halls, and amusement parks, often charge a sales tax on the cost of admission. This tax rate can vary depending on the type of entertainment and the location. For instance, tickets to a sports event may be subject to a different tax rate compared to a museum admission.

Sales Tax on Souvenirs and Gifts

Souvenirs and gifts purchased by tourists are subject to the standard sales tax rate in Chicago. This includes items like t-shirts, keychains, and other memorabilia. Businesses selling these items must collect and remit the appropriate sales tax to ensure compliance.

| Tourism Category | Tax Rate |

|---|---|

| Hotel Accommodations | 17% - 21% |

| Entertainment and Attractions | Varies |

| Souvenirs and Gifts | 8.75% |

Sales Tax Challenges and Future Trends

Navigating Chicago’s sales tax landscape presents unique challenges and opportunities. As technology and consumer behavior evolve, the sales tax system must adapt to stay relevant and effective. Here’s a look at some of the current challenges and potential future trends.

Challenges with Remote Sellers

The rise of remote sellers and e-commerce platforms has presented a challenge for sales tax collection. With many online businesses operating across state lines, it can be difficult to determine the appropriate tax rate and compliance obligations. This issue is being addressed through initiatives like the Wayfair Decision, which establishes economic nexus thresholds for remote sellers.

Automating Sales Tax Compliance

The complexity of sales tax compliance, especially with multiple tax rates and exemptions, has led to a growing demand for automated tax solutions. These tools help businesses calculate the correct tax rates, collect the appropriate amounts, and ensure accurate reporting. As technology advances, we can expect further innovations in this space.

Potential for Sales Tax Reform

The current sales tax system, with its multi-tiered structure, can be seen as complex and potentially inefficient. There have been discussions and proposals for sales tax reform, including the idea of a simplified, flat tax rate. While such reforms are not imminent, they represent a potential future direction for sales tax in Chicago and other jurisdictions.

Conclusion

Chicago’s sales tax landscape is a complex but essential component of doing business in the city. From understanding the multi-tiered tax rates to navigating exemptions and special considerations, this guide has provided a comprehensive overview. Whether you’re a business owner, an online retailer, or a visitor to Chicago, having a clear understanding of sales tax is crucial for compliance, accuracy, and a positive consumer experience.

FAQ

How often do businesses need to remit sales tax in Chicago?

+

Businesses typically remit sales tax on a monthly or quarterly basis, depending on their tax liability and registration category. Monthly filing is required for businesses with a higher tax liability, while quarterly filing is suitable for smaller businesses. It’s important to stay updated on the filing deadlines to avoid penalties.

Are there any sales tax holidays in Chicago?

+

Yes, Illinois, including Chicago, has designated sales tax holidays throughout the year. These holidays often occur during back-to-school season and provide tax-free shopping for specific categories of goods, such as clothing and school supplies. It’s a great opportunity for shoppers to save, and businesses should be aware of these periods to ensure compliance.

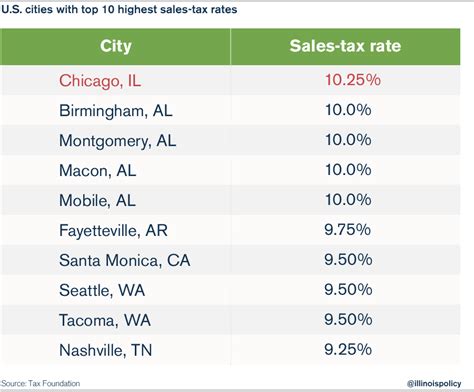

How does Chicago’s sales tax compare to other major cities in the US?

+

Chicago’s total sales tax rate of 8.75% is on the higher end compared to other major US cities. For instance, New York City has a combined state and local sales tax rate of 8.875%, while Los Angeles has a rate of 9.5%. Understanding these variations is crucial for businesses with operations in multiple cities.

Are there any resources available for businesses to stay updated on sales tax changes in Chicago?

+

Yes, the Illinois Department of Revenue provides a dedicated website with the latest information on sales tax rates, regulations, and updates. Additionally, there are third-party resources and newsletters that track sales tax changes across different jurisdictions. Staying subscribed to these resources can help businesses stay compliant.